We break down our outlook for the Australian market into these 3 key drivers:

1. Earnings per share: We think it is reasonable to expect earnings could decline over the year as mortgage rates bite and consumers rein in their spending. So much of the Australian share market is a first or second derivative play on consumer spending (e.g. banks, retailers, shopping centres, travel companies), and corporate profit margins look to have peaked. However, we note the earnings downturn has already begun, with EPS expectations falling 1% over FY23. In our view there is a risk of further earnings declines.

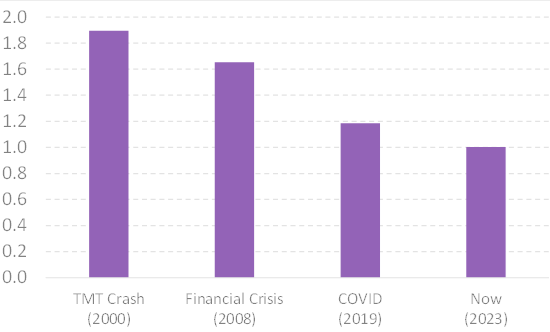

2. Dividends: Corporate balance sheets are a bright spot in the gloomy economic outlook. Gearing levels remain low across the board, and if we are heading into an economic downturn, we are heading into one with lower levels of corporate debt than any downturn in recent history. As such, we expect dividend returns to remain in line with their long run average of 4-5%.

Chart: ASX 200 ex financials net debt to EBITDA heading into a downturn

Source: MST Marquee

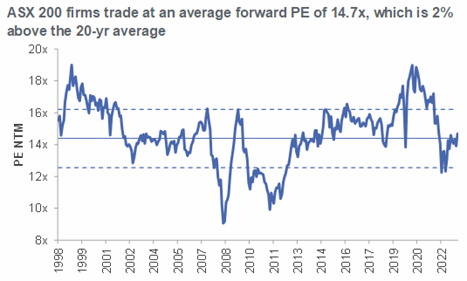

3. PE multiple: The market PE has re-rated in FY23, following two years of PE declines. This is shown in the chart below – the market went from very expensive in 2020 to very cheap in 2022, and the market multiple has now rebounded to its long-term average. We now see the market as neither particularly cheap nor expensive, although pockets of absolute value have emerged in consumer-facing sectors; most notably, discretionary retail.

Source: Goldman Sachs

We are entering our second year of the economy deteriorating, we have worn 12 interest rate hikes and a de-rating of the market PE. Consumer confidence is at 1991 recession-type levels, and retailers are downgrading each week. The 'vibe check' is bad, people are discussing the cost-of-living crisis everywhere. Even the mortgage-free boomers who should be cheering the return of >5% term deposit rates are grumbling about their super going sideways. Everyone has a job, but no-one is having a good time.

In our view, these are not the conditions in which it is time to get max-bearish. There are pockets of value emerging in the market, for example retailers and some REITs. Strong immigration and resilient commodity prices are helpful counterweights to a sluggish consumer, and our base case is the economy continues to muddle through.

Investing in consumer-facing businesses: lower share price, lower risk

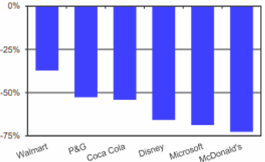

Investing is a complex, interesting, and rewarding job. However, it is certainly not easy. The hardest part of investing is learning to separate the business from the share price. A great business can be a poor investment at the wrong time (if expectations and hence the share price are too high). One example that stands out is the 'tech bubble' of the late '90s – we tend to think the craze swept up only those businesses with 'dot-com' in their name, but it was a very broad-based rally that went beyond tech stocks. The market was actually pretty good at identifying a bunch of companies that would go on to have the best prospects of the next two decades, yet if you’d bought them at their share price peak in the late ‘90s, you would’ve experienced 30-75% share price falls from peak to trough. If you’d correctly identified Microsoft as a long-term winner and bought in December 1999, it would’ve taken you 17 years to get your money back! Never mind the poor Cisco investors who have still never recouped the share price peak. While we are as far from AI experts as could possibly be imagined, it is something to keep in mind when considering the stock market mania for anything AI-related at the moment.

