Amid the furore over the potential changes to superannuation rules, investors should not turn away from the continuing taxation benefits. Super is still the best place to save for retirement for the majority of people.

I am reminded of events during the GFC. It was as if some investors had a view on how the game should be played, rather than how it will be played. There is no point sulking over the rights and wrongs of retrospectivity, but rather, focus on the remaining advantages.

As the GFC was unfolding, some bearish friends seemed certain the whole financial system would collapse and probably never fully recover, especially after the fall of Lehman Brothers. The problem in their case was that more than anything, they wanted the system to collapse because it deserved to collapse.

Their only question was timing. Inevitably, I’d pipe up, “But don’t you think governments might take some action to prevent the complete destruction of the global economy?”, to which the reply was usually, “Investors should have known the risks and they will have to pay the costs.”

(My preference was that the destructive impact of the GFC should have been more widespread. The buying opportunities would have been even better and the lessons imparted would have been better learned. It would have been a lot longer before they were repeated.)

However, the job of an investor is to discount probabilities. The likelihood that the governments of the major economies of the world standing idly by seemed fanciful, so I steadily deployed capital into the ongoing destruction of the markets. I finally ran out of available funds in February 2009, which was only a month before the market eventually bottomed.

Understanding the rules

It is critical to operate within the rules of the system to achieve the best results, even if you don’t agree with the rules. For example, you may think that negative gearing is a foolish system that causes more harm than good and distorts the market. But while the system exists, if you intend to own investment property, you need to understand the system and structure your financial affairs to create the greatest long-term benefit. As Kerry Packer famously said, “Of course I am minimising my tax - if anybody in this country doesn't minimise their tax they want their heads read”. If the rules on negative gearing change and the benefits disappear, then you must find the most advantageous setup available under the new regime.

Another under-exploited opportunity is when couples find themselves in different tax brackets. Investment earnings should be in the lower-earning spouse’s name, and opportunities such as superannuation spouse contributions’ should be thoroughly investigated.

Superannuation remains a place where people can exploit the rules of the game, provided there is a willingness to lock precious capital away and notwithstanding the ever-changing rules of the system.

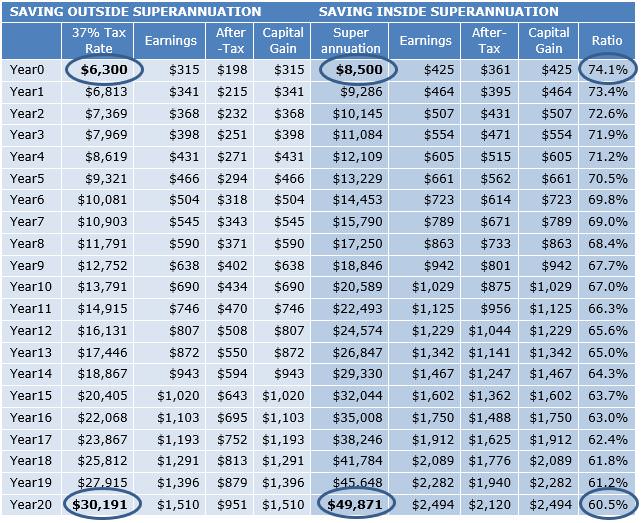

Consider the taxpayer in the 37% tax bracket who expects to be in that bracket for the rest of their working life and then retire in 20 years’ time. The table below shows the different path of $10,000 saved inside and outside of superannuation. For simplicity, the investor will make 10% per annum, equal parts earnings and capital growth with the after-tax earnings reinvested.

The capital saved out of ordinary income begins life as $6,300 (after paying 37% tax on $10,000 income). The capital contributed pre-tax to superannuation begins its life as $8,500 (after paying the 15% contributions tax). The immediate disadvantage of ordinary savings leaves the saver with only 74.1 cents ($6300/$8,500) for every superannuation dollar.

The pernicious effect of the higher tax rate widens the advantage by roughly 0.7c per dollar every year, culminating in the amount saved out of ordinary earnings being worth only 60.5% of the same amount saved behind the shield of superannuation. That is, in this 20-year example with the same earnings rate, the investor has $30,191 when saving outside super while they have $49,871 inside super, making the non-super investment only 60% of the super balance.

The Government still wants people to fund their own retirement

If you are nervous about potential changes to the superannuation system, remember that the Government wants you to fund your own retirement. They may poke around to extract additional tax revenues from the enormous superannuation savings pool, but it remains the place where the average saver is likely to generate the best return on an after-tax basis.

Know the rules of the game and exploit them to your greatest advantage.

Tony Hansen is Chief Investment Officer at Eternal Growth Partners. This article is for general educational purposes and does not address the investment needs of any individual.