Investors are currently faced with challenges when it comes to portfolio construction. The macro uncertainty caused by slowing economic growth in the US and China has created a higher level of disruption, noise, and equity market volatility. Investors seeking stable growth and income in their portfolios are rethinking their asset allocations.

The search for high income

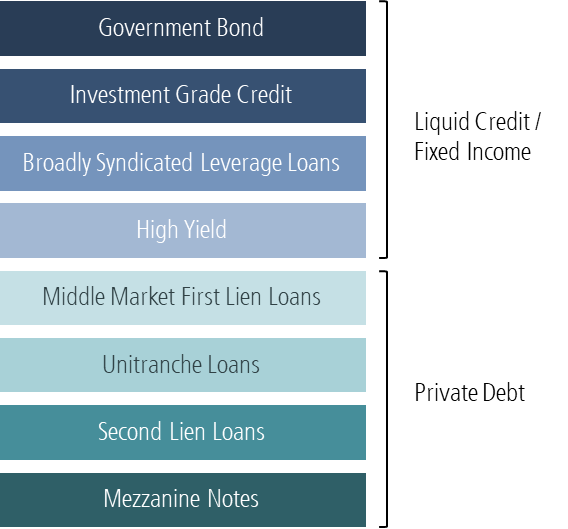

Fixed-income assets have become an area of increased focus given their attractive level of income and lower sensitivity to interest rate risk. In the following sections, we discuss three different types of fixed income and highlight the key risks and benefits:

- High yield bonds

- Leveraged loans

- Private debts

Fixed income spectrum overview

1. High yield bonds: an evolving market

High yield bonds are corporate bonds rated below BBB- or BBa3 by credit agencies, such as Moody’s and Fitch. They offer higher yields than investment grade corporate bonds based on the risk profile of the company.

Investors often label high yield bonds as ‘junk bonds’. This may have been an apt description in the 1980s when small and speculative companies dominated the sector, but the market has matured dramatically since.

The high yield market has evolved into an international financing mechanism widely used by fundamentally sound companies looking to diversify their funding mix away from bank debt or shareholder equity. The market has grown significantly to approximately US$2.8 trillion with more than 2,000 issuers across the globe, including Netflix, Hertz, Fiat, and Mattel, and large players in the telecom and internet sectors.

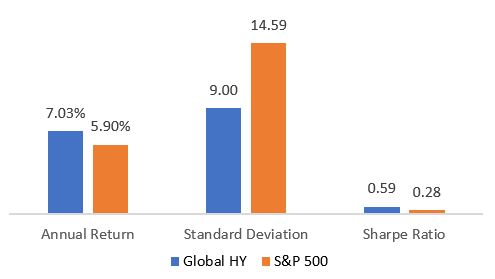

Over the long term, high yield bonds have provided attractive total returns, outpacing equities after adjusting for volatility. Due to income and a high position in the capital structure, high yield bonds have generally outperformed equities during economic downturns while retaining some potential upside during economic recoveries.

The chart below highlights the performance of high yield bonds and US equities for the past 20 years (performance in USD, June 1999 - June 2019).

(The Sharpe Ratio is a measure of the return of an investment compared with its risk).

Default is the largest risk to high yield bonds. A variety of factors, including uncertainty around trade wars, might bring disruptions to the global economy. However, we believe fundamentals supporting the global high yield market continue to be constructive. Corporate revenue and cash flow are growing modestly while leverage is declining. Operating performance of underlying issuers has been stable, revenue and EBITDA growth remain in the positive, and refinancing activity has significantly reduced the number of bonds maturing in the near term.

2. Leveraged loans: senior floating rate debt

Leveraged loans, also known as senior floating rate loans or bank loans, are made by banks to non-investment grade companies to finance various corporate activities, including mergers and acquisitions, leveraged buyouts, recapitalisations, and capital expenditures.

Leveraged loans are floating rate, which means that the coupons readjust every quarter to a spread over a base rate (typically LIBOR). If interest rates rise or fall, the coupon on these loans also rises or falls along with market conditions.

In addition, leveraged loans are generally secured, implying they are in the senior-most position in the capital structure. Therefore, holders of these loans typically have a first priority lien on the assets of the borrower and must be repaid before any other obligation, including bondholders or stockholders, in the event of a default.

In general, leveraged loans have protective covenants built into the contract for the safety of lenders, such as financial maintenance tests which measure the debt-servicing ability of the issuers.

Leveraged loans and high yield bonds share some similar characteristics in that both are issued by non-investment grade corporations and are subject to credit risk as well as changes in market sentiment. In fact, many non-investment grade companies will often have both leveraged loans and high yield bonds outstanding.

