In this piece we'll look at the key themes from the recently finished reporting season, along with the best and worst results.

Consumer still opening up their wallets

Before reporting season, one thing that was not fully understood was how consumer spending would be affected by interest rate increases. However, we saw that consumers continue to spend but expect more value for the dollars spent. This was evident in the Endeavour Group results, which saw customers transition to buying six and 10-pack 'ready-to-drink' (RTD) beverages in seeking out more value than the customary four-packs.

Similar themes were seen in Wesfarmers Kmart division, with shoppers gravitating to their in-house developed Anko apparel brand and away from specialty retailers, seeking out more value. This saw Kmart's profits rise 25%, a very good outcome in a weaker economic environment. JB HI-FI saw solid sales growth, albeit at a small cost to their profit margin, with the company's lower-cost offering resonating with consumers and taking market share off rival Harvey Norman.

The big supermarket providers Coles and Woolworths showed that consumers continue to spend more for groceries, with each booking revenue increase of 6% and 4%, respectively. However, it is not good news for retailers, with consumers pulling back spending on discount pizzas (Dominos Pizza) as well as gambling (Star Entertainment and Tabcorp).

Very pleasingly, the trading outlooks for the first six weeks of the 2025 financial year showed that the July stage three federal income tax cuts have energised retail sales. Many retailers, including Universal Stores (+12%), Super Retail (+3%), Baby Bunting (+3.5%) and JB Hi-Fi (+5.2%), have all posted strong sales growth post-June 30.

Steady as she goes for the banks

Consistent with the previous reporting seasons, there was minimal evidence of the dreaded 'fixed-interest rate cliff' from 2022 on bank bad debts or net interest margins.

As we saw from the Commonwealth Bank result, the banks have largely kept interest margins and profits at highs and bad debts at record low levels of 0.09% of loans. This theme of low bad debts and strong margins was consistent across the other Big Four banks in their quarterly reports and Judo Capital, which saw their loan book increase to over $10 billion.

The winners and losers of higher interest rates

For a long time, debt servicing costs were not much of an issue during reporting season as company debt costs were very low. Indeed, sell-side analysts exhorted management teams to gear up "lazy" balance sheets to juice up shareholder returns and buy back stock! However, since late 2022, the Australian cash rate has increased 13 times from 0.1% to 4.35%, along with the cost of corporate debt, which has been felt differently across different companies and industries and was a feature in the August reporting season.

Higher interest costs can change what would typically be a solid result into something that is not nearly as strong, as we saw with the Endeavour Group. The underlying business was performing well, with both the retail (Dan Murphys) and hotel businesses' earnings growing at 4.7% and 1.8%, respectively. However, this growth in the underlying businesses was completely offset by a 22% increase in interest costs, leading to reported net profits being down -3.2% on last year.

Big acquisitions that were announced in lower interest rate environments have started to weigh on earnings, with APA Group, Eagers Automobiles and Aurizon all announcing an increase in interest costs following large acquisitions over the last two years. Both Harvey Norman and Kelsian have seen large increases in financing costs, 21% and 155%, respectively, due to having to take on more debt to fund capital expenditures.

Conversely, the insurers all reported strong earnings, with many having record profits following health insurance profits and large investment earnings from their 'investment float'. In addition to profits made via underwriting insurance, insurance companies receive premiums upfront, with claims to be paid later. This mismatch in the timing of cash inflows and outflows gives insurance companies a cost-free pool of money that can generate investment profits for the benefit of shareholders. Since interest rates began to rise in 2022, these billion-dollar investment floats have returned to being a source of profit for insurance companies, with QBE Insurance earning US$733 million on its $31 billion float in the first half of 2023, compared to US$382 million in all of 2021. Similarly, Suncorp earned $1 billion from its investment income compared to $608 million last year.

Chinese malaise

Being Australia's largest trading partner, the health of the Chinese economy has a big influence on the profits of many Australian companies. In 2024, the slowdown in Chinese real estate and construction has seen a reduction in the demand for Chinese steel domestically. This excess steel flowed into overseas markets such as Australia, depressing global steel prices, which saw Bluescope Steel's profits fall by 20%. For Chinese blast furnaces, it is more economical in the short term to take the pain and keep the steel mills flowing with unprofitable steel than to turn off the furnaces and restart them once prices come back within profitability. Weaker Chinese demand was apparent in the mining sector, with falling commodity prices impacting the profits of all miners in August.

