Eric Marais, CFA, is an Investment Specialist at Orbis Investments. He joined Orbis in 2013 and is a member of the institutional client servicing team and part of his role includes conducting investment and economic research. He spoke to Firstlinks from his San Francisco office. The Orbis Global Equity Strategy launched in 1990 and has assets of over $28 billion, of which $13 billion is sourced from Australian institutional and retail investors.

***

GH: The Orbis Global Equity Fund has experienced a good last 12 months but struggled in the previous few years. What changed?

EM: The biggest thing is that the environment changed. We're not traditional value investors who focus only on low Price to Earnings (P/E) Ratios. We approach valuations by asking what a reasonable businessperson would pay for the entirety of a company if they were buying on the private market. We’re very valuation sensitive.

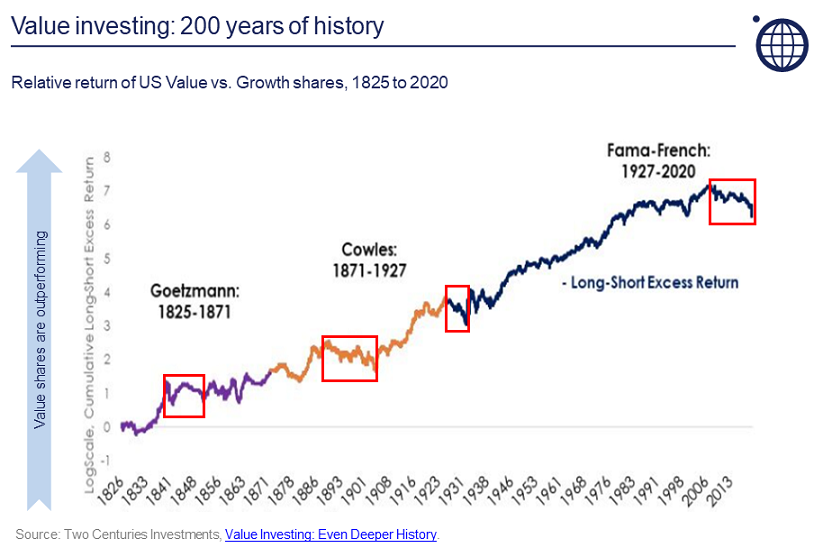

What we saw from say 2006 until 2021 was a once in 50-year cycle where value shares underperformed growth shares by about 50%. We’ve only seen maybe four or five cycles like this over the last 200 years. It was a tough environment for all value investors but in 2022 it started to change, and we think the current cycle is still at its early stages.

GH: But in 2023, we have seen another surge in NASDAQ, especially the biggest tech stocks, so how has that played out?

EM: Yes, 2023 so far has been the reverse of 2022, but that’s only a few months, and we're no less excited about the opportunity set amongst value shares, for three reasons.

First, the long-term trend line would need value shares to almost double relative to growth to return to trend.

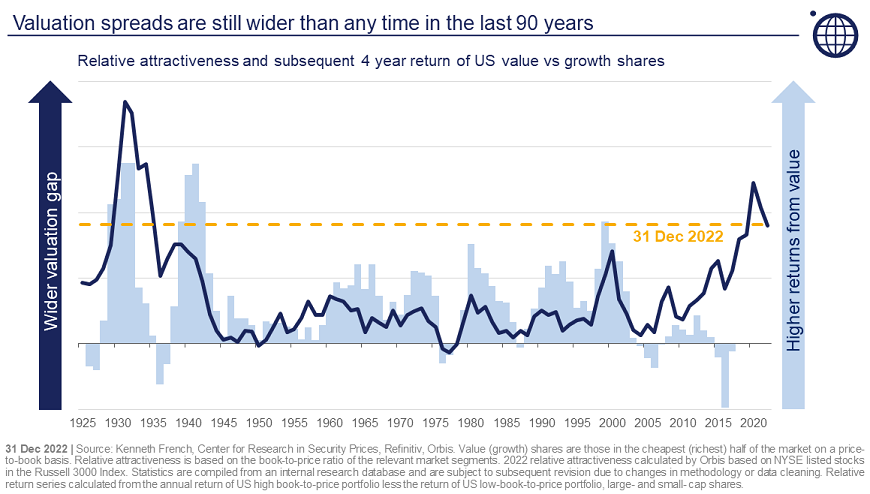

Second, the large size of the valuation spreads between low P/E multiple and high P/E multiple stocks. There always is a spread, and usually for good reason, because the better companies tend to grow a little bit faster, so we should pay higher multiples for those businesses. But that gap varies over time and where we today, that gap closed a bit in 2022, now it’s opened up a bit, but it’s still at an historical extreme.

And third is that investors are worried about recessions, and there is an incorrect perception that value stocks always do poorly in recessions, so investors have flocked to the growth stocks. But a look at the data shows that's actually not true.

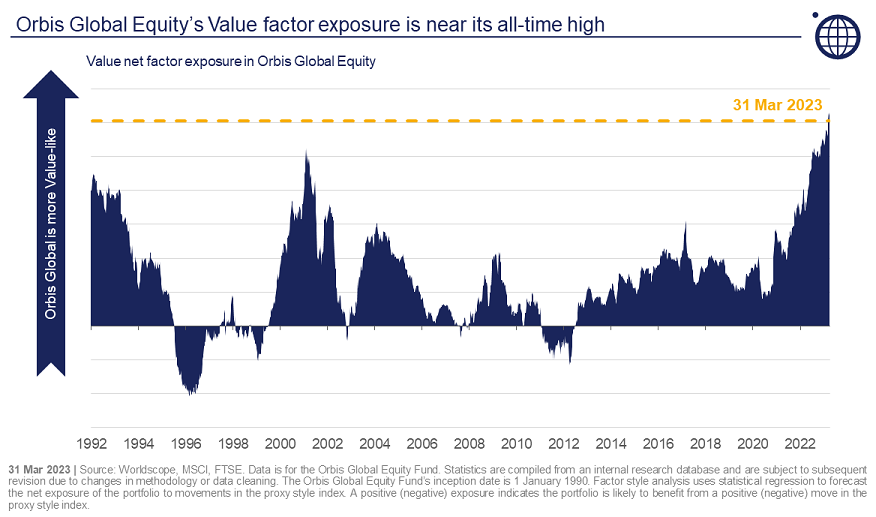

So since the inception of the Global Equity strategