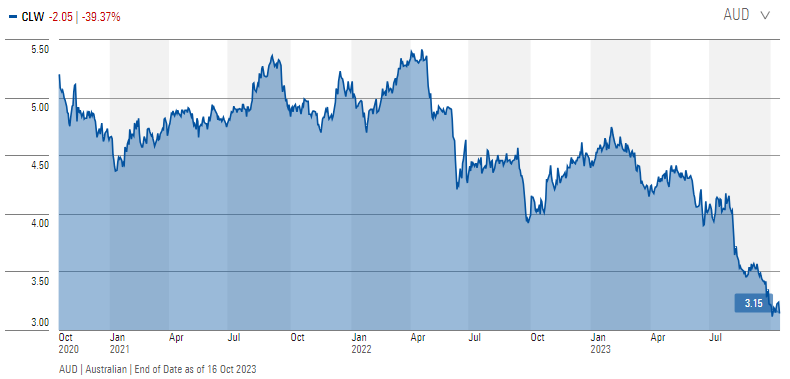

We are in a new era of investing. The 40-year rally in bond rates which underpinned rising asset values concluded in July 2020 when the bellwether US 10-year Treasury rate hit a low of 0.52%. We may never see such extremes again. Overall, that’s good, because there should be a cost of debt and a reward for saving. However, the rise in the 10-year to 4.90% (at time of writing, 18 October 2023) has punished bond prices and 'bond proxies', with many US Treasury bond experts predicting 5% plus as the US seeks to finance its trillions of debt.

Five years of the 10-year US Treasury rate

Source: Ycharts.com, latest close 4.9% on 18 October 2023

While some asset classes have reacted quickly to higher bond rates, others react slowly. Every portfolio assessment should be looking at the impact of higher rates across all assets because there are pockets where the market has not fully recognised the implications.

Many large companies locked in debt at lower rates and have not experienced the shock of a big increase in interest expense. Private equity has remained strong despite values thriving previously in a low-rate environment. The US stockmarket has been protected in 2023 by the surge in the Magnificent Seven and AI-related companies, disguising the traditional connection between higher rates and lower equities. In the main index, the S&P500, the 'S&P493' is up only 4% while the 'S&P7' is up 57% in 2023 to date.

Commercial property is another example: stockmarket price punishment for listed property has been handed out but where to from here?

The stock that has most hit me personally in the last couple of years is Charter Hall Long WALE (ASX:CLW) REIT. Its price is down 40% over three years and from $5.40 in April 2022 to $3.15 this week. My average entry price is $4.80, although I received dividends of 30.5 cents in FY22 and 28 cents in FY23 so it is not as bad as it looks on price alone. The market reaction to its FY23 results and outlook was severe.

Source: Morningstar Premium

What is Morningstar’s view?

I am not an equity analyst and there is no merit in me repeating the detailed report of my colleague, Alexander Prineas. Although such details are usually available only to Morningstar Premium subscribers, the main points in Alex’s research paper are attached.

When Alex updated his report on 8 August 2023, CLW was trading at $3.80 and his ‘fair price’ estimate was $5.10. At $3.15, it is in Morningstar’s 5-star band with an estimated dividend yield of about 8.5% on a trailing 12-month period.

A few highlights from Alex’s comments:

- He recognises that high debt levels and a fall in asset values of 5.8% in FY23 have left CLW with relatively high gearing at about 40% (on a look-through basis to the underlying assets and funds). Similar falls again in FY24 would push the REIT nearer to its banking covenant limits. However, the high number of leases which are tied to inflation should support the value.

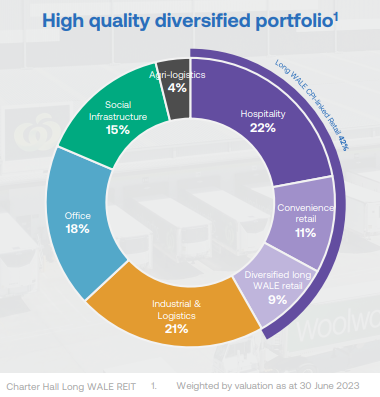

- CLW is a highly-diversified portfolio across many property sectors including assets with long leases to top-quality tenants in industrial sectors with solid tailwinds, making asset sales more favourable than for other trusts.

