Australian Baby Boomers are among the world’s wealthiest, yet they experience widespread retirement funding insecurity due to inadequate access to the three pillars of our retirement funding system:

*the age pension and social security system generally

*superannuation

*voluntary savings, including home ownership.

Our pension system is means tested, adjusting for variations in our non-housing wealth over time. In our superannuation savings system, however, Baby Boomers only began contributing 3% to their super half-way through their working lives.

For most, the bulk of wealth is stored in the family home. Retirees need to plan for long lives at home for 25 to 30 years in retirement. Few want to downsize or prematurely enter aged care. For many Australians, the question is how to fund their long lives at home with confidence.

New opportunities to fund retirement

So, the challenge is to support retirees by providing funding, housing, care and community throughout retirement to ripe old age.

Here are some new rules of thumb that can draw on all three pillars of retirement funding and meet the needs of the vast majority of retired Australian homeowners.

1. The longevity challenge of retirement

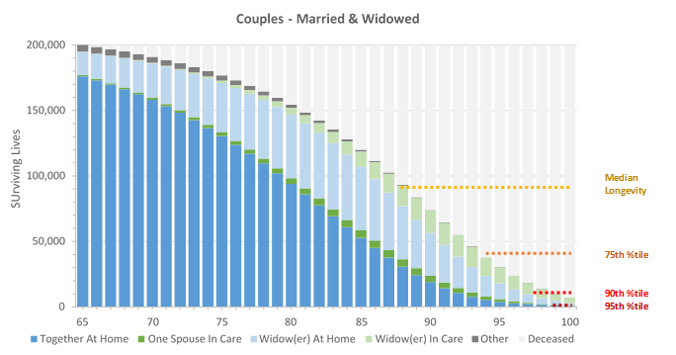

Australians enjoy remarkably long and healthy lives. An average Australian couple aged 65 can expect to be alive together for some 20 years and for the surviving spouse to live into their late 90s. This extended longevity brings both opportunity and challenge for Australian retirees with the uncertainty of knowing how much money is needed to provide for a comfortable retirement.

2. The housing challenge of retirement

Most older Australians wish to remain at home throughout retirement. Recent retiree research confirms that around 75% of homeowners aged 60+ wish to remain in their own home, leaving just over a quarter intending to downsize.

The recent pandemic experience has challenged the health, finances and confidence of a generation of older Australians. The Royal Commission into Aged Care, in combination with the high incidence of COVID mortality and morbidity in aged care facilities, has reinforced the overwhelming desire to age in place.

While many government policies are aimed to support in-home ageing – and in-home ageing is both popular and more cost efficient than institutional aged care – the overall funding of aged housing and aged care by government alone is insurmountable.

Part of the answer must involve recognising the fundamental dual role of the family home in both housing and savings. Another part is to allow retirees to better access to manage their wealth to fund their own retirement.

3. The funding challenge of retirement

Traditional approach: 4% drawdown

In the early 1990s, William Bengen demonstrated that an annual drawdown of 4% of savings at retirement each year would improve the chances that those savings would last 30 years. Around the world, variations of the 4% rule of thumb have often been used as the 'safe withdrawal rate' to ensure pension sustainability.

Since then two major changes have challenged the ability of the 4% rule to generate a sustainable retirement income: longevity has increased significantly over the past 30 years and we are now facing a significantly lower growth environment, with reduced interest rates, dividends and portfolio appreciation.

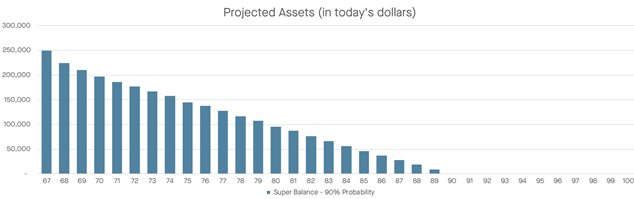

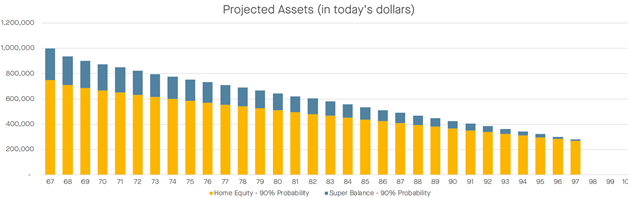

Let’s take the case of a retired couple, both 67 years of age with $250,000 in superannuation and owners of a $750,000 home trying to fund their retirement. The new reality of the long term, low growth outlook they face is: 5% pa returns on superannuation growth, 0.75% pa paid in fees to manage their investments and 6% pa investment volatility.

House price growth is 3% pa long term, with 3.5% estimated volatility of house prices and 5% pa home equity access cost. Long-term inflation is 3% pa. How can they navigate the next 30 years?

