While there is universal consensus that we experience climate change there is much more uncertainty about how much this will impact economic growth and output. While we have very good climate change models that are remarkably precise, our economic models for the impact of climate change are more dispersed. Which is why it is worthwhile checking in on some new research.

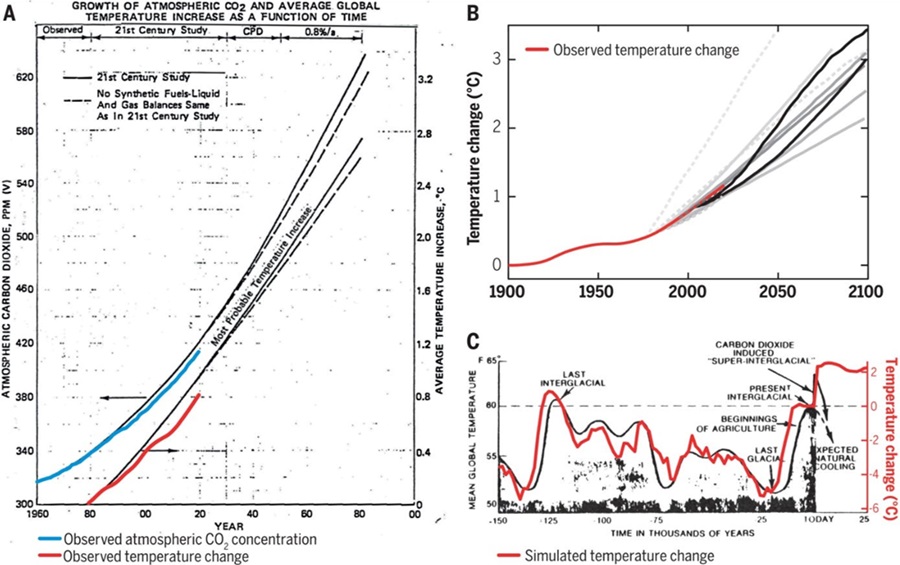

How accurate climate change models were already in the early 1980s came to light when investigative journalists uncovered internal documents from Exxon from 1982 that modelled the impact of greenhouse gas emissions on temperature.

These models were some of the earliest climate change models around, yet they managed to forecast actual temperature changes quite well. And Exxon decided to cover up this in-house research and instead fund a decades-long campaign to convince the public that burning fossil fuels would not lead to climate change. In case you don’t know about this story, I suggest you read this scientific analysis of Exxon’s actions or just look at Exxon’s projections from 1982 with the actual change in greenhouse gas emissions and global temperature in the chart below.

Exxon’s 1982 in-house forecasts of global warming

Source: Supran et al. (2023).

But when it comes to the economic impact of these temperature changes, our models are still evolving. The first models, developed by Nordhaus and his collaborators were simple models that did not include nonlinear effects, feedback loops, and tipping points in our climate and thus came to the conclusion that the GDP impact of climate change by the year 2100 will likely be in the low single digits.

Because of their shortcomings in capturing nonlinear effects, these projections can only be called a lower limit for the economic costs of climate change. I have discussed in this previous post what happens when you ask experts to assess the likely costs of climate change to the economy today. In short, the consensus impact on output seems to be in the order of 5% to 7% globally.

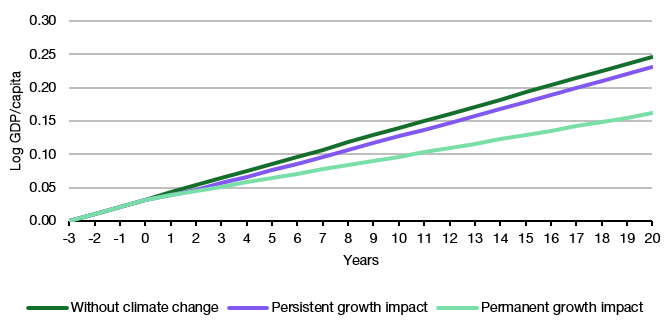

However, there is an important question that is still being debated and that has recently been tackled from a new angle by Ishan Nath and his colleagues: Is climate change going to reduce economic growth permanently or just temporarily.

