It must have been a slow news day on Thursday 19 January 2023. Or yet another case of our major news outlets taking a pot-shot at each other. Here’s what happened.

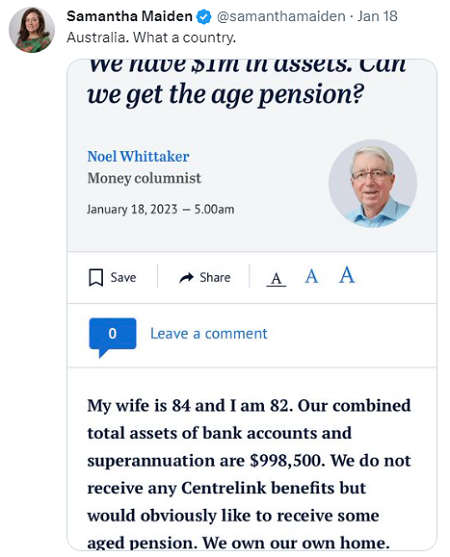

One major publisher (Nine) ran a Q&A with Money commentator Noel Whittaker answering a question from a couple (homeowners) with $998,500 in assets. The 82-year-old male wanted to know if he would receive an Age Pension.

The question was answered in a matter-of-fact way; the assets could be reduced but any part pension would hardly be worth the effort.

News Corp journalist, Samantha Maiden then picked up and retweeted the exchange.

An article was then created by Alexis Carey on News.com, mainly consisting of cutting and pasting Twitter responses, with the headline, ‘Entitled’: 82-year-old millionaire’s outrageous pension request mocked by furious Australians.

Anyone who understands the rules of the Age Pension would be bemused, if not disheartened, by the angle of the News.com article as well as the polarising language attached to this discussion of entitlement.

Let’s allow some facts to get in the way of this good story.

The assets threshold for a homeowning couple is $935,000, so this couple is close to the threshold for Age Pension eligibility. If they did not own their home, they would come in well under the non-homeowner couples’ threshold of $1,159,500. As things stand, they are likely to qualify for the recently expanded Commonwealth Seniors Health Card, regardless of homeownership or not.

Age Pension thresholds have been in place for many, many years. They increase marginally when indexation is applied, to keep them relevant to prices in the wider world. To put it plainly, this is not news. This information is in the public domain. People with nearly one million dollars can qualify for an Age Pension because that’s how our system works.

So why draw attention to this silly exchange? Why not just let it sink without trace? Because equity in retirement matters.

A nuanced debate is overdue

And in amongst all this hot air and indignation, there is a much more nuanced debate begging to be heard. At the core of the debate is the question of whether our Age Pension is still fit for purpose.

We may be under the impression that pension rules are undergoing continuous review and improvement, largely due to widely reported twice yearly indexation and various scheduled July 1 changes. But the vast bulk of the changes associated with the Age Pension are those of degree, not design; tweaks to rates and thresholds to keep the pension in touch with the real world. Whilst many changes are occurring in superannuation, substantial changes to the Age Pension have been rare since it was first introduced at the beginning of the last century.

So it is high time we had another look at this major pillar of retirement income for nearly four million older Australians.

Questions need to be asked:

- What do we expect from our Age Pension?

- What is it designed to achieve?

- How much does it cost (particularly in relation to super concessions)?

- Has the growth of the superannuation industry supplanted some of its core purpose or key features?

- What of its delivery via Centrelink? Is this functioning reasonably or poorly?

- What of systemic complexity, particularly the mix of rules linking the Age Pension and superannuation?

There have been significant changes in Australian society since it was first introduced, not the least of which is enhanced longevity, with most Australians expected to live into their late 80s and some beyond.

But suggesting revisions to the income of most older voters presents a political minefield. Just ask Bill Shorten! Everyone has a view, ranging from:

I’ve paid taxes all my life so an Age Pension is my entitlement, regardless of how many assets I have.

to:

I have no savings, so it’s my lifeline.

Somewhere in the middle of these two extremes could be some more reasonable iterations of our current pension system. But where? And how will we ever uncover them if we don’t question this fundamental source of income for so many?

Starting points for change

Already we can find some common ground – increasingly industry leaders and policy experts are calling for a $5 million cap on superannuation balances. And whilst politically contentious, the blanket family home exemption could also be worth a reset.

With significantly improved household equity access products, including the government’s own scheme, it’s also reasonable to review exactly how we might view the family home, associated debt and ways this equity could better complement Age Pension entitlements.

Not another enquiry, I hear you sigh. Well, not necessarily. The Retirement Income Review report in June 2020 has already assessed some aspects of the Age Pension pillar of retirement income, in particular equity, access and sustainability. It’s an important start and this work could easily provide a foundation for a more forensic investigation of what we hope our Age Pension will deliver and to whom.

So, thanks Samantha Maiden for tweeting the opposition newspaper’s content. The subsequent article may have been superficial, but the issue is very real.

Kaye Fallick is Founder of STAYINGconnected website and SuperConnected enews. She has been a commentator on retirement income and ageing demographics since 1999. This article is general information and does not consider the circumstances of any person.