The Weekend Edition includes a market update plus Morningstar adds links to two recent stock pick highlights from the week.

Weekend market update

Most western diplomats and political commentators did not expect Putin to order an invasion of Ukraine, but this extract from his 7,500-word speech to his nation highlights his conviction about Russia's destiny.

“It is an inalienable part of our own history, culture and spiritual space. These are our comrades, those dearest to us - not only colleagues, friends and people who once served together, but also relatives, people bound by blood, by family ties. For a long time, the inhabitants of the historical lands of the south-west of ancient Russia called themselves Russians and Orthodox. This was the case until the 17th century, when part of these territories were reunified with the Russian state, and after ... Ukrainians squandered not only everything we gave them during the USSR, but even everything they inherited from the Russian empire. Even the work created by Catherine the Great.”

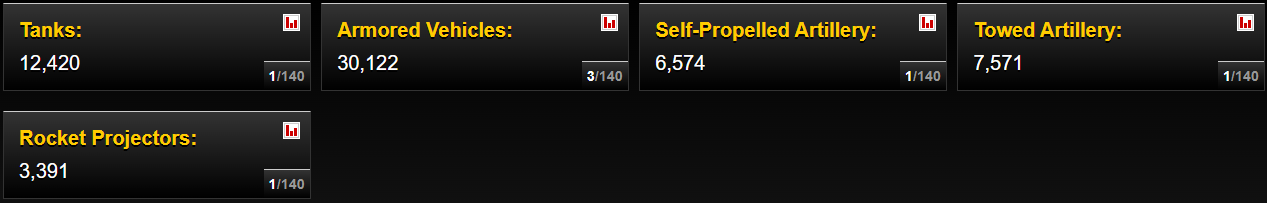

Where will he stop? According to GlobalFirepower, "For 2022, Russia is ranked 2 of 140 out of the countries considered for their annual review." For a nation of only 140 million people, their military resources are frightening, with 850,000 active personnel and more land forces than the United States.

Russian Airpower and Land Forces, 2022

***

From AAP Netdesk: The Australian sharemarket ended marginally higher on Friday after the rout in the previous day, as investors remained on edge over the impact of Russia's invasion of Ukraine. The benchmark S&P/ASX200 index closed just 0.1% higher at 6998 points after rising as much as 0.8% in early trade. The index was down 3.1% for the week after sliding 3% on Thursday.

Western nations unveiled fresh sanctions to limit Russia's ability to do business by freezing bank assets and cutting off state-owned enterprises. But they stopped short of disconnecting Russia from the SWIFT international banking system or targeting its oil and gas exports.

Technology shares rallied, led by a 32% surge in payments giant Block. Its stock, which replaced Afterpay on the ASX in January after taking over the buy now pay later pioneer, closed at $153.75. Appen shares jumped nearly 9% while Wisetech Global rose 5% and Xero climbed 3%. Utilities and consumer discretionary stocks also saw gains.

But the heavyweight mining sector was weaker, mainly on account of a decline in bullion prices. Newcrest, Evolution and Northern Star Resources all dropped between 3 and 5%. Iron ore majors BHP and Rio Tinto also ended lower. Energy stocks were mixed even as oil prices rose. Each of the Big Four banks closed heavily in negative territory, while Magellan Financial dropped another 10% to $17.78 after the troubled investment firm disclosed further fund outflows in the past few weeks.

From Shane Oliver, AMP Capital: While US shares fell below their January low into mid-week, a relief rally from oversold conditions helped by expectations that a further worsening of the energy crisis could be averted pushed them higher later in the week such that through the week as a whole they actually rose 0.8%. Despite rallies on Friday, Eurozone shares fell 2.6% through the week, Japanese shares fell 2.4% and Chinese shares fell 1.7%.

The market volatility in reaction to the Ukraine conflict reflects a fear of the unknown about how far the conflict will go. The key risk is that Russia (which accounts for around 30% of European gas imports) cuts off its supply of gas to Europe when prices are already very high, with a potential flow on to oil demand at a time when conflict may threaten oil supply. In short, investors are worried about a stagflationary shock to Europe and, to a lesser degree, the global economy generally.

If the conflict is limited to Ukraine with Russian gas still flowing to Europe and NATO not getting involved, then the economic fallout will be limited. Russia has no interest in war with NATO and President Biden has continued to stress that the US will not engage in military conflict with Russia just as it managed to avoid it right through the Cold War and ever since. The presence of nuclear weapons on both sides remains a huge deterrent here.

European exports to Russia are just 0.7% of its GDP and US exports to Russia and Ukraine are less than 0.2% of its GDP so the direct impact on them from say a collapse in the Russian economy would be small.

***

Last year, two of my close friends died, both in their late 60s. One was undergoing cancer treatment, so it was not a major surprise although he had been improving. The other suffered a heart attack while he slept at night, and his death was a massive shock. Putting aside the personal tragedy, in both cases, their estates were left to their wives who had not been heavily involved in managing their investments. Both are strong women capable of handling the stress but not everyone has their fortitude. One wife turned to the financial adviser her husband had worked with, but the other was forced to quickly pull together the financial pieces.

There are additional complexities with SMSFs. Most are managed by a dominant trustee, usually the husband, yet women have longer life expectancies. It's possible the surviving spouse will not want to continue to manage the investments, there are tax and estate implications and some assets may be illiquid.

