This note explores the findings of a recent survey of Australians about superannuation and retirement. The survey comprised 1,500 adults – representative of the broader population in terms of age, gender, education and whether respondents reside in urban or regional areas. This note also utilises a range of data from the ABS.

Retirement pathways differ

There is no typical pathway to retirement.

Differences include the age at which people retire permanently from work, their work arrangements at the time of retirement, any changes to work arrangements in the period leading up to retirement, and the age at which they choose to access their superannuation.

While the decisions that shape retirement pathways certainly reflect financial circumstances, these are not the only considerations for many older Australians. Some people delay retirement and remain in the workforce to maintain social connections. Others retire earlier than they would like due to ill health or in order to care for family members – with the latter disproportionately impacting women.

Individual access to the Age Pension and super

In terms of financial circumstances, retirement decisions are framed by the ages at which individuals can access the Age Pension and/or their superannuation. Australian residents, once retired, can access the Age Pension from age 67. For individuals, their eligibility for the pension and their pension amount are determined by income and assets tests.

Typically, an individual’s pension eligibility and the payment amount change during their retirement. Individuals can access their superannuation when they reach their ‘preservation age’ – for those born after 1 July 1964, this is age 60. Members of defined benefit superannuation schemes are often subject to an earlier preservation age.

This does not imply that an individual needs to retire to access their superannuation upon reaching preservation age. In particular, workers are able to access part of their super savings via a transition to retirement income stream (or "TRIS"), which enables them to reduce their working hours while topping up their income.

These settings provide flexibility for older Australians in their pathway to retirement and, more broadly, supports participation by older Australians in the workforce.

Many older Australians remain engaged in the workforce

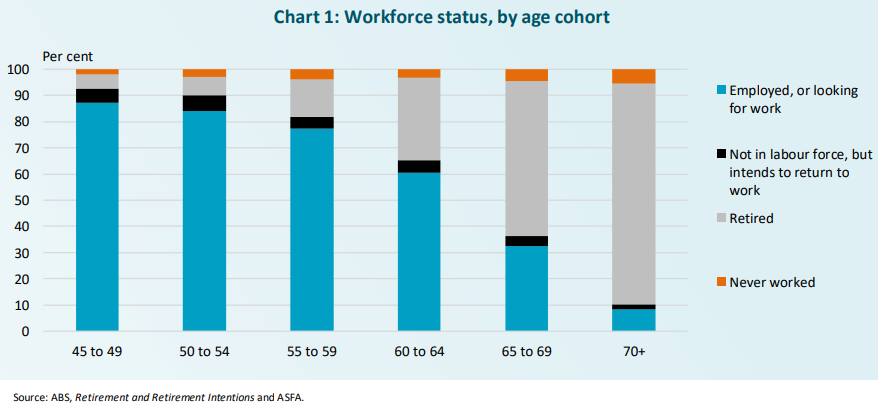

For the population of Australian adults, Chart 1 below shows the variation in workforce status (which includes retirement), across and within age cohorts – where being "retired" specifically refers to people who have “ceased working and/or ceased looking for work”.

Note that the outcome for the 70+ age cohort comprises the (weighted) average of all 5-year cohorts older than 70. The outcome for the 70 to 74 age cohort (not shown) can be assumed to contain a smaller proportion of retirees, and a larger proportion of employed people, than the average.

Chart 1 shows that a substantial minority of older Australians delay retirement and remain engaged in the workforce.

For the cohort who are either employed or actively looking for work (the blue bars), this accounts for 33% of people aged 65 to 69, and 8% of people aged 70+. In addition, a small percentage of people are not currently in the labour force but want to work: 4% of people aged 65 to 69, and 2% of people aged 70+.

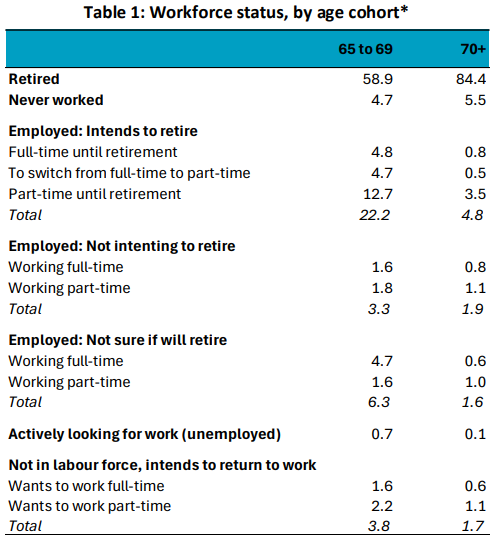

For these two older cohorts, Table 1 provides details of employment arrangements. In particular, it shows a general shift from full-time to part-time work through the two age cohorts. For all individuals who are employed, Table 1 reveals that:

- Full-time workers account for 16% of the 65 to 69 cohort, and 3% of the 70+ cohort.

- Part-time workers account for 16% of the 65 to 69 cohort, and 6% of the 70+ cohort.

* Source: ABS, Retirement and Retirement Intentions and ASFA.

This suggests an increasing preference for part-time work over fulltime work as Australians move through the older age cohorts, and re-enforces the need for flexibility in policy settings regarding the interaction between work and access to superannuation.

