The refund of excess franking credits has been available since 2000. Many SMSF trustees have become accustomed to receiving a large deposit into their bank account at the end of each financial year. If Labor’s proposed changes to dividend imputation become law, the refund will be a thing of the past and trustees will need to rethink their investment and tax planning strategies.

Franking credits will still be beneficial for superannuation funds that have taxable income as the franking will reduce their tax liability. However, many funds, especially those paying a pension, have little or no tax payable and currently receive a refund. They will be the funds that lose out the most.

A flaw in the policy proposal is that the burden of the extra tax will affect one group of investors, those using an SMSF, more than any other. Most large industry and retail funds will generate enough income from contributions and investment earnings to use their franking credits and pass on the benefit to members. This creates the unfair situation where two investors with the same investments, one in an SMSF and one in an industry or retail fund, will be treated differently.

What can SMSFs do to reduce the impact?

Given the possibility that Labor will be in power by this time next year, SMSF trustees and their advisers are already contemplating strategies to limit the effect of the potential change. These strategies include:

- Changing the investment mix to include investments that don’t provide a franking credit such as property trusts, overseas investments, and companies that pay unfranked dividends.

- Many high net worth super fund members currently receive a pension simply to reduce the tax liability of their SMSF and not because they need the income. In future, this strategy may simply increase the amount of franking credits that are lost, and members may leave their superannuation in accumulation.

- Children who are making taxable superannuation contributions may join their parents’ SMSF. The taxable income of the fund will rise and use up some of the excess franking credits.

- Closing the SMSF and have their investments managed by an industry or retail fund.

There is another strategy that may be of benefit to some investors: member-directed investments.

What are member-directed investments?

Generally, when joining an industry or retail fund, investors are given a choice as to what fund category they will invest in. For example, they may be asked if they are a 'Conservative', 'Balanced', or 'Growth' investor. Some funds also provide another alternative where the member can choose specific investments. This alternative is generally known as 'member-directed investments'.

The member-directed investments option allows the member to buy and sell investments, similar to using an SMSF. It is managed through the superannuation fund website. Brokerage is charged at rates comparable to the major online brokers, and the administration fee, usually under $400 through industry funds, is reasonable when compared to fees charged to administer an SMSF.

Where an SMSF provides almost unlimited investment choice, this is not the case with the member-directed investment option. Investments are generally limited to:

- ASX 300

- A selection of listed investment companies

- A selection of exchange traded funds

- Term deposits

- Cash

It is not as flexible as an SMSF in other ways. There are limits on how much can be invested in any one asset, usually 20%, along with a requirement to hold a portion of your balance in cash.

Despite these restrictions, this type of product may be beneficial to some investors as shown in the examples below:

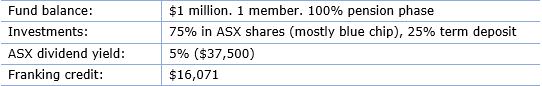

Example 1

If no action is taken, the franking credits will be lost. The member would have the option to shift to the member-directed investment platform and limit their investments choice. This could potentially result in a full refund of franking credits.

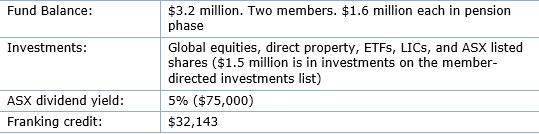

Example 2

The members could shift $1.5 million into a fund providing member-directed investments and maintain their SMSF for the balance. If the new fund pays an account-based pension, a franking credit refund of $32,143 could be received.

Some final words of caution

Superannuation law (SIS Reg 5.03) states that the trustee is required to allocate income between members “in a fair and reasonable way”. What does “fair and reasonable” mean? In the case of member-directed investments, the good news is that currently the benefit of all credits relating to shares held are allocated to the member's account. It is hoped that this practice continues if there is a law change. However, we have no guarantee at this point.

In commenting on an article by Michael Hutton last week, a Cuffelinks subscriber, Ramani, did an excellent summary of this issue:

“The option of moving from a SMSF to an APRA (industry or retail) fund such that franking credits that would be wasted in the SMSFs can soak up the fund-as-a whole tax liability would make sense, but only if the APRA fund would equitably distribute the credits so saved back to the members who gave raise to the credits in the first place.

I would urge caution against such an automatic presumption. The black-box of calculating member earning and crediting rates (or the related unit pricing if the fund is unitised) as well as the fuzzy nature of equity among member cohorts, not to mention generic member apathy, militate against it. It would be feasible to check if the trustee would so distribute, and having confirmed it would, prosecute any failure in the new dispute resolution authority might be required. Otherwise, the SMSF members would be ‘donating’ the excess credits to other members without being aware of it, instead of to the Treasury as wasted franking.”

Given the issue's importance, I suspect clarification will be provided by the funds before any change in the law.

It's an important opportunity. According to the Class SMSF Benchmark Report of March 2017, listed shares account for 30.2% of money invested in SMSFs. Therefore, there will be plenty of investors looking for strategies to keep their franking credits if refunds are no longer allowed. Assuming there are no legislative or other administrative impediments, member-directed investments may be a viable alternative.

[Editor's note: We expect a large industry fund to comment on their intended approach on their member-direct offer next week.]

Matthew Collins is a Director of Keystone Advice Pty Ltd and specialises in providing superannuation tax and structural advice to high net wealth individuals and their families. This article is general information and does not consider the circumstances of any individual investor. It is based on a current understanding of related legislation which may change in future.