Australian equities have been a star long-term performer -- 27 years without a recession has that effect -- and our local market is ripe with success stories. Australian investors aren’t blind to that success either as the latest ASX Investor Study shows a stout 31% of Australian adults hold listed shares.

As great a ride as it has been, though, Australia is far from the only long-term winner for equity investors. In fact, even though the Australian economy punches above its weight, the whole of the Australian equity market only comprises about 2% of the world’s list equities.

Australian equity market is sector-specific

You might think that a majority of Australian investors who hold listed shares would be invested overseas as well, given Aussies own exchange-listed investments at a much higher rate than peers like the US (14%), UK (18%), and New Zealand (23%). However, less than 8% of Australian adults (up from 5% in 2014) hold listed overseas shares even though overseas equities make up 98% of the global market.

The international investing blindspot costs Australian investors in two big ways.

The first is an opportunity cost around world-leading companies. Yes, Australia is home to some global champions, but the vast majority of iconic global companies are not listed here. Visa, Amazon, and Booking, for example, all have big footprints in Australia but are not locally listed. Just the state of California alone has more companies with market capitalisations above US$100 billion (19) than the whole of Australia (5).

The simple reality is that when a market makes up only 1/50th of the world’s equity market, the odds of backing a breakout winner in that market get very long (more on that later). The odds get longer still for investors only focused on the big end of town.

Massive differences in Australia and Global

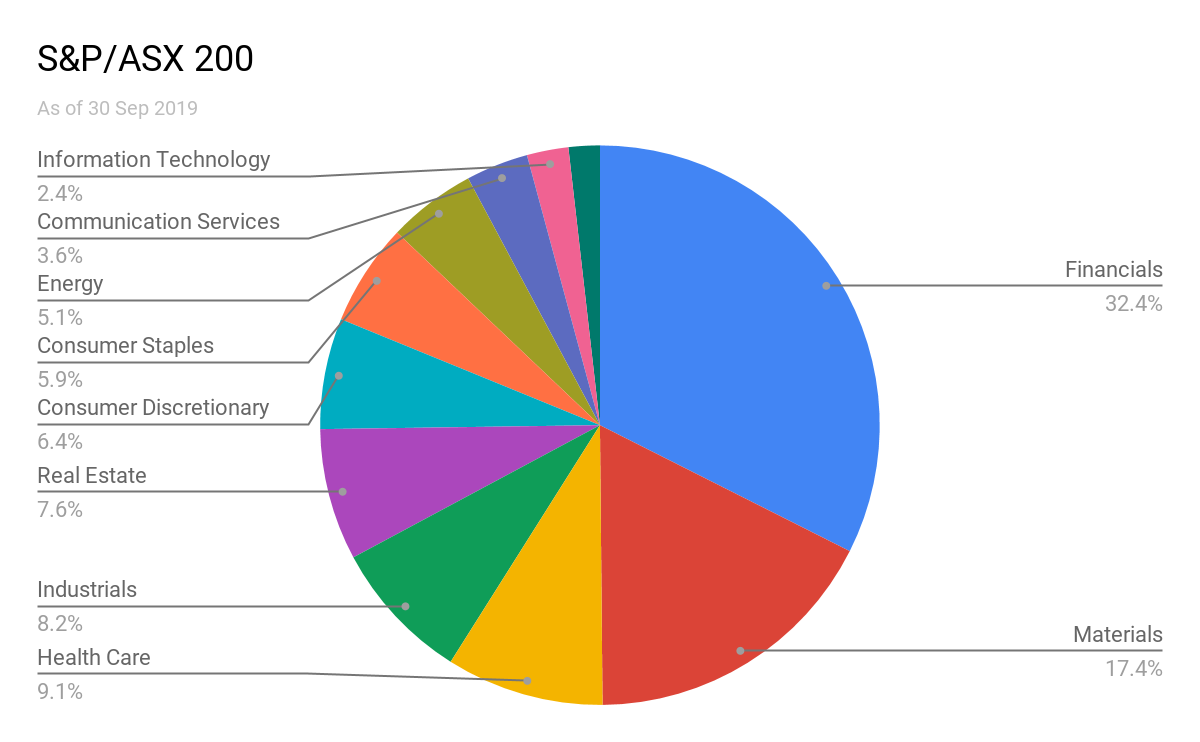

Consider the sector makeup of Australia’s S&P/ASX 200:

A stout 32.4% of the benchmark is in financials, which is mostly comprised of a handful of mature, slow-growing banks. The next largest bucket, materials, does have some winners to point to, namely Fortescue, but for the most part materials is a capital-hungry sector known for historically-poor returns on capital.

