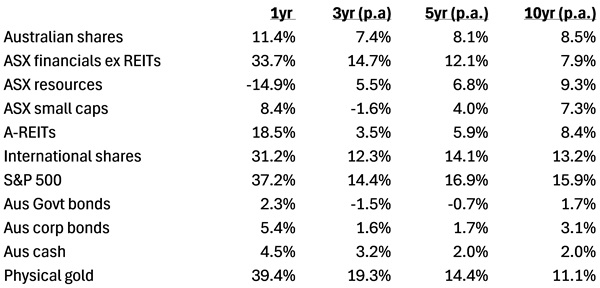

Let’s first review the performance of the major asset classes and sub-sectors in 2024.

Asset class returns

Note: All figures as at Dec 31, 2024. Aus shares = ASX 200, A-REITs = S&P/ASX 200 A-Reit Index, International shares = MSCI World ex-Aus in AUD, Aus Govt bonds = Bbg AusBond Treasury Index, Aus Corp bonds = Bbg Ausbond Credit 0+ index. Source: S&P Global, Bloomberg, Firstlinks

The winners in 2024

The asset with the highest return last year would surprise many: it was gold, which jumped 39% in Australian dollar terms. Other big winners were US shares, up 37%, and Australian financials, with a 34% return.

The gold price rose by 27% in US dollar terms, but higher in Australian dollars thanks to a fall the Aussie dollar against the greenback.

Why did gold go up so much? Historically, gold has tended to move inversely to the US currency – when the US dollar rises, gold often falls. But that wasn’t the case in 2024.

The World Gold Council's John Reade explained to Firstlinks in late October that gold has benefited from two things: central bank buying and emerging market demand. Central banks have been purchasing gold as they seek diversification following the American confiscation of Russian US dollar assets after Putin’s invasion of Ukraine. Emerging markets have also been keen on the yellow metal, as the Chinese seek safety amid their economic downturn, and other countries such as India and Turkey increase their buying of jewelry and other gold-related products.

It’s intriguing that Australian investors, especially institutions, generally shun gold, in spite of its recent strong performance.

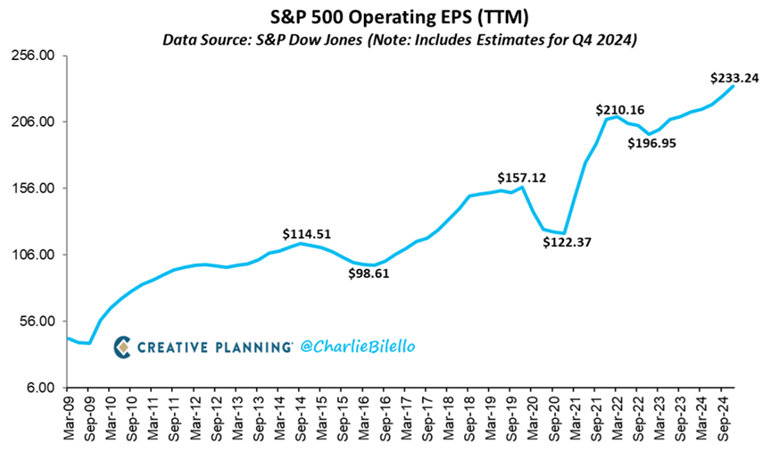

US shares grabbed far more headlines than gold with its barnstorming 2024. The S&P 500 rose more than 20% for a second year in a row, driven by earnings and an increase in the valuations attached to those earnings. S&P 500 operating earnings rose 9% during the year to new record highs.

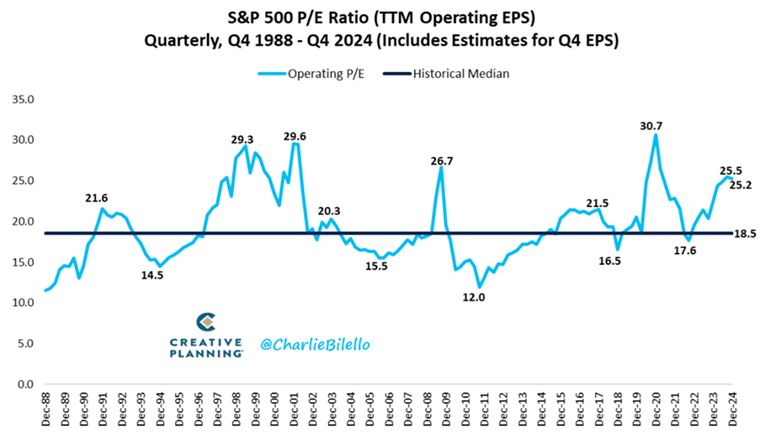

The market rise was aided by the S&P 500’s price to earnings (P/E) ratio moving up to 25.2x at year-end from 22.3x at the start of the year.

