(This article is an extract from a longer report linked at the end).

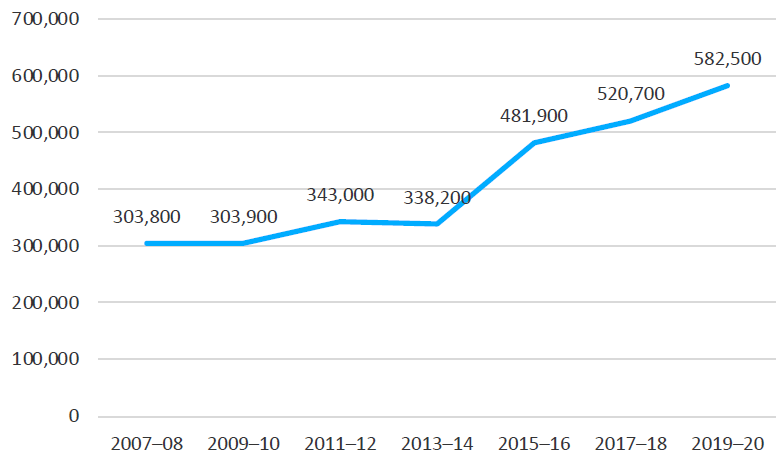

Superannuation is substantially improving retirement incomes for nearly two million retired Australians by providing regular income streams. Australian Bureau of Statistics (ABS) data also indicate that in 2019-20 around 580,000 households, encompassing over 1 million Australians, were mainly dependent on payments from superannuation. This is nearly double the number of households mainly dependent on superannuation in 2009-10. For those dependent on superannuation income, around 75% of such households have less than 20% of their income from government pensions. Many more retirees also have benefitted by taking lump sum benefits either at retirement or during retirement.

Putting super income payments into context

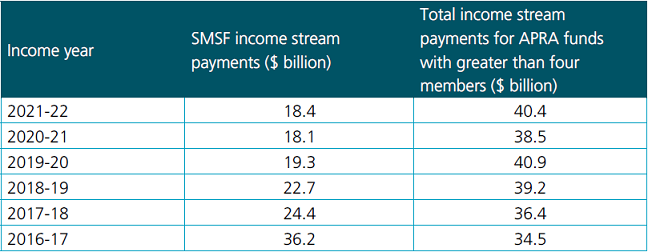

By 2021-22, there was a total of $59 billion in superannuation income payments in retirement, (Table 1), which is greater than the annual Age Pension expenditure of around $51 billion in that year [DSS 2021-22 Annual Report].

Table 1: income stream payments from APRA funds and SMSFs (a)

(a) Figures from APRA Annual Superannuation Bulletin June 2022, Excel version Table 2

Historically the Age Pension has been the main source of income for most retirees in Australia. Government pensions and allowances were the most common main source of income for the 3.9 million retirees in Australia in 2018–19 aged 45 and over (49% for men, 44% for women), followed by superannuation (30% for men, 17% for women).

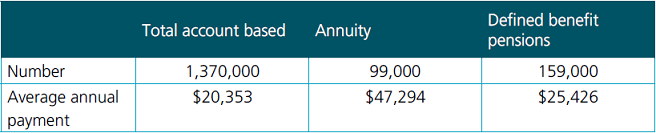

Yet this is beginning to change with increasing superannuation balances and with more retirees relying mainly on superannuation. As shown by Table 2, in 2021-22 (for funds with more than six members) there were around 1.37 million people who received regular income from account-based income streams. There also were 99,000 people receiving annuity payments (both term and lifetime) along with 159,000 individuals receiving defined benefit pensions, (mostly related to former public service employment). The total amount of pensions paid by funds with more than 6 members increased from $28.4 billion in 2014-15 to $40.4 billion in 2021-22.

A further 81,000 people received transition to retirement pensions in 2021-22. These pensions have become less popular due to changes in their taxation treatment. In 2016-17 there were 162,000 individuals receiving such pensions from funds with more than four members.