This is an important distinction as the illustration below shows. If climate change leads to a permanent reduction in economic growth, then the long-term costs of climate change will become larger and larger over time. However, if the growth shock from climate change is persistent, but can eventually be overcome by technological progress and humans adapting to climate change, then we will still lose some output, but in the long run, these output losses will stop, and we evolve on a parallel track to the original growth path.

Persistent vs. permanent growth impact of climate change

Source: Liberum.

In their research, Nath and his co-authors build an economic model for climate change that includes several important real-life features. First, the model is a nonlinear model that allows for climate change to have effects that can grow faster and faster the more extreme they become. Second, the model allows for technology transfer and know-how transfer between countries, i.e. technology to adapt to climate change can be invented in one place and then ‘diffuse’ to other countries over time. This is obviously what happens with new technologies all the time. It’s highly unrealistic to assume a technology will be kept to one company or one country forever.

But if we assume these two key facts (nonlinear, tipping point effects of climate change and slow adoption of technologies internationally), then one can show that climate change most likely has a persistent, but not permanent effect on economic growth.

To put it bluntly, higher temperatures and more extreme weather triggered by climate change lead to economic disruptions, be they floods, droughts, severe windstorms, etc. These disruptions reduce economic output in the year they happen, but then the economy starts to recover. Of course, the next year another disruption may appear, knocking the economy off course once more, etc.

Eventually, we develop technologies to mitigate these effects and adapt to a hotter, more volatile world. And the technologies that allow us to adapt to climate change spread from high-income countries where they are most likely to be invented to middle-income and finally low-income countries over time. Empirical evidence points to a persistence of climate shocks of about 8 to 10 years before growth resumes its original trajectory.

It is this effect why I think the real investment opportunity in ESG investing is not so much in climate change mitigation technologies like renewable energy anymore but in climate change adaptation, where much more investment is needed and where much more can be done to deal with the long-term impact of climate change.

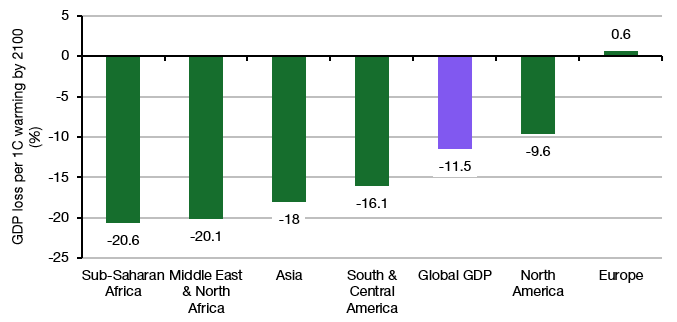

When it’s all said and done, the authors of the new study estimate that the amount of economic output lost by 2100 will be around 11.5% of global output per degree centigrade of global warming. This means with the global climate being on track to a 2.5 degree warming, the economic costs could be somewhere around 2.5 * 11.5% = 28.75%.

However, as always, the losses are not distributed equally. Countries closer to the poles will benefit economically from climate change, mostly because their winters get shorter and their summers longer, allowing for agriculture to cultivate more land and have better harvests. Similarly, businesses like construction or travel and leisure that rely a lot on outdoor work can produce more during a year since shorter winters reduce the time spent idle.

This means that Europe will feel little economic impact from climate change. At least on average. Obviously, the winners are countries like Norway or Sweden in the North of the continent while Spain or Italy will feel substantial negative impacts.

North America will also feel an economic impact less than the global average. Again, here Canada will likely benefit on average from climate change while Mexico and the southern parts of the US will feel a significant negative impact.

But the largest negative impact economically will be felt across Africa, where estimated economic damages by 2100 will be twice as large as the global average. And now consider what this means for global migration flows, geopolitical stability in the region and other geopolitical developments. If you think Europe or the US have a migrant crisis today, just wait a decade or two…

Estimated economic losses by 2100 per degree of global warming

Source: Nath et al. (2023)

Joachim Klement is an investment strategist based in London. This article contains the opinion of the author. As such, it should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of the author’s employer. Republished with permission from Klement on Investing.