With Australia’s population moving through the fastest rate of growth since the 1950’s, our cities and towns are naturally densifying. At a national level, the population density of 3.5 people per square kilometre (sq. km) is among the lowest in the world, highlighting our highly urbanised population where half the populace lives in the three largest cities. In fact, 75% of Australia’s population resides on just 2.6% of the land mass.

The density of the population, which is simply the number of residents divided by the land area, becomes more relevant at a city level and even more interesting across smaller areas.

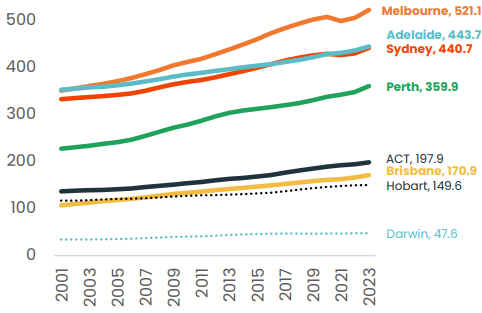

Melbourne and Adelaide have the highest population density

At the capital city level, the highest population density may come as a surprise – it’s not Sydney. In fact, Sydney comes in third on the population density leagues tables with 441 residents per sq. km. Melbourne (521 people per sq. km) and Adelaide (444 people per sq. km) both show an overall population density that is higher than Sydney’s.

Sydney’s lower population density relative to Melbourne and Adelaide comes despite Sydney having a larger portion of medium to high density housing stock (units comprise 39.5% of all Sydney dwellings compared with 33.4% in Melbourne), and generally smaller blocks of land (the median land area for houses sold over the past year, at 569sqm was the second lowest of any capital after Perth).

An important factor contributing to the lower population density across Sydney is the larger land area that comprises the metropolitan region. The Sydney metro area, as defined by the 2021 Greater Capital City Statistical Area (GCCSA) boundary, includes the Central Coast, the Blue Mountains, Penrith and Sutherland covering 12,369 sq. kms.

Every capital city is recording a rise in population density, however, the way this is occurring is quite different from region to region.

For example, Perth has recorded the largest increase in population over the past 20 years, with 54.4% more residents, yet it has the highest portion of detached houses of any capital, comprising 85.5% of the housing stock. Rather than ‘building higher’, Perth has densified via smaller block sizes for detached housing alongside a sprawling urban footprint, where the population has spread to the northern and southern fringes of the city.

A different example of densification can be seen in the ACT, where medium to high density housing stock has risen from a share of 25.1% of all dwellings 10 years ago to 34.2% in 2024, while the median block size for houses sold over the past 12 months remains among the highest of any capital at 750sqm.

Figure 1: Summary of population density over the past 20 years

Figure 2: Population density, Australian capitals (Number of residents per sq. km)

A closer look at the capital city trends

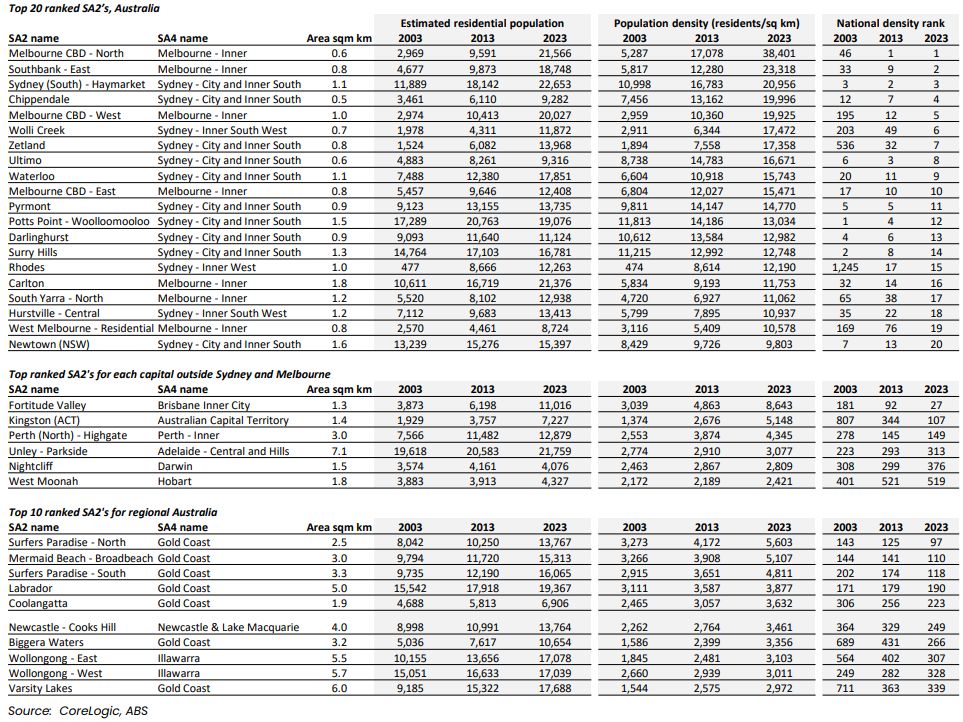

Analysing population density at a geographically granular level reveals inner city precincts of Melbourne and Sydney dominate the highest density locations nationally, however the rankings of density have changed remarkably over the past 20 years.