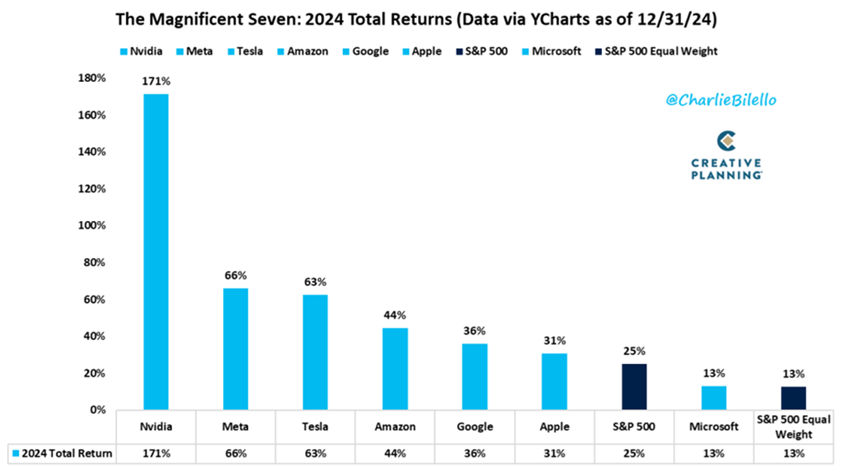

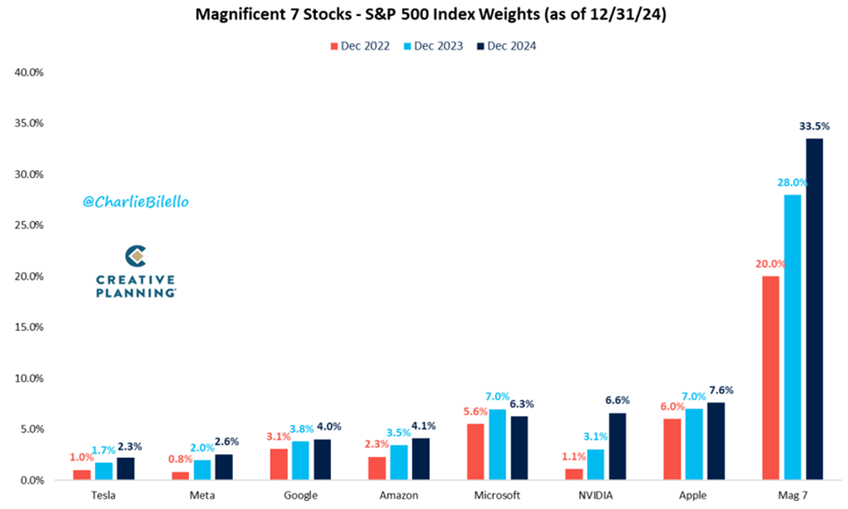

The ‘Magnificent Seven’ technology stocks helped the S&P 500 to new highs. They went up an average 61% in US dollar terms, compared to a 25% rise in the index (+37% in AUD terms).

Nvidia led the charge, up a stunning 171%, as expectations for AI demand soared. Following Nvidia was Meta, rising 66%, and Tesla, 63% higher. Microsoft was the laggard of the bunch.

The Magnificent Seven now accounts for 34% of the S&P 500, up from 20% just two years ago.

The other big winner from 2024 was the Aussie banks. The ASX financials sector ex-REITs leaped 34%, surprising many investors. Westpac was best, up 41%, followed by heavyweight, CBA, 37% to the better.

