Last week, the Government introduced the new Aged Care Act into Parliament and provided its response to the Aged Care Taskforce. Combined they represent the biggest changes to aged care in almost 30 years. The changes, which Prime Minister Anthony Albanese described as “once in a generation”, will redefine aged care and who pays for it.

At its heart, the reform package will see the Government pay for all of your care, regardless of your means, with care recipients needing to pay more towards their other services based on their assets and income. The million-dollar question is “What is care?”. While the reform package will invest $5.6 billion into aged care services, the net impact of the changes is a $930 million spend over four years and a $12.6 billion saving over the next 11 years.

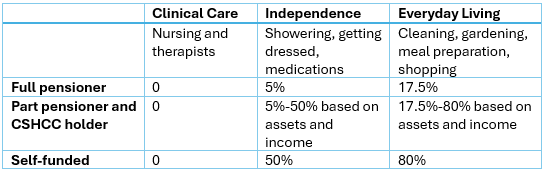

Quiet cleverly, the government have decided to define care as clinical care services, such as nursing, occupational therapy and physiotherapy. This means the list of non-care services is extensive and will include things many people think of as care – such as help with medications, having a shower and getting dressed. As well as services that people cannot do due to their care needs such as help with shopping, preparing meals and gardening.

How much you will contribute towards your non-care services will depend on whether you receive your care in your own home or in an aged care home.

Home care

Demand for Home Care has tripled over the last five years with current wait times for some home care packages exceeding 12 months. With more people wanting to age at home, the lion’s share ($4.3 billion of out of $5.6 billion) of funds in the reform package are aimed at the new “Support at Home” programme.

Support At Home will bring the current home care package and short-term restorative care programmes together and add two new programmes: the Assistive Technology and Home Modifications Scheme and the End of Life Pathway.

The Assistive Technology and Home Modifications Scheme will give people access to home modifications and assistive technologies up to a value of $15,000 without the need to wait for funds to accumulate in their package. The End of Life Pathway will provide up to $25,000 for funding palliative care in the home in the last three months of life.

The current four levels of Home Care Package will be increased to eight, with the maximum funding increasing from around $61,400 per year to $78,000 per year and the services within your Support at Home package designated as either clinical care, independence or everyday living.

The government will pay for all of your clinical care, and you will pay towards your independence and everyday living services based on your assets and income.

Case studies – Support at home (based on a Level 5 package) (provided by Government)

Bill, a full pensioner with $10,000 of assets will pay $2,467 per year for his Support at Home Package. The Government will pay $37,107 per year.

Marco, a part pensioner with $65,000 p.a of income and $200,000 of assets, will pay $11,464 per year for his Support at Home Package. The Government will pay $28,110 per year.

Harry, a self-funded retiree with $100,000 p.a of income and $500,000 of assets, will pay $16,615 per year for his Support at Home Package . The Government will pay $22,959 per year.

Aged care homes

The changes to what you will pay for an aged care home span both the cost of your accommodation and the cost of your ongoing services.

Accommodation costs

Market Price Cap increasing to $750,000

From 1 January 2025, the market price cap on Refundable Accommodation Deposits (RADs) will increase from $550,000 to $750,000. The cap sets the price beyond which an aged care home requires government approval. While there are plenty of examples of prices above and below this price, the effect of the cap is that we see a clustering of prices around the cap.

The reforms don’t change who is classified as a Market Price payer. If you have assets above $206,039, you need to pay the market price. This perverse assessment currently creates a gap that I often refer to as “aged care no man’s land”, where people with $300,000 or $400,000 need to pay substantially more than they can afford. If most prices go up to $750,000, there will be a $500,000 gap between what some people need to pay and what they can actually afford for their accommodation.

Exit fee of up to 10% on RADs

From 1 July 2025 aged care homes will charge an exit fee of 2% of your RAD per year for up to 5 years. Which means if your RAD is $750,000 and you stay for 5 years (or more) then $75,000 will be deducted when you leave. There will also be a change from the current fixed rate that applies to people who pay towards their accommodation by daily payment. From 1 July 2025, Daily Accommodation Payments (DAPs) will be indexed twice a year at CPI.

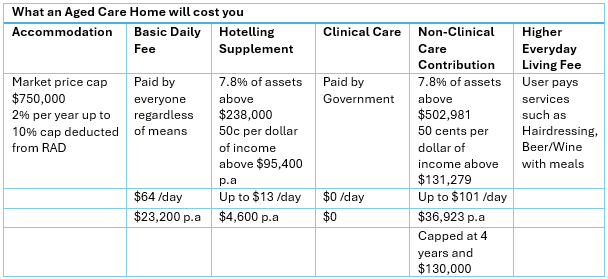

The cost of ongoing services

When it comes to the ongoing cost of your aged care, you will pay the Basic Daily Fee, which is set at 85% of the Age Pension. Beyond this, you will pay a hotelling supplement and a Non-Clinical Care Contribution based on your assets and income, as well as a higher everyday living fee if you choose to get ‘extras’. The Government will pay for all of your clinical care.

No change to the treatment of the family home

There is no change to the assessment of the family home for aged care means testing. Your home will be included in your aged care assets up to a capped value of $206,039 unless a protected person lives there in which case, it is exempt.

A protected person includes your spouse or dependant child, a carer who has been living in the home for at least two years and is eligible for an Australian Income Support Payment, or a close relative who has been living in the home for at least five years and is eligible for an Australian Income Support Payment.

'No Worse Off Principle' for people already receiving aged care

The no worse off principle is designed to protect people already receiving aged care or waiting for a home care package. If you are receiving a home care package or have been assessed as eligible then the no worse off principle will mean that your costs will be the same or less after the reforms.

If you move from home care to an aged care home after 1 July 2025, the changes to accommodation payments will apply but you will have the choice of staying on the existing contribution arrangements or moving to the new ones. If you are already living in an aged care home or move in before 1 July 2025 your contributions will not change while you live there.

Case studies – Residential aged care (provided by Government)

Hannah is a full pensioner who owns her home and has $150,000 of other assets. Under the new rules she will pay $28,800 per year (the Government will pay $111,300 per year). Under the current rules Hannah would pay $24,700 per year.

George is a part pensioner who owns his home and has $500,000 in other assets. He will pay $47,700 per year (the Government will pay $92,400 per year). Under the current rules George would pay $34,300 per year.

Heather is a self-funded retiree who owns her home, she has $500,000 in other assets and receives $70,000 p.a of income. She will pay $62,800 per year (the Government will pay $77,400 per year). Under the current rules Heather would pay $49,400 per year.

The government estimates that 3 in 10 full pensioners and 3 in 4 part-pensioners will pay more. When you consider these case studies, it’s easy to see why. While the message has been that “wealthy Australians will pay more for aged care”, it seems that in reality most Australians will pay more. In some cases, much more.

Rachel Lane is the Principal of Aged Care Gurus where she oversees a national network of advisers dedicated to providing quality advice on retirement living and aged care. She is also the co-author of a number of books with Noel Whittaker including best-seller 'Aged Care, Who Cares?' and 'Downsizing Made Simple'.

For further information see: The Final Report of the Aged Care Taskforce (2024), and the Aged Care Legislated Review (Tune Review, 2017).