Most investors have polarised portfolios bifurcated between cash deposits and equities. Few appreciate that these two very different securities span a rich corporate capital structure that allows for a much more continuous distribution of risk and return experiences. One powerful illustration of this point is the recent financial market turbulence, which has unearthed some fascinating opportunities across the cash deposits, senior bonds, subordinated bonds and hybrid securities issued by the major banks.

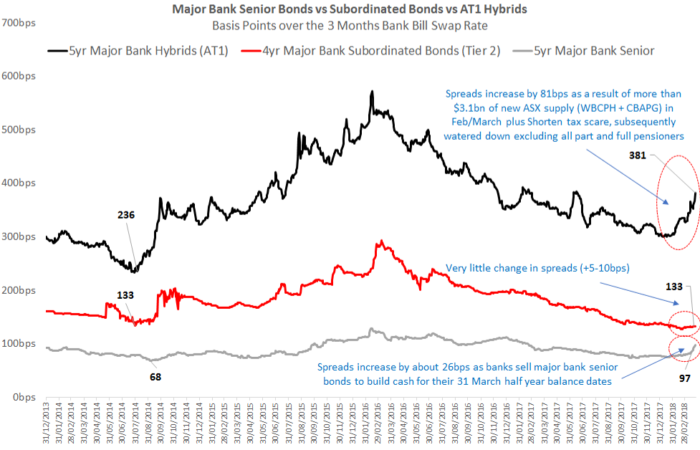

Let’s deal with each in turn. The hybrid market has been hammered by a number of technical, or non-fundamental, shocks since late January 2018. First, Westpac and then CBA both announced large hybrid deals (WBCPH and CBAPG respectively).

Over $3.1 billion of new hybrid supply

It is quite unusual to have two major bank hybrids launched at effectively the same time, and we explicitly warned CBA about following Westpac so closely. In total, the two major banks have flooded the ASX with over $3.1 billion of new hybrid supply over February and March.

When Westpac officially launched WBCPH in early February we wrote that fair value for this security with no ‘new issue concession’ was a spread of 3.43% above the 3-month bank bill swap rate (BBSW) based on the spreads offered by similar major bank hybrids at the time.

We would normally expect a minimum of 0.2% (or 20 basis points) in extra spread as a new issue concession, or a total trading margin of about 3.6% above BBSW. Rightly or wrongly, Westpac chose to issue almost $1.7 billion of hybrids at an incredibly tight spread of just 3.2% above BBSW, or 0.23% less than the fair value margin assuming no new issue concession.

Today WBCPH is unsurprisingly trading poorly, bid at $96.90 on 26 March, which translates into a 3% plus capital loss for the original investors in the issue.

New hybrid margins too skinny

CBA offered a 3.4% margin above BBSW for its new CBAPG security, which was the secondary market fair value on the same day that Westpac launched. The problem is that the effect of bringing $3 billion plus of new hybrid supply to market blew-out this fair value margin to 3.5% on 2 March before one accounts for any new issue concession (ie, 3.7% including one).

With Westpac and CBA both paying brokers and advisers sales commissions of 0.75% on the new deals to push them, we have seen enormous churn, or selling, of older existing hybrids paying superior spreads (or returns) to the new securities.

This temporary dislocation has been amplified by Bill Shorten’s sudden announcement in mid-March that Labor would ban cash rebates on franking credits (notably not franking credits themselves). While the policy does not affect more than 92% of all taxpayers, and Labor has subsequently diluted it down materially by expressly excluding all pensioners and part-pensioners (over 300,000 retirees), including pensioners in self-managed super funds, the knee-jerk reaction on the day of the news was savage with hybrid prices falling over 0.4%.

The reality is that both parties have confirmed their support for the franking system, which is a win for investors, and anyone who happens to not be able to fully use franking credits will be selling to buyers who can price them in.

