The mid-caps space on the ASX is characterised by successful companies with strong growth profiles, which can offer attractive diversification benefits for Australian equity portfolios. In this article, we highlight some of the favourable characteristics of this often-overlooked segment of the market.

What are mid-caps?

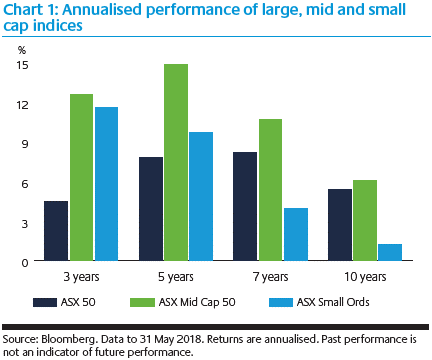

‘Mid-caps’ generally refers to Australia’s 51 to 100 largest companies and are represented in the S&P/ASX Mid Cap 50 Index. Companies that sit in this band have outperformed the S&P/ASX50 Index and S&P/ASX Small Ordinaries Index over three, five, seven and ten years.

Despite this consistent outperformance, mid-caps usually comprise only a small proportion of broad-based portfolios which invest in the S&P/ASX300, and are omitted altogether in small cap portfolios which are limited to the S&P/ASX Small Ordinaries Index (ex S&P/ASX100).

Mid-cap stocks generally trade on a higher price to earnings (PE) ratio to the broader S&P/ASX300, to account for the strong growth phase of many companies in this space. This PE ‘growth premium’ has remained reasonably consistent over the past 10 years, moving from a 16% premium in June 2008 to an 18% premium in June 2018, despite the sector’s outperformance compared to large and small caps during the same period (Source: S&P and Factset).

This is owing to the fact that the expected earnings growth has largely kept pace with the price growth over the last decade.

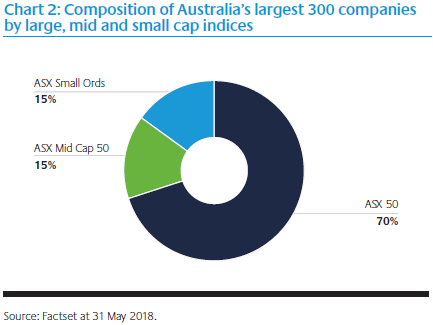

Due to the concentrated nature of the Australian share market, roughly 70% of an S&P/ASX300 portfolio – and fund manager’s attention – is invested in Australia’s top 50 companies. The remaining market capitalisation of the S&P/ASX300 is split roughly evenly between mid-caps (15%) and small caps (15%), as shown below.

Such a relatively small exposure means that investors may be missing out on a rich seam of successful, growing companies which characterise the mid-cap space.

Strong alignment with management

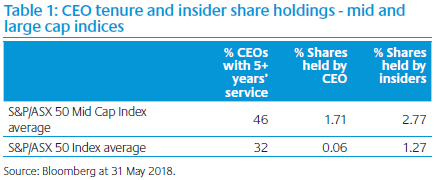

The senior management teams of mid-cap companies have often been with the company for many years. In some cases, the CEO is the original founder of the company, for example David Teoh of TPG Telecom, Andrew Bassat of Seek, Don Meij of Domino’s Pizza Enterprises, and Gerry Harvey of Harvey Norman.

The management team often has significant equity in the business, usually as a result of participating in the initial public offering or sharing in the company’s success. For example, the original three founders of Flight Centre still hold 40% of the public company’s stock and one of the founders, Graham Turner, is the CEO. This equity in the business, combined with long service, aligns management’s interests with other shareholders. It also encourages a prudent approach to investment decisions and risk management.

Sector distribution

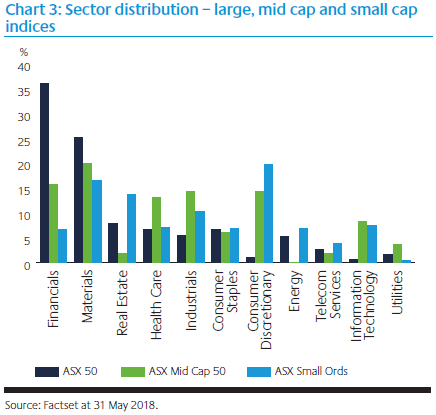

The mid-cap universe offers sector diversification to investors. Most apparent is the reduced exposure to the Financials and Materials sectors, which together comprise more than 60% of the S&P/ASX300, yet only 36% of the mid-cap universe. Mid-caps also provide relatively more exposure than either small or large caps to Health Care, Industrials, Information Technology, and Utilities.

Company size by market capitalisation is also more evenly spread across companies. The top 10 stocks by size, for example, comprise 40% of the S&P/ASX Mid-Cap 50 Index. By comparison, the largest 10 stocks account for 60% of the S&P/ASX50 Index.

Because mid-cap sector exposure is more evenly distributed across market sectors, it is less susceptible to movements due to macro themes, such as weakening commodity prices. This particularly suits bottom-up stock pickers, as good companies are rewarded on their merit, rather than the prevailing market sentiment.

A hive of activity

The mid-caps space is rich with corporate activity, which can provide investors with additional opportunities. Mid-cap companies are typically in a growth phase, funded by reinvesting their excess cash or through acquisitions. Given their larger size and generally stronger balance sheets than small companies, mid-caps have ready access to debt markets and funding which they can use to grow their business and expand into new markets. Recent acquisitions in the mid-caps space include Magellan’s purchase of Airlie Funds Management, Carsales’ purchase of South Korean company SK Encar, and Flight Centre’s purchase of Executive Travel Group.

Given their existing profitability and potential for growth, mid-cap companies are also often the subject of takeover offers from large companies or private equity, which typically results in strong share price appreciation.

Mid-cap companies are commonly well positioned for further growth. They typically have strong management teams, a successful business strategy, strong cash flow, a competitive advantage, access to debt markets and, perhaps most importantly, the hunger and capacity to grow.

A natural extension of small caps

Around two-thirds of companies in today’s S&P/ASX Mid-Cap 50 Index have graduated from the S&P/ASX Small Ordinaries index within the past seven years. This means an established small cap manager would typically have already researched or owned around 33 out of 50 mid-cap stocks. This makes small cap managers ideally placed to manage a mid-cap portfolio.

Traditional small cap managers necessarily have a deep understanding of companies in their universe, given the heightened risk and volatility of fledgling companies. Experienced managers are likely to personally know senior management, often from the time of listing. They will have a deep understanding of the business and the journey it’s taken. They may have participated in capital management initiatives, been a cornerstone investor, or helped to guide the business strategy.

This in-depth company knowledge gives small cap managers an information edge in the mid-cap universe and allows them to drive significant alpha, especially as mid-cap companies are generally less well researched and understood by the sell-side and buy-side. This lack of information, or an inconsistent interpretation of information among investors, can create mispriced investment opportunities that can be identified and exploited by professional mid-cap investment managers.

Managers with the resources to complete independent and thorough analysis of small and medium sized companies are able to generate favourable long-term returns for investors. The bottom-up stock selection process of small caps is also ideally suited to mid-cap portfolio construction, although many small cap managers lack the scale, resources and infrastructure to successfully also operate a mid-cap fund.

Dawn Kanelleas is Senior Portfolio Manager, Australian Equities Small Companies, at Colonial First State Global Asset Management, a sponsor of Cuffelinks. For more articles and papers from CFSGAM, please click here. This article is for educational purposes and is not a substitute for tailored financial advice.