To do it yourself or not, is often a question we hear when it comes to superannuation. There’s no right or wrong answer, it is an individual decision. When taking the step to set up an SMSF or to wind an existing SMSF down, it’s important to understand both the benefits and costs.

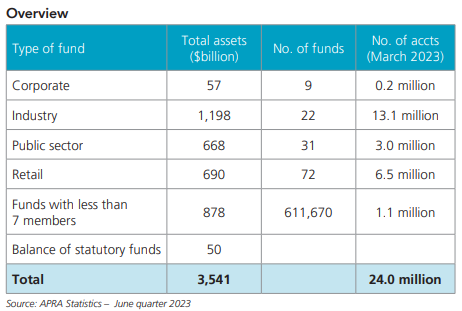

According to ASFA, as at June 2023, Self-Managed Super funds (SMSFs) accounted for just under 25% of total superannuation assets (listed in the below table as "Funds with less than 7 members"). There is undeniably a place for SMSFs and, for some, they can be the only way to hold certain assets within a superannuation environment. They suit people who want to be quite ‘hands on’ with their superannuation and who are comfortable with the level of responsibility that comes with a SMSF.

The issue of costs

The first thing most people want to know is the cost. The way in which fees and costs work within SMSFs is similar to other types of super but they tend to vary more. SMSF costs can include yearly independent audits, asset valuations, and legal fees if the fund deed needs amendments. Depending on the assets in the fund, as well as any professional financial and investment advice received by the trustees, the running costs can generally be between $1,500 and $10,000 per annum, and this may even be before the management costs of any underlying assets or investments.

In a managed super fund, the costs of running the fund and operating its investments are often pooled and spread across all the members, generally resulting in a lower ‘per head’ cost that is largely predictable.

Some people choose to take a hybrid approach where they have both a SMSF and a managed fund. If you choose this approach you’ll be paying fees on each, so you’d want to have a good reason to do this.

Who's responsible?

Another question is around responsibility - who is responsible for investment decisions and keeping the fund compliant (to avoid fines and other penalties). For an SMSF it’s the trustees, but the depth of expertise in these areas depends on the individuals involved and many trustees do need guidance.

In a managed super fund this is all taken care of. Managed super funds can invest at scale, keeping costs low while also opening investment opportunities not necessarily available to the average investor, for example exposure to unlisted assets like infrastructure that can be an attractive diversifier and well aligned to long-term investing, or niche investment strategies managed by experts. Members of managed funds can often choose from a wide range of investment options and still be very active in managing their investment strategy if they choose to.

Insurance and other issues

When it comes to insurances, the trustees of a SMSF are responsible for sourcing, updating and paying for their own personal insurance cover (death, disablement, income protection). Managed super funds offer group insurance policies that are typically very competitive with other offerings from insurers. Of course, rates do vary and can be influenced by the composition of the membership.

Having an SMSF does throw up other complexities, for example for a couple managing an SMSF, divorce and separation can present a raft of legal and financial issues to ensure ongoing trustee obligations are maintained, where superannuation arrangements can be simplified by transferring to a managed super fund. Also, if a trustee becomes ill or passes away, it could change the obligations and responsibilities of the remaining member/s, issues that are generally avoided by members of a managed fund.

Latest SMSF trends

At UniSuper we’ve seen trends emerging in those taking up and giving up SMSFs. The average age of UniSuper members rolling out to an SMSF is age 50, while the average age of our members who roll money in from an SMSF is age 62, and with an ageing population we are seeing more members rolling in from their own SMSF. Over time, the SMSF members’ financial goals and their desired level of involvement in managing investments may change or wane, or the original purpose for creating the SMSF may no longer be necessary, for example if the asset that it was specifically set up to own is no longer held within the fund. In our experience, some people start to ask if this is how they want to be spending their time.

As you can see, there’s a lot to think about if you are considering setting up or winding down an SMSF. The best bet is always to seek professional advice and understand the pros and cons of these options to set you up for the future you aspire to achieve.

Derek Gascoigne is State Manager Advice at UniSuper, a sponsor of Firstlinks. Please note that past performance isn’t an indicator of future performance. The information in this article is of a general nature and may include general advice. It doesn’t take into account your personal financial situation, needs or objectives. Before making any investment decision, you should consider your circumstances, the PDS and TMD relevant to you, and whether to consult a qualified financial adviser.

For more articles and papers from UniSuper, click here.