Additionally, a weaker Chinese market has impacted the golden stocks of milk producers from 2018 to 2020. The fall in the Chinese birth rate has shrunk the addressable market for infant formula group A2 Milk. During the year, A2 Milk increased its market share and became a top 5 brand within China, but it expects the addressable market to shrink again as the birth rates continue to fall.

Show me the money

A large focus for the August 2024 reporting season was how companies allocated capital management and how best to utilize it within the company and return earnings back to shareholders. Companies that earned franking credits saw most of them distributed back to shareholders in dividends, with only a few major on-market share buybacks announced over the reporting season.

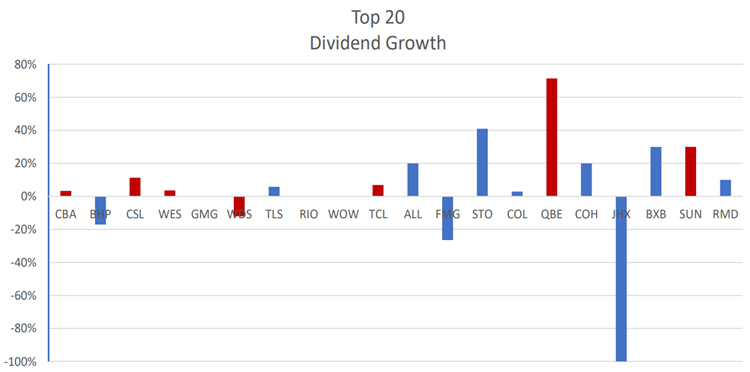

Across the ASX Top 20 stocks (that reported – the major banks minus CBA have a different financial year-end), the weighted average increase in dividend was 2.5%. On the positive side of the ledger, QBE Insurance, Santos, Suncorp and Brambles offset cuts in BHP and Woodside. Due to these companies having high cashflows even in a moderately down year, they can still maintain their dividends, which was seen across Goodman Group, Rio Tinto and Woolworths. Across the wider ASX200, corporate dividends declined by -4%, though August 2024 was the 3rd highest dividend period ever, and it was ahead of 2019!

Best and worst performers

Over the month, ZIP Co, Wisetech Global Limited, Judo Capital, Brambles and JB HI-FI delivered the best results. Despite the uncertain economic environment, especially around higher interest rates, these companies were able to grow the businesses (Wisetech, JB HI-FI, Judo Capital), return to profitability (ZIP Co) and improve efficiencies and productivity through the business (Brambles).

Looking at the negative side of the ledger, Audinate Group, Tabcorp Holdings, Kelsian Group, Mineral Resources and Star Entertainment Group reported poorly received results by the market. The common themes for this group are cancellation of dividends (Audinate Group and Mineral Resources), increased capital expenditure and costs (Kelsian and Tabcorp), or lack of providing a financial result (Star Entertainment).

Result of the season

When looking for the result of the season, it was hard to look past what Wisetech was able to achieve in the last year. In signing the large Japanese global freight forwarder Nippon Express and continuing to grow its market share in the top 25 largest freight companies to over 50%. Wisetech's flagship product, CargoWise, achieved revenue growth of 33% whilst maintaining a disciplined approach to costs, leading to profit margins of close to 50%. Additionally, management provided upbeat guidance for 2025, which will see profits increase by 33-41%, driven by a revenue increase in CargoWise of 31-37%.

How did we go?

Overall, we are reasonably pleased with the results from the reporting season, with most of our portfolio companies able to increase earnings and dividends with some reporting record dividends in a more challenging economic environment. Though we saw two portfolio companies cut their dividends in response to significant expansions or a major acquisition, it was a prudent move for long-term investors.

When a company reports a result, one of the first things we look at is the dividend paid, as this is the best indication of the actual health of a company. A company’s board is unlikely to raise dividends if business conditions worsen or their bankers hammer at the door demanding debt repayments. Earnings per share can be restated later due to “accounting opinions” or financial shenanigans from the CFO, and bullish outlook statements from the CEO can be retracted. However, once dividends are paid into investors’ bank accounts, they can never be clawed back.

Hugh Dive is Chief Investment Officer of Atlas Funds Management. This article is for general information only and does not consider the circumstances of any investor.