The consensus is that retirement income should be the primary goal of superannuation and the federal government plans to enshrine an objective in legislation. This will require a change in focus for investment managers around the risks they manage and the options they provide to investors.

In its response to the Financial System Inquiry, the government also agreed to remove impediments to retirement income products and for the publication, where practical and cost-effective, of income projections on members’ statements.

As always, the devil is in the detail. While publishing income projections is a good idea, it must be meaningful for investors.

That means participants should be able to see not only what they may be able to afford in retirement, but the uncertainties around those projections. They should be given investment options to help manage those uncertainties so that confidence in the income projections increases as they near retirement.

If their plans are not on track, they need to be made aware of their options, whether it is saving more, working longer, or otherwise adjusting their expectations for retirement.

We also must be mindful of the nature of the risks that may affect retirement income. If the solution is not managing market risk, inflation risk and interest rate risk, are the income estimates actually useful?

Managing the right risks

If income is the goal, we need to think about risk management in different ways. Currently, many of the options offered to savers may be managing non-crucial risks, sacrificing asset growth goals with no clear benefit relative to an income goal.

If the volatility of an account balance is all that is managed, employees will not be in a position to know how much inflation-adjusted income that balance can provide when they retire.

Just about everyone who saves or invests does so to support some future consumption. We know that the key to any asset allocation is to identify the right hedging asset for a given liability.

So if you want to reduce the volatility of your account balance, you can invest in assets that are stable in wealth terms, like term deposits or short-term fixed interest. But short-term fixed interest is the wrong hedging asset if you are seeking to manage lifetime income risk. Instead, you end up accepting a lower expected return with no clear benefit relative to an income goal.