Table 2: Superannuation income streams, 2021-22 (a)

(a) Payments from funds with more than 6 members. Source: APRA Annual Superannuation Bulletin

There also are very substantial numbers of people (over 330,000 in 2019-20) receiving income stream benefits from Self-Managed Superannuation Funds (SMSFs). SMSFs have a substantial proportion of their membership in the retirement phase.

The average income stream benefit paid by an SMSF was around $47,900. This is significantly higher than the average for APRA regulated funds, reflecting the higher average account balances in SMSFs. Income stream payments in 2019-20 would also have been affected by the temporary reduction in minimum draw down rates. The minimum annual payment required for account-based pensions and annuities, allocated pensions and annuities and market-linked pensions and annuities was reduced by 50% for the 2019–2023 financial years.

Vast majority draw down almost all super

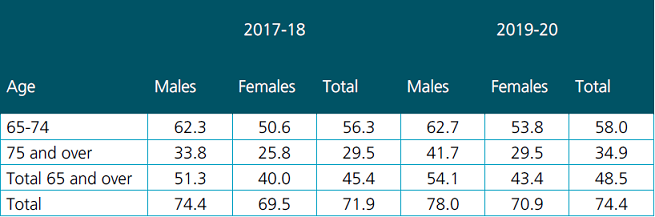

The evidence available indicates that in most cases individuals draw down entirely on their superannuation during retirement rather than leaving a substantial amount for a spouse or children. The Association of Superannuation Funds of Australia (ASFA) 2021 paper findings are confirmed by more recent ABS data which indicate that in 2019-20 for those aged 75 and over, only 41.7% of males and 29.5% of females had a superannuation account balance or were receiving income from superannuation (which would include receiving a defined benefit pension which cease on death).

Table 3: Percentage of older Australians with superannuation

(a) Includes persons with a superannuation account balance above zero and/or receiving regular income from superannuation and/or who received a lump sum superannuation payment in the last two years

(b) The number of persons with superannuation coverage expressed as a percentage of total persons in the corresponding group (age and sex)

ATO sample file data indicate that in 2019-20 for the 2.9 million Australians aged 70 and over, only 540,000 had more than $1,000 in superannuation, around 310,000 had more than $200,000 and only 180,000 had more than $500,000. Most of the higher balances are held by members of SMSFs. In 2019-20 there were around 115,000 members of SMSFs aged 70 and over receiving income streams and with balances over $500,000.

However, overall, 90% or more of those aged 70 and over pass away with little or no superannuation, having drawn down on their balances after their retirement.

That said, some individuals do have significant balances in superannuation. In 2019-20 around 35,000 individuals had more than $3 million in superannuation, with around 90% of them in SMSFs. The number is expected by Treasury to grow to around 80,000 by 2025-26.

Growing super assets ease burden on government

As well, the large and growing pool of superannuation assets is positively influencing both adequacy of retirement incomes and sustainability of government expenditure on the Age Pension.

As a result of increasing superannuation account balances, at Age Pension eligibility age an increasing proportion of retirees have substantial private incomes, which increases retirement incomes, decreases the proportion of retirees who receive a full Age Pension and increases the proportion who receive no Age Pension at all.

Already there has been a fall in the percentage of new Age Pensioners who are on the full Age Pension and an increase in the percentage who at the time of retirement are fully self-funded.

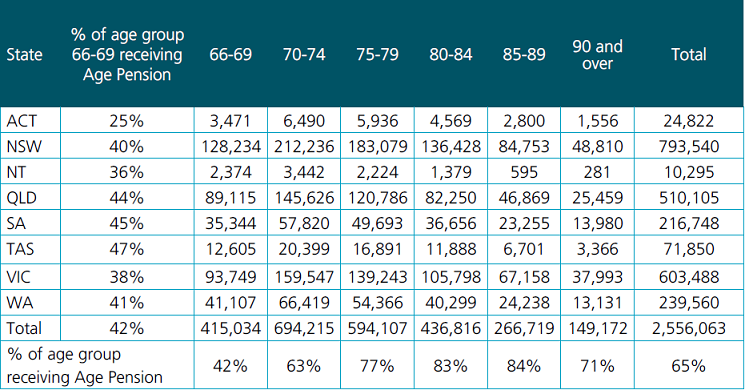

As shown by Table 4, only around 40% of the age group 66 to 69 currently receive the Age Pension.

