Most retirees have seen their savings fall in value over the past six months and may question whether this affects their ability to fund a comfortable lifestyle for the duration of their retirement. Seeing investment values fall is undoubtably an unpleasant experience; however, it doesn’t need to have a lasting impact on retirement plans.

Protect your future cash flow

In a best-case scenario, a retiree’s annual living costs are met by income from investments including those held inside superannuation. Living off investment income avoids eating into the capital value of retirement savings and funds a comfortable lifestyle in perpetuity.

However, dividends and distributions can be lumpy and at times, unpredictable. Building a cash reserve within a super fund can provide a safeguard to ride out investment market volatility and avoid selling investments at a low value. The cash reserve should typically be the equivalent of 1-2 years of living expenses. As an example, if living expenses are $90,000 a year, the cash reserve should fluctuate between $90,000 and $180,000.

Contrasting two common super strategies

In this article, we contrast two super fund structures and the impact of drawing a regular income from each during a market down-turn.

1. Single unitised investment such as a diversified fund

These are single investment options within a super fund that comprise a range of assets such as shares, bonds and cash. The member purchases units in the investment option along with other members of the same super fund. Each member receives a share of the investment return proportionate to the amount they invested.

These are the most common super fund structures and typically have names such as ‘Conservative’, ‘Balanced’ and ‘Growth’.

When a member draws retirement income from these structures, they are selling units in the investment at the current market value.

2. Portfolio + cash account

Let's call this a bespoke portfolio, such as an SMSF. Each member selects shares, bonds and managed funds in which to invest their superannuation. The super fund also has a cash account which receives any investment return and from which regular payments to the retiree’s personal bank account are made. Each member’s return is based on their own individual investments, irrespective of other members of the same fund.

These are typically SMSFs or super wraps. The key point is that the retirement income comes from drawing funds from the cash account rather than selling investments.

Case study

Consider a retiree with superannuation savings of $2,000,000 who requires $90,000 a year to fund a comfortable life. They have a balanced risk tolerance, allocating 65% of their savings to shares to generate a higher long-term return and 35% to interest-bearing investments for stability.

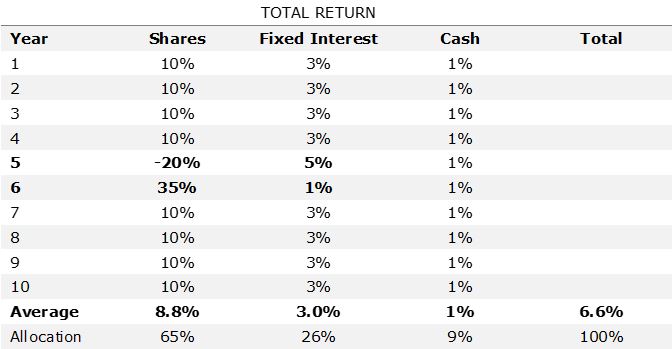

Let's assume the retiree's average return over a 10-year period is 6.6%, including a share market decline of -20% in year 5 and a recovery in year 6. For simplicity, outside years 5 and 6, we have assumed a constant return in each asset class year (shares: 10%, fixed interest: 3%, cash: 1%).

This table shows the total return we have assumed in each year:

Strategy comparison

Diversified Fund

- Each year the member draws $90,000 from their balance to fund their living costs.

Bespoke Portfolio

- The member starts with the same investment allocation as the Diversified Fund, including a cash reserve of two years of income (i.e. $180,000)

- Each year they draw $90,000 from the cash reserve

- Prior to the market crash, they top up the cash reserve annually back to $180,000 by drawing on their investments

- Shares are not sold after the market crash which results in the cash reserve reducing temporarily

- After share markets recover the cash reserve is topped up gradually ensuring it never falls below $90,000.

Possible outcome

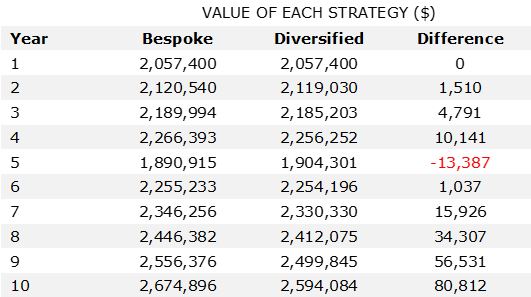

The chart below compares the value of the Bespoke Portfolio relative to the Diversified Fund. Over a 10-year period, the Bespoke Portfolio gains an additional $80,812.

This difference is primarily a result of allowing investment returns to compound over longer periods, but this is also the cause of the negative outcome in year 5. The cash reserve allows the retiree to preserve their share market investments during the market correction helping their retirement savings grow in future years.

The main reason the Bespoke Portfolio does better is that shares are not sold after the market crash, as income needs are met from the cash reserve. In this example, the Portfolio then benefits materially from the 35% gain in the following year.

Other considerations

Other considerations that will impact the future value of the retiree’s savings:

- Starting allocation to shares vs fixed interest investments

- Frequency and level to which the cash account is topped up

- Regularity of rebalancing between asset classes

- Fees and costs of the super fund and financial advice

- Taxation on investment returns.

Here we’ve compared only the super fund structures and assumed all else is equal. There are many other considerations including insurance options, estate planning and ease of management. There is no right or wrong, rather different fits for different situations.

Most important is that retirees have clarity on the cost of a comfortable life, understand where they want to be in the future financially and have a strategy in place to achieve these objectives. Don’t leave it to chance.

Andrew Wilson is a Client Director for Wealth Management at Pitcher Partners Sydney. This article is for general information and does not take into account your investment objectives, particular needs or financial situation.