In 2003, areas of Sydney comprised 19 of the top 20 SA2’s for the highest population density. Melbourne’s CBD-East was the only non-Sydney area included in the top 20, ranked 17th.

Fast forward to 2023 and the data shows Sydney now comprises ‘only’ 13 of the top 20 highest density SA2’s, with Melbourne now occupying seven of the top 20, including the top two positions.

Melbourne’s CBD-North has topped the list for the highest population density in Australia since 2013. This 0.6 square kilometre area that includes the RMIT campus and Victoria Markets, was home to 21,566 residents in 2023, equating to a population density of 38,401 residents per sq. km. In 2001, this precinct was ranked 187th for population density nationally.

Melbourne’s Southbank-East SA2 region has ranked second for population density since 2019, climbing from a ranking of 113th in 2001.

The Sydney (South)-Haymarket SA2 was ranked third for population density, slipping from a consistent number one ranking between 2009 and 2012, followed by Sydney’s Chippendale and Melbourne CBD-West rounding out the top five regions for population density.

Outside of the Sydney and Melbourne metro areas, the SA2 regions with highest population density nationally were concentrated in Brisbane (Fortitude Valley was ranked 27th nationally, home to 8,643 residents per sq. km), the Gold Coast (Surfers Paradise – North was ranked 97th) and the ACT’s Kingston (107th).

Figure 3: SA2 leagues tables: highest population density in 2023

Population density and housing

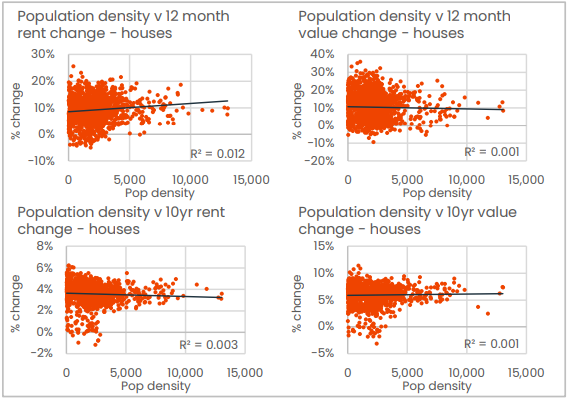

The relationship between population density and rental growth is weak. Population density across the unit sector provides little explanatory value about unit rental growth over the past 12 months or the past 10 years. Areas with a high population density have shown slightly stronger rental appreciation over the past 12 months relative to lower population density areas, but slightly weaker growth over the past decade.

Figure 4: Population density trends - units

The relationship between density and appreciation in house rents is even weaker than seen across the unit sector, but the weak relationship runs opposite to that of units, where higher population densities have been associated with slightly weaker rental appreciation than areas with a lower population density over the past 12 months and slightly stronger over the past decade.

Figure 5: Population density trends - houses

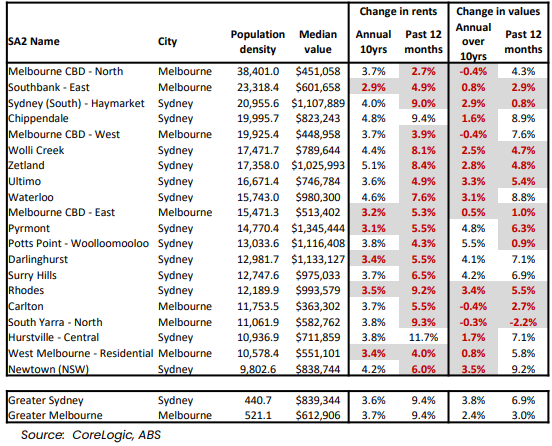

Of the 20 highest density SA2 locations nationally, only two recorded a larger rise in unit rents over the past 12 months than the capital city benchmark. Both were in Sydney: Chippendale (+9.4%) and Hurstville-Central (+11.7%).

Figure 6: Change in rents and values (unit markets within the top 20 highest population density SA2s)

The relationship between unit values and population density is more significant, with high density unit markets generally showing a lower level of value growth over both the past 12 months, and past 10 years – although the longer-term relationship is more significant, potentially reflecting periods of higher unit supply that weighed on value appreciation.

Sixteen of the top 20 have recorded a lower annual rate of unit value growth over the past decade relative to the broader capital city trend. Over the past 12 months, nine of the top 20 have underperformed.

On the other hand, high population densities provide virtually no explanatory power for house values with the coefficient of determination just .001 over the past 12 months and over the past decade.

Over the long term, precincts with a high population density tend to show slightly stronger growth in unit rents, but softer rates of capital appreciation across the unit sector, while for houses there is hardly any relationship between population density and trends in rental or value appreciation.

Stronger rental growth for units is unsurprising given the high level of amenity along with proximity to major employment nodes and academic facilities that is typical for high density precincts. They are likely to be popular across a broad range of cohorts including students, inner city professionals, service workers and migrants.

Softer value growth despite generally high levels of population growth and strong rental demand may be attributable to the propensity for higher levels of new housing supply in these same precincts. New supply, especially across the high rise sector, can be ‘bulky’ with the potential to deliver hundreds, if not thousands of new dwellings to a market in a relatively short space of time.

Tim Lawless is Executive, Research Director Asia Pacific at CoreLogic. Read or download the full report here. This article is general information and does not consider the circumstances of any investor.