Take-up rates vary between each State and Territory, largely driven by differences in average superannuation balances. For instance, in the Australian Capital Territory coverage of superannuation and average superannuation balances are higher than the national averages. There also is a relatively high incidence of defined benefit pensions in the Australian Capital Territory.

Table 4: Age Pension recipients by state and territory by age group, December 2021

Source: Department of Social Services Demographic Data, ABS Population Estimates

In 1997, the take-up rate for the Age Pension and the age-related Veterans Pension for those aged 65 and over was 79%. By 2007, this had fallen to 75%. As shown by Table 4, it is now around 65% for those eligible by age to receive the Age Pension. If the take-up rate for the Age Pension in 1997 applied to the Age Pension in 2021 there would be around 550,000 extra Age Pensioners, increasing the cost of providing the Age Pension by about 20%.

As people age, their receipt of the Age Pension generally increases. This makes sense as older age groups had less or no time in the compulsory superannuation system. Superannuation balances also generally decline with age as balances are drawn down.

However, greater wealth is associated with longer life expectancy so there is a small decline in the relative incidence of accessing the Age Pension after age 90 for the relatively low number of Australians in that age category. As well, most individuals aged over 90 are single and subject to the relatively tighter asset test for singles.

The take-up rates for the Age Pension will decrease further as superannuation balances increase and if the trend for more people to remain in paid work after age 65 continues. The decrease in take-up will be particularly marked for those in their late 60s.

Currently just under 20% of those aged around 67 are still in paid employment with a further 40% or so self-funded (or at least not eligible for the Age Pension).

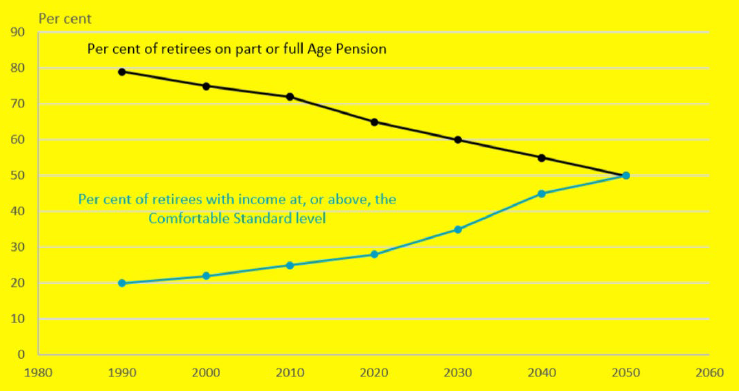

Currently around 30% of couples and singles reach or exceed the ASFA Comfortable Standard and projections indicate that the superannuation system as it matures will play a crucial role in improving retirement living standards. By the year 2050 ASFA projections indicate that around 50% of retiree households will be able to afford expenditure at the level of ASFA Comfortable or above.

Australia relies less on the Aged Pension than other countries

Consistent with ASFA projections, projections published by the Retirement Income Review (RIR) indicate that by the year 2060 around 50% of the Age Pension population group will be totally self-funded. Of the 50%, around 40% will be part-rate pensioners. In comparison, currently only around 35% of the total Age Pension population are self-funded with only around 32% Age Pension recipients on a part-rate pension.

As a result, according to the RIR report, Age Pension expenditure as a percentage of GDP is expected to fall moderately over the next 40 years, from 2.5% in 2020 to 2.3% in 2060. This is despite the population over Age Pension eligibility age being expected to grow faster than the working-age population, leading to fewer working-age people for each person of Age Pension eligibility age.

