It’s been another eventful year in financial markets. Stocks soaring for a second year in a row, America continuing to attract a gush of money despite re-electing a convicted felon as President, ‘meme coins’ again back in vogue, high profile ASX owner operators coming unstuck, and commodities continuing a decade-long dry run, albeit with some exceptions.

Here are my key lessons from 2024:

1. The expensive can always get more expensive

We started the year with the S&P 500 being moderately expensive on traditional valuation metrics and concerns about an increasing concentration in the Magnificent Seven tech stocks. Yet, we’re ending this year with much more expensive US market and even greater concentration into the ‘Mag 7’ companies.

The S&P 500 is up 28% year-to-date, while the Nasdaq is 30% higher. About 10% of those gains have come from forecast earnings growth for this year. The rest has come from expansion in valuation multiples.

The price-to-earnings (PE) ratio of the S&P 500 has moved up to 26x today on a trailing earnings basis. That’s 32% higher than the average PE ratio of 19.7x since 1989.

The Magnificent Seven stocks have rallied ~50% this year and surpassed US$18 trillion in market value for the first time in history. These stocks now account for a record 33% of the S&P 500 index.

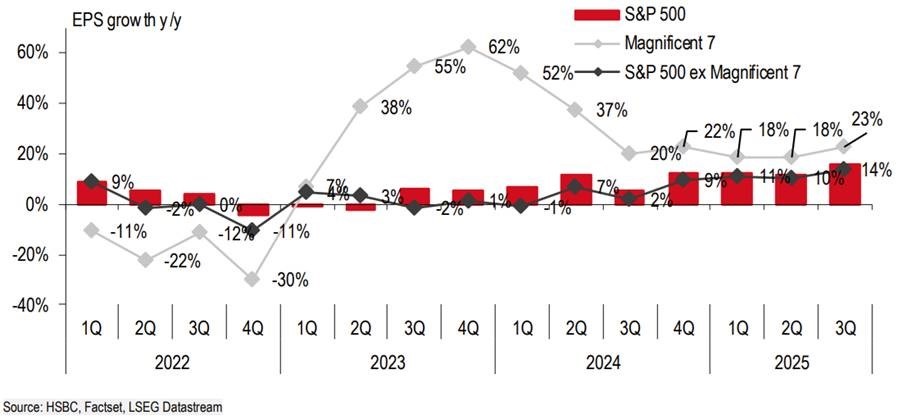

The share price rises in mega-cap tech stocks can be partly justified by strong earnings growth.

Apple (NYSE: AAPL) is the exception to that, with pedestrian single digit earnings growth, but that hasn’t stopped the stock from roaring higher.

While earnings can explain some of the rise in the US, the same can’t be said for Australia. EPS growth is likely to be close to flat for this calendar year, yet our market is up 23% this year. The rise is solely attributable to an increase in the price attached to the earnings, with the PE ratio rising from 17x to 22x for the ASX 200.

The extraordinary run of the Big 4 banks explains much of the market melt up. Commonwealth Bank’s share price has lifted 42% in 2024, excluding dividends, and it now trades at a 28x PE ratio – not bad for a company where earnings have declined of late!

Source: Morningstar

2. America IS the market

Australia has always taken its lead from US markets, though never more so than today.

We can talk about global markets but they’re not really global anymore – there’s America and then the rest.

US stocks now make up 65% of the global equity market. This is more than 11x bigger than the second largest country by market cap (Japan at 5.5%).

The last time that the US was at these levels was in the late 1960s when the America was at the peak of its power versus the rest of the world.

3. Markets love economic growth combined with disinflation

US inflation peaked at 9.1% in June 2022, and has since declined to 2.6%. It’s no coincidence that the S&P 500 bottomed soon after inflation peaked and has entered a roaring bull market since. There’s nothing more that markets love than a falling inflation rate combined with punchy economic growth.

