In 2020, in a high-profile change, Treasurer Josh Frydenberg extended the ban on fund managers paying selling commissions to financial advisers and stockbrokers. We have covered the subject extensively. The ban on certain issues was good policy because the fees tempted advisers and stockbrokers to act in their own interests to earn a 'stamping fee', rather than offering the best investment for their clients.

So what’s this in the offer document for a new Listed Investment Trust (LIT)?

“The Manager proposes to pay a stamping fee to the Joint Lead Arrangers and Joint Lead Managers in respect of all Applicants who are certified to be Wholesale Clients.” (my bolding)

The definitions of ‘wholesale’ and ‘retail’ clients, and the ease of qualifying as wholesale, are driving a reversion in the way new issues and other products are sold and a return to the bad old days of potential conflicts of interest.

The wholesale push is widespread but includes some surprising developments. The Commonwealth Bank endured years of agony sorting out the mess in financial advice due to conflicted remuneration, yet anyone who registers as a wholesale investor with its stockbroking arm, CommSec, must sign a document which says:

“I acknowledge and accept I will lose the retail protections which are available under the Corporations Act 2001 (Cth) which include but are not limited to … (CommSec) acting in my best interests; and access to CommSec’s internal and external dispute resolution services.”

The Bank spent a billion dollars employing an army of consultants and compensating people for poor advice while divesting itself of financial services businesses, and now its stockbroker is absolving itself of the need to act in the client’s best interests and even refusing access to dispute resolution.

What’s going on?

Not a good look for financial advisers and stockbrokers

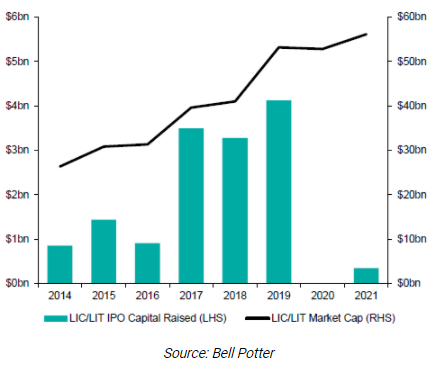

It was incriminating for many (but far from all) financial advisers and stockbrokers when the banning of stamping fees closed the Listed Investment Company (LIC) and LIT new issue market in 2020. As the chart below shows, a record amount of over $4 billion was invested in new LICs and LITs during 2019, up from $3.3 billion the previous year. In a golden period for issuers and arrangers, over $10 billion was placed with investors in only three years. Assuming a 1% stamping fee, that was $100 million to share around. And then it stopped.

Why? The main reason was that in January 2020, Treasury began a review of stamping fees paid for placing LICs and LITs with retail investors, leading to a ban a few months later. Treasurer Josh Frydenberg said at the time:

“The Government’s changes will ensure that listed investment companies are treated no differently to any other managed fund that invests in the same assets. These changes will provide the sector with certainty and address the risk of mis-selling.”

LIC and LIT new issues, 2014 to 2021

Issuing had become so dependent on conflicted fees that when the fee was no longer paid by the issuer, the market closed. Another reason was the poor investor experience from some large LICs and LITs issued in 2019 which sunk to significant discounts to NTA, suggesting the placements had not been well targetted with firm end investors.

We wrote at the time in this article:

“Can anyone deny that many brokers and advisers are motivated by the selling fee? Some of the advisers rebate the fee but what about the rest? Was a LIT offered in a particular month the best fixed interest fund available, and so much so, it deserved a billion dollars? That’s a stretch.”

Since 2020, despite record inflows to the competitor vehicle, Exchange Traded Funds (ETFs), the only new LICs have been driven by existing clients of Wilson Asset Management and Salter Brothers.

Amid major reviews of the financial advice industry, including new education standards and guidelines, stamping fees are a legacy incentive putting advisers and brokers in conflict with their clients. When many people celebrated the banning of stamping fees, they overlooked one thing.

The ban applies only to retail clients.

Jumping through a loophole

The floodgates are opening. In the two years since Treasury’s so-called ban, a threshold has been reached where enough product distributors (financial advisers and stockbrokers) are either running their businesses by accepting only ‘sophisticated’ or wholesale clients, or they have identified the qualifying clients in their overall business.

Legislation such as the Financial Planners and Advisers Code of Ethics applies to protect retail clients only, such as this definition:

“client, in relation to a relevant provider, includes a retail client of the principal of the relevant provider.”

