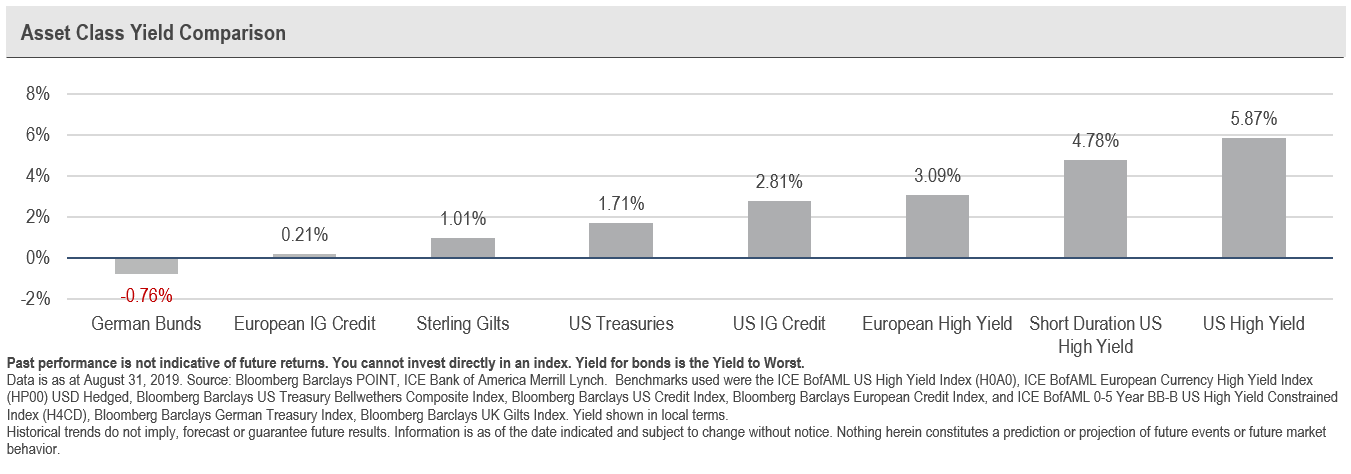

In today’s low interest rate environment, fixed income investors are faced with the challenge of generating meaningful income while seeking to insulate their portfolios from the impact of market forces. In the past 30 years, the fixed income universe has seen profound changes as it has evolved in complexity and geography, and from generally higher yielding to the historically low yields seen today. Fixed income managers need to employ a greater variety of approaches and asset classes to achieve objectives for investors.

The evolution of the portfolio manager’s role

At one time, bond managers could focus on a few indicators and markets to make their portfolio decisions. The landscape is far more complex now. European core market bond yields, for example, can have rapid impacts half a world away. And the amount of data out there is extraordinary. Managers need expertise in far more sectors and across far more geographies than before. Obviously, one or two professionals can’t keep an eye on all of these inputs, so this has put a premium on team-building and coordination in managing investment portfolios.

Investor psychology also creates market hazards. As investors seek yield and move further along the risk spectrum, they go to places that are less comfortable for them. They are not in their usual habitat and are more likely to overreact at the first hint of volatility. Coupled with changing liquidity dynamics, these jittery investors can lead to sharp market responses, which should be considered when sizing positions, considering liquidity and choosing securities that have a better chance of withstanding short-term volatility.

How can fixed income assets provide significant yield at this point?

Co-mingled fund vehicles come in many shapes and sizes. It’s possible to invest in a single fund that provides exposure across the fixed income spectrum, or to narrow your choices to specific sectors. Which you choose will in large part depend on individual circumstances. In our view, investors should generally start with a portfolio that provides broad diversification of fixed income exposure across of range of sectors and exposures. This provides some of the key benefits of fixed income such as portfolio stability and diversification. Investors can then seek to improve their return/risk profile by adding positions in single sectors such as mortgage credit, corporate bonds, senior bank loans and emerging market debt (EMD).

Doesn’t that add risks to a portfolio?

In some ways yes, and in others, no. For example, EMD, although a generally high-quality asset segment overall, will tend to add volatility to the portfolio. On the other hand, bank loans, whose yields are reset frequently, will tend to reduce overall portfolio duration (sensitivity to rate fluctuations) due to their floating rate character, they can provide some insulation from inflation and rising rates. Although below investment grade, they are typically secured against corporate assets.

Combining traditional investment grade fixed income sectors with a broader set of fixed income sectors has historically increased portfolio diversification while lowering overall volatility, improving the risk/return tradeoff. However, investors should avoid sticking too closely to broad market benchmarks. For example, passively taking exposure to the Barclays U.S. Aggregate Bond Index (‘Barclays Aggregate’) gives a heavy weighting to low-yielding US Treasuries and investment grade bonds, which reduces total return potential. These days, a fixed income portfolio needs to do more.

Additional choices in seeking better fixed income returns

There are benefits in investment strategies that afford portfolio managers increased flexibility in seeking returns and managing risks. In multi-sector bond funds, managers may invest in a variety of sectors, across the spectrum of credit, duration and geography. Such funds may also have the ability to take short positions, for example using derivative contracts to profit from interest rates increase.

A diversified relative value approach to fixed income investing capitalises on price anomalies across a broad range of fixed income sectors throughout the market cycle. A globally-integrated fixed income platform and a repeatable and robust process should identify relative value opportunities over time.

Asset prices reflect consensus expectations across various factors - the level and path of interest rates, the shape of the yield curve, credit risk, cash flow patterns, volatility, etcetera. At times, our expectations on these factors differ materially from what is implied by the consensus.

How do you identify and capitalise on market mispricings?

There are three main questions in evaluating any fixed income asset:

(1) What are the market’s expectations?

(2) Where do we have investment insight?

(3) How confident are we in our views?

The answer to the first question provides context, the second considers whether our views are different from market consensus, and the third measures our level of conviction for portfolio implementation.

The outlook for the fixed income market

From 2018 to 2019, the U.S. bond market moved from pricing a Fed tightening cycle to a significant Fed easing cycle, and interest rates on government bonds in Europe have moved into more extreme negative yield territory. Are these changes reflective of changing fundamentals that investors should embrace, or are they reflecting overblown fears of a global slowdown or recession?

In our minds, it’s a bit of both. The Fed and ECB have shifted toward easing biases, yet it’s largely due to how they want to respond to low inflation rather than significant fears about the growth outlook.

Our central view is that a global soft landing is more likely than negative scenarios. Across the U.S., Europe and Asia, consumption rates in the major global economies are stable, despite weakness in production and trade sectors. Ultimately, structural shifts in many major economies toward services-oriented consumption make them less prone to recession and hard landings over the next 12 months.

We believe that investors should continue to invest for a soft landing outcome but recognise that tail risks are rising and centered on trade policy. Given market volatility and slower growth, incremental sources of yield become an important portfolio contributor, especially over the long run. However, this just reinforces the need to be flexible and look for opportunities globally and across sectors to seek to enhance risk-adjusted returns.

Adam Grotzinger is Senior Portfolio Manager, Global Fixed Income at Neuberger Berman, a sponsor of Cuffelinks. Neuberger Berman is the manager for the listed NB Global Corporate Income Trust (ASX:NBI). This material is provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. It does not consider the circumstances of any investor.

For more articles and papers by Neuberger Berman, please click here.