Vanguard has thrown down the gauntlet to the superannuation industry by launching its Super SaveSmart accumulation offering. This launch gives it the ability to go head-to-head with the large superannuation funds, but will it really be able to compete with the likes of AustralianSuper? Vanguard is a global monolith with over $10 trillion of assets globally, but homegrown AustralianSuper is pretty sizable on the global stage with over $250 billion in assets. Let’s take a closer look at Vanguard's super offering and how it stacks up.

Vanguard’s Super SaveSmart investment offering

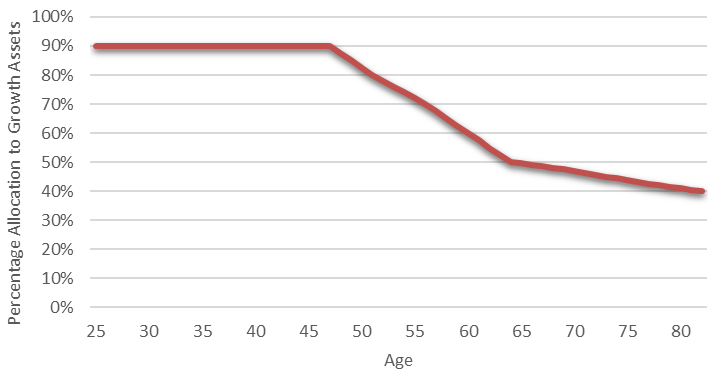

Vanguard’s offering provides a range of investment options—a Lifecycle investment option, five diversified investment options, and six single-sector options. Let’s focus on its MySuper (or default) option, which is a Lifecycle investment option. Lifecycle investing automatically adjusts investors according to their age—there are 36 Lifecycle stages. (See Exhibit 1.)

Basically, if you’re 47 years old or under, you will be invested in an option that has 90% of its investments in shares and property—that is, “growth assets”. Beyond this age, Vanguard starts to ratchet down the allocation to growth assets and increases defensive assets. A lower allocation to growth assets generally means fewer market ups and downs but also lower returns. By age 56, the growth exposure is down to 70% and the defensive exposure at 30%. At 64 years old, investors hold an even mix of growth and defensive assets. Finally, the last milestone is 82 years or older—at which point growth assets are down to 40%. Between these age milestones, Vanguard is making incremental adjustments for you - for example, at age 52, 78% is in growth assets.

Exhibit 1: Vanguard lifecycle—percentage allocation to growth assets by investor age

Source: Morningstar.

Why lifecycle?

In typical lifecycle investing, an initial investment is made, based on investor age, into a well-diversified mix of investments. The investment mix gradually transitions into lower risk investments as one ages—as shown in Exhibit 1. It is generally accepted as a good approach for investors who are more “hands-off” and would like a professional to monitor and adjust the investment mix over time. This approach is certainly not new. At the end of 2022 in the United States, Vanguard managed around US$1.1 trillion of this style of product, and the overall market there is more than US$3 trillion. Also, in Australia, Aware Super, AMP, and Australian Retirement Trust (to name a few) offer lifecycle-style products.

But retirement is a personal experience, and adjusting investments based only on age is simplistic compared with working with a financial planner, who generally considers many more factors such as your total wealth (and your spouse’s), homeownership status, age pension eligibility, risk capacity and risk tolerance, future liabilities, spending patterns, and more.

Having said that, personalised advice can be expensive. Setting your initial asset allocation and then adjusting it based on age is normally a much better option than selecting an investment with a limited understanding of what you’re buying and never making any adjustments to it.

Vanguard’s lifecycle approach—adjusting the asset mix

Vanguard’s Lifecycle product has been designed to make reasonably gradual adjustments to the mix of investments, as shown in Exhibit 1. The adjustment to the investment mix ranges from 0.5% to 2.50% in any given year. No one knows exactly when markets are going to turn. More gradual, smaller adjustments over time are generally recommended over larger, arbitrary ones (such as annually on your birthday); as this minimises the risk of making a large change to an asset allocation at the worst possible time. Every month, Vanguard rebalances each investor’s portfolio back to the targeted mix of growth and defensive assets, if this mix has fallen outside of reasonably generous tolerances ranges. It also uses any new investments made by an investor into their option to align the mix. Sensible tolerance ranges and the use of cash flows help minimise outsize changes and unnecessary transaction costs including taxes.

