In first grade, my elementary school opened a new campus. It had a computer lab stocked with Apple MacIntosh computers. For one hour each week, we learned coding language on an application called Logo Writer. If we were lucky, the teacher would let us play Oregon Trail when our assignments were complete. I remember the first mouse Apple introduced. We giggled as we adjusted from using the keyboard arrows to the magical handheld device named after a rodent. Actual floppy disks transformed into hard, floppy disks to save our projects and papers. By high school, we were tasked with creating multimedia presentations on our turquoise-colored iMacs. They looked like control boxes on a spaceship. When I went away to college, however, I bought a Dell desktop. MacIntosh was temporarily out of favor.

Then Apple takes over

I moved to New York to work on Wall Street in the early 2000s. The first-generation iPod was all the rage. I felt like the only person in Manhattan riding the subway without earphones and an iPod. The smaller, nano version came out later that year, and I received one as a birthday gift. When the iPhone launched in 2007, it was originally limited to service with AT&T. AT&T service was terrible in Manhattan. We all used Verizon exclusively. Besides, I already had a company-issued Blackberry for emails. When Apple launched new products, people would line up for hours (some overnight) outside the Apple stores on 5th Avenue and in Soho to be among the first purchasers. I didn’t go on the first day but waited several hours in line to buy the first iPad at the 5th Avenue store.

I didn’t jump on the iPhone wagon for several years. Fast-forward to today, I have three or more Apple devices that I use daily – iPhone, iMac, and AirPods. I keep a backup pair of AirPods just in case mine die. I cannot imagine life without them. I am fully immersed in the Apple ecosystem, right down to the monthly subscription for storage. My only holdout is the watch. I’ve never worn a watch, so I find no reason to start. Never say never.

One could argue that Apple, Inc. is history’s most influential and powerful company. Apple’s products and services permeate every facet of modern Western lives. The iPhone has replaced hundreds of other devices. Devices that, not too long ago, were considered cutting-edge technology in their own right. Now we get all of these devices in one tiny rectangular box that fits in our pocket. iPhone is simultaneously an alarm clock, Walkman, computer, camera, heart rate monitor, map, newspaper, magazine, book, video game console, photo album, weather source, and even television. I could go on. The iWatch is literally monitoring biodata 24/7 -reminding you when to eat, sleep, walk, and stand up. Many well-to-do Americans own not one or two but three or more Apple devices and subscribe to one or more of Apple’s monthly services. The Apple savings account, which launched in April, has over US$10 billion in deposits.

I didn’t fully comprehend the importance of my iPhone until it was snatched from my pocket by a thief at Mardi Gras. My life runs on that little device. Thank goodness for iCloud backup; my life was up and running on a new device in minutes once I purchased a used iPhone XR. I didn’t even miss the last photo I snapped less than 10 minutes before the theft.

The rise and rise of Apple's share price

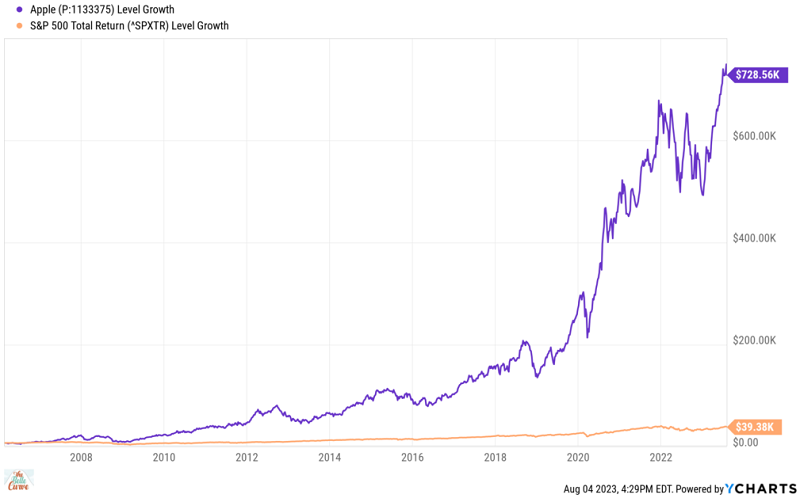

But the impact of Apple’s stock may be even more influential than the company’s products and services. I have met countless investors who have life-changing portfolio returns attributable solely to Apple stock. These are everyday people, not uber-wealthy, who invested normal sums of money (think $10,000 – $50,000) into Apple shares and held onto them for 10, 12, 15 years, or more. Their Apple returns have allowed them to retire earlier than planned, to spend more in retirement, and countless other financial dreams. My only challenge is convincing them to dial back their single stock exposure risk and to pay a little capital gains tax to enjoy those earnings.

Just for fun, or maybe to give myself heartburn, I looked at what my first bonus in 2006 (US$8,000) would be worth today had I bought only Apple shares and never sold. Those shares would be worth over US$725,000 today! That’s from an investment of US$8,000 in March 2006. I know myself, however, so I know I would have taken gains off the table along the way; either to diversify or put a down payment on a home or something else that reasonably happens in life. But it’s still fun to dream or make myself sick with the benefit of perfect hindsight.

How large can it get?

It is no wonder that we all worship at the church of Apple (or Facebook, Microsoft, Google, Netflix, etc). These companies not only permeate our everyday lives – in most cases making them better – but also have contributed significant gains in our portfolios. I recall watching in amazement as Apple became the first stock with a US$1 trillion market cap in 2018. Today Apple’s market cap is over US$3 trillion. The GDP of France, the 7th largest economy is the world, is US$3 trillion. The numbers are simply astounding.

I am writing this post as neither a praise nor criticism of Apple as a company or an investment. I am merely in awe of this one institution’s sheer size and prevalence in modern life. I am grateful for the ways Apple’s products and service make my life easier, and I am equally grateful for the returns the stock has provided not only to those who bought shares individually but also to everyone who invested in the US stock market over the past 20 years. I’m not sure if its dominance is good or bad for society in the long run, but it gives me comfort to know that Tim Cook, a fellow native Alabamian, was hand-picked by Steve Jobs to be his successor.

Blair duQuesnay, CFA®, CFP® is an investment advisor at Ritholtz Wealth Management, LLC. For disclosure information please visit: https://ritholtzwealth.com/blog-disclosures/. Republished, with permission, from The Belle Curve.