US Stocks - TSR (t=0 at Peak trough Share Price)

Source: Diogenes

US Stocks - Peak Period

Source: Bloomberg, Diogenes research

Similarly, a poorly performing business can be a great investment at the right time if certain conditions for future improvement are there. We look for a good balance sheet that can buy an underperforming business with time to turn things around, and an agent for change – typically, new management, a new board, and a new operating structure in the case of a demerger. Portfolio holdings QBE and Tabcorp are current examples that we think fit this bill.

The key lesson to get your head around with investing is that the share price doesn’t tell you anything about the company’s future prospects. For example, the share price of CBA tells you nothing about the likelihood of it remaining Australia’s largest bank or the likelihood of a bad-debt cycle occurring in Australian property. All it tells you is valuable information about expectations. The good news for active investors is that expectations oscillate wildly – share prices imply expectations that swing from “things will be good forever!” to “things will never be good again!” One need look no further than the local ‘buy now, pay later’ sector to see how quickly expectations (and hence share prices) can change as optimism turns to despair.

We believe opportunities in investing arise when the expectations implied by the prevailing share price are too conservative as compared against what you believe is likely to play out. If a company has a strong balance sheet, then the logical extension of this lesson about expectations is that the lower the share price, the lower the risk. This is because a lower share price implies expectations for future cash flows have fallen. The reason we say the company needs a strong balance sheet for this to be true is because for a company with a weak balance sheet, the opposite holds: a lower share price leads to higher risk of permanent capital destruction. If deteriorating fundamentals cause a company to swing to a loss or breach debt covenants, they may need to raise equity, which can convert a temporary fall in earnings into a permanent value destruction for shareholders.

This was the experience through the GFC, particularly for the local REIT sector. Local REITs were unable to roll their debt obligations as capital markets froze, forcing emergency capital raises at very dilutive prices and, in the case of Centro, the equity was wiped out completely.

So where does all this leave us today? We are starting to see bearish, even very bearish, expectations being priced into consumer-facing parts of the Aussie economy. At the very front line are the discretionary retailers. We’re basically seeing a downgrade each week from retailers, with Adairs, Universal Holdings, Best & Less, Dusk, and Baby Bunting all noting a marked deterioration in sales in May/June.

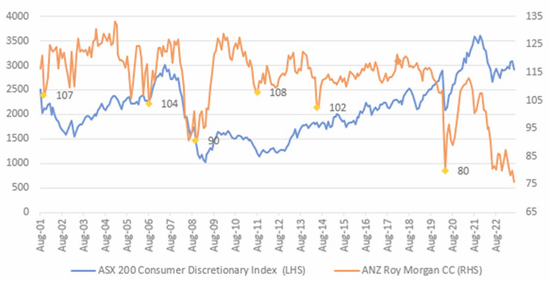

To say that consumer confidence is in the doldrums is an understatement. The Roy Morgan Consumer Confidence survey has now spent 16 straight weeks at a reading below 80; the last time it spent so long below 80 was during the 1990-91 recession.

Source: Roy Morgan, Factset

In the real economy, it’s fair to say the outlook for retailers looks extremely tough. However, the stock market is not the real economy, it’s the sum of expectations. As the sector is repriced down and expectations are slashed, we think value is emerging.