The amazing thing about the banks’ performance was that their earnings last year went backwards, so their share price performance was entirely driven by multiple expansion. For instance, CBA is now the most expensive bank in the developed world, trading at 27x trailing earnings. That compares to America’s largest bank, Bank of America, which has a price to-earnings (P/E) ratio of 16x.

The Australian banks were obviously helped by a rotation out of the miners, which suffered from China’s economic slowdown. That rotation has slightly turned in 2025, with miners starting to find some love.

The other strong performer was the REITs. That may be a headscratcher for some, given the plight of the office and retail property sectors last year. However, Goodman Group accounts for almost 40% of the ASX 200 REITs index, and it rose 75% in 2024, thanks to excitement over its growing data centre portfolio.

Meanwhile, the ASX 200 increased 7% last year, and 11% including dividends. It was a decent enough year, albeit badly lagging the likes of the US. The main reason for being a laggard is that earnings barely grew in 2024 as the economy stalled.

The losers in 2024

The Australian miners were the biggest losers last year, dropping 15%. It didn’t help that the price of our biggest mining export, iron ore, fell 28%. That resulted in resource majors, BHP and Rio Tinto, declining by 22% and 18% respectively.

Some of the biggest losses were in the lithium sector, as the lithium price went down a further 22% in 2024. That led to IGO, Pilbara Minerals, and Mineral Resources, sinking 43%, 45%, and 51%, respectively.

The other loser from last year was Australian Government bonds. The bonds went up 2.3% though lost money in real terms as they trailed the rate of inflation. Bonds are entering their 5th year of a bear market, with 2025 delivering more bad news so far.

The best over a decade

One year is just one year, and it’s often best to zoom out to get a better picture of asset class returns.

Over the past 10 years, the standout performers have been US and international shares. The S&P 500 has returned 16% per annum in Australian dollar terms. America has had an amazing run since the financial crisis, with the index up 8.8x, and almost 10x including dividends, since bottoming in March 2009 at 666. Almost a 10-bagger over 15 years!

The US has helped international shares ex-Australia return 13% p.a. over the past decade. America now accounts for 75% of the MSCI World Index – it’s now a case of where the US goes, the world goes.

Australia has trailed US and international shares badly over the past 10 years, rising 8.5% p.a. That’s well below its long-run return of close to 10%. The banks have dragged on the index, despite a better 2024, due to tepid earnings growth.

Surprisingly, at least to me, is that miners have beaten the ASX 200 since 2015. That’s because the resource companies had a sharp downturn from 2012 to 2014 as commodity prices swooned, but they’ve since somewhat recovered.

Bonds and cash over the decade have been poor investments, largely due to the low interest rates that prevailed up to 2022.

Meanwhile, gold has not only been a solid short-term performer, but a longer term one too. It’s returned 11% p.a. during the past decade. That’s better than Australian shares over the period.

What do past returns tell us about the future?

Unfortunately, the asset class returns of the past year and decade don’t tell us a lot about what will happen during the next 10 years. They can give little clues, though.