New risk rises amid growing loan issuance

While roughly half the size of the current high yield bond market, the leveraged loans market has grown significantly in recent years. With the rapid issuance, we are seeing new risks in the lower-rated segment of the loans market. Investors should fully consider the following:

• Increase in lower-rated issuance. Default rates grow exponentially at progressively lower ratings. Moody's notes that a record 43% of first-time issuers in the first half of 2018 were rated B3, which typically is the lowest rating acceptable to investors.

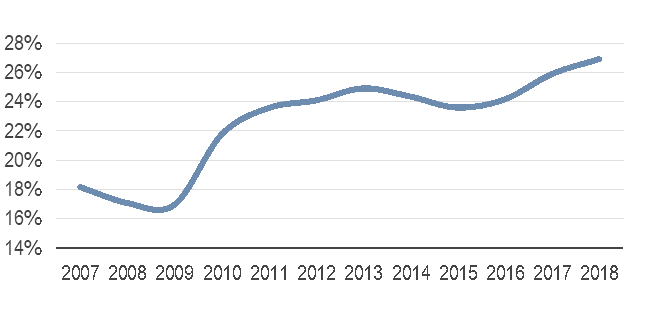

• Smaller or nonexistent debt cushions. Since the financial crisis, the share of debt cushion on outstanding covenant-lite leveraged loans has fallen from 35% to ~22%. Moreover, loans today are more likely to be structured as first-lien-only transactions (58% in 2018 versus 39% in 2012). These loans are the only form of debt financing in the issuer’s capital structure.

• Percentage of outstanding loans without a debt cushion

Source: S&P Capital IQ LCD. Data is as of June 30, 2019. Based on pro forma financials at the closing of each loan; debt cushion represents the share of debt that is subordinated to first-lien term loans.

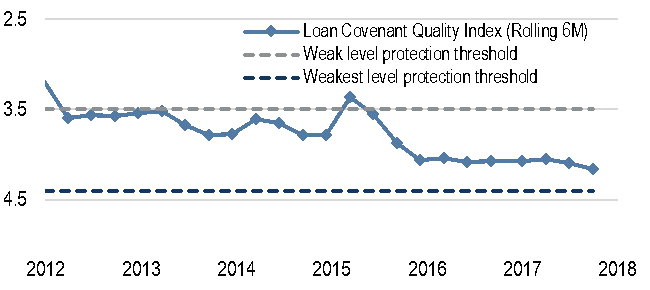

• Weaker loan documentation. The typical loan credit agreement has become less restrictive for issuers, presenting a greater risk to lenders. In general, credit agreements have become more aggressive, allowing the issuer such leeway as asset transfers, greater incremental secured-debt incurrence, and an increase in the retention of asset-sale proceeds. Such weakening covenant protections have the potential to dilute the position of first-lien loans at the top of the capital structure. As such, we are seeing the emergence of covenant-lite loans which typically require fewer financial maintenance tests. Companies provide greater flexibility and freedom to manage cash flows but offer less protection for investors.

Loan covenant quality index hovers near lows

Source: Moody’s, as of September 30, 2018. Scores range from 1 to 5, with a higher score denoting weaker covenant quality

3. Private debt: selection is key

Disintermediation of the financial sector is encouraging companies that would normally have borrowed from banks to seek debt funding directly from investors.

Generally speaking, public debt securities are those that are registered with regulators. ‘Traditional’ fixed income asset classes such as investment-grade credit, agency mortgages, high yield bonds, and emerging markets debt all fall under the public umbrella. In contrast, private debt is either unregistered or registered under specific exemptions.

However, the key practical difference historically has been their liquidity profiles. Although private debts generate higher returns, they are considered illiquid investments due to long investor horizons and restricted access to investors. Investing in private debt securities require special expertise and robust research platforms, as the market is highly complex with high entry barriers.

Additionally, investors should be aware that there are limited details and a lack of transparency of these private investments due to their product structure and the nature of the agreement. As such, many of them are not rated by rating agencies. Furthermore, investors need to mindful about the valuation methodology to fully understand the risk involved.

Private debt is not homogenous. It now finances a range of investments, such as corporate, consumer non-residential, small-business, residential mortgage, and other more-niche categories of lending, which present investors with a differentiated opportunity set. The risks associated with each type of strategy can be very different. In fact, the majority of private debt funds were created after the financial crisis and many strategies are untested against adverse market conditions. To navigate this market, investors should be aware of the risks involved and extremely selective their choice of investments.

Conclusion

Historically, fixed income assets provided income and diversification benefits for investors. In the current low interest rate environment, high yield bonds, investor focus on leveraged loans and private debts is rising as the asset class offers unique opportunities to investors. However, investors must fully understand the risk and return profile of these fixed-income investments.

Vivek Bommi is a Senior Portfolio Manager at Neuberger Berman, a sponsor of Cuffelinks. This material is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. It does not consider the circumstances of any investor.

For more articles and papers by Neuberger Berman, please click here.