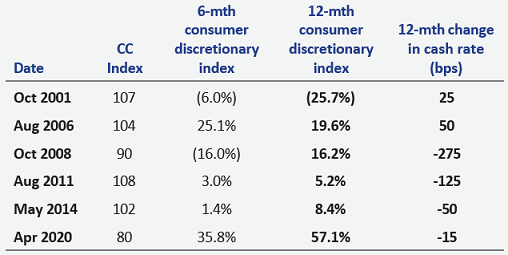

Historically, buying discretionary retailers when the consumer confidence index hits a low has been a pretty good investing strategy. As per the below table, while the 6-month performance can be mixed (i.e. you can be early), we typically see a rebound on a 12-month view. The subsequent rebound is particularly strong when consumer confidence bottomed at a sub-100 reading, and we note the current index reading of 76 is below all prior low points.

Source: Roy Morgan, Factset

Our consumer discretionary exposures in the fund were among our best-performing names over the second half of 2022, as sales remained more resilient than feared in the face of rising interest rates. In January, we significantly reduced our holding across the fund, exiting ARB and selling 80% of our position in Nick Scali (which had rallied from $7.50 June 2022 lows to over $12 a share). Now we find the sector appealing again – it has been quick to price in expectations of a consumer slowdown. Nick Scali has retraced to c$8.50, and Premier Investments has fallen from $27 to $20. We have been adding to both positions in recent weeks.

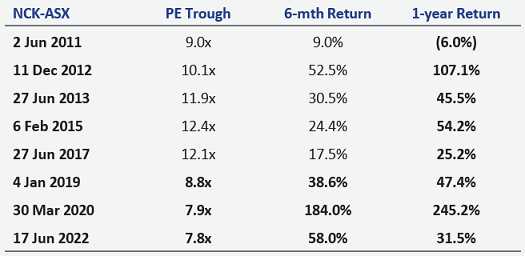

Taking Nick Scali as an example, it has traded on a forward PE multiple of 8-18x earnings, reflecting wildly different expectations of future earnings. It is currently on a forward PE of 10x.

Nick Scali NTM PE multiple

Source: Factset, Airlie Data

Buying Nick Scali when the PE has troughed has historically been a good strategy, with subsequent 6- to 12-month performance typically very strong. While we acknowledge the multiple could go lower yet, we believe value is emerging in a retailer with incredible economics and decent store rollout potential, and have been adding to our position again.

Source: Factset

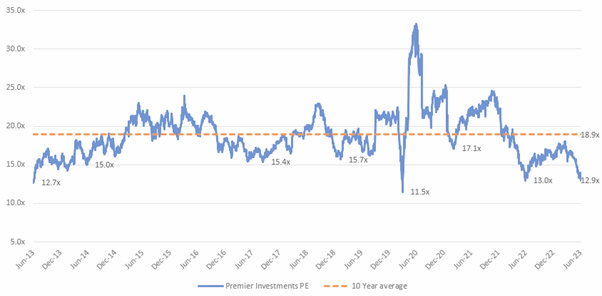

Premier Investments is a similar story. The PE multiple has typically ranged from 11-25x, and it is currently trading on 12.9x.

Source: Factset, Airlie Data

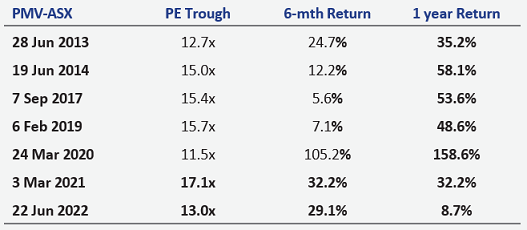

Historically, buying Premier as the PE troughs has been a good strategy.

Source: Factset

With Premier’s $400 million net cash and >$750 million stake in listed entities (Breville and Myer), we consider Premier’s fortress-like balance sheet will allow it to weather the retail storm much better than most. The falling share price reflects a revision in expectations that we believe now appear fair in the short term, and too conservative in the medium term.

Emma Fisher and Matt Williams are Portfolio Managers at Magellan-owned, Airlie Funds Management. Magellan Asset Management is a sponsor of Firstlinks. This article has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not consider your investment objectives, financial situation or particular needs.

For more articles and papers from Magellan, please click here.