Bad news hits the weakest the hardest.

Australian investors already endured a rather disappointing latter half of 2019 when companies, including banks and resources companies, announced sizeable cuts to dividends.

It shows not all was well even before the Covid-19 pandemic spread across the globe and forced countries into lockdown.

Facing the reality of massive dividend cuts

Now 2020 is shaping up as the worst year on record in Australia as far as corporate profits and shareholder dividends are concerned, in particular hitting those shareholders hard whose strategy is aimed at receiving sustainable income from the share market.

However, the truth is that many of those investors blissfully ignored the very basic number one rule when making investment decisions (to quote Warren Buffett from a long time ago):

- -Rule number one: never lose money

- -Rule number two: never forget rule number one

What Buffett tells us all through this seemingly facetious and simplistic two-rule mockery is that successful investing is about ‘managing’ risk, not about ‘taking’ risk or 'ignoring' it.

And many Australian investors and their financial advisers have ignored the risk that comes with investing in high-yielding stocks on the share market for far too long.

Rethink a faulty income strategy

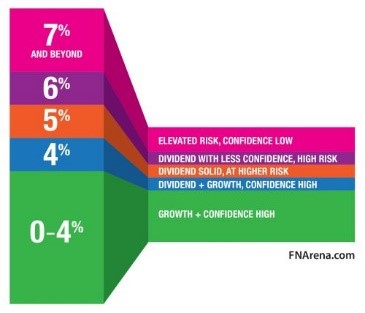

Many now facing serious budgeted income shortfall would not necessarily have realised but buying 5% or 6% yielding equities (forward looking) in the share market pre-corona implies a serious step up on the overall risk ladder.

This is because government bonds, theoretically the ultimate low-risk financial instrument available beyond cash under the mattress, are now yielding so little, financial markets have pulled back all yields across instruments and markets accordingly.

Years ago, I illustrated this process through the diagram below (first published in 2015).

The validity of this general assessment of risk as implied by stock market pricing of securities follows through the observation that most cuts in dividends last year and in 2020 are from the higher-yielding cohort on the ASX. Plus most dividend cuts announced tend to be much larger than for lower yielding equities.

Investors would be wise not to underestimate this process of absorbing the fall-out from the lockdowns and the subsequent economic recession still has a lot longer to run. Dividends will still be absent and cut next year and in some cases maybe even in 2022.

Maybe this is as good as any time to pause and reflect on what went wrong and set out on a better strategy for the future. A faulty income strategy starts with the wrong focus.

Step number one, for all kinds of investors, no matter experience, age or specific strategies, is to look after your capital.

Step number two is to adopt a total return strategy whereby everything is taken into account, including costs, fees and taxes.

Step number three is to incorporate potential income.

Too many investors, panicked by the change in the yield and income landscape post 2012, ignored the natural order for setting up a robust investment portfolio and moved straight to step number three. And many an adviser failed to inform or educate their clients otherwise.

Even prior to last year’s dividend cuts, and this year’s bear market for equities, the failings of strategies with a sole or extreme focus on income 'right now' had already revealed themselves in spades.

Look no further than the fact three of the major four banks’ share prices had lost about one-third of their value since April 2015, prior to sinking near GFC lows in March this year.

Many a stock held for the sole attraction of the dividend has fared a lot worse, including the likes of AMP, G8 Education and, indeed, Telstra.

Focusing on income and not capital is a mistake

Even those investors hiding behind the fact they purchased their initial shares many moons ago at much lower prices still cannot deny that any strategy providing income while the capital base erodes away is not a good strategy.

Especially not when after the fall in capital comes the realisation there will not be a dividend at all this year, or a substantially reduced pay-out.

A much better strategy is one that incorporates the one key element that separates equities from bonds and other income-providing investment products: growth.

Investors should consider there are two ways for creating income from owning shares: one is through dividends, the second is via selling at a higher level than the purchase price.

The best way to combine both key share market characteristics is through adopting a wholistic approach: by constructing a portfolio that combines growth with income and income with growth. The end result should be a strategy that is much more protected against negative developments, including capital erosion, while offering growth of capital and income instead.

A truly superior outcome.

Sounds too good to be true? I’ve done the groundwork over the past five years. I can report from first-hand experience it’s not a theoretical chimera. Get the basics right and you too can grow your capital while enjoying a steady income.

Past research indicated the share market’s sweet spot lies between 4%-4.5% in forward-looking dividend yield (see also the diagram earlier). But because of the significant drop in global bond yields, I believe the optimal point where risk, income, growth and return meet on the ASX is probably now around 3%.

Even with franking credits added on top, 3% won’t be sufficient for most retirees and pensioners. So we have to be smart and add in growth.

Growth adds two key features to our portfolio: share prices for companies that grow to a higher level plus today’s dividend payouts will be higher in the future as well when supported by growth. By combining income with growth, a portfolio that today yields 3% (for the portfolio as a whole) can yield 4%, then 5%, and more as time goes by.

In the meantime, the capital inside the portfolio grows to a higher level and investors can sell a portion each year to make up for the initial shortfall in income from dividends.

In case you are still not 100% convinced, I’ll meet you half-way.

The importance of growth stocks

A simple ETF (exchange-traded fund) that mimics the ASX200 Accumulation Index would have done a better job than owning a large overweight portfolio positions in banks, energy companies and retail REITs (all bought for their high yield) and the like over the years past.

The ASX200 combines CSL with CBA and other financials, BHP, Woodside, JB Hi-Fi, and others (200 stocks in total) for an average dividend yield of circa 4%.

Assuming most investors are aiming for 6% income plus franking, they would have to sell circa 3% initially each year to generate the required income (there are some costs to take into account as well).

Starting in January 2015, such a basic index-following strategy would have generated the following returns (ex-dividends)

- 2015: -2.13%

- 2016: +6.98%

- 2017: +7.05%

- 2018: -6.90%

- 2019: +18.38%

The above returns are ex-costs, but ETFs are low cost. Also, because of the significant underperformance by yield stocks in recent years, the average dividend yield for the ASX200 has actually been closer to 4.5%, which makes the past return from an index ETF even more attractive.

Even without the spectacular outcome in 2019, a simple ETF would have provided a superior total return than your average ill-conceived, dividend-oriented strategy over the past five years.

Because of the heavy overweight positions for the banks, Telstra and other large cap dividend-paying stocks in the index, a carefully constructed portfolio with less exposure to the share market’s weak spots can generate an even better outcome.

We have managed our 'All-Weather Model Portfolio' in accordance with this smart income principle and it has done better than an index ETF over the period, including this year when losses incurred are significantly lower.

Admittedly, constructing a low-risk basket of stocks during a time when dividends are being deferred, reduced or cancelled, and when company profits are expected to fall by most since the GFC is more of a challenge this year. However, I still maintain the outcome from combining growth with dividends will be superior over the years to come.

Rudi Filapek-Vandyck is an Editor at the FNArena newsletter. This article has been prepared for educational purposes and is not meant to be a substitute for tailored financial advice. FNArena offers impartial analysis and proprietary tools and insights for self-managing investors. The service can be trialled for free at www.fnarena.com.