Looking ahead, Table 1 also reveals the varying intentions for future workforce engagement among older Australians. Within the 65 to 69 cohort who are currently employed (32% of the full cohort), around 70% have a specific intention to retire – though the expected timing of retirement differs (see next section).

Of the remainder, around 10% consider that they will not retire at all, while a further 20% are not sure if they will do so (similar proportions are reported for the 70+ cohort). For these two groups, financial considerations are likely to be the key driver of retirement decisions.

What age do people intend to retire?

Further insights around pathways to retirement can be gleaned from data on the age at which people (who are currently working or looking for work) intend to retire.

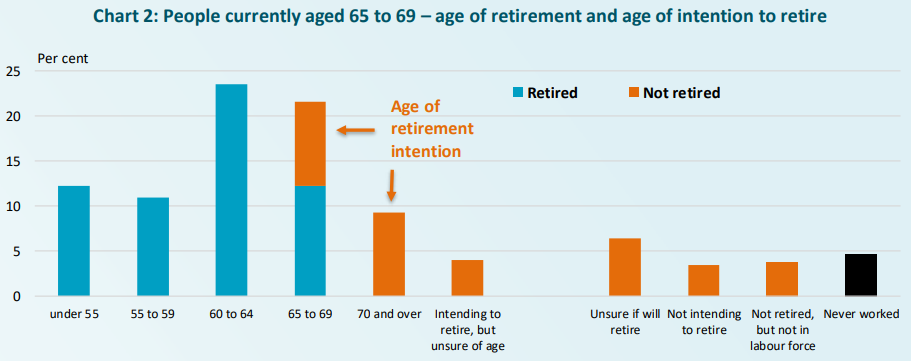

Chart 2 reflects the population of Australians currently aged 65 to 69 only.

- For people who are retired (blue bars), Chart 2 shows the age at which they retired from work.

- For people who are not retired (orange bars), Chart 2 shows the age at which they intend to retire.

59% of the 65 to 69 age cohort is retired (sum of the blue bars in Chart 2), with 23% having retired prior to the age of 60.

For those who are not retired (orange bars), retirement intentions are evenly split between those who:

- intend to retire when aged between 65 to 69 (9%)

- intend to retire when aged 70+ (9%).

A smaller proportion intend to retire, but are unsure of the age at which they will do so (4%). A substantial minority of those aged 65 to 69 do not intend to retire (3%), or are unsure if they will retire (6%).

This highlights the differences in retirement pathways for older Australians, and the importance of retaining and improving flexibility in superannuation policy settings to support those differences.

It also highlights the fact that there is no typical pathway to retirement – for the majority of Australians it does not mean working full-time until the point of retirement between ages 60 to 67.

Drivers of retirement intentions

While retirement is not generally front-of-mind among younger Australians, it is instructive to assess and compare the retirement intentions of younger and older generations.

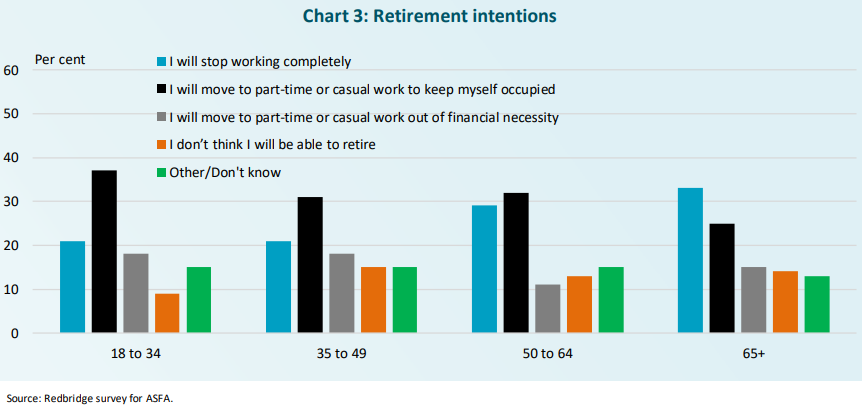

Derived from the ASFA survey, Chart 3 compares retirement intentions of the 65+ age cohort, with those of the three previous generations, where the results show the intentions of people who are not yet retired only.

Note, this data is not directly comparable with the previous charts and tables as it excludes people who have already retired.

A striking feature of Chart 3 is the extent of the importance of staying employed in order to keep occupied – across all the age cohorts (black bars in Chart 3). While this result was highest for the 18 to 34 cohort (at almost 40% of respondents), 25% of the 65+ cohort reported this option as best representing their retirement intentions. Generally, these results may also reflect the importance of work as a means to remain active and/or maintain social connections.

The results for the 65+ age cohort (those who have yet to retire only), provide some context for the findings presented in the preceding sections. In particular, that a significant proportion of older Australians who delay retirement, and continue to work, do so for non-financial reasons.

Conversely, the survey results also confirm that some older Australians will need to continue to work for financial reasons. Indeed, 14% of the 65+ age cohort (those who have yet to retire only), don’t think that they will be able to retire (orange bars). This is equivalent to around 3% of the total population of Australians aged 65+.

The Association of Superannuation Funds of Australia (ASFA) has been operating since 1962 and is the premier policy, research and advocacy body for Australia’s superannuation industry.