The 2021/22 Budget handed down by Treasurer Josh Frydenberg this week delivered many welcome changes to superannuation. However, they are subject to legislation and at best, the start date will be 1 July 2022. The changes are non-controversial, and even if there is a different party in government a year from now, the proposed amendments should stand.

But they introduce a confusion over which changes are due on 1 July 2021 and which are due on 1 July 2022. This article describes the new rules and clarifies those coming in less than two months.

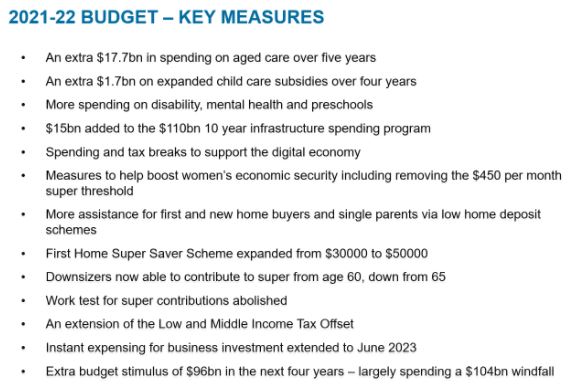

Briefly on the Budget numbers:

- Real GDP is forecast at 1.25% for 2020/21, rising to a healthy 4.25% in 2021/22. However, this is not sustained with a fall to 2.5% and 2.25% in the following financial years.

- Budget deficits continue over the forward estimates, from $161 billion this year to $80 billion in 2023/2024. Not much fiscal repair there. Net debt reaches $920 billion over the four years.

- There is little expected on CPI and wage growth, at 1.75% and 1.5% for 2021/2022 pushing up to 2.5% for both in 2023/2024.

The first section below on the Budget changes is prepared by Liam Shorte of Verante Financial Planning, who writes as The SMSF Coach.

New changes from 1 July 2022

The key measures from the Budget are outlined below with some commentary and tips. I have benefited from the technical input of the SMSF Association, Accurium Technical and conversations with other professionals in preparing this content.

All measures outlined below, other than the proposed changes to legacy retirement products, are expected to commence from 1 July 2022, once they have received Royal Assent.

1. Repealing the work test for voluntary contributions

Individuals aged 67 to 74 (inclusive) will be able to make non-concessional (including under the bring-forward rule) or salary sacrifice contributions without meeting the work test, subject to existing contribution caps and existing total superannuation balance limits.

TIP: The waiver of the work test will not apply to personal deductible contributions, so individuals aged 67 – 74 wishing to claim a tax deduction for personal contributions will be required to meet the work test (or be eligible to apply the work test exemption).

Individuals aged 65 to 74 will also be able to use the bring forward provisions subject to the available caps and meeting the total super balance criteria. Currently, only those under age 65 on 1 July of a financial year can trigger the bring forward provision in that financial year. The measure that was originally announced in the 2019-20 Federal Budget to extend this age from 65 to 67 effective 1 July 2020 has not been legislated.

Opportunity to even up spouse balances and maximise superannuation in pension phase – Couples where one spouse has exhausted their transfer balance cap and has excess amounts in accumulation are able to withdraw and recontribute to the other spouse who has transfer balance cap space available to commence a retirement phase income stream. This can increase the tax efficiency of the couple’s retirement assets as more of their savings are in the tax-free pension phase environment.

Top up retirement savings up to age 74 – Subject to contribution caps, the new rules can help individuals contribute additional funds to super up to age 74, perhaps where they may have received an inheritance or sold an investment property.

Make your tax components more tax free by using recontribution strategies – SMSF members can cash out their existing super and re-contribute (subject to their contribution caps) them back in to the fund to help reduce tax payable from any super death benefits left to non-tax dependants. They can now do this until they turn age 75.

Tip: There is always a cost of making changes so work with your adviser and accountant to time these strategies to minimise additional accounting costs.

Opportunities to make spouse contributions for longer – The new rules can provide you with the opportunity to continue making spouse contributions which can not only help with equalising super between spouses, but may also enable the contributing spouse to benefit from the spouse contribution tax

2. Reducing the eligibility age for downsizer contributions

The eligibility age to make downsizer contributions into superannuation will be reduced from 65 to 60 years of age. All other eligibility criteria remain unchanged, allowing individuals to make a one-off, post-tax contribution to their superannuation of up to $300,000 per person from the proceeds of selling their home. These contributions will continue not to count towards non-concessional contribution caps.