- About half the leases are so-called ‘triple-net’, where the tenant pays the property outgoings. This is attractive in the face of inflation but also if the economy enters recession.

Why did I buy it and where did I go wrong?

The irony is that in a difficult equity market with corporate earnings falling in a recession, I thought an investment in such a high-quality REIT would be a defensive position. There were two main miscalculations (so far) on my part:

1. I did not expect the market to consider CLW as much as a bond proxy as other REITs, given over half of its leases are tied to inflation, which has a relationship with long bond rates. As with other property trusts, CLW’s share price has fallen as long-term bond rates have risen.

2. The market has also marked down the value of the assets more than I expected, despite most of the properties being in industrial rather than office sectors. According to CLW’s 2023 Annual Report, the Net Tangible Assets (NTA) value is $5.63 per security versus the current share price of $3.15, a discount of $2.50 or 44% of the NTA.

The attractive features include (I thought):

- Over 80% of rents are paid by high-quality corporate tenants and government agencies which are highly unlikely to stop paying the rent. This is not a portfolio heavily exposed to individuals or small tenants.

- The Weighted Average Lease Expiry (WALE) is an attractive 11.2 years, and with almost 600 properties valued independently at $6.8 billion, the term and size seemed enough to see the trust through a business cycle and the short-term impact of rising rates.

- A portfolio with a mix of commercial assets in industrial, hospitality, social infrastructure and retail property and only 18% in offices, where the pandemic and WFH is expected to hit values.

- As insulation against rising rates, 51% of leases are CPI-linked, which gave a 7.1% weighted average increase in rentals in FY23.

But the market - whatever that is these days - is unhappy. On the negative side, the 2024 distribution guidance was down on 2023, analysts are looking for proof of more asset sales to retire debt and the banking covenant gearing is 50%, still a long way to go from the current 42% but closer than a year ago.

Where to from here for me and the market?

This is not intended as a research report, I’ll leave that to the analysts at Morningstar. This is the thought process of an investor wondering what has happened in a stock expected to show more resilience. Where to from here?

There’s a famous saying by the great economist John Maynard Keynes that:

“Markets can remain irrational longer than you can remain solvent.”

There is nothing ‘insolvent’ about my SMSF. It’s a large portfolio with no debts and the CLW position represents less than 2% of its assets. But in dollar terms, it’s the biggest red number in my listed portfolio, emphasising that in the short- or medium-term, regardless of what anybody thinks about their investment thesis, the market can go elsewhere.

We’ll see if Mr Market is right. He’s the imaginary investor invented by the legendary Benjamin Graham in his 1949 book, Intelligent Investor. Mr Market is prone to swings of mood, and at the moment, he hates REITs.

Every fund manager goes through this, and there is always a reason why the market has reacted adversely. There are buyers and sellers with different views. Today, someone (or something, like a trading bot or algorithm) sold the assets of a large trust – not a speculative tech company, not a fashion label, not a product recall – with 600 diverse properties for 44% less than their most-recent valuation. There are reasons, especially rising interest rates and asset values, why they may be right.

We’ll leave for another day the broader implications for the hundreds of billions of unlisted assets in Australian super funds which have not been marked to market, but in a listed market such as for CLW, there is nowhere to hide.

I don’t need to sell as I’m long cash with few attractive places to invest and lots of risk in the market. I’m a long-term CLW investor, watching with interest how Charter Hall moves from the wonderful years of low rates, rising property values and rapid growth, to a period where interest costs and gearing ratios need careful management.

Graham Hand is Editor-At-Large for Firstlinks. This article is not financial advice and investors should see an investment adviser before acting on anything mentioned in this report. Graham Hand holds an investment in ASX:CLW through his family’s SMSF. Charter Hall is a sponsor of Firstlinks.

Attached is an extract from a more detailed report by Morningstar Equity Analyst, Alexander Prineas. Although such details are usually available only to Morningstar Premium subscribers, the main points in Alex’s research paper are attached here.

Access data and research on over 40,000 securities through Morningstar Investor, as well as a portfolio manager integrated with Australia’s leading portfolio tracking service, Sharesight. Sign up to a free trial below:

Try Morningstar Investor for free