Psychologists use the 'Contrast Principle' to explain how our perceptions are formed using comparisons. The Principle says perception is relative. That is, if we experience two similar things, the perception of one is influenced by the other.

In his book ‘Influence: The Psychology of Persuasion’, Robert Cialdini gives many examples of the way buyers are exploited using the Contrast Principle and clever sales techniques. Something can be made more attractive by comparing it to another choice that is less attractive. For example:

“It is more profitable for salespeople to present the expensive item first … presenting an inexpensive product first and following it with an expensive one makes the expensive item seem even more costly.”

Cialdini followed a real estate agent showing properties to potential buyers. The agent always started with a couple of undesirable properties, which he called ‘setups’.

“The company maintained an unappealing house or two on its lists at inflated prices. These houses were not intended to be sold to customers but only to be shown to them so that the genuine properties in the company’s inventory would benefit from the comparison.”

The agent watched the buyers’ ‘eyes light up’ when they saw the houses he wanted to sell after they had looked at the dumps.

The superannuation fund performance test

The Your Future, Your Super (YFYS) reforms are designed to improve outcomes for members. They feature a seven-year investment performance test for MySuper funds against a benchmark imposed by the Australian Prudential Regulation Authority (APRA).

(A point of detail on the regulations. The Australian Securities and Investment Commission (ASIC) is responsible for policy on communications and associated comparisons sent to members by funds. As ASIC advised me, "that they do so without hyperbole, fibbing, spin and general palaver". But the benchmarks and judgements are APRA's responsibility).

Last night (Wednesday, 13 October 2021), Senator Jane Hume, Minister for Superannuation, delivered a keynote address to the World Pensions Summit in the Hague where she described how 13 funds with 1.1 million members had underperformed, adding: "A bright-line test, with no excuses. A fund passes, or it fails."

Large super funds that failed the test are now applying a version of the Contrast Principle to explain the results to their members. Rather than compare performance against APRA's benchmark, they are using another measure such as a CPI+ or an absolute return target, with more favourable results.

They are correct to use this technique, as their funds have been managed in ways that differ from APRA's measurement. The performance test makes no judgement on the level of returns achieved, only the performance relative the underlying asset class benchmarks chosen by APRA.

Many of the failed funds have delivered returns better than their investment objectives, and yet they are judged as failures. It is possible for one fund to deliver 10% and fail, and another to return 5% and pass, which will confuse many fund members.

For example, a balanced fund may be managed with an investment target of CPI plus 3%, and with an allocation 50% to growth and 50% to defensive, it returned 15% last year, well ahead of its target. But it is benchmarked against a surging equity market with the S&P/ASX300 up 28% and S&P500 about 40% in FY21. It is deemed a failed fund because it was positioned at the defensive end of its asset allocation, which pushed its relative return 0.5% below its benchmark. Contrast this to a defensive fund invested in bonds which returned the same as its 5% benchmark. One fund is a fail at 15%, the other is a pass at 5%.

In explaining to members using a version of the Contrast Principle, it is better for the super fund to justify performance based on the long-term investment target rather than APRA’s benchmark comparison.

Examples of how underperforming funds are communicating

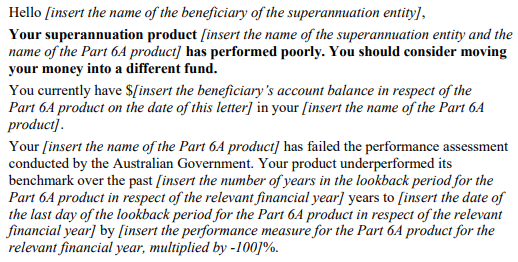

ASIC has warned fund underperformers against customising their communications. The regulator has provided a proforma letter which all underperforming funds must send to members. It is precise and critical, and here is an extract from the full ASIC letter.

ASIC’s Senior Executive for Superannuation, Jane Eccleston, added in a note:

“The text of the letter you send to beneficiaries is mandatory – don’t change it. Any communication you make in relation to the [annual performance assessment] or about your performance should provide information in a balanced and factual way that is not misleading and/or deceptive.”

Heavy stuff, writing to members that their fund has ‘performed poorly’ and they should consider moving their money. Surely, a self-respecting fund trustee would not leave it at that in any decent communication to members.

Well, they don’t.

a) Commonwealth Bank Group Super

The letter from the CEO of Commonwealth Bank Group Super, whose Balanced (MySuper) fund was designated as underperforming, included a two-page glossy cover note from which the following explanation is extracted, followed by a bland A4 version of the official ASIC document.

“We set out to achieve a certain (target) investment return above inflation. The rate of inflation used is the Consumer Price Index (CPI). Our objective is to achieve our target return during times of investment market ups and downs, we do not track an index or benchmark. This target informs how we invest.

Generally, we invest less in shares than many other super funds. Instead, we generally invest more in alternative investments and real assets such as property and infrastructure. This could mean that in strong share markets like we have seen in recent years, our Balanced (My Super) option returns will be lower than other MySuper products. The approach we take can be referred to as diversification. We expect diversification to produce more consistent returns, rather than relying on a smaller range of investments to perform well.

As at 30 June 2021, our Balanced (MySuper) option delivered an annual return of 15% and a long-term return of 7.3% pa over the last 10 years. This long-term return has exceeded our objective which is 2.5% above CPI over a 10-year period.

At the same time, it has also produced a smoother return experience for members compared to the average experience for other MySuper products.”