Then, on the business day after the investor’s birthday (once older than 47 years), Vanguard adjusts the portfolio in line with the ‘new’ mix of investments. The monthly rebalancing mechanism could see an investor buying shares a month before their birthday and then selling shares a month later. But Vanguard is the largest provider of index solutions in the world, so ‘trading’ a portfolio effectively and minimising transaction costs to investors should be well within its skill set.

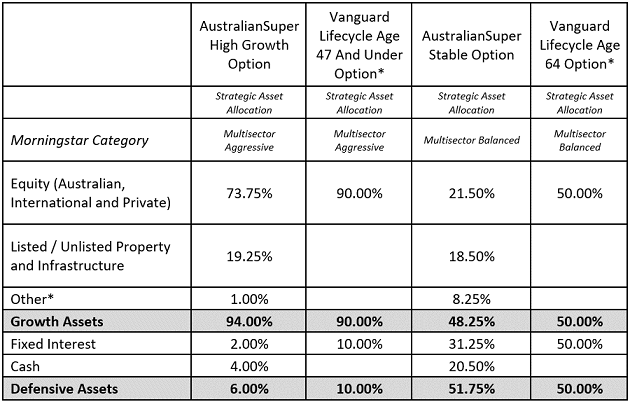

Comparing funds based on asset allocations

These gradual adjustments to the investment mix over time make a comparison to other MySuper funds a little tricky. For simplicity, let’s assume there are two investors: one is 40 years old, and the other is 64 years old. In Vanguard’s Lifecycle options, the 40-year-old investor will be invested with a 10% allocation to defensive assets and a 90% allocation to growth assets, while the 64-year-old investor will be invested with an even mix of 50% defensive and 50% growth investments.

Unfortunately, it can be a minefield trying to compare ‘like for like’ across funds based on the investment mix. Due consideration should be given to the underlying asset mix, but there are a lot of nuances. At the risk of oversimplifying the issue, let’s define “defensive” assets as only cash and fixed interest and the rest as growth assets. There’s much debate around the classification of credit and unlisted assets, but that is another article in itself.

Under this simplified definition, the AustralianSuper options that currently correspond most closely with the Vanguard Lifecycle Age 47 And Under Option and Vanguard Lifecycle Age 64 Option are not their MySuper Option (that is, the Balanced Option) but are the AustralianSuper High Growth Option and the AustralianSuper Stable Option (see Exhibit 2). This comparison is very much ‘point in time’; consideration should also be given to how investment mixes can move over time. To give a sense of this, the AustralianSuper Stable Option targeted 58% in defensive assets in 2019 and is down to less than 52% in 2022. This more-active approach to strategic asset allocations can make long-term performance comparisons challenging.

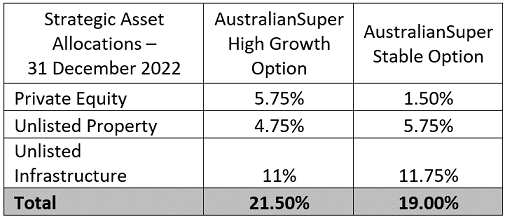

Exhibit 2: Strategic Asset Allocation comparison—as at 31 December 2022

Source: AustralianSuper and Vanguard. *Other – credit investments.

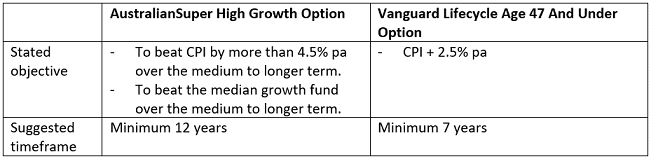

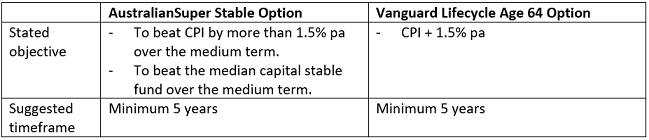

Objectives – what’s the difference?

