Risk assets are off to a historically poor start in 2022, a year in which seemingly diversified portfolios have been generating undiversified returns. Stocks and government bonds are down by double digits, with equities posting their worst performance in decades while investment-grade corporate bonds have had their worst year-to-date performance ever. There have been few places for investors to hide.

Unlike in recent years, the quality of the individual securities investors own will likely matter more to overall portfolio return than which broad asset classes they are allocating to. Another change is that with higher rates, cash is becoming a viable alternative to risky assets, leading to higher asset-class correlations.

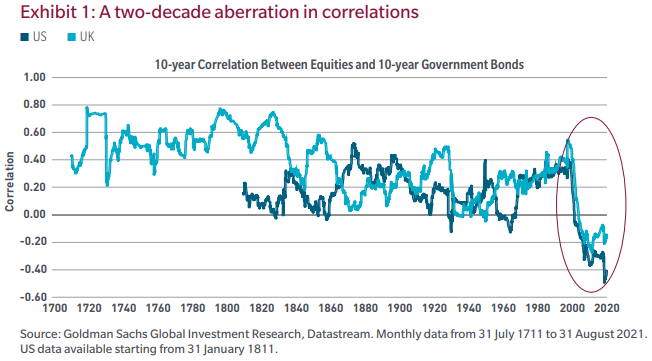

In November, I wrote about the risks of positive stock-bond correlation in a rising interest rate environment. Now I want to address the topic again from a different angle.

The Hawk and the Nightingale

In a Greek fable dating to around 500 B.C., a hungry hawk captures its prey, a nightingale. In desperation, the nightingale tries to convince the hawk that there are more appetizing birds in the bush behind it. The nightingale’s effort proves unsuccessful as the hawk replies that a meal already caught, even if small, is better than a larger meal yet to be obtained.

Over the centuries, the story got boiled down to the maxim “a bird in the hand is worth two in the bush.” Or, what you have is of greater value than what you hope to have (because you already have it). It’s an apt metaphor for valuing risky financial assets in a turbulent 2022 and beyond.

Applying the fable

The nightingale stands for the yield on cash, such as in savings accounts and money market funds. During the worst of the COVID-19 crisis, as interest rates went to zero (and in many cases below) in both nominal and real terms, the value of the bird in the hand (cash) evaporated.

The hawk represents investors. As the yield on safe assets disappeared, the only selling point of riskless assets was that they were a store of value that would return your principal at a future date. That’s not a very compelling proposition.

The two birds in the bush are proxies for risk assets, everything from corporate bonds to private and public equities to real estate to cryptocurrencies and the like. As investors were forced to hunt in the bush for their metaphorical dinner, demand overwhelmed supply. For example, in 2021 net flows into global equities exceeded the combined flows of the prior 20 years.

A 2022 reversal

In late 2021, as investors realised inflation wasn’t transitory and had risen much more than expected, the riskiest segments of the equity market such as initial public offerings, special purpose acquisition companies and small caps began to underperform. With the anticipated yield on cash continuing to rise as the new year began, its effects became more far reaching as a supply of new, competing investments had to be digested.

The bird in the hand offered something it hadn’t in a long time: yield. That resulted in the correlation between stocks and bonds going straight up as both asset classes underperformed whereas correlations had fallen heavily earlier in 2021, as shown below for the US and UK markets.

Consistent with historical patterns, defensive equities outperformed non-commodity cyclicals and growth stocks during this time. Historically, investors have tended to shift from higher-reward but high-degree-of-difficulty assets (eg unprofitable enterprises with hard-to-understand business models) to lower-reward but lower-degree-of-difficulty ones (eg companies with demonstrable, sustainable profits).

Keeping with the fable, the hard-to-catch - but awfully tasty - bird in the bush becomes less attractive. Investors have opted for easier-to-catch birds, which are generally enterprises with greater long-term profit certainty. At MFS, we generally prefer these and call them lower-degree-of-difficulty stocks. Others call them quality, a label we use as well.

Expecting correlation to rise

A sharp rise in interest rates has seen the tide turn and now the bird in the hand has value and will compete for investor capital.

Higher short-term interest rates may bring higher asset class correlations. Not only might stocks and bonds become more correlated, but styles such as growth and value may sync more closely than in the past. If so, the performance gap between asset classes should prove less pronounced than in recent years.

We believe emphasis should be placed on the quality of assets owned within each category rather than on the category itself. Security selection will therefore be paramount. The visibility and surety of the cash flow of the individual growth or value stock or high-grade or high-yield bonds is what will matter, not the broad asset class it’s assigned to.

I think company fundamentals, whether we’re investing in stocks or bonds, will be the main drivers of investors’ returns. Owning quality, cash-flow-generating assets, regardless of style or category, is the portfolio construction roadmap to follow, and this is how our strategies are positioned.

Robert M. Almeida is a Global Investment Strategist and Portfolio Manager at MFS Investment Management. This article is for general informational purposes only and should not be considered investment advice or a recommendation to invest in any security or to adopt any investment strategy. Comments, opinions and analysis are rendered as of the date given and may change without notice due to market conditions and other factors. This article is issued in Australia by MFS International Australia Pty Ltd (ABN 68 607 579 537, AFSL 485343), a sponsor of Firstlinks.

For financial advice professionals: Rob Almeida is speaking in person at Morningstar Investment Conference next Thursday, 2 June in a session titled "Key Considerations for the Portfolio of the Future". Click here to register your attendance, either in-person at the ICC Sydney or digital experience.

For more articles and papers from MFS, please click here.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.