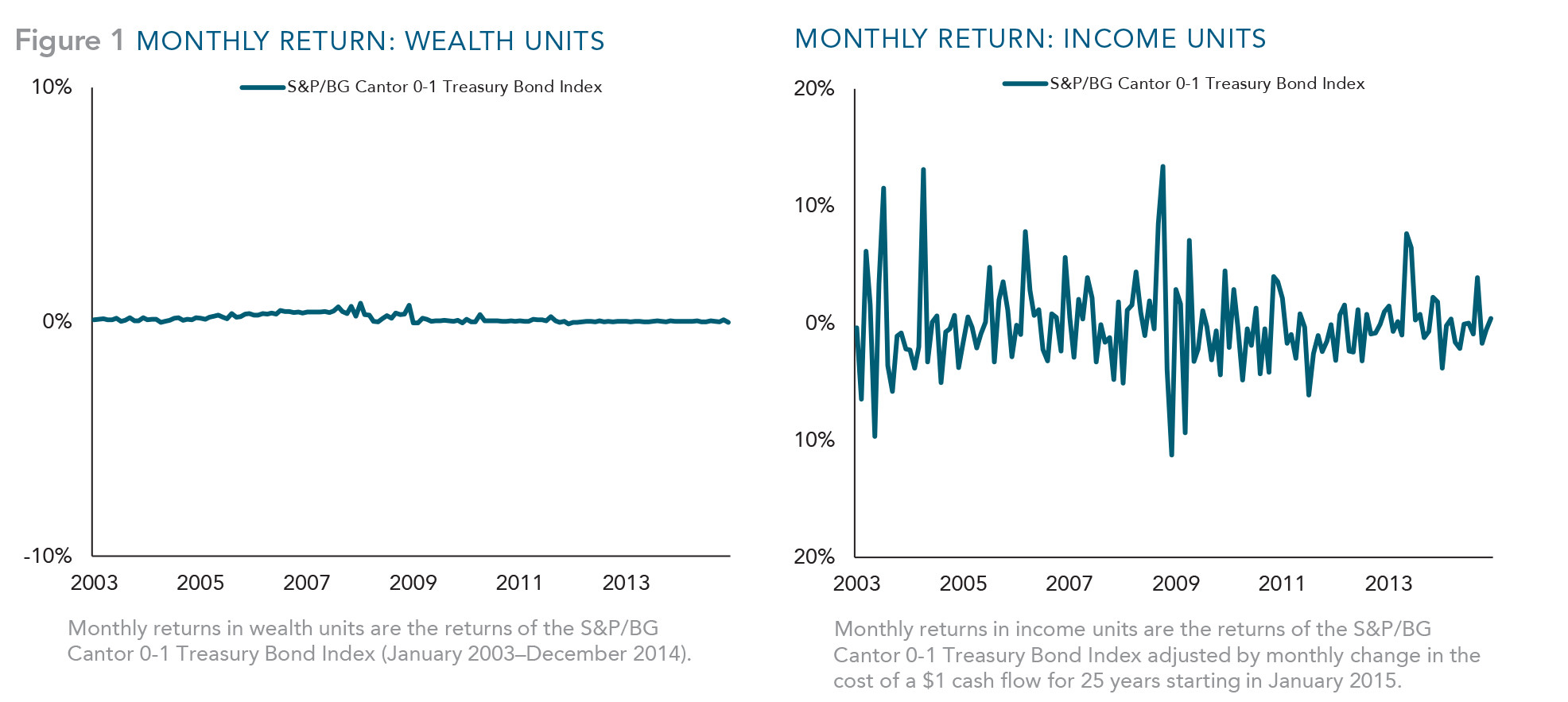

Figure 1, using US data as an illustrative example, shows how risk and return characteristics differ when looked at through an income lens.

The left-hand chart shows that when managing the volatility of an account balance, short-term government bonds are a fine hedge. But the right-hand side shows if you are managing toward income, those same securities become much more volatile.

To hedge a retirement income liability, we need to devise a solution that manages relevant risks – among them rising inflation and interest rates.

We can conceptualise our retirement liability as a series of equal inflation-adjusted payments from retirement to life expectancy.

This future liability looks a lot like a bond. The series of payments, like any bond, has a duration. By investing in a portfolio of inflation-protected instruments that match the duration of those payments, we construct a strategy that hedges interest rate and inflation risk.

DB, DC and a middle way

The idea of buying assets today that hedge a future liability is called ‘liability-driven investing and is an approach that is commonly used among the old defined benefit (DB) pension plans that used to prevail before the introduction of defined contribution (DC) superannuation in 1992.

A DB plan is designed to provide a predetermined retirement benefit to members either in the form of a specific dollar amount or as a percentage of compensation. In a DC plan, individuals contribute to their fund through their working lives, but they do not know how that may translate to supporting income once they stop working.

There are a number of advantages in DC plans, such as member control and better portability. But the individual carries all the investment risk and must make often complex asset allocation decisions with little or no expertise.

A middle way is to use two key principles established by lifecycle research in financial economics.

The first principle says that investors derive utility from being able to afford a steady stream of consumption through retirement. The risk management framework should be designed to deal with uncertainty risk around that goal.

Every asset allocation involves a trade-off between growth assets and risk-hedging assets. If the goal is retirement income, the right measure of risk is uncertainty about income. And the right trade-off is between income risk management and the opportunity of growing income.

The second principle is that investors should make saving and asset allocation decisions based on various sources of capital throughout their lifecycle.

Fund members have two main sources of capital to fund future consumption - today’s financial assets and expected future savings from their human capital. For most investors, the human capital component tends to be less risky than equities.

At the beginning of members’ working lives, they tend to have little financial wealth. The majority of their total wealth consists of future savings from human capital. As time progresses, members convert future savings into financial assets.

So the right asset allocation approach should be to manage the trade-off between assets for income-growth (increasing the balance available to draw income from) and assets for income risk management.

