The number of Australians choosing to manage their own superannuation investments – both before and during retirement – has been progressively increasing over time.

Current data from the Australian Tax Office (ATO) shows around 1.15 million people are now members of self-managed super funds (SMSFs), with their SMSF trustees collectively managing more than $900 billion of net assets.

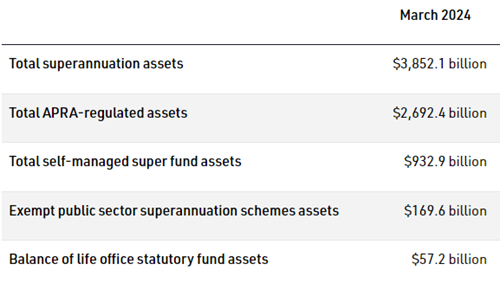

Source: apra.gov.au

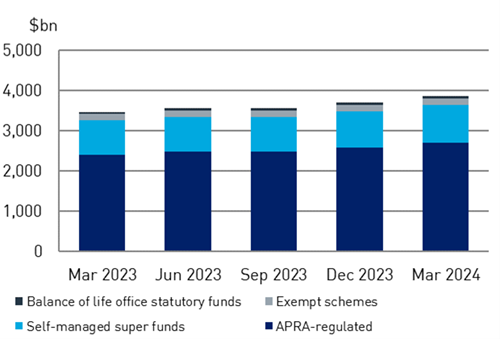

Source: apra.gov.au

It’s a very sizeable amount, and it begs some obvious questions. Why are many Australians preferring to take the do-it-yourself (DIY) route instead of placing their super with a fund regulated by APRA (the Australian Prudential Regulation Authority) and into the hands of professional investment managers?

Are SMSF trustees generally better investors and fund super managers than the professionals, or are other factors coming into play?

Ultimately, choosing between an APRA-regulated fund and an SMSF depends on individual preferences, financial situations, and the level of involvement one wishes to have in managing their retirement savings. Each option has its own set of benefits and considerations.

Importantly, it doesn’t necessarily have to be one way or the other. Many SMSF members are also members of APRA funds. I’ll explain why later.

The desire for control

Broadly speaking, most SMSF trustees have one thing in common – their desire for total control over their superannuation investments.

This was one of the key findings from the 2024 Vanguard/Investment Trends SMSF Report.

Control incorporates having full choice over investment products, control over asset allocation, and total flexibility (within the strict parameters defined in the Superannuation Industry (Supervision) Act).

Just like APRA funds, SMSFs provide their members with the ability to make investment decisions tailored to their personal circumstances, risk tolerance, and retirement goals.

But SMSFs can invest in many things that APRA funds can’t, or don’t. This includes the ability to invest beyond mainstream assets such as Australian and international shares, fixed income, and cash.

For example, many SMSFs invest in direct property, including residential properties and privately controlled commercial property assets. Some hold collectible assets such as artworks and luxury vehicles.

Tax management is an extension of the control aspect for many SMSFs because they can provide opportunities for strategic tax planning, such as timing the sale of investments to minimise capital gains tax and utilising dividend imputation credits.

Cost effectiveness can also come into play for DIY funds. For those with larger balances, the per-member cost of running an SMSF can be lower than traditional super funds, making it a potentially economical choice. Also, in terms of pooling resources, SMSFs can have up to six members, which can be beneficial for families looking to combine their resources for investment purposes.

On the other hand, the costs associated with setting up and maintaining an SMSF, including audit fees, administration fees, and legal fees, can be disproportionately high for smaller fund balances.

Managing an SMSF requires a significant amount of time, financial literacy, and compliance with complex legal regulations. There are major risks associated with non-compliance. SMSFs are subject to strict regulatory requirements, and failing to comply can result in significant penalties.

How APRA funds compare

Contrasting with SMSFs, members of APRA-regulated funds have far less control over making specific investment decisions, which may not align perfectly with their personal investment strategies.

APRA funds do typically offer a range of options, mainly diversified investment products offering different weightings to equities, fixed income and cash that are usually labelled as conservative, balanced, growth, and high growth. Many also offer lifecycle products that automatically adjust members’ weightings to asset classes based on their age.

Some also offer access to quasi-DIY options, such as the ability to invest in Australian and international equities, which are generally underpinned by exchange traded funds (ETF).

There’s a degree of comfort for many people knowing that APRA funds are managed by investment professionals, which is ideal for individuals who lack the time or expertise to manage their own investments.

The cost of participating in an APRA-regulated fund can be more favourable than having a SMSF, particularly for people with smaller super balances.

That’s because larger APRA-regulated funds benefit from economies of scale, which can lead to lower fees per member and potentially higher investment returns due to more significant investment opportunities and bargaining power.

But a major advantage for people joining an APRA-regulated fund is that the process is generally much simpler, and potentially much cheaper, than setting up and maintaining an SMSF. This can be particularly appealing for those who prefer a straightforward approach to their super.

Overarching this is the fact that APRA fund members are not responsible for the day-to-day management and compliance, reducing their administrative burden. APRA funds are subject to strict oversight, ensuring adherence to legal standards and reducing the risk of mismanagement.

Which way is better?

In summary, choosing between an SMSF and an APRA-regulated fund largely depends on individual circumstances, including financial goals, investment knowledge, and the desired level of involvement in managing retirement savings.

Many Australians actually choose to have both. They may use an SMSF to hold certain assets that are not available through an APRA fund, such as direct property, and an APRA fund that invests in mainstream assets such as equities and fixed income for their employer contributions.

Another advantage is that most APRA funds offer life and disability insurance at competitive rates with automatic acceptance up to certain levels. This can be more convenient and sometimes cheaper than obtaining similar insurance as an individual.

When deciding between managing a SMSF and using an APRA-regulated superannuation fund, it's essential to consider the advantages and disadvantages of each, based on individual financial situations, expertise, and personal preferences.

SMSFs do offer more control and flexibility but require significant commitment and responsibility. In contrast, APRA-regulated funds provide professional management and simplicity but at the cost of personal control over investment choices.

Tony Kaye is a Senior Personal Finance Writer at Vanguard Australia, a sponsor of Firstlinks. This article is for general information purposes only and does not consider the circumstances of any individual.

For more articles and papers from Vanguard Investments Australia, please click here.