Hybrid cash yields over 4%

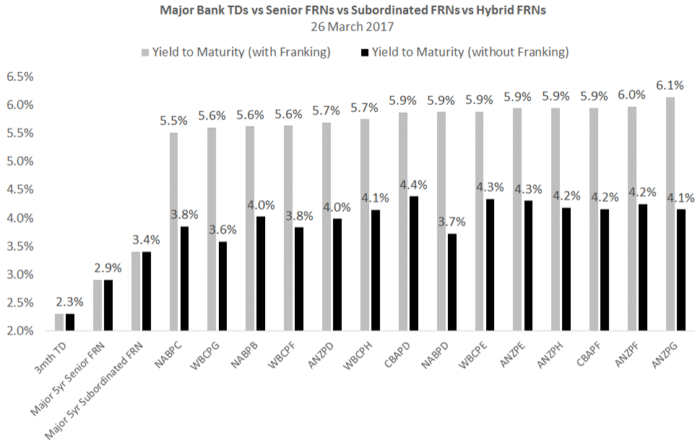

Even excluding all franking credits, major bank hybrids like CBAPD are paying a very attractive, 2.38% cash spread above 3-month BBSW, which means it is offering an all-in cash return of 4.38% for a BB+ rated security that has much better liquidity than other Australian sub-investment grade bonds.

With franking, CBAPD’s spread above BBSW jumps to 3.87%, which represents a total yield to maturity of 5.87% (see the first chart). Put differently, cash returns on hybrids today are significantly above anything else that investors can switch into with comparable risk. For the 9.5 out of 10 people that can still use franking credits if Labor wins the election, and the pensioners that can still get cash rebates, the fully franked yields are in the order of 5.5% to 6.1% per annum.

Click to enlarge

ASX hybrid supply to shrink

We believe that the stock of ASX hybrids will shrink over time as the major banks shift some of their issuance to the deeper US dollar market, as ANZ, Westpac and Macquarie have recently done. And we think that there will likely be unlisted issues of major bank hybrids to institutional investors in the Aussie dollar over-the-counter market in the years ahead, which will collectively combine to create a shortage of ASX supply.

Whereas 5-year major bank hybrids were paying spreads of about 3.0% above BBSW in January, this has now blown-out to 3.81% as at 26 March. This is about 1.45% (or 145 basis points) above the mid 2014 ‘tights’ of circa 2.36% above BBSW even though the major banks have massively increased their common equity tier 1 (CET1) capital ratios from around 8% in mid-2014 to circa 10.5% today. This increase in CET1 capital directly reduces the risk of the hybrids being automatically converted into bank shares, which occurs when the CET1 ratio falls to 5.125%.

Hybrids much more attractive than subordinated bonds

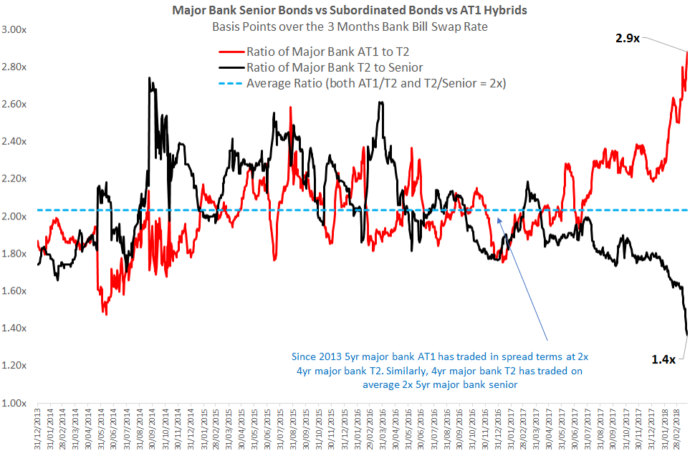

The unusually attractive trading opportunity associated with major bank hybrids is highlighted by the second chart, which examines the historical ratio of 5-year major bank hybrids over 4-year major bank Tier 2 subordinated bonds (we use the 4-year maturity because there are more securities to sample from). It also compares 4-year subordinated bonds to 5-year major bank senior bonds.

Since 2012 both ratios have tended to oscillate around a 2-times-multiple until late 2017 when subordinated bond spreads compressed further than hybrids and major bank senior bonds. But the real break has been seen in 2018 where the ratio of major bank hybrid to subordinated bond spreads has exploded to its highest level ever of 2.9 times. At the same time, the ratio of subordinated to senior bond spreads has also fallen to its lowest level ever at 1.4 times.

