(Following the article by Anthony Asher on possible inclusion of the family home in the pension assets test, a reader who is required to remain anonymous by his employer demonstrates the inequity he feels).

Here’s the boldest idea the government’s inquiry into retirement incomes should consider but might not: no longer exempting all of the value of each retiree’s home from the pension assets test.

The test would merely exempt part of the value of retirees’ homes. The change would free-up funds to support other retirees who are struggling because they have to pay rent.

It’s an idea with an impressive lineage.

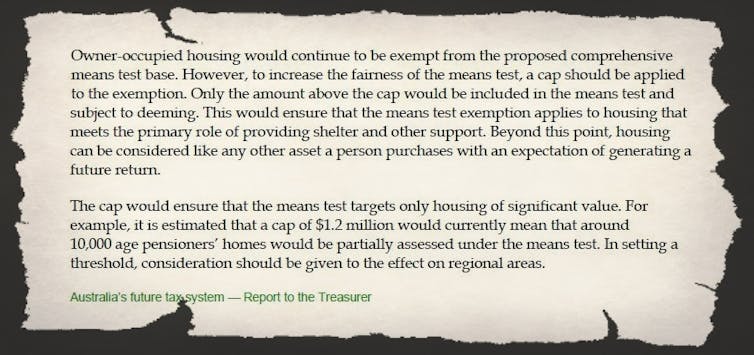

The Henry Tax Review suggested exempting only the first A$1.2 million. The bit above $1.2 million would be regarded as an asset and subject to the test.

Henry Tax Review

The review said it would hit only 10,000 retirees. The $1.2 million figure was in 2009 dollars, meaning that if the change came in today the review would want it to cut in at a higher dollar figure.

The Grattan Institute suggests a lower cut in at $500,000. The first $500,000 of each mortgaged home would remain exempt from the pension assets test, the part above $500,000 would be regarded as an asset. Grattan says it would save the budget $1 to $2 billion a year.

The Australian Chamber of Commerce and Industry agrees, as does the Actuaries Institute.

The idea scares homeowners

Who could object?

The Combined Pensioners and Superannuants Association says asset testing the family home would be “massively unfair”, targeting the vulnerable. But people with high-value mortgage-free homes aren’t normally thought of as vulnerable.

Labor’s treasury spokesman Jim Chalmers says it would push more retirees “off the pension, out of their homes, or both”. He is right about the former, but wrong to think the retirees who suffered a cut in their pension or lost their pension would be badly off.

The worst off retirees, as recognised by a Senate Committee, are those without homes making do with grossly inadequate rental assistance.

Right now it is possible for a single person owning a $1.3 million mortgage-free home and $260,000 of other assets to get the full age pension.

Assuming that person draws down on those other assets at the rate of 5% per year, he or she can spend $37,000 per year and pay no rent.

Yet homeowners do well

A non home owner with $785,000, or half the assets, would be denied the pension. Like the much-richer homeowner, that person would be able to draw an income of about $37,000 per year, but half it will have to go on rent.

It’s hardly fair. It encourages retirees with homes to stash more and more of their assets into them in order to get the pension (and pass something valuable on to their children). Retirees with lesser assets miss out and have to rent.

But fairness is in the eye of the beholder. The problem is that a ceiling on exemption from the assets test that seems fair in one part of Australia might not seem fair in another where home prices and perhaps the cost of living is higher.

Our suggestion could be sold as fair

In order to make more equal treatment seem fair to all retirees with homes I and fellow actuary Colin Grenfell have worked up an option that would use the median (typical) price for each postcode as the cut off point for exemption from the assets test.

It would happen postcode by postcode, updated every year using council valuations and as the median prices changed. Only the owners of homes who values were atypical for the area would be affected, and only that part of the value of their home that was atypical would be included in the assets test.

Its key selling point is that it wouldn’t threaten homeowners with values at and below the average for their area.

The funds freed could increase the overall pension, but would probably be better applied to lifting rent assistance.

It’s important to treat retirees in the same financial circumstances the same, regardless of whether they own a mortgage-free home, and fewer and fewer retirees are owning mortgage-free homes.

It would have the added benefit of reducing the pressure on our parents and grandparents to own houses with bedrooms on the first floor that are never opened, not until they die and their houses are sold.

Anthony Asher is Associate Professor at University of New South Wales.

This article is republished from The Conversation under a Creative Commons license. Here is the original article.

(The following note from a reader is published on condition his identity remains confidential. He has identified himself to us but his employer requires him to remain anonymous).

Hi Graham

It’s frustrating the retirement review can’t consider recognising the family home for the age pension.

My friend and I have a retirement plan of living in neighbouring townhouses. With our wives, we’ll have a very convenient support and social network, especially as we age further and mobility issues set in or we can no longer drive.

When we get to age 67, we’re estimating, in today’s dollars, that his townhouse will be worth around $1.2 million in Sydney while our house in Albury will be $400,000. His and his wife’s super will be around $700,000 while my wife and I will be around $1.5 million.

So, we’ll both be worth the same, but because of the home exemption from the age pension he and his wife will get a part pension and all the benefits that flow from all three levels of government and anywhere that offers pensioner discounts.

But our plan will see me and my wife also using this age pension concession and joining the gravy train as well.

- If the family home was included in the age pension calculation, with an offsetting increase in the assets test, we’ve discussed the idea of moving to a regional coastal town. That would be a better lifestyle for us, and if enough retirees did the same it would help housing affordability and congestion in Sydney.

- The family home concession favours people in Sydney and Melbourne over other capital cities, who are favoured over large regional centres, who are favoured over people in smaller towns where house prices are generally lowest. It’s the reverse of all other tax systems where the wealthiest pay the most.

- Not including the family home also ends up for many as an increased inheritance handout to children of retirees. If my parents downsized, they’d lose their age pension and all the other benefits. Uncles and aunts will either lose or see a reduced age pension if they downsize. So the older generation helping each other and my generation are helping to keep everyone in their home as long as possible as we get more money as a family.

Taking me and my friend, if we both moved up the coast and bought neighbouring townhouses we could end up in a scenario where we have exactly the same wealth in our homes and in super/personal names, but the other couple gets a part age pension and all the handouts and we don’t.

I am happy for you to share these ideas.

** we will load some of the comments received in the survey to the comments section of the article **