High levels of inflation and rising interest rates have shifted the investor landscape. Many investors have pursued cashflow growth and its contribution to investment outperformance. Commercial real estate is often considered to be a defensive asset class given the contractual cashflows offered through periods of uncertainty. These contracts typically have fixed rental increases or other rental features linked to inflation/CPI rates.

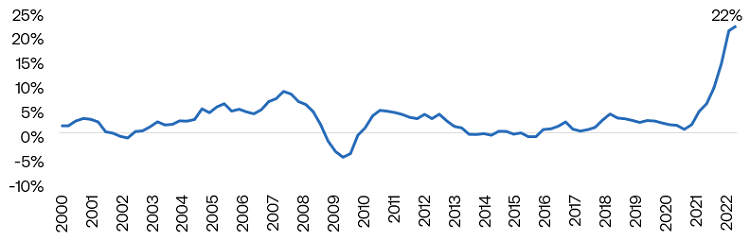

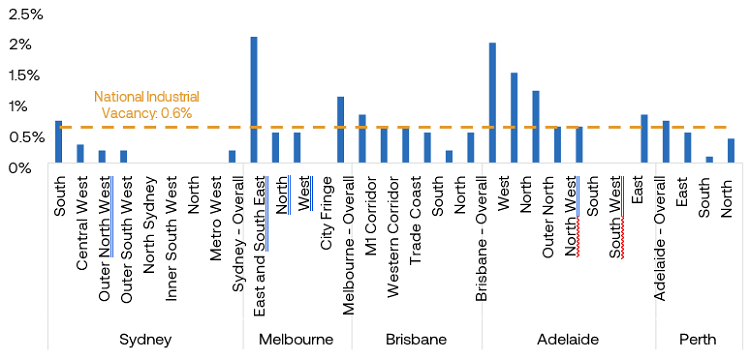

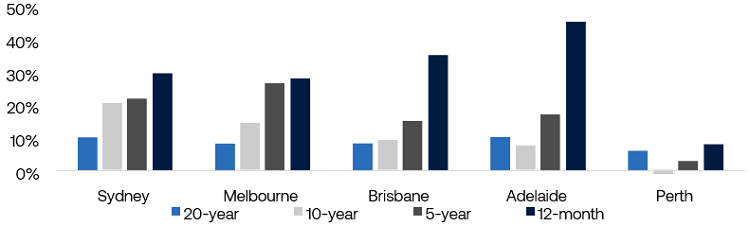

Growth in demand for Industrial & Logistics (I&L) assets has been unprecedented over recent years and the sector has adapted to changes in technology and consumer behaviour. Yet the construction of new I&L assets has been insufficient to meet tenant demand. New supply has been inhibited by a lack of zoned I&L development land and supporting infrastructure. This imbalance between demand and supply has translated to record rental growth (+22% pa), significant increases in land value and ultra-low vacancies (<1%).

Rental growth across the Australian Industrial sector reached the highest level on record

Figure 1: Prime Annual I&L Rental Growth (%)

Source: JLL Research, Charter Hall Research. At 4Q22.

The imbalance between I&L supply and demand has reduced vacancies to the lowest level on record

Figure 2: I&L Vacancy Rates, by Market (%)

Source: CBRE, Charter Hall Research. At 2H22.

Shortage in development stock manifesting in significant growth in industrial land values

Figure 3: I&L Land Value Growth (Compound Annual Growth Rate) (%)

Source: CBRE, Charter Hall Research. At 2H22.

A sector adapting to fundamental shifts in demand

Demand should continue to remain strong driving further rental growth, due to the following:

The ongoing rise in online retailing: The growth in online retailing has been an impetus for growth the I&L sector. More goods are transported directly from I&L assets to the consumer. Like retailing of the past, success is fundamentally predicated by cost, range of product, stock availability, and time to consumer. As such, retailers have been competing for I&L assets with:

- proximity to consumers;

- greater storage capacity; and

- the ability to move goods faster.

Advancements in technology and the longer-term shifts in consumer behaviour is driving a sustained growth in digital retailing. Online sales continued to increase over the year, reaching $53 billion equating to 13.3% of total retail sales. Total volumes are ~75% above pre-COVID levels. Total online retailing volumes are forecast to grow by 123%* over the next five years – requiring significantly greater capacity across the I&L market.

A shift in supply chain strategies: The pandemic has increased occupier focus on supply chain resilience. Supply chain strategies shifted to higher levels of holding inventory and greater stock security. With the risk of escalating geo-political tensions, strategies will continue to support stock security and supply chain resilience.

A growing focus on Environmental, Social and Governance (ESG): Institutions and consumers have increased scrutiny about where and how goods are sourced. Additionally, frameworks are being developed to measure the emissions across supply chains.

With higher costs of transportation and a focus on reducing emissions, there will be increased demand for well-located assets with high sustainability credentials.

The rising feasibility of automation: Online retailing will rely on stocking a wider variety of goods, moving them faster and reducing operating costs. Given specific sets of requirements, advanced automated systems can usually only be installed in higher quality assets. High upfront investment costs and increased scrutiny on emissions will influence the feasibility of asset locations – thereby increasing the value placed on location.

Restrictive conditions on new construction: The challenges to the construction of new I&L assets are expected to persist over the medium term. The rise in construction costs, ongoing shortages in labour, and supply chain disruptions have increased the costs of developments. These issues are further compounded by the rise in interest rates.

A combination of these factors and the ongoing rebound in Australian population growth will continue to generate demand for the sector. But the performance of portfolios will be distinguished by asset quality and active management. The deficit of modern assets with high sustainability credentials will drive income and value growth for well-curated portfolios.

Good quality managers will continually review their portfolios and seek to divest older buildings and properties at risk of obsolescence as they may erode future value growth. Over the near-term, the quality of the tenant is crucial. The higher interest rate environment will exert pressure on certain firms, particularly those across low-margin industries.

We’re also approaching a period where there may be market price declines, possibly providing further buying opportunities. As such, it is essential that managers have the capital structure and strategies in place to outperform, whilst having the capacity to acquire quality opportunities at attractive pricing.

Sasanka Liyanage is Head of Research and Steven Bennett is Direct CEO at Charter Hall Group<, a sponsor of Firstlinks. This article is for general information purposes only and does not consider the circumstances of any person, and investors should take professional investment advice before acting.

For more articles and papers from Charter Hall, please click here.