Click to enlarge

Click to enlarge

As there are no credit events affecting major bank paper - as borne out by the strength of the riskier subordinated bond securities and only marginal increases in the major banks’ 5-year credit default swap spreads - it is likely that hybrids and senior bonds have been impacted by one-off ‘technical events’ that should normalise over time.

Major bank senior debt spread changes

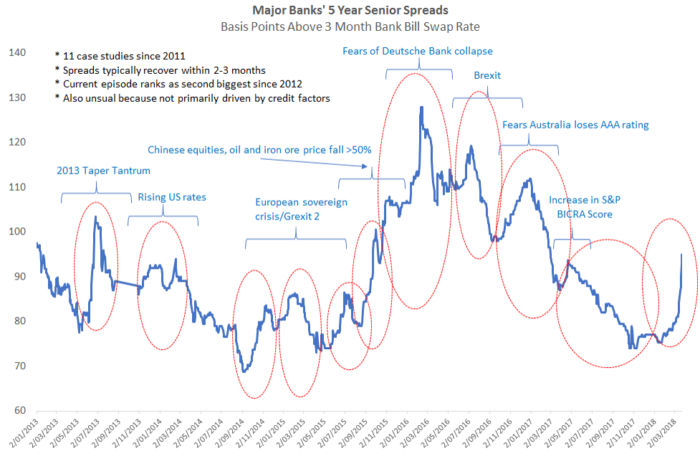

Normally among the safest and lowest risk assets other than cash, the major banks' AA-rated senior-ranking floating-rate notes (FRNs) have gapped some 26 basis points wider in spread terms since January 2018. Specifically, the bid for 5-year major bank senior FRNs has jumped from 0.74% over the 3-month BBSW to around 1.0% over, which has in turn reduced the clean price of these bonds by almost 1%.

After a massive increase in major bank senior spreads over late 2015 and early 2016, which was subsequently reversed, this is the biggest spread widening in major bank senior bonds since 2012. However, it does not appear to be driven primarily by credit-related concerns as was the case in 2015 and 2016. The major banks' subordinated bonds are behaving like they are safer than senior debt. In 2015/2016, the blow-out in major bank subordinated bond spreads was 1.5 times to 2 times more than the increase in senior spreads.

Banks selling to boost LCRs

So what is going on? We understand US companies have been pulling their cash deposits out of Australia and sending the money back to the US following recent tax changes made by President Trump to encourage the repatriation of capital. This has left Aussie banks with lower than normal amounts of cash on their balance sheets.

Market participants report that over the last month or two these banks have been selling their holdings of major bank senior bonds, which are among the most liquid assets (ie, easy to both sell and buy-back), to improve their cash ratios coming into their half-year ends. Specifically, they want to boost their ‘liquidity coverage ratios’ (LCRs).

At the same time, important buyers in the market in the form of Japanese banks, life insurance companies and asset managers have temporarily disappeared because all Japanese institutions have their full financial year balance dates on 31 March. Market participants suggest that these Japanese investors ordinarily withdraw from the market in the final month of their financial year, returning again in April.

Click to enlarge

Cash rates spike

The jump in 5-year major bank senior spreads has been significantly amplified by a very large increase in the 3-month BBSW from 25 basis points above the RBA's 1.5% cash rate (or 1.75% in total) to 50 basis points above cash, or 2% today. This has likewise been driven by non-fundamental factors.

Specifically, an increase in short-term US government debt issuance has pushed all short-term money market interest rates higher. This has been accentuated by changes in US regulations in 2016 that encouraged US money market funds to shift their capital from short-term bank paper to government bonds, which has created a scarcity of short-term funding.

It would, however, be unusual for BBSW to remain at 50 basis points above the RBA cash rate, and these spikes have always normalised historically. Until BBSW mean-reverts, investors in major bank senior FRNs can potentially get an extra 51 basis points of return (26 basis points from major bank senior spreads and the 25 basis points via BBSW).

A final influence on these interest rates has been the general widening in credit spreads globally, although this has not been driven by any empirical deterioration in credit fundamentals. The move wider in spreads has been mostly explained by technical factors in the northern hemisphere.

Christopher Joye is a portfolio manager with Coolabah Capital Investments, which invests in fixed income securities including those discussed by this column. This article does not address the individual circumstances of any investor.