The $300,000 downsizer limit (or $600,000 for a couple) and the $330,000 bring forward NCC cap allow up to $630,000 in one year contributions for a single person and $1,260,000 for a couple subject to their contributions caps.

Tip: Great for people who have little super and invested in their business or property to now switch to tax-effective pensions.

3. Relaxing residency requirements for SMSFs

SMSFs and small APRA funds will have relaxed residency requirements through the extension of the central management and control test safe harbour from two to five years. The active member test will also be removed, allowing members who are temporarily absent to continue to contribute to their SMSF. The Government expects this measure will have effect from 1 July 2022.

Tip: Probably useful post-COVID for those working or travelling extended periods overseas and levels the playing field somewhat with APRA funds.

4. Legacy retirement product conversions

Individuals will be able to exit a specified range of legacy retirement products, together with any associated reserves over a two-year period. The specified range of legacy retirement products includes market-linked, life expectancy and lifetime products, but not flexi-pension products or a lifetime product in a large APRA-regulated or public sector defined benefit scheme.

Currently, these products can only be converted into another like product and limits apply to the allocation of any associated reserves without counting towards an individual’s contribution cap.

There is considerable additional detail in this feature so consult an adviser if you are affected, especially to ensure you do not lose other entitlements such as the age pension.

This measure will take effect from the first financial year after the date of Royal Assent of the enabling legislation.

5. Removing the $450 per month threshold for superannuation guarantee eligibility

The Government will remove the current $450 per month minimum income threshold under which employees do not have to be paid the superannuation guarantee by their employer.

Great move and will help people get more benefit from super. If you can combine this with a personal contribution yourself or for a low-income spouse of $20 per week ($1,000 per annum) then the member may benefit from the Government Co-Contribution of up to $500 per year.

6. First Home Super Saver Scheme (FHSSS) increasing the maximum releasable amount to $50,000

The Government will increase the maximum releasable amount of voluntary concessional and non-concessional contributions under the FHSSS from $30,000 to $50,000.

Voluntary contributions made from 1 July 2017 up to the existing limit of $15,000 per year will count towards the total amount able to be released. Subject to passage of legislation, it is expected that this measure will be effective from 1 July 2022.

The Government will further make four technical changes to the legislation underpinning the FHSSS to improve its operation as well as the experience of first home buyers using the scheme.

Tip: This is a great way to show your children the benefit of salary sacrifice and get them used to putting savings away.

7. Improving the Pension Loan Scheme

The Pension Loan Scheme (PLS) currently allows a fortnightly loan of up to 150% of the maximum rate of age pension to boost a person’s retirement income by unlocking capital in their real estate assets. It can be available for self-funded retirees who are age pension age but do not receive a social security pension. Interest is compounded fortnightly at 4.50% p.a., and any debt under the scheme is paid back when the property is sold or the person dies.

From 1 July 2022, the Government will introduce:

- No negative equity guarantee

Borrowers under the PLS, or their estate, will not owe more than the market value of their property in the rare circumstances where their accrued PLS debt exceeds their property value. This brings the PLS in line with private sector reverse mortgages.

- Immediate access to lump sums under the PLS

Eligible people will be able to access up to two lump sum advances in any 12-month period, up to a total value of 50% of the maximum annual rate of age pension (currently $12,385 for singles and $18,670 for couples).

8. Low and Middle Income Tax Offset extended another year

The Government announced that it will retain the Low and Middle Income Tax Offset (LMITO) in the 2021-22 financial year. Eligibility for the LMITO:

| Low and middle income tax offset |

| Taxable income |

Offset |

| $37,000 or less |

$255 |

| Between $37,001 and $48,000 |

$255 plus 7.5 cents for every dollar above $37,000, up to a maximum of $1,080 |

| Between $48,001 and $90,000 |

$1,080 |

| Between $90,001 and $126,000 |

$1,080 minus 3 cents for every dollar of the amount above $90,000 |

9. Increasing the Medicare levy low-income thresholds

The income thresholds at which Medicare levy is payable for singles, families and pensioners will be increased for the 2020-21 financial year as follows:

- Singles will be increased from $22,801 to $23,226.

- The family threshold will be increased from $38,474 to $39,167.

