Passive investing is currently all the rage. This is in large part due to the strong performance of the US stockmarket, which very few active managers have outperformed in recent years.

A passive index exposure is going to be a great investment when the biggest companies in that index are growing their earnings faster than most other companies in the index.

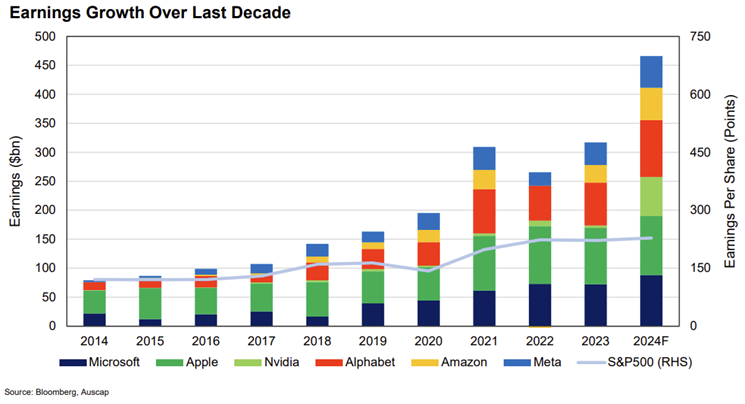

If we look at the US’s S&P 500 Index, its largest weights are currently Microsoft (7.2%), Apple (7.0%), Nvidia (6.7%), Alphabet (4.3%), Amazon (3.8%) and Meta (2.4%). These 6 companies account for 31.4% of the S&P 500 Index. They are also companies that are growing earnings a lot faster than the broader market, and in fact faster than most of the other companies in the Index.

This can be seen in the chart below.

Over the last decade the 6 current largest companies in the S&P 500 have compounded their earnings at 19.4% per annum. This compares to the Index, which includes these companies, which has seen compound earnings growth of 6.6%, implying the compound earnings growth of the other 494 companies has collectively been even lower than this.

The result is that a passive US index exposure in recent years has given investors a low-cost overweight exposure to a group of companies with significant earnings growth. So significant is the earnings growth and corresponding stock market performance of these six largest companies in the US that less than 25% of individual companies are outperforming the S&P 500 Index, a record low number over at least the last forty years.

In such an environment, a passive index approach is very difficult to beat as an active manager. On the other hand, we suggest that there are also certain conditions that make an ideal environment for active investing.

These conditions include an index that is materially overweight large companies that are likely to exhibit low, or even negative, earnings growth over future periods. This is particularly the case when the market has plenty of other companies that should see strong earnings growth over time.

The argument for active management in Australia appears to us to be as strong as the argument for passive investment has been in the US.

Australia does not have large technology companies dominating the domestic stockmarket. The largest weights in the ASX200 are the Commonwealth Bank of Australia (9.3%), BHP (9.3%), CSL (6.3%), National Australia Bank (4.8%), Westpac (4.1%) and ANZ (3.8%).

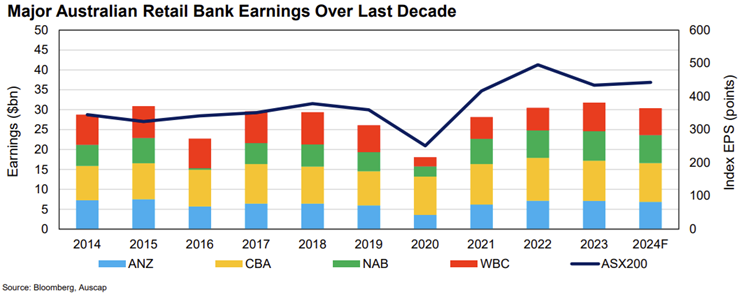

Australia’s largest six companies, four of which are the large banks, account for 37.6% of the ASX200. If we focus on the four retail banks, collectively they account for 22% of the Index, yet they have failed to grow earnings meaningfully over the last decade.

With the large banks continuing to display a more risk averse approach to lending, facing increasing competition in residential mortgages and business lending with the emergence of private credit providers, and having to deal with rising cyber security, information technology, compliance and employee costs, we struggle to see tailwinds for material earnings growth in the future.

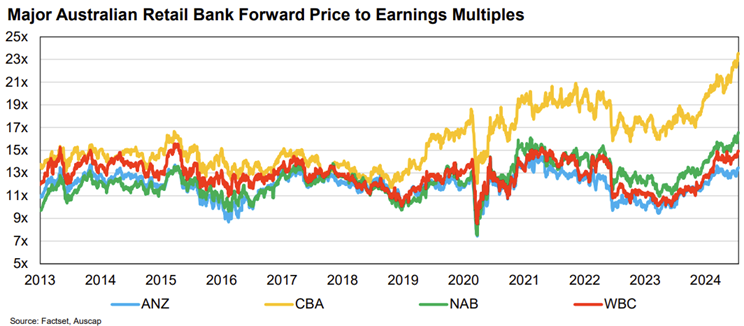

All four banks have recently experienced strong share price appreciation, but this largely appears to be a function of the market paying a higher multiple of earnings for these companies than representative of a lift in their earnings growth. In fact, analyst forecasts suggest the market expects anaemic earnings growth for the big four banks over the next five years.

BHP, RIO and Fortescue account for a further 12.8% of the ASX200 Index. Their largest commodity exposure is iron ore. Yet it would appear that China’s steel consumption, and hence iron ore consumption, peaked in 2020. This is extremely significant. In 2023 China accounted for 53.9% of the world’s steel production and 50.8% of the world’s steel consumption.

There is also political pressure on the margins for the large supermarkets, Woolworths and Coles (2.7% collectively of the ASX200 Index), and energy transition issues facing Australia’s large energy companies, Woodside and Santos (3.2% collectively of the Index).

All of these stocks are in the largest 20 companies in the Index. So in contrast to the US market, we think there is a strong argument for relatively anaemic growth out of many of the largest weights in the domestic Index. But that is not true of all constituents within the Index.

Our caution around the outlook for earnings growth in the biggest domestic companies stands in contrast to our view on the attraction of investing in the Australian stockmarket.

Australian equities have returned 13.0% per annum from 1900 to 2023. This compares favourably with US equities, which have returned 9.9% per annum over the same time period. We are firmly of the view that the Australian economy is well placed to experience growth as strong as any developed economy on a go forward basis.

This is likely to be driven by structural advantages which include: strong population growth; an abundance of natural resources that will continue to be in demand globally through the energy transition; proximity to the growth of the emerging nations in Asia; a sound democracy with an established rule of law and firm private property ownership protection; a solid Government fiscal position; an educated population and a business culture with a track record of innovation and entrepreneurship.

We continue to believe that the domestic economy will present great opportunities for investment over time. Indeed there are currently many companies in the mid cap universe that are significant in scale with strong competitive advantages, have high return on capital metrics and plentiful opportunities for organic growth. This should lead to these companies experiencing strong earnings growth over time.

What does this mean? We think investors should expect their long-term return from investing in equities to approximate the sum of the earnings growth and dividend yield delivered over time. A passive investment in an Australian index appears to us to be overweight many companies that will struggle to grow earnings at attractive rates.

Such a market is one in which active management should outperform over time, if that active management is based on identifying businesses that are reasonably priced that will grow their earnings at healthy rates by reinvesting capital into attractive opportunities. We see many such opportunities in the domestic Index, particularly in the mid-cap space.

Tim Carleton is the Chief Investment Officer and founder of Auscap Asset Management. This article is an extract from Auscap’s July 2024 letter to investors. You can see a full version of the letter here. This article contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person.