Australia’s inflation rate peaked much later, at 7.8% in the fourth quarter of 2022. The rate has also been slower to fall, with the latest CPI reading at 2.8%.

This, plus lacklustre GDP growth, goes some way to explaining why Australia's share market has lagged the US and many other developed markets over the past two years.

The other thing that markets like about a falling inflation rate is that invariably leads to cuts to interest rates. Today, 71% of major central banks are in easing mode versus only 9% at the lows of July 2023. The RBA hasn't followed suit … yet.

4. Bitcoin is our tulip mania

There’s always a bubble somewhere, yet the Bitcoin one has been something to behold. It could go down in the history books as a modern-day tulip mania. Tulip mania, a speculative frenzy in 17th century Holland that involved the sale of tulip bulbs, is widely regarded as the biggest bubble in history.

Bitcoin might be rivalling that. It’s climbed 140% this year, after a gain of 156% the prior year. It’s up an annualised 149% since 2011. Put another way, one dollar invested in Bitcoin 14 years ago has turned into about $338,000.

Off shoots such as ‘meme coins’ are taking off. One of them, fartcoin (you read that right), recently rose 300% in one week and now has a total value of close to US$900 million.

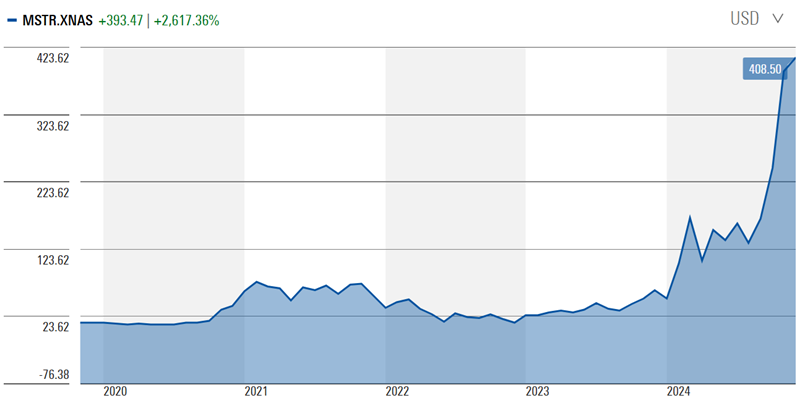

MicroStrategy (NASDAQ: MSTR), whose main business is buying Bitcoin, has just been admitted to the Nasdaq 100 index with a market capitalization of US$98 billion. The share price is up a cool 546% this year. The company is run by a man who was charged with accounting fraud in the late 1990s tech bubble. And the company’s strategy seems to involve issuing new shares and debt to acquire more Bitcoin, which invariably pushes the Bitcoin price up – a seemingly virtuous circle. A flywheel to some, but a Ponzi scheme to others.

Source: Morningstar

The whole thing is likely to end in tears for one reason: Bitcoin has no real-world use. It was invented 16 years ago with hopes to decentralize the world of currencies. It’s done nothing of the sort and, ironically, may become a tool of the state, with Donald Trump’s plans for a Bitcoin strategic reserve.

5. Beware of investment bankers bearing gifts

I’ve always been bemused by the Australian media’s love affair with investment bankers, though it isn’t hard to figure out the reasons behind it. The bankers are a reservoir of gossip and ‘background’ information for journalists looking for a story.

My background in stockbroking and funds management has led to a more sceptical, nay cynical view, of these bankers.

So, the latest story involving DigiCo (ASX: DGT) hasn’t come as a surprise. For those who haven’t been following it, DigiCo is a date centre play recently listed in the ASX. It was quickly cobbled together by prominent former investment banker, David Di Pilla. DigiCo was the biggest float on the ASX since 2018, raising almost $2 billion in equity. There was a lot riding on the IPO.

It didn’t turn out as planned as the stock tanked 14% over the two days after listing. Di Pilla and his bankers are desperately trying to shore up the growth story, while retail investors, who gobbled up the IPO, have been left holding the can.