Across the OECD, expenditure on publicly funded pensions averages 8.8% of GDP and is projected to increase to 9.4% by 2050. Some European countries already have four times the level of Australian expenditure, with this projected to rise further. Those countries where expenditure on public pensions is expected to increase (in the absence of reform) include Canada, Germany, New Zealand, the United Kingdom and the United States. In contrast, as noted earlier, Australian expenditure is already relatively low as a percentage of GDP and is expected to decline.

As shown by Chart 1, the growth in the percentage of retirees reaching ASFA Comfortable (largely through the growing maturity of the compulsory superannuation system) is accompanied by a fall in the percentage of retirees who receive a part or full Age Pension.

Chart 1: Projections of reliance on the Age Pension and also for reaching ASFA Comfortable Retirement Standard

Source: Department of Social Services demographic data and ASFA estimates. Note: Per cent of retirees on Age Pension and per cent achieving ASFA Comfortable do not necessarily add up to 100%. Some retirees at ASFA Comfortable or above will receive the Age Pension after drawing down on their superannuation.

Consistent with this, the maturing compulsory superannuation system has led to a substantial increase in households that are mainly dependent on superannuation rather than being mainly dependent on the Age Pension (Chart 2).

Chart 2: Number of households mainly dependent on superannuation income

The impact of additional tax on super balances over $3 million

The tax concession enjoyed in relation to investment earnings for high balance members is substantial for large accounts. Based on ATO data, in 2019-20 there were around 35,000 superannuation fund members with balances within superannuation of over $3 million. Treasury projects the figure will be around 80,000 in 2025-26. Some of these funds have balances of some hundreds of millions of dollars, well in excess of retirement needs. The Treasury estimates suggest that the average additional tax paid by the individuals affected would be $25,000 a year.

While the current caps on superannuation contributions limit the ability for members to build up excessive balances in the future there is a real question regarding the appropriate treatment of high balances that were achieved in the context of more generous contribution caps in the past. Large capital gains on business and/or real property asset holdings are also an issue, particularly for SMSFs. These have not been impacted to a great extent by changes to contribution caps as the increase in account values has been driven by capital gains rather than contributions.

The Transfer Balance Cap regime limits the amount a member may take into pension phase. However, ‘excessive’ balances may still be present in accumulation accounts and therefore will be subject to a current tax concession of up to 30% of the tax on earnings (that is, 45% personal tax rate less 15% tax on fund earnings).

Treasury has estimated that changing the taxation treatment of investment earnings related to total superannuation balances in excess of $3 million would lead to additional revenue of around $2 billion a year, although the exact amount raised would depend on how excess balances were invested after they were withdrawn from the superannuation system. This figure of $2 billion would reduce the total tax concession applying to superannuation contributions and investment earnings by around 4.5%, and by 9.5% in regard to investment earnings alone. This clearly is a substantial impact.

In regard to who would be affected by such a cap, broad demographic information on holders of large superannuation accounts is available from the ATO sample file for 2019-20 and from SMSF taxation statistics.

These statistics indicate that around 65% of those affected by the proposal are male. Those affected are relatively old, with around 50% aged over 70 and around 90% aged over 60.

Even though the age groups affected are relatively old, only around 50% are retired, with around 30 receiving wage or salary income.

Labourers and unskilled workers are not represented in those affected by the measure. The ATO statistics suggest that of those likely to be affected around 20% currently identify as managers, around 10% as a professional, around 5% clerical or administration, around 2% as consultants. However, as noted above many of those affected are retired with no data available about former occupations.

Those likely to be affected are relatively affluent on a number of measures. Around 25% owned a rental property, around 25% received dividends of over $40,000 a year and around 15% had total income for tax purposes of over $500,000.

The majority of those likely to be affected live in Sydney and Melbourne, but there are significant proportions living in Brisbane, Perth and Adelaide. Only a relatively small proportion of those likely to be affected live in regional areas of Australia.

Ross Clare is Director, Research and Resource Centre at The Association of Superannuation Funds of Australia Limited (ASFA). Read the full report here. This article is general information and does not consider the circumstances of any person.