Let’s now consider the investment strategies’ stated objectives to help understand what it is trying to achieve. Exhibit 3 compares these strategies’ objectives. higher return objectives and longer minimum time horizons generally mean that there’s a higher level of risk in that option. This normally means more market ups and downs. At the age of 45, though, most people have at least 20 years until retirement – so a few market ups and downs are probably worth the additional return.

Based on the underlying asset mix, the Vanguard Lifecycle Age 47 And Under Option’s objective appears quite low. Interestingly, according to Vanguard, these investment objectives consider prevailing market conditions (this just means the price level of markets at a given time) and are expected to change over time. They were formulated in early 2022 (using their proprietary return forecasting tools), and if you remember, equity valuations were still quite elevated, and bond yields were low (meaning that bond prices were high) relative to where they are now. This meant that future returns forecasted at that time, and therefore the objective of the option that was set, is quite low (CPI plus 2.5% pa). This makes sense; it’s often easy to lose sight of the impact an investor’s starting point can have on future returns.

With global equities markets down over 12% for calendar-year 2022, the potential returns from equities compared with 12 months ago should now be more attractive. And in Vanguard's Economic and Market Outlook for 2023 (produced in December 2022), it acknowledged that globally, their 10-year equity return expectations are now 2.5% higher than they were at the same time last year. Bottom line - the objective set is low but explainable and let's see how it changes over time.

Exhibit 3: 45-year-old investor – AustralianSuper High Growth Option vs. Vanguard Lifecycle Age 47 And Under Option

Source: AustralianSuper and Vanguard.

Exhibit 4: 64-year-old investor – AustralianSuper Stable Option vs. Vanguard Lifecycle Age 64 Option

Source: AustralianSuper and Vanguard.

Asset allocations – listed and unlisted assets

These strategies are very different in their holdings of listed and unlisted assets. At present, Vanguard does not have an allocation to unlisted assets. On the other hand, AustralianSuper aims to have a strategic allocation to unlisted property, infrastructure, and private equity of around 20% (Exhibit 5). These assets are not listed on the Australian Securities Exchange or other global exchanges, often making it more challenging to know precisely what you are holding and at what price.

Exhibit 5: AustralianSuper Options’ strategic asset allocation to private equity,

unlisted infrastructure, and unlisted property as at 31 December 2022

Source: AustralianSuper.

Can you beat the market?

The two strategies also differ in their investment approach. Looking at the underlying investments, Vanguard’s strategy is not presently designed to ‘beat the market’ – the underlying assets are simply trying to generate a return in line with some large indexes (think the S&P/ASX 300 Index).

AustralianSuper, on the other hand, tries to beat the market – it uses an ‘active’ approach. Beating the market is tough, but to date, it has been successful across a number of asset classes.

Still, at the launch of the Super product, Vanguard was on the record as saying that it wouldn’t rule out adding active or unlisted strategies in the future once it has scale and liquidity. Only time will tell how Vanguard’s investment strategy will evolve, and we will monitor this closely.

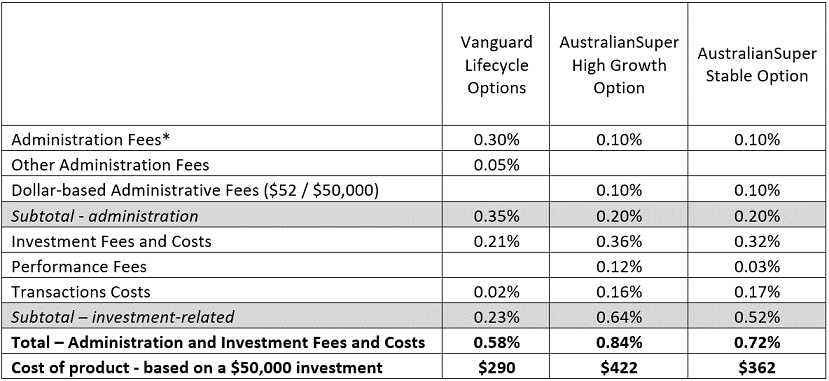

How much will it cost?

Fees can’t be ignored – a higher fee burden makes outperformance more challenging. Exhibit 6 shows that Vanguard is true to label in delivering a low-cost investment option compared with AustralianSuper when it comes to investment fees. Fees shouldn’t be viewed in isolation though – understanding the net returns delivered for the fees charged and making a judgment call as to whether that is possible in the future is key.