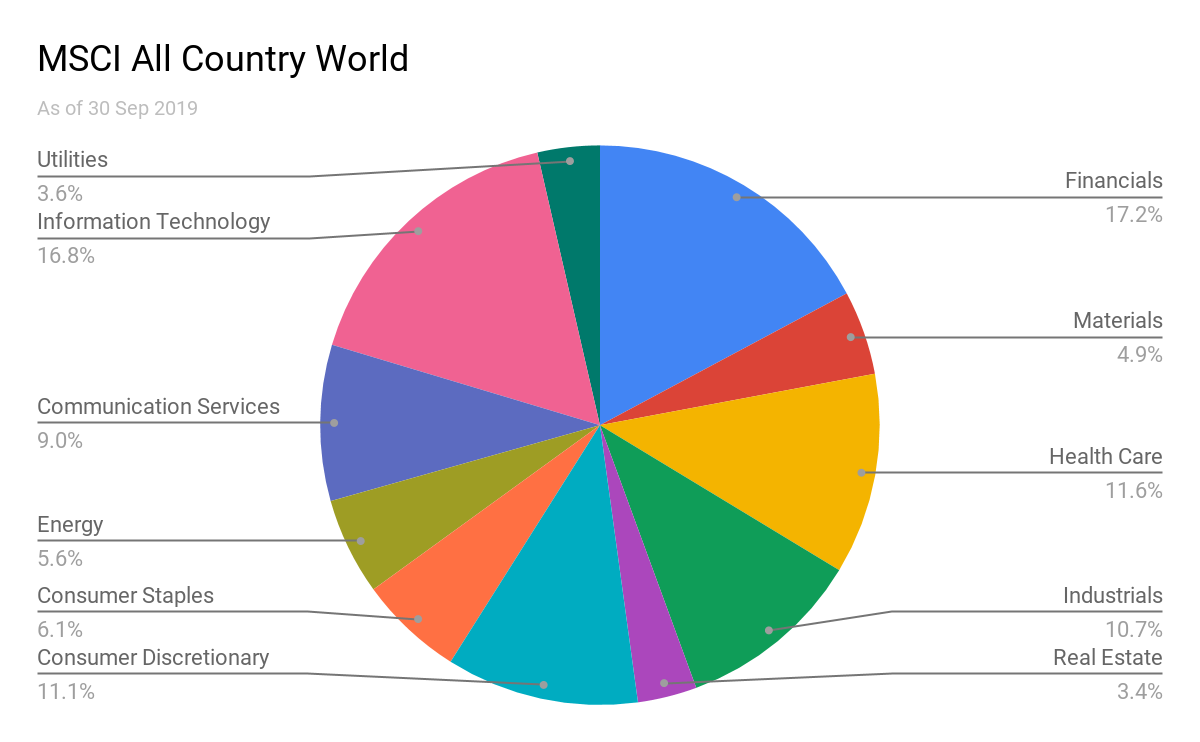

Now contrast that with the makeup of the MSCI All Country World Index:

Note the huge differences. Materials is more than three times as heavy on the ASX. Information technology (IT) is seven times as large for the MSCI All Country World. We could point to plenty of fabulous IT flops, however, it’s also the sector that is home to the world’s most disruptive companies and where value can accrue the fastest.

For example, a recent study by Kantar of the world’s most valuable brands found that three of the top 10 were IT companies and another four were classified as IT until they were reclassified last year as part of a broader reclassification.

The massive gap between the sectors and styles of companies in Australia and offshore leads to a second key appeal of investing offshore: diversification.

Unfortunately, far few too many investors are genuinely diversified. The aforementioned ASX Investor Survey notes that 40% of investors say they do not have diversified portfolios while another 46% say they do but only hold an average of 2.7 investment products.

Investing offshore is a direct way to improve a portfolio’s diversification. A recent study by Vanguard found that the Australian equity market only has a 0.58 correlation to international equity markets, which provides a lot of diversification bang for the buck. Indeed, the same study found that increasing an international equity allocation to around 60% could reduce average annualised portfolio volatility by around 20%.

A handful of global stock ideas

And so the appeal of global investing is quite clear. What’s less clear is how to tackle global investing. The MSCI All Country World Index has more than 2,800 constituents, for example, spanning 23 developed markets and 26 emerging markets. It’s a lot of ground to cover for, say, a punter with a day job.

Fortunately, my day job is to sift through those very markets, so in the spirit of helping investors here are a couple of examples of the opportunities available overseas. These aren’t recommendations -- do your own due diligence -- but we think they’re worth studying.

Let’s start with Facebook. What most readers may not realise is that for all the bad press the company has received it is still highly profitable and growing at healthy rates. The number of daily active users on the core Facebook platform grew 8% year on year to 1.6 billion through the second quarter of 2019 with revenue growing 32% in constant currency terms.

The business is also growing strongly outside of the flagship platform -- each of Instagram, WhatsApp, and Messenger has more than 1 billion monthly active users -- and is cashed up with more than 7% of the company’s market capitalisation held in net cash. The long spate of fines and bad press aren’t behind the company yet and there remains an outside risk the US government might disentangle Facebook’s platforms. However, we think there is a lot to like and the regulatory risk is accounted for given the shares are only selling for around 22 times consensus forward earnings estimates.

An interesting company that would not be on the radar of many Australians is MercadoLibre. The business is listed in the United States, however, it is present in 18 countries and hosts the largest online commerce and payments ecosystem in Latin America. The company has more than 292 million registered users and close to 2 million items are sold on its website each day. The company’s eBay-like marketplace has a classic network effect, bringing buyers and sellers together, and is growing at strong rates. We think the payments business is the crown jewel, with the year-on-year growth in total payment transactions accelerating from 64% to 112% in the past year.

The shares are spicy. The valuation is not conventionally cheap, the business is underearning today because it is investing heavily in strengthening its logistics network and broadening the reach of its marketplace and payments networks. Its home country of Argentina is not exactly the classic picture of political stability. Nonetheless, we admire management’s willingness to reinvest in the business with a long-term view and think the company, and particularly its payments business, could grow at high rates for a long time to come.

Joe Magyer is the Chief Investment Officer of Lakehouse Capital, a sponsor of Firstlinks. Joe owns shares of Visa, Amazon, Booking, and Facebook, each of which is a holding of the Lakehouse Global Growth Fund. The Lakehouse Global Growth Fund also owns shares of MercadoLibre. This article contains general investment advice only (under AFSL 400691) and has been prepared without taking account of the reader’s financial situation.

Lakehouse Capital is a growth-focused, high-conviction boutique seeking long-term, asymmetric opportunities. Lakehouse is the investment manager of the Lakehouse Small Companies Fund and the Lakehouse Global Growth Fund.

For more articles and papers by Lakehouse Capital, please click here.