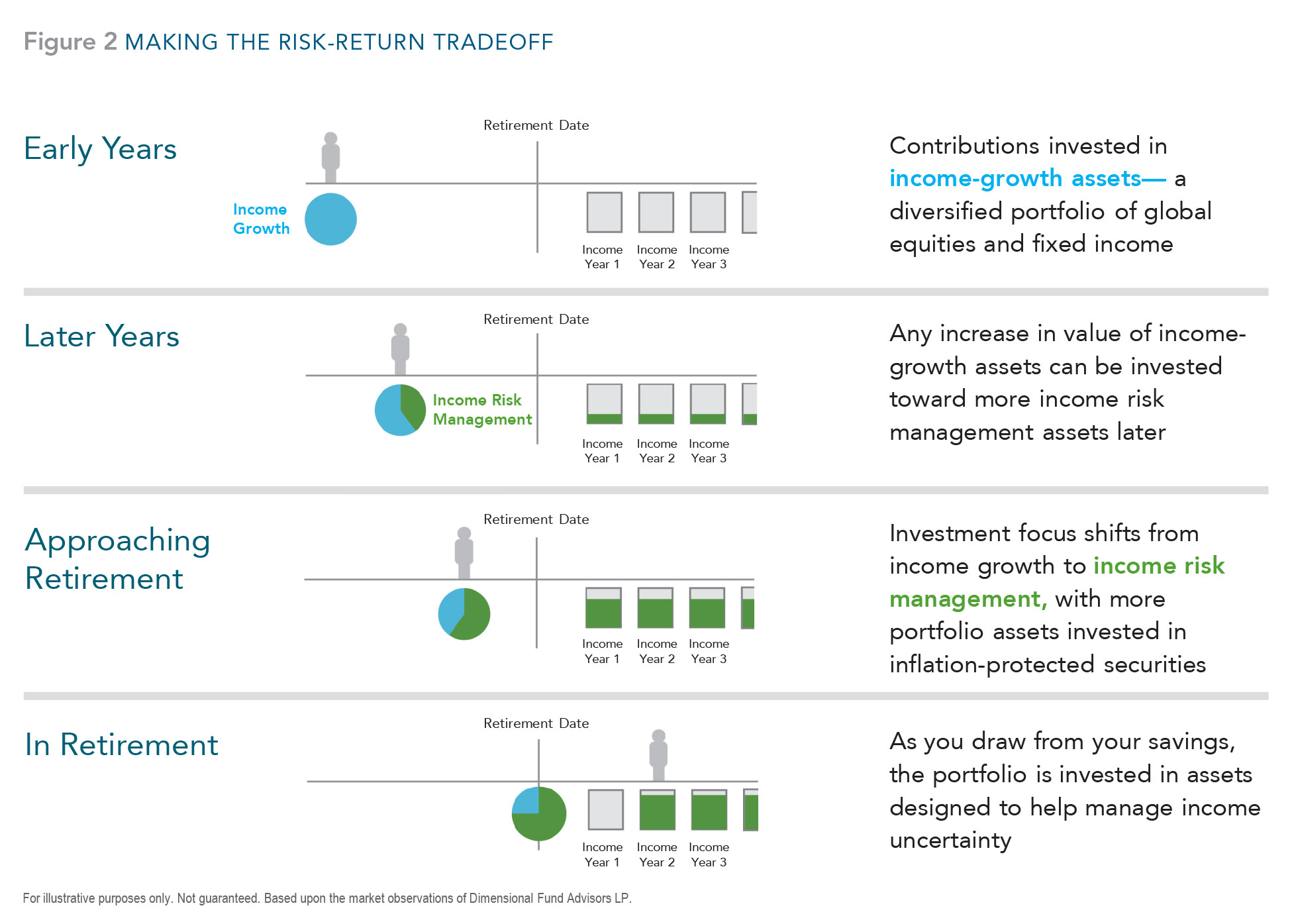

This relationship drives changes in the allocation to income-growth and income risk management assets. Early in life, the focus is on income-growth assets. Later, as human capital is depleted, the focus shifts to income risk management assets – duration-matched inflation-protected securities. Figure 2 below shows how this might work.

Summary

The primary goal of retirement savings should be to provide a steady stream of income for people when they stop working. So a primary risk for people is uncertainty about how much income they can afford in retirement.

An ideal solution would allow participants to invest toward retirement income over time, and seek to protect those investments from inflation and market risks.

Providing relevant information to investors alongside solutions that manage the right risks can be a powerful combination in pursuing better retirement outcomes.

Graham Lennon is head of retirement investment strategies and a senior portfolio manager in Sydney with Dimensional Fund Advisors, a wholesale asset manager with more than $500 billion under management globally. This article is for general educational purposes only and does not consider the needs of any individual.