Administration fees and costs are the other big focus when it comes to comparing options. The value proposition can vary – members value different services, including access to particular investment options; ongoing reporting; insurance; investor education, and investor support. In the case of AustralianSuper – for an investor with $50,000, you will pay $102 each year (or 0.20% per annum) to be a member of AustralianSuper. By comparison, Vanguard Super charges the same investor $175. At this point, AustralianSuper has a significant scale advantage, and when it comes to lower administration fees, scale counts. Although, if Vanguard is true to form, it will pass these scale benefits through to investors as the product grows. Vanguard has a strong record of doing this on the investment side.

Exhibit 6: Fees and costs each year – administration and investment

*This 0.30% administration fee is not charged on the portion of your account balance in excess of AUD 850,000. Source: Morningstar, Vanguard, AustralianSuper as at 31 December 2022.

Performance

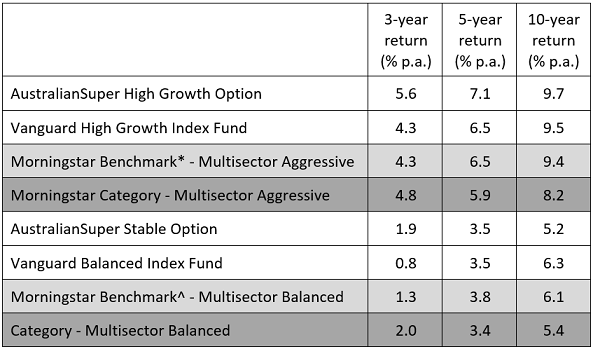

While Vanguard clearly states that its Lifecycle product is new and there is no performance track record available, let’s use the Vanguard High Growth Index Fund and the Vanguard Balanced Index Fund as reasonable proxies – the investment mix looks very similar to the Vanguard Lifecycle Age 47 And Under Option and the Vanguard Lifecycle Age 64 Option, noting that Vanguard has included some ethical exclusions in its super offering.

We all know that past performance is not a guide to future performance, although as far as declaring ‘success’, long-term returns are an important yardstick. And ultimately, net returns are what are most important to investors. So, how do the options stack up? When it comes to the High Growth Options – AustralianSuper has it over Vanguard in terms of net returns over the long term. But the returns from both strategies are strong – beating both the Morningstar benchmark and the category average over 10 years. In terms of the AustralianSuper Stable versus Vanguard Balanced, AustralianSuper has certainly recouped lost ground in the last three years, although it is still lagging Vanguard over the 10-year time frame. As highlighted earlier, AustralianSuper does move the mix of growth and defensive assets reasonably actively which will play role in its performance at any point in time.

Exhibit 7: Performance returns - 31 December 2022

Source: Morningstar Investor. *Morningstar AUS Agg Tgt Alloc NR AUD. ^Morningstar AUS Balanced Tgt Alloc NR AUD. The AustralianSuper Options' performance returns are subject to the impact of taxes and franking credits inside the superannuation environment. There were no available Vanguard comparisons inside a superannuation taxation environment.

Who Is winning the war?

Who’s winning the super war here? AustralianSuper and Vanguard are investment powerhouses, and both offerings are compelling. The arrival of Vanguard Super feels very much ‘game on’ in the super wars, and we will watch with interest to see how they scale, set the standard in terms of attractive fee levels for investors, and evolve their investment strategy. What will be really interesting to watch in the next three years, though, is how these two bridge the advice and education gap for investors and offer more-holistic solutions than purely administration and investment. Ultimately, investors will be best served by not only great investment solutions but also a provider who can build a complete picture of their financial situation to help them achieve financial security in retirement. T-pension, investments outside of super, and more are taken into account. Surely these two dynamos can set the standard on this front, and hopefully, the end beneficiaries will be the investors.

Annika Bradley is Morningstar Australasia's Director of Manager Research ratings. Firstlinks is owned by Morningstar. This article is general information and does not consider the circumstances of any investor. This article was originally published by Morningstar.

Access data and research on over 40,000 securities through Morningstar Investor, as well as a portfolio manager integrated with Australia’s leading portfolio tracking service, Sharesight. Sign up to a free trial below:

Try Morningstar Investor for free