Fair enough. Get that: "we do not track an index or benchmark". I'll bet they do now, because the consequences of failing the test for a second year are too severe - the inability to accept new members.

Before we point a finger, who can claim if they were a trustee for this super fund, that they would argue against the emphasis on protecting capital with less volatility? It’s a valid defence. Then to top it off, the letter adds:

“To form a more holistic view of a MySuper product’s performance, there are other key areas, beyond net returns, that could be considered. Comprehensive evaluations carried out by industry rating agencies assess not just net returns but also insurance cover and premiums, education, advice, fund governance and more.”

b) Christian Super

Christian Super may be unique among funds, because it says:

“We believe that God invites us to put our faith into action with everything we do, including how we steward our members’ super.”

Fund managers need all the help they can get, and no doubt its Christian members support this principle. The super fund includes a Q&A section on its website dedicated to the performance test. Here are two relevant explanations.

“Why is Christian Super’s MySuper product labelled ‘underperforming’?

Christian Super has historically managed its investments to deliver the investment return objectives outlined in the Product Disclosure Statement. For our MySuper product (My Ethical Super), this objective was to achieve a 3% average annual return above inflation over 10 year periods, which the fund has over-achieved.

We have a more diverse range of members invested in our MySuper product than many other funds and have therefore historically taken a more defensive investment approach, which means we worked to minimise investment losses for our members and took less risk. This approach reflects risk-return investment theory and was made by analysing the way our members respond to market volatility. As well as this more defensive approach, there was also a degree of underperformance in some areas of our investment strategy, which we have addressed.

In response to the changing way that super funds are assessed by the regulator (APRA) in recent years, we increased the amount our MySuper product invests in riskier investments. As a result, we have delivered our investment return objectives, as well as meeting the new performance test benchmark requirements for the past two years ...

How has Christian Super’s MySuper product performed compared to its stated investment objectives?

Our MySuper product (My Ethical Super) has consistently achieved its investment objective stated in our Product Disclosure Statement, delivering an average annual return of 7.95% each year over the last 10 years. This means that we’ve more than doubled our members’ money during the last 10 years through investment returns alone.”

There's an important highlight here. Christian Super has now invested more in riskier investments to meet the assessment test. That could come back to haunt trustees in a down market, when they supposedly thought the previous positioning was correct for their members.

But there's their version of the Contrast Principle in operation. Explain the results in terms of absolute returns rather than focussing on 'a degree of underperformance'.

c) BT Super

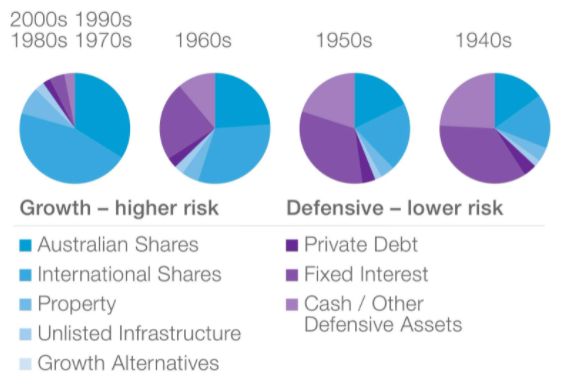

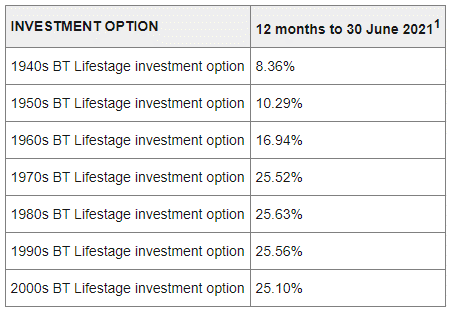

BT Super offers lifecycle or lifestage funds where the defensive allocation increases with age. Younger members gain higher exposure to growth assets and are switched to defensive as they age. In FY21, the younger person's allocation achieved a highly-respectable return over 25% and yet they received a notice about their underperforming fund. No doubt totally confusing to many.

BT Super explains:

“For Lifestage products like those offered by BT, the annual performance assessment takes into account the asset-weighted performance of all Lifestage investment options collectively to calculate a single performance return. The combined seven-year performance of our BT Super MySuper product failed the annual performance assessment, and will be recorded as underperforming on the Australian Taxation Office (ATO)’s YourSuper comparison tool at ato.gov.au/yoursuper.”

The asset allocation of the four Lifestage funds are radically different, as shown below, for people born in the 1940s, 1950s and 1960s, versus those born after the 1970s. BT’s challenge is to explain how APRA has judged all these against one asset-weighted benchmark, especially when people are ringing up the call centre asking how their failed fund earned 25%.

And what is BT Super saying in response to failing the test? What everyone else is saying ... nothing to see here:

“We have worked hard and invested heavily to improve member outcomes and are seeing the result of this in our recent performance.

We’ll continue to look for ways to provide better performance outcomes for our members, be it reviewing our investment strategies, our fees, or our services. In addition, over the past five years we’ve also enhanced our member tools, educational offering and digital experience to make it easier for our members to understand and manage their super.”

Will it work?

It's the early days of so-called underperforming funds writing to their members, and (to my knowledge) no information is publicly available on fund losses. It's my guess the amounts will not be high, as many people in MySuper funds are disengaged and do not even open their mail. Then relatively few will change in light of the alternative explanations.

As Robert Cialdini says of the Contrast Principle:

"An advantage of employing this lever of influence is that its tactical use typically goes unrecognised."

Graham Hand is Managing Editor of Firstlinks. This article is general information.