(Editor's introduction: Peter Thornhill is well-known to our readers as an author and speaker advocating a multi-decade investment strategy of holding industrial companies for income. His previous articles in Firstlinks are here. In this update, he again checks the long-term return from industrial shares, adding comparisons with listed property and term deposits. He argues that for investors with the right risk capacity and investment horizon, there's only one place to invest).

***

Another year has passed and it’s my favourite time. I get to update my presentation material highlighting, yet again, the inexorable creation of wealth by investing in productive enterprises.

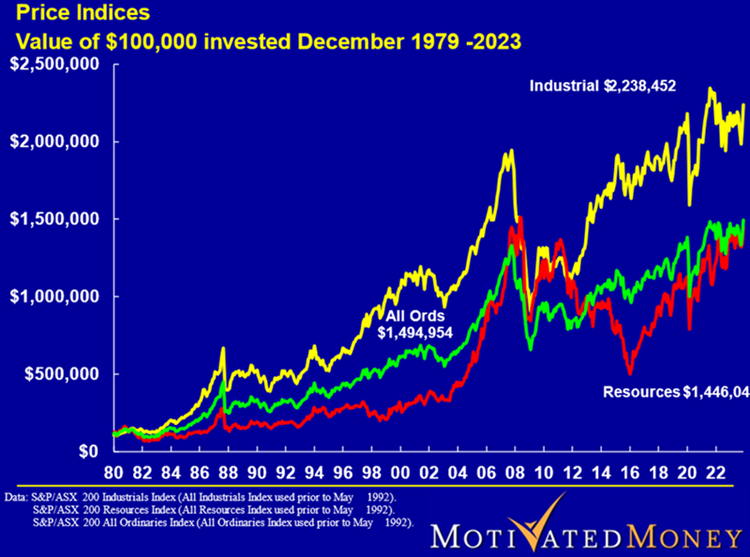

Let’s now look at the major indices, price only index first.

As always, digging stuff out of the ground clearly remains at the bottom of the wealth creation ladder. By adding the resources to the Industrials index we can drag it down to the All Ordinaries. Please note the proximity of the Resources Index to the All-Ords Index, both at around $1.4 million.

The difference between the Industrials and the other two indices is due to TIM! That is, the Technological, Intellectual, and Manufacturing inputs that convert resources into almost everything.

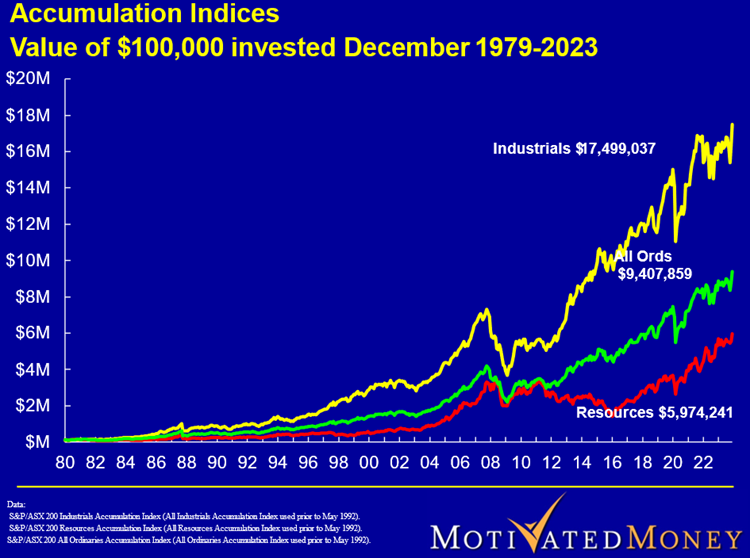

There is a critically important element missing from this chart and you will not be surprised if I said it was the dividend stream. Refer below to see the impact of reinvested dividends. Note that the All-Ords index now jumps up from the Resources Index reflecting the ever-poor cash flow from many resource companies, and the Industrials Index soars.