Regardless of personal circumstances - health or financial - we should all take the time to ensure spouses or partners know in advance what steps to take if someone dies or becomes otherwise incapacitated. Making major decisions at a time of grieving is unwise. In any case, it is a legal requirement for SMSF trustees to have a documented investment strategy and to review it regularly. All 'non-dominant' trustees should know a trusted financial adviser they can turn to.

Some people will think it is too early in their lives to worry about such a morbid subject, but do they understand what life expectancy really means? Former leading asset consultant, Don Ezra, explained in a recent newsletter that while most people probably know the average age at death is in the early 80s, few people know the age distribution of deaths. He wrote:

"If we don’t have a rough, intuitive idea of how large the uncertainty is, we will make decisions that are totally inappropriate ... the distribution is extremely wide. That suggests that longevity is a big risk, and we need to consider it seriously, particularly those of us who are risk averse."

Ezra asked five of his friends to guess what one standard deviation of the longevity data might be. (Stay with me here. Simply put, standard deviation is a measure of variance around a mean, and one SD is about 68% of samples - in this case, ages at death - and two SDs is about 95% of samples). Ezra reports:

"One colleague, an actuary, clearly had the right mind-set. He said: ‘A few will live to 100. Let’s say that’s a two standard deviation event. If the average age at death is 81, then 19 more years will be roughly two standard deviations. So, in round numbers, I’d say 10 years is the standard deviation'."

Which is about right. Most of Ezra's friends guessed too low. The point is, while life expectancy is a useful measure of how long you might live, there will be outliers like my friends who will live a lot less. We usually worry about outliving our savings but consider also if you drop off the twig earlier than expected.

To top it off, The Economist reported last week that life expectancy in many countries is falling:

"To assess just how much damage the virus has done according to this (life expectancy) measure, a team of researchers based across Britain, Denmark and Germany compared life expectancy in 28 countries and Northern Ireland before and after the start of the pandemic."

The chart below shows a fall in life expectancy in nearly all countries surveyed. This must be the first time in history. For years, we have talked about living longer, and that might not be right in future.

It has been surprising to read this week how dependent much of Europe is on Russia for its energy needs. Germany relies on Russia for 50% of its gas and Austria is 100% dependent. At US$90 a barrel, Russia earns US$1 billion a day in hydrocarbon revenues and that buys a lot of military hardware. In contrast, the US now produces enough petroleum for its own needs. It means the rise in the oil price and supply dependencies impose different economic and geopolitical implications on the US and other countries. Where the US does import oil, half comes from Canada.

In this week's edition, a welcome return to Peter Thornhill who updates his 'mothership' chart to prove again the benefits of holding dividend-producing shares instead of other assets, especially cash. Peter has no time for diversified investing, but it takes a strong risk tolerance over a long time horizon to be a true disciple.

How many people know Stephen Jones, the 'shadow' Labor minister in Jane Hume's portfolio of financial services and superannuation (although Hume has a broader remit)? Given Labor has a decent chance at the May election (current Betfair odds, Coalition $3.15, Labor $1.46), it's worth knowing what he thinks about super, advice and other parts of the portfolio.

There are fascinating changes underway in media which perhaps older generations of investors are not aware of. Video games are bigger than the movie industry. Jody Johnsson and Martin Romo explain how traditional media is being disrupted, including some of the market's favourite companies.

While there is an obvious focus on the implications of inflation and a potential war, Shane Woldendorp says many companies were already falling and vulnerable due to their expensive valuations. They are no place to hide.

The new Design and Distribution Obligations (DDO) may sound arcane to most investors, and indeed, many issuers simply bury the regulations in the paperwork. But not so with bank hybrids. Norman Derham explains how access to this mainstay of many retiree portfolios is changing, as seen already in a new ANZ Bank issue.

Despite the best intentions of a well-considered asset allocation, all portfolios change as asset prices rise and fall. Inna Zorina suggests investors undertake a portfolio rebalance, especially in the context of taking a 'total return' approach during low interest rates.

Michael Batnick is a US financial adviser and author who issues a regular newsletter, and last week, he featured a most-intriguing note from one of his readers. After a lifetime of investing, the reader has come to the conclusion that it's a 'colossal waste of time' listening to all the market pundits. There's at least one good reason, however, why it's worthwhile.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Lewis Jackson explores seven undervalued mining companies amid the copper boom. And Adrian Atkins believes AGL was right to knock back Mike Cannon-Brooke's $5 billion bid saying it would lock shareholders out of any share price revival.

This weekend's White Paper from Martin Currie looks at the political and ideological risks of investing in Russia and its place in an emerging markets portfolio (written shortly before the invasion).

There was a super-lively debate on my article about LIC discounts but I need to make two things clear after readers made incorrect comments. First was the claim that ETFs don't pay franking credits, which is wrong, and the second is that NTAs don't matter for ETF prices. Not so ... ETFs are priced off NTA. However, the Comment of the Week goes to John on the article about short-let apartments. John confirmed how some of these properties are a disaster yet many people think they are safe investments:

"Excellent article; spot on with all the details. As a public accountant I have seen first hand and in great detail examples of such 'investments' owned by clients! The latest example showed a 32% loss (contract selling price compared to contract purchase price) over a 12 year holding period."

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website