When Standard 7 of the Code of Ethics says the following, it applies only to retail:

“You may not receive any benefits, in connection with acting for a client, that derive from a third party other than your principal.”

Without the same protections afforded to retail clients, it is far easier to offer new issues. The CommSec website includes this section headed: “The Risks of Being a Wholesale Client”:

- You'll need to make your own evaluation of investment opportunities without being provided disclosure documents such as a Prospectus or Product Disclosure Statement (PDS).

- You’ll make investment decisions without the same protections as Retail clients where the risk is entirely borne by you.

- We’ll contact you (either by email and/or phone) to let you know when a wholesale or other investment offer occurs.

None of those tiresome Statements of Advice. No need to jump through hoops deciding whether an issue is suitable for a client. Clients are sophisticated so it is their problem.

I'm not saying CommSec will act against the best interests of its clients but why ask customers to sign a document accepting that CommSec has the right not to act in the client's best interests?

It’s game on for LICs and LITs and other products such as property syndicates, private placements and hybrids directed at potentially millions of clients who qualify as sophisticated.

DDO obligations have encouraged the move

Ironically, advisers and brokers have been assisted by compliance with the new Design and Distribution Obligations (DDO) meant to protect investors. Under DDO, issuers have decided that hybrids, for example, can only be distributed to sophisticated investors.

For the recent issues by ANZ and CBA, brokers registered qualified clients as sophisticated and now they have a large database that can be sold to outside retail protections.

This is what potential applicants for ANZ’s recent hybrid issue were advised, even those who simply wanted to rollover their previous holding:

“If you want to apply for ANZ Capital Notes 7, you must be a client of a syndicate broker ... and either a wholesale investor, or a retail client within the Notes Target Market who has received personal advice from a licensed professional adviser.”

Out of the blocks and running

Entering this back-to-the-future world is the first of many expected new LICs and LITs, the PIMCO Global Income Opportunities Trust (proposed code on ASX:PMX), currently in the market seeking $500 million with potential for oversubscriptions of another $200 million.

(This article makes no attempt to analyse the merits of the transaction. We are drawing attention to the distribution processes and changes in advice businesses).

Page 69 of the Product Disclosure Statement says:

(i) Remuneration of financial advisers

The Manager will pay the fees (some of which are based on the volume of funds raised, as explained below) payable to the Joint Lead Arrangers and Joint Lead Managers (see Section 11.2), some of which may also act as financial advisers.

The Manager proposes to pay a stamping fee to the Joint Lead Arrangers and Joint Lead Managers in respect of all Applicants who are certified to be Wholesale Clients. However, no stamping fee will be paid in respect of an Applicant who is not certified to be a Wholesale Client.

In addition to fixed payments for respective roles, the fees are outlined in clause 11.2 on page 76:

* 0.55% for the first $40 million of allocations made to Wholesale Clients

* 0.75% of the next $20 million of allocations made to Wholesale Clients

* 0.90% of any further allocations made to Wholesale Clients raised in excess of $60 million; and

* a broker fee of 0.75% of the total dollar amount of all allocations made by that Joint Lead Manager to Wholesale Clients.

Brokers share the fees with financial advisers. It’s the first big LIC or LIT since 2019, proving that there are now enough identifiable wholesale investors to drive a large offer.

Is it difficult to qualify as sophisticated?

Becoming a wholesale investor is significant as clients agree to lose the retail protections under the Corporations Act. Not only have such protections been argued about and developed for years, but billions of dollars have been spent on fines and costs of non-compliance. Some may argue that retail investors never read Statements of Advice or Financial Services Guides, but that’s another story. Obviously, governments and regulators think they are necessary.

Given the lack of protection when accessing this wonderland of new issues, surely it’s difficult to qualify. No, it’s relatively easy and millions of Australians are eligible. To qualify, a ‘sophisticated investor form’ must be completed, certified by an accountant, confirming the investor has:

- Net assets of at least $2.5 million, or

- Gross income of at least $250,000 per year for the last two financial years.

There is no requirement that the client demonstrate any standard of knowledge about investing or products. The $2.5 million threshold is not indexed and has not changed since its introduction in 2002 and the amount includes the net value of the family home. It is not investible assets, it is all assets.

CommSec is far from alone and the common retail protections lost include:

- Financial Services Guide which explains services and fees charged.