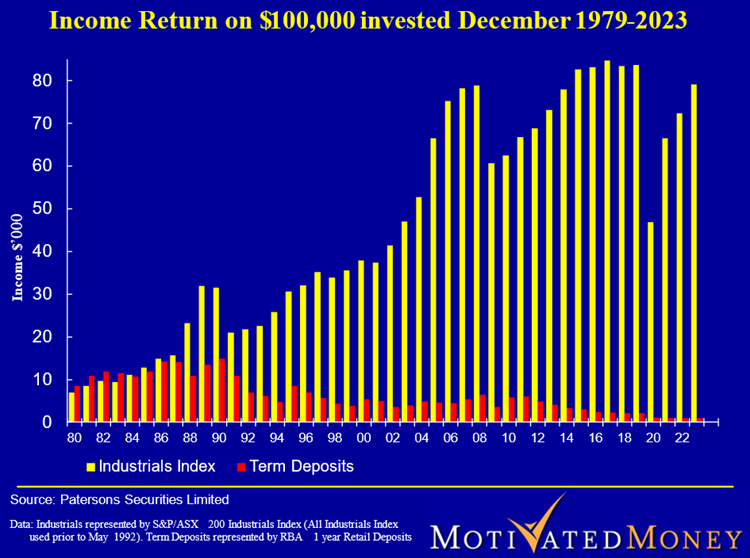

This next chart now compares the annual cash flow from deposits to the dividends from the industrials. The huge gap continues to widen despite the GFC and the Covid intervention. It is important to remember that a large proportion of the dividend reductions were simply due to companies reducing or cancelling dividends during the uncertain times where government intervention cramped economies. We are now seeing the normalisation of dividends which was to be expected.

The opportunity cost of investing in alternatives

I feel for those people who are still using cash as a ‘safe’ haven for their money. It frustrates me that the industry I left in 2000 still uses volatility as a measure of ‘risk’. Volatility is simply a function of liquidity; the ability to buy and sell shares on a daily basis.

The reason for fear is that share prices are the constant daily disturbing factor with shares whilst the cash flow is ignored. The result is to add cash, bonds, and property to a portfolio to smooth the returns.

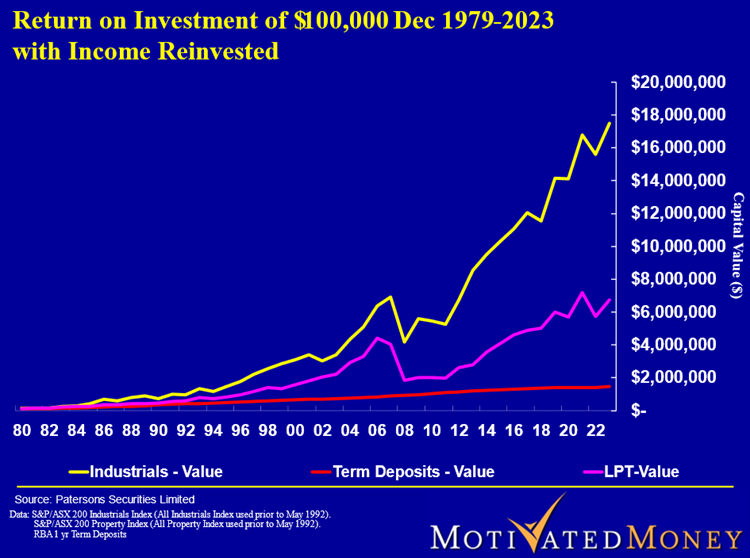

If you refer to the chart below it compares shares, property and cash; the Industrials index, Listed Property Trust index and term deposits. So, the constituents of a ‘balanced portfolio’ looks something like this, with cash and property to reduce the overall volatility of the portfolio.

No one in all my years (50) in the industry has ever advised investors of the huge opportunity cost that this exacts. The result of this balance above means a return of roughly half what the industrials would have delivered.

Are you prepared to pay that?

Peter Thornhill is a financial commentator, author, public speaker and Principal of Motivated Money. He runs full-day courses in the major capital cities explaining his approach to investing "in the vain hope that not everyone is frozen with fear".

This article is general in nature and does not constitute or convey specific or professional advice. Share markets can be volatile in the short term and investors holding a portfolio of shares will need to tolerate short-term losses and focus on a long-term horizon, and consider financial advice.