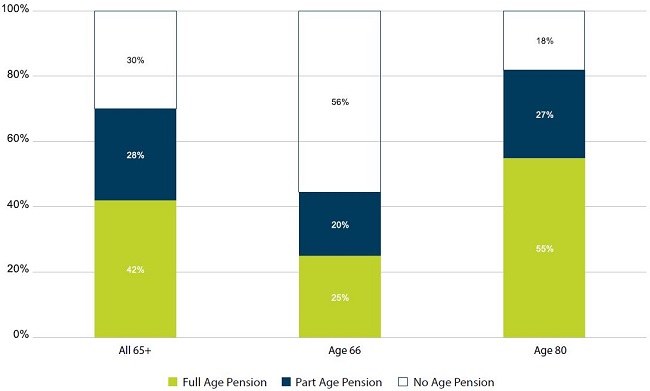

Contrary to many opinions, super is reducing reliance on the age pension for the large majority of people entering retirement. At the end of December 2018, only 45% of 66-year-olds were accessing the age pension, and only 25% of 66-year-olds were drawing a full age pension.

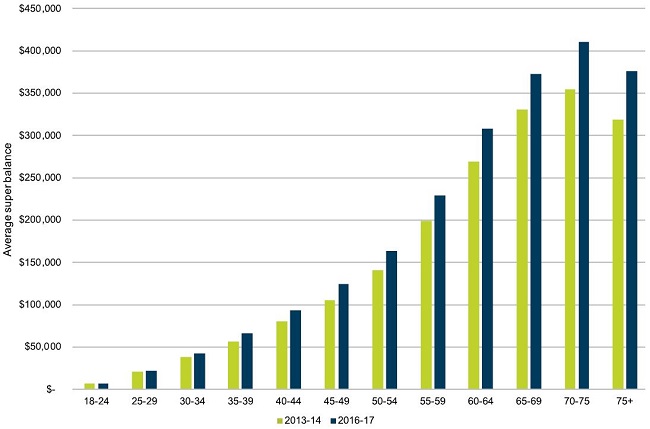

The average consolidated super balance for Australians aged 60-64 (i.e. those approaching retirement) is now over $300,000. This is far from where the super system peaks, as average balances continue to rise across all age groups as the system matures.

Average consolidated super account balance, by age

Source: Taxation statistics, ATO

The success of super is widespread

The average retirement phase member balance across all large APRA funds at June 2018 was $281,253. These are not consolidated balances, but it is far less likely for a member to have multiple account-based pensions than it is to have multiple accounts in the accumulation phase.

This figure is an average of balances spread across all age cohorts in retirement and will include older retirees who have either spent the bulk of their super or never had much in the first place (only one in five people aged over 75 has a super balance).

Super balances at the household level

Most people enter retirement as a couple, so considering the combined super balances of a couple household in the 60-64 age group is a better measure of how well people are financially prepared for retirement.

The majority of people in the 60-64 age group are part of a couple. The combined super balance of a couple-household will be higher than the average male balance in this age group of $336,360. The average female balance is $278,000, but simply adding these averages together would be misrepresenting the likely true picture. Broken work patterns and part-time work need to be factored in.

This means that a typical couple-household will probably be starting retirement today with more than $400,000 in super.

Who is getting the age pension?

These averages are significant in that they are all above the lower threshold for the age pension assets test of $258,500. This means that the average member in the retirement phase does not get the full age pension.

In 2018, only 42% of age-eligible retirees were on the full age pension. This is an overall average and includes retirees in their 90s who have never had super.

Recent retirees are much less likely to be on the full age pension, with the typical super balance at retirement for a household over $400,000, and most owning their own home. As stated above, Department of Social Services (DSS) data reveal that the majority of new retirees are not accessing any age pension and only 25% of 66-year-olds were accessing a full age pension.

The apparent success of super in building savings at retirement means most people can expect to spend longer in retirement before they receive any age pension.

Age pension access at selected ages, as at December 2018

Source: Calculations based on ABS and supplied DSS data.

Retirees will need access to secure and reliable income

The next phase for large APRA funds will be to make it easier for their members to convert an appropriate part of their super into secure, lifetime income to compensate for their delayed and reduced access to the age pension.

Jeremy Cooper is Chairman, Retirement Income, at Challenger. The full research report by Challenger can be accessed here.