- Disclosures and warnings about conflicting interests in financial advice.

- Fee disclosures or consequences of replacing one product with another.

- Access to internal complaints handling procedures for retail clients.

Modelling by Australian National University Associate Professor Ben Phillips, commissioned by Coolabah Investments, and reported by The Australian Financial Review, suggests the wholesale investor test is met by 16% of Australians, or over one million households and 3.25 million consumers. It was only 100,000 in 2002.

Let’s face it, these are the people that advisers want anyway, not only to reduce compliance, but because they have the money. It further excludes retail clients from the financial advice process as businesses switch their entire operating model to cater only to wholesale. Given the rise in home prices in the last year, these eligibility estimates are probably conservative.

A person who knows little about investing and whose house has risen in value to $2.5 million, or who inherits a valuable estate, or otherwise has wealth without financial expertise, is considered sophisticated and can be targeted. It’s reinstating the reason why stamping fees were banned two years ago.

ASIC surveillance of fund marketing

In a strange juxtaposition, at a time when such consumer protection is watered down, the Australian Securities & Investments Commission (ASIC) announced last week:

“a surveillance into the marketing of managed funds, to identify the use of misleading performance and risk representations in promotional material. ASIC is scrutinising traditional and digital media marketing of funds, including search engine advertising, targeting retail investors and potentially unsophisticated wholesale investors, such as some retirees.”

So now we have a new term, ‘unsophisticated wholesale investors’. Wait a minute. Anyone who has net assets over $2.5 million is defined as sophisticated. There is no requirement to identify the unsophisticated people among them.

ASIC is especially focussed on its Regulatory Guide 234 Advertising financial products and services (including credit): Good practice guidance (RG 234) which states:

- Marketing must give balanced messages about returns, features, benefits and significant risks.

- Risk disclosure needs to be clear and prominent.

- The safety, reliability or security of an investment should not be overstated.

- Comparisons with other products or benchmarks must be appropriate and reasonable.

When a new issue is in the market, do advisers need to explain why it is better than the thousands of other products already on offer, and reveal the fees being earned? For example, on the PIMCO transaction, the management fee is 1.24%, plus indirect costs of 0.18%, plus transaction costs of 0.02%. Will ‘unsophisticated wholesale investors’ be told that a fixed interest fund will charge 1.44% per annum?

Not all advisers are the same

Many financial advisers charge their clients a flat fee for service and reimburse commissions received. For example, in response to a Firstlinks article on this subject in January 2020, Richard Brannelly from CommonCents Financial Planning in Toowoomba commented:

“As a professional financial planner with almost 20 years experience in helping clients I cannot think of a single valid justification an adviser could use to accept the "stamping" fee. I believe a very large percentage of my colleagues would feel the same, but I would like to know how many licensees and advisers are accepting such fees. A true profession will call out such behaviour in the interests of consumers. The time for such conduct has well and truly past and if individual advisers cannot do the professional and ethical thing then legislation to remove the exemption is the only recourse.”

The legislation subsequently introduced had the desired impact for a couple of years, but with business models changing and many clients now registered as sophisticated, it’s game on.

Footnote

The day after this article was published, PIMCO issued the following statement:

PIMCO TO WITHDRAW APPLICATION TO LIST PIMCO GLOBAL INCOME OPPORTUNITIES TRUST

Sydney, (1 April, 2022) – PIMCO, one of the world’s premier fixed income investment managers, has announced it will not proceed with the launch of its Australian listed investment trust (LIT), the PIMCO Global Income Opportunities Trust.

PIMCO cited insufficient demand due to residual investor concerns around the historical secondary market trading performance of segments of the LIT sector in the local market as the reason for its decision.

Rob Mead, Head of PIMCO Australia and Co-head of Asia-Pacific portfolio management, said: “In the current market environment, the level of demand did not give us confidence that the product would trade strongly in the secondary market. We therefore decided it would be in the best interests of investors not to proceed with the listing.”

Brendon Rodda, Head of Distribution, Global Wealth Management in Australia, said: “This experience highlighted that there is strong demand for this kind of strategy, albeit the preference is for an unlisted structure. PIMCO will therefore focus on expanding our footprint in this sector of the market to bring our expertise in alternative credit solutions to deliver much-needed income to Australian investors.”

ENDS

Graham Hand is Editor-At-Large at Firstlinks. This article is general information and based on an understanding of current legislation.