Editor's Note: Ahead of Berkshire Hathaway's annual meeting on Saturday, we look back on the Oracle of Omaha’s latest letter to shareholders. It's full of lessons for investors, including waiting for value, keeping a buffer, trusting the quality of your investments and recognising new and important trends.

Warren Buffett published his 57th letter to Berkshire Hathaway shareholders in late February. He discussed market valuations, the company’s US$144 billion pile of unspent cash and how America’s largest owner of infrastructure assets is positioning itself for environmental sustainability.

The letter came as Berkshire Hathaway (BRK.A) reported net income had more than doubled to US$89.9 billion in 2021, driven by strong results at its utilities and railroad holdings.

After lagging the S&P 500 index in 2020, Buffett’s conglomerate edged out the benchmark last year as its dozens of banking, insurance, energy and industrial subsidiaries rode the resurgence in value stocks amid the post-covid economic recovery.

Berkshire shares finished the year up 29.6%, compared to a 26.9% for the index. Outperformance has extended into the new year, where Berkshire Hathaway is up 4.8% versus a 10.2% decline for the index.

Buffett uses the annual letter to update shareholders on the company’s performance, but it’s read by legions of investors eager to hear his take on world events.

Here are 5 takeaways for investors.

Berkshire pips the S&P 500

Source: Morningstar

Little value on offer for the world’s famous value investor

Buffett defended Berkshire Hathaway’s $144 billion in unspent cash saying low-interest rates had pushed up prices for everything from stocks to oil wells and limited worthwhile spending opportunities.

“Berkshire’s current 80%-or-so position in businesses is a consequence of my failure to find entire companies or small portions thereof (that is, marketable stocks) which meet our criteria for long-term holding,” he said.

Investing in the company’s portfolio of businesses was preferable to acquisitions currently, Buffett said, while acknowledging the firm’s cash file was too large to be spent just internally. Looking across publicly traded markets, Buffett and long-term partner Charlie Munger saw “little that excites”.

With few attractive external opportunities, Berkshire has spent billions buying back its own stock. In addition to the $51.7 billion spent in 2020 and 2021, the conglomerate made another $1.2 billion in share repurchases through 23 February this year.

Buffett also warned investors to be on the watch when companies use “deceptive ‘adjustments’” to report earnings, saying “bull markets breed bloviated bull.”

Always maintain a margin of safety

Buffett spoke of the value of keeping cash on the books. He pledged to keep US$30 billion in the coffers at Berkshire to ensure the company would always be “financially impregnable” and never need to depend on the kindness of strangers. Raising money in an emergency, in other words.

“Both of us [Buffett and Munger] like to sleep soundly, and we want our creditors, insurance claimants and you to do so as well,” he said.

Buffett is no stranger to picking up a distressed bargain. During the depths of the Global Financial Crisis in 2008, he threw Goldman Sachs a US$5 billion lifeline in exchange for equity. The bank redeemed the shares in 2011, netting Buffett US$3.7 billion in profit.

Jump when the valuation is right

One of the “four giants” that power Berkshire Hathaway is its wholly-owned stake in BNSF, one of the US’ largest freight railroads. Buffett decided to takeover BNSF one day after markets ditched the company’s stock in the aftermath of disappointing earnings.

BNSF’s share price shed 10% in the days following its third-quarter report on 22 October 2009. A little under two weeks later, Buffett lobbed a US$26 billion bid. Last year alone, the railroad posted a record US$6 billion in profit.

“BNSF, our third Giant, continues to be the number one artery of American commerce, which makes it an indispensable asset for America as well as for Berkshire,” Buffett said.

Quality wins out

Berkshire Hathaway’s collection of banks, insurance companies, utilities and industrials benefited from the recovery in value stocks over the course of 2021.

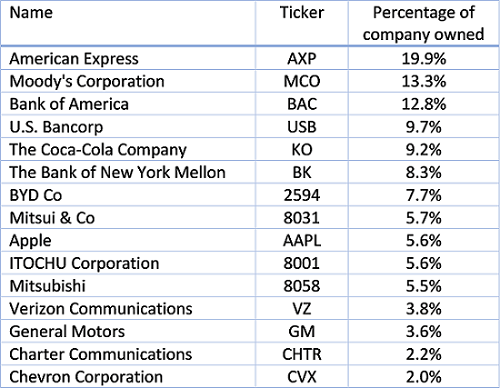

In addition to its wholly or nearly wholly-owned stakes in insurers, railroads and utilities, the firm also holds parts of Apple, American Express, Mitsubishi, Chevron and a $7.6 billion stake in Chinese electric automaker BYD that it bought for $232 million in 2008.

“We own stocks based upon our expectations about their long-term business performance and not because we view them as vehicles for timely market moves. That point is crucial: Charlie and I are not stock-pickers; we are business-pickers,” he said.

Stronger economic growth and the prospect of higher interest rates helped value stocks stage a recovery last year. Value investors look for stocks trading at prices they believe to be below fundamentals. The Morningstar US Large Broad Value returned 33% last year compared to a loss of 3% in 2020. It’s growth equivalent notched 36%.

Berkshire Hathaway's top 15 largest equity holdings

Source: Berkshire Hathaway filings.

Renewable investments on the rise

Buffett touted the environmental performance of Berkshire’s most polluting holdings as the conglomerate flagged further investments in clean energy across its utility portfolio.

Two of Berkshire’s biggest holdings, wholly-owned railroad BNSF and its 91% stake in Berkshire Hathaway Energy (BHE), a collection of utilities and energy infrastructure companies, generated 90% of the conglomerate’s direct emissions.

In a separate letter, Buffett’s anointed successor Greg Abel, outlined plans for BHE and its subsidiaries to invest or finance US$37 billion in clean energy projects. BHE also plans to invest billions in energy storage and transmission. Railroad BNSF plans to cut greenhouse gas emissions by 30% in 2030, relative to 2018 levels.

“Berkshire will have failed if BHE and BNSF do not achieve their GHG [greenhouse gas] emissions reduction goals,” said Abel.

Greater renewable energy investment across the conglomerate sits alongside Berkshire’s US$4.5 billion stake in oil and gas giant Chevron. Buffett defended Chevron at the annual general meeting last May, saying the company had “benefited society in all kinds of ways”.

Lewis Jackson is a reporter/data journalist at Morningstar, owner of Firstlinks. This article is general information and does not consider the circumstances of any investor. This article was originally published in Morningstar on 2 March 2022.

Access data and research on over 40,000 securities through Morningstar Investor, as well as a portfolio manager integrated with Australia’s leading portfolio tracking service, Sharesight. Sign up to a free, four week trial below:

Try Morningstar Investor for free