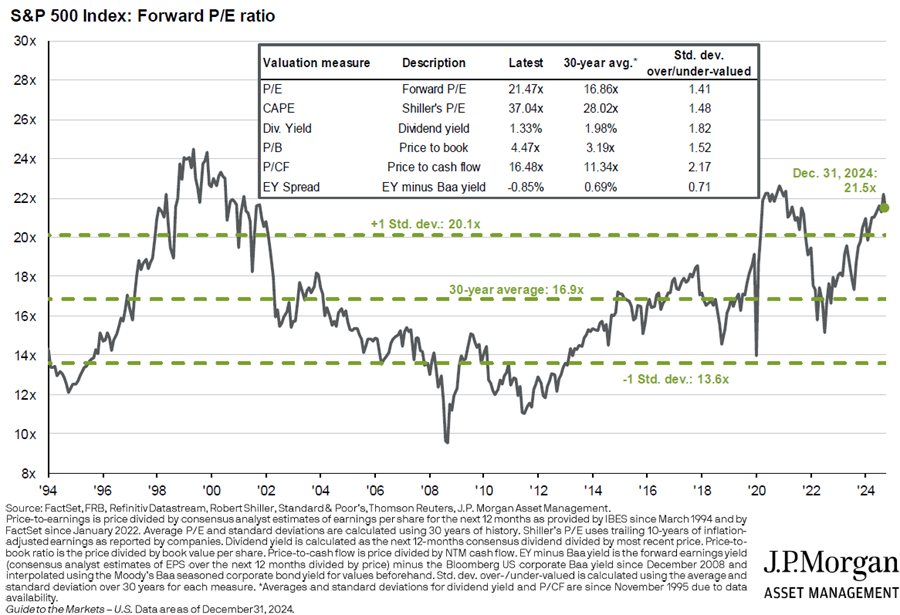

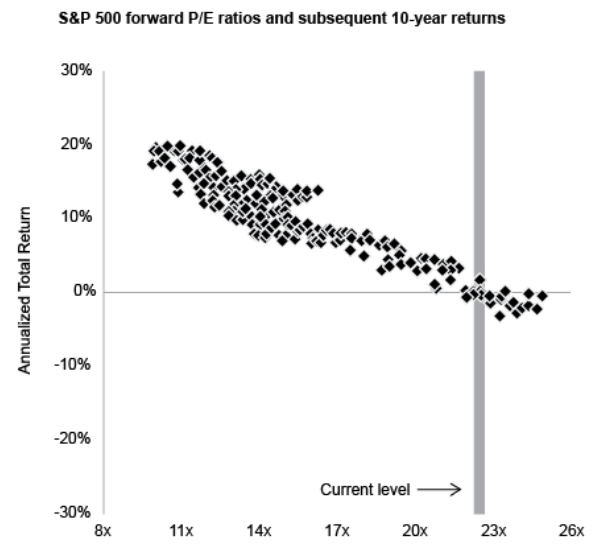

US shares have clearly had an extraordinary run and look expensive, at 1-2 standard deviations above historical norms on most valuation metrics.

Current valuations for American don’t augur well for future returns.

Source: JP Morgan

Unfortunately, most other developed markets, including Australia, also trade at higher than average multiples. It would surprise if banks didn’t pull back from recent highs, unless they can generate some decent earnings growth. If the Big Four don’t perform, it will be up to the resource companies to pick up the slack. And that will depend on commodity prices, whose future is always difficult to predict.

Bonds are offering greater competition to equities, with 10-year yields approaching 5%. Those yields should result in better returns for bonds over the next decade than the paltry ones delivered in recent years.

Gold has had a great run, though given its history of boom and bust, it seems unlikely to repeat that performance over the next 10 years.

What about alternative assets? Private equity and private debt have become increasingly important in the portfolios of super funds and other institutional investors. And of late, they have delivered commendable performance. Yet, they haven’t been fully tested in times of steeply rising bond yields and/or deteriorating credit quality. That said, listed and unlisted infrastructure looks more interesting.

I’m often asked about Bitcoin. I briefly wrote about it and copped some backlash from enthusiasts. None of them have rebutted my critique that Bitcoin is yet to prove useful for anything barring speculation. If it becomes useful in the real world, I might change my mind. Until then, I can’t advocate it for investor portfolios.

What should investors do with their portfolios?

Given this context, what should you do with your portfolio? Probably the worst thing that you can do is overreact to the past performance of assets and make wholesale changes to your portfolio. Tinkering perhaps, but radical surgery is usually unwise.

One of the best strategies to implement is re-balancing. I talked about this in a previous article on building a portfolio.

Say you’ve got a 60/40 equities/bonds portfolio, with a 70/30 split between international and Australian shares. Perhaps that split is now 75/25, given the recent outperformance of international stocks. Rebalancing back to 70/30 can make sense.

Research has shown that rebalancing every year or two, or when certain assets reach a certain percentage of a portfolio, improves investment performance in the long term. The reason for this is that rebalancing is essentially a value strategy: it switches out of outperforming, and possible expensive, assets into cheaper ones.

What if you’re worried about the future and expect a sharp downdrift in stocks? Again, overreacting can be a mistake. It’s handy to remember that Australian shares go up about four out of every five years on average. Therefore, if you’re a pessimist, the numbers are against you.

That doesn’t preclude buying some more defensive shares, if you’re that way inclined. Defensive ASX stocks such as Woolworths, Endeavour, and Lotteries Corp are offering better value than a lot of other Australian companies at present.

James Gruber is Editor at Firstlinks.