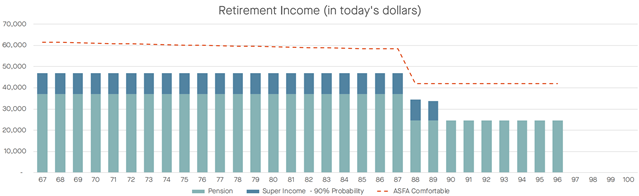

Scenario 1 – Drawing 4% a year of super in a low growth environment provides only 20 years of an inadequate income with the surviving partner living without any super

Clearly the 4% rule doesn’t go the distance and the couple’s retirement savings run out well before their expected longevity. These approaches have only been applied to the question of how to draw down a superannuation or investment portfolio balance.

In this 4% drawdown example, the couple were forced to live on a retirement income consistently well below the ASFA 'comfortable' standard and the surviving partner lived on the pension alone for the last seven years. The couple had little flexibility to maintain a quality lifestyle, manage unanticipated expenses like healthcare and in-home care, or even to fund and enjoy extended longevity.

The Australian retirement funding conundrum: drawing on all three pillars

Jane Hume, Assistant Minister for Superannuation, Financial Services and Financial Technology recently stated:

The third pillar, or voluntary savings, is incredibly important to the retirement security of Australians. For many, as we know, the family home is possibly the most significant form of voluntary savings that retirees have historically had, because retirees have historically had a very high level of home ownership compared to other countries than Australia. However, the family home is not actually considered a part of a person's retirement income.

The solution to this conundrum is arguably simple: access some of the home equity to improve retirees’ lifestyles. Australians, however, have no widespread experience of responsible, long-term access to home equity as part of wealth management and retirement funding. Quite simply, our system has not provided universal access to all three pillars of the retirement funding system.

The preceding challenge notwithstanding, there is hope on the horizon in new forms of home equity access that allow borrowers to release modest amounts of home equity on an ongoing basis, as well as provide flexible access to anticipate financial contingencies throughout retirement.

A new approach: 3+1% drawdown

Australian retirees are among the wealthiest in the world, with average wealth per household over the age of 65 years an eye popping $1,400,000. But in most cases, around $1 million of that wealth is stored in the home where the couple want to stay throughout their retirement.

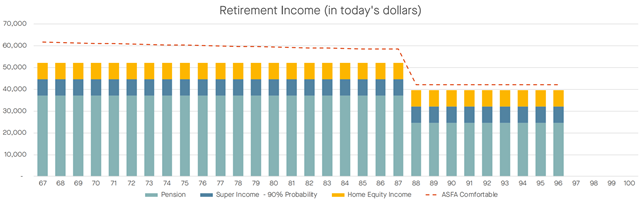

Instead of the old 4% drawdown rule of thumb, to get through retirement with confidence, Australian retirees should use a 3+1% drawdown rule: draw down 3% of the value of your investments at retirement per year plus 1% of the value of your home equity per year.

By reducing the superannuation drawdown rate and adding an additional 1% per annum draw down from home equity, our couple could begin to achieve a retirement income that is both sustainable over more than 30 years and adequate relative to comfortable lifestyle standards.

Scenario 2 – Drawing 3% a year of super and 1% of home equity in a low growth environment provides lifelong and adequate income with additional available access to capital

Using a 3+1% retirement drawdown approach also provides our couple with the flexibility to draw additional funds along the way if they need to renovate the home, meet unexpected expenses, if they live longer than anticipated or they choose to give to their children and grandchildren before they die.

4. The challenge of a sustainable retirement

In providing a path to a sustainable and adequate retirement, the 3+1% rule of thumb has major implications for Australian retirement funding:

- 3+1% provides a sustainable and adequate retirement funding plan for the majority of Australian retirees, not just those with $1 million in super

- 3+1% would improve retirement outcomes, lifestyles, and wellbeing

- 3+1% helps Australian retirees drawn on all three pillars of retirement funding flexibly throughout retirement to meet their own retirement funding needs

- 3+1% harnesses the value of the family home for both retirement housing and funding

- 3+1% diversifies retirees’ sources of retirement funding and improves the probability they will successfully fund their full longevity.

- 3+1% preserves significant savings for retirees to be the bank of mum and dad and to bequeath to the next generation without unduly depleting available retirement funding

- 3+1% supports age-appropriate housing for in-home ageing at all stages of retirement for couples and surviving partners

- 3+1% maintains a significant reserve of value to fund in-home care and residential aged care

- 3+1% would boost retiree consumption and provide a long-term stimulus to the local economy

- 3+1% brings $1 trillion of retirees’ savings to bear on funding their own retirement without including the home in the assets test for the pension or imposing a death tax to recoup the costs of aged care services.

Joshua Funder is Chief Executive Officer of Household Capital. This analysis and the charts were created by Household Capital Pty Ltd using data from the ABS 2016 Census combined with mortality information from the Australian Government Actuary and Household Capital internal company data. Nothing in this report provides any form of financial advice.