From the outset, there were many red flags with DigiCo as investment bankers rushed to put together a float based on the hot theme of AI.

It’s yet another reason to beware investment bankers bearing gifts…

6. Scale in superannuation comes with benefits and costs

Australia’s superannuation sector continued its unstoppable growth this year. Super assets now total more than $4 trillion, having increased 13% in the year to September, driven by strong asset returns.

Assets of superannuation entities

Source: APRA

Regulators have promoted consolidation in the sector, resulting in the big funds getting larger. Increased size has resulted in several benefits, including lower fees for members. However, the costs of increased scale are also becoming apparent, with more member complaints and heavier regulatory scrutiny.

Whether we’re expecting too much from the super funds may become a bigger issue going forward.

7. Smart money is backing private investment, further squeezing active equity managers

It always pays to look at where the smart money is investing, and there’s not many smarter in the financial sector than BlackRock’s CEO, Larry Fink. BlackRock is an ETF giant, having moved aggressively into the space with the acquisition of Barclays Global Investors in 2009.

It’s noteworthy that the firm is now moving aggressively into a new area: private investments. Recently it announced a US$12 billion acquisition of private credit firm HPS Investment Partners, which will turn into top five player in private credit. It comes two months after the company acquired infrastructure manager Global Infrastructure Partners.

These businesses appear to be small at first glance. The firm says alternatives will account for just 4% of its assets, compared to 67% for passive strategies. However, they’ll be heftier from a profit perspective. Blackrock expects alternatives to be around 25% of earnings, versus 40% for passive.

Fink and others see several tailwinds for private investment, including a pullback from banks in lending, fewer public listings and more companies choosing to stay private, and the ability to charge steeper fees vis-à-vis other asset classes such as equities.

BlackRock has ridden the wave of growth in passive investing, and with these acquisitions, it hopes to do the same in private investment.

With passive investment on the one hand and private investment on the other, active fund managers are being squeezed from both sides. The struggles of local fundies like Perpetual are testament to this.

8. The young are reaching for pitchforks on housing

For several decades, Governments, banks, and vested interests have been juicing housing returns with all their might. Younger generations have been slow to cotton on to the racket, but cotton on they have.

I’ve previously said that the Governments have no intention of doing much about housing, despite their endless announcements and soothing words to the masses. That’s for personal reasons, because the politicians have much of their own wealth tied up in housing, and for electoral reasons, because most voters own residential property.

This was clearly spelled out by the Federal Housing Minister, Clare O’Neil, in a recent interview with ABC youth radio station, Triple J. Pushed on whether she wanted to see house prices come down to give young people a chance to get into the market, she didn’t deflect like a good politician normally does.

“That might be the view of young people,” she said of the idea that sustained price falls are actually a good thing. “But it’s not the view of our government. We want to see sustainable price growth. We want to see more houses come online. We want to see that rental vacancy rate go up a bit … and we certainly want to see more homeowners.”

O’Neil’s interview went viral as Triple J listeners vented their anger at Government intentions to keep house prices rising, putting them further out of reach of younger people.

In a recent Firstlinks article, Alan Kohler, suggested the best outcome may be for policies to ensure that house prices stay stagnant for up to a few decades, allowing incomes to catch up to make housing affordable again.

Unfortunately, that benign scenario may be too long for the young, many of whom are angry about skyrocketing rents and being unable to afford to buy their own home.

9. The importance of staying invested and diversified

2024 has again proven that forecasting future is difficult, and it’s prudent to stay invested and diversified.

Many investors switched to cash in 2022 as both stocks and bonds swooned. Yet, holding more cash has been a significant drag on returns over the past few years.

On the flip side, retail and institutional investors are pouring money into US stocks today, hoping for a slice of the seemingly easy returns of 2023-2024. Whether that’s wise remains to be seen.

James Gruber is Editor of Firstlinks.