Last year, 2019, was better than many expected, but as 2020 is underway, institutional investors are not particularly upbeat. According to the annual Natixis Investment Managers global survey, institutions around the world are concerned that ongoing low yields, stalled trade talks and slow global growth represent significant risks to portfolio performance. In fact, 83% expect a GFC-type event within the next five years.

The survey collates the views and expectations of 500 institutional investors, including 19 from Australia. Those surveyed control USD15 trillion of assets and include superannuation funds, sovereign wealth funds and other corporate pension funds. Their views on what’s in store and how to respond offer compelling insights into what Australian institutional investors are likely to do in 2020, and how this will affect returns.

The major portfolio risks

The survey findings showed investors’ top five portfolio risks for the year ahead are:

- market volatility (53%)

- interest rates (50%)

- credit crunch (37%)

- liquidity (36%)

- deflation (20%).

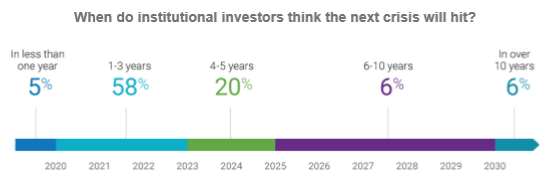

The question isn’t which risk will do the damage, it’s more a question of when. A majority of institutional investors say they expect the next GFC within the next five years, as shown below. Almost three-quarters (73%) project trade will have a negative impact on performance, as well as slow growth and the low yield environment. About 58% see the potential for asset bubbles to thwart performance and 89% are concerned about the impact of rising public debt on global financial security.

Allocations between active and index

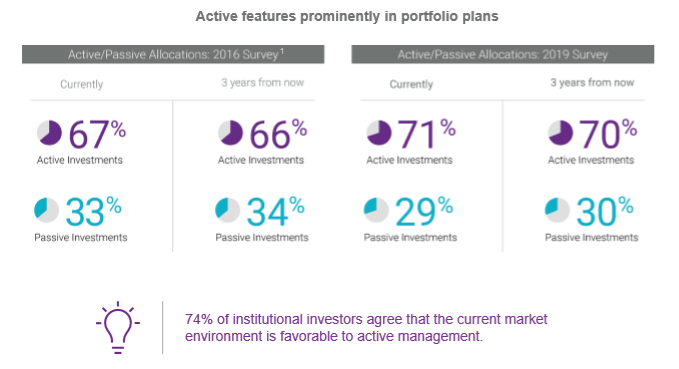

When asked about how they intend to respond to these risks, 74% of institutions said that uncertain markets call for active management. As shown below, despite the strong returns from passive investments in 2019, most institutions believe a 70/30 split between active and passive is the right mix. They believe that large inflows into passive investments present significant risks, partly because they indicate that the market is ignoring fundamentals, but also because large flows risk amplifying volatility.

The investment outlook

Australian institutions are asking how they should invest to achieve a target return, without becoming too caught up in macroeconomic factors over which they have no control. There is a sense that the global macro and geopolitical events – Brexit and trade tensions for example – are taking a long time to play out. There is widespread acceptance that keeping a sharp focus on meeting investors’ retirement and investment goals in the face of difficult market conditions is their number one priority.

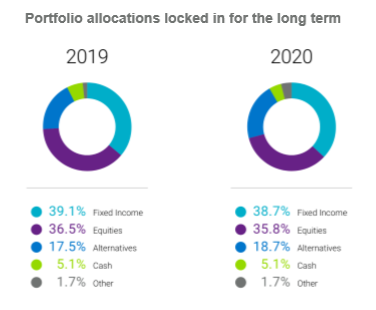

Even though they see challenges on the horizon, institutions are not planning significant allocation shifts. In fact, current allocations are within one or two percentage points of what institutions projected for 2019, as shown below. Those looking to adjust alternative allocations say they will increase allocations to private debt, infrastructure and real estate.

Diversification and the role of non-traditional assets

What does a diversified, robust portfolio actually look like? Lower yields have rekindled risk appetite globally, including in Australia. Faced with historically low yields, and a Governor of the Reserve Bank of Australia (RBA) who has explicitly stated that ‘lower for longer’ is likely to be the new reality. Investors understand that they have to move up the risk curve in order to achieve reasonable rates of return.

As a result, we are seeing more niche strategies included in portfolios. In Australia, institutional investors are looking outside traditional asset classes to real estate, infrastructure, private equity, hedge funds, global macro strategies, ESG-focused funds and global credit. They are also looking outside of traditional asset managers to provide exposure to these markets. This means greater willingness to unclude offshore asset managers if they are convinced of the value the manager can bring.

The growing role of environmental, social and governance (ESG) factors

The reasons for the institutional embrace of ESG are illuminating. More than half (54%) say that there is alpha, or excess returns, to be found in ESG, and 57% focus on ESG in order to align their assets to organisational values. Even more surprising perhaps is that it’s not all about returns or even their own organization. More than a quarter (28%) of institutions said ESG in order to help make the world a better place.

We are also seeing an evolution in ESG thinking with more institutions integrating sustainable development goals into their portfolio. There is more rigorous thought process around the carbon footprint of an overall portfolio, rather than honing in on specific sectors or companies. For example, a key theme for Mirova, Natixis Investment Managers’ affiliate manager dedicated to sustainable investing, is to identify which companies will likely benefit from the transition from old world reliance on fossil fuels to new world renewables, and to keep their portfolio’s carbon footprint below the 2 degrees agreed by the Paris Agreement.

Managing investor expectations in 2020

When asked about investors’ expectations for 2020, many institutions expressed concern that investors are not as acutely aware of the risks on the horizon as they should be, nor of the necessity of shifting portfolio allocations to more ‘risky’ assets in order to meet long-term goals. Over three quarters of institutions said that individual investors have unrealistic return expectations, while a similar amount don’t understand their own risk tolerance and may even liquidate their assets prematurely due to fears of a recession.

The survey also revealed the tendency of individual investors to focus too heavily on short-term results. This problem, prevalent in Australia, can mean losing sight of the importance of staying invested for the long-term.

Education is key. Investment managers are taking steps to fully inform their investors about risk and return and the importance of diversification and active management. Our industry needs to rebuild trust post the Royal Commission, and we need to offer investors credible solutions at a reasonable price.

Investors need to tune out market noise, build meaningful positions within their portfolios and invest with conviction over the long term. Keeping a close eye on market conditions, maintaining a truly diversified portfolio – with a mixture of traditional assets and non-traditional assets – is the best way to help investors achieve their long-term goals.

Louise Watson is Managing Director at Natixis Investment Managers Australia. This article is general information and does not consider the circumstances of any investor.