There is a fascinating contrast in age pensions in Australia and France. In a few months from now, the eligibility age in Australia rises to 67 years. There is no marching in the streets in protest. In France, there are violent objections against increasing the age from 62 to 64 years. Wild mobs set fire to Bordeaux’s town hall, invaded the stock exchange building in Paris and constructed brick walls across major roads. Tons of garbage are piling up on the streets of Paris as workers campaign against plans to increase their retirement age from 57 to 59, lower than the national average due to the physical effort. Yet in April 2014, the Federal Liberal Treasurer Joe Hockey announced an intention to increase Australia’s eligibility age to 70, although this was scrapped in 2018.

Australia, as high as 70 years (but not for now), France as low as 57 years. What’s going on?

French police fight protesters as roads blocked during pension violence

Source: Twitter

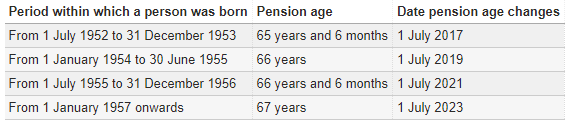

Australia at 67 years on 1 July 2023

The age pension was first introduced in Australia in 1909 with an eligibility age of 65, and it was not until 100 years later in 2009 that the Rudd Government introduced a schedule for a gradual increase.

The background to the 1909 introduction was that life expectancy at birth was 55 for males and 59 for females, so few people were expected to receive the age pension for long. According to the Australian Bureau of Statistics (ABS), life expectancy at birth in 2021 was 81 years for males and 85 years for females. So Australians expect to live 26 years longer than in 1909 but the eligibility age has increased by only two years. The majority of Australians will receive a full or part pension, even out to 2060, despite the maturing of the superannuation system.

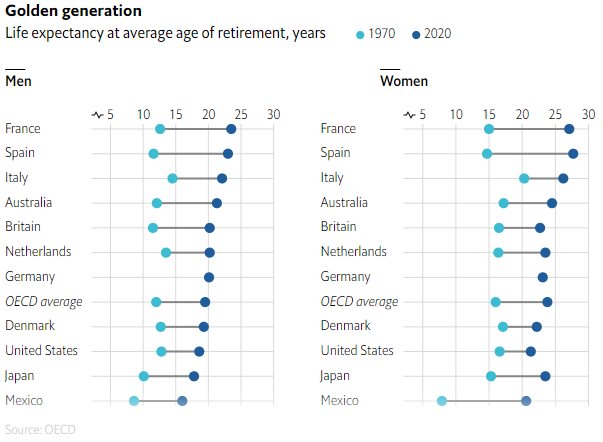

French are retired the longest

According to the OECD, in 2020, the French had the longest life expectancy at their average age of retirement of any OECD country, with Australia a few years behind.

Source: The Economist

What did the Government say in 2009?

Prime Minister Kevin Rudd gave Australians plenty of notice of the coming increases, announcing them eight years before their effective date. He said in 2009:

"With the aging of the Australian population, unless we make these changes for the long-term, then its capacity to undermine the overall financial integrity of budgets in the long term ... is a serious problem. To make this fair is to give people lots and lots of warning. This does not start to be phased in until 2017; it doesn't obtain full effect until the year 2023, and therefore in terms of preparing for it we think it's the right thing to do."

The reaction was mooted, maybe because it was so far ahead. In fact, there were arguments at the time that if the age pension age increases, so should the age for drawing down superannuation pensions. It would be reasonable to expect people already retired not to object, because they benefit the most. Budget improvements due to delayed pensions for other people increase the likelihood that existing pensions can be sustained. Rudd effectively told Australians to 'suck it up', and we did.

Why are Australians passive when government policies change?

Even if we accept that the French have a long history of protest and working fewer hours, Australians rarely take to the streets to force policy change. Perhaps the closest examples were the campaigns against franking credit changes at the 2009 Federal Election, but it was civilised, with no burning of buildings and blocking of roads. There were some lively arguments in local meetings, then it was off for a cup of tea and a biscuit.

In fact, in Australia, violence may be interpreted as negative to the cause.

A recent Tweet asked ‘Anyone know why?” in response to this posting.

Given the Firstlinks audience is usually heavily engaged on pension issues, we are running a Survey to ask the same question. We will publish a range of replies next week, but please keep the comments civil and non-racist.

Here are a few examples in response to the tweet, but we will not include many others here is their tone is bigoted and discriminatory. We want to engage in meaningful insights into the Australia response to government policies, such as on the pension eligibility age. The Twitter responses include:

"I think this question is fascinating! Look at how each country took to masking and lockdowns, and injection uptakes, which citizens trust their government and media, I think has a lot to do with it! It’s like a huge sociological experiment we are witnessing in real time!"

“We are too busy having fun, don't listen to real news, arrogant but don't understand what is happening or its consequences.”

“It must be about more than the retirement age being 64! Australian baby boomers are working into their 70’s to support their children and grandchildren doing it tough and getting tougher!”

“We have been programmed to believe that we are the lucky country - she'll be right mate - so we never get upset, we just blindly accept whatever is dished out.”

“Are we supposed to be protesting our government not bankrupting the economy with retirement at 62?”

“Because the French still maintain a bond amongst proletariat. A bond of unity that the government have been unable to destroy. Unlike the U.K. and Australia."

"French value their work life balance. In France the mealtimes are very long, it includes groups of people and a lot of conversations. There is no rush to pay the cheque and go. On weekends cafes open towards lunch and fill with people having long lunches with fam & friends.”

Fill in this survey and tell us what you think.

Graham Hand is Editor-at-Large for Firstlinks.