- For single seniors and pensioners, the threshold will be increased from $36,056 to $36,705. The family threshold for seniors and pensioners will be increased from $50,191 to $51,094.

For each dependent child or student, the family income thresholds increase by a further $3,597 instead of the previous amount of $3,533.

Thanks to Liam Shorte of Verante Financial Planning for the section above. Liam Shorte B.Bus SSA™ AFP is a Financial Planner and SMSF Specialist Advisor™. This is based on Liam's interpretation of the Budget announcements which may change in final legislation.

To complete this Budget summary, here is a slide from Shane Oliver of AMP Capital summarising the major changes for 2021/2022.

Changes from 1 July 2021

To recap, higher superannuation choices are coming from 1 July 2021 and apply to institutional funds and SMSFs. Caps on contributions are increasing while governance is being overhauled to promote transparency, minimise fees and eliminate poor performing funds.

1. Increase in SG

The Superannuation Guarantee (SG), the mandatory contribution made by employers, is increasing from 9.5% to 10%. SG is legislated to rise by 0.5% until 1 July 2025 when it will reach 12%. However, there is opposition to the increases due to arguments about the trade-off between current wages and future superannuation, so the increments are far from assured.

2. Increase in contribution caps

A range of changes allows most people to put more into super.

- Concessional (pre-tax) contributions are increasing from $25,000 to $27,500 per year. Concessional contributions are taxed at 15% upon entry.

- Non-concessional (post-tax) contributions (NCCs) are increasing from $100,000 to $110,000 per year. Non-concessional contributions are not taxed upon entry, although you will have already paid tax on the sum.

- Activating the ‘bring-forward arrangement’ allows contributions of up to three years’ worth of NCCs in a single year. That is increasing alongside the NCC from $300,000 to $330,000. The three-year bring-forward maximum contribution is based on the non-concessional contributions cap at the time the bring-forward is triggered. Triggering it before July 1 will exclude you from accessing the increased cap.

3. Increase in total super balance (TSB) cap

The ability to add to super with NCCs is limited by the TSB. After the super balance exceeds the TSB, no more NCCs can be made, and the TSB cap is increasing from $1.6 million to $1.7 million on 1 July. Note there are eligibility limits depending on a person's age on 30 June of the previous financial year.

4. Increase in transfer balance cap (TBC)

The amount a peson can transfer from accumulation phase to a retirement phase pension is called the TBC and is also going up to $1.7 million for people starting a new pension. Investment returns in the pension phase are generally tax free while they are taxed at 15% in the accumulation phase.

Anyone with a transfer balance account of $1.6 million any time since 1 July 2017 is not eligible for the $100,000 increase. Those with transfer balance accounts below that previous TBC cap will receive a portion of the increase. This calculation becomes complicated and most people affected should obtain financial advice. Those who have yet to start a retirement phase income stream before 1 July 2021 will receive the full increase. People with more than one fund, such as an SMSF, a retail fund or an industry fund, need to know that all balances are included in the transfer balance cap.

The bottom line is more contributions can be made. Chat with your financial adviser about how much of the increase you will be eligible for.

5. Changes in governance and monitoring

Changes are also expected in the way super funds and SMSFs operate because of the Government’s ‘Your Future, Your Super’ (YFYS) legislative package. Some of these changes are still subject to industry consultation and may not clear legislation before 1 July 2021.

Many Australians have multiple superannuation accounts from previous jobs. Duplicated fees and possibly insurance policies lead to lower returns and less savings in retirement. From 1 July, superannuation account will follow members when they change jobs, and the new employer will pay contributions into the existing account.

The Government is also rolling out a new tool, ‘YourSuper’, to compare public superannuation products based on performance and fees. There will be annual performance tests and underperforming funds will be required to notify members and refer them to the ‘YourSuper’ comparison tool. Those funds that fail the test twice in consecutive years will not be allowed to accept new members.

Superannuation funds will be required to be more transparent in how they spend fund money, for example, on advertising campaigns or sponsorships. Funds that are unable to justify expenditures are in the best financial interest of the members will face penalties.

As the YFYS package has yet to pass, these proposals are subject to change.

Graham Hand is Managing Editor of Firstlinks. With thanks to Lewis Jackson, Data Journalist at Morningstar, for additional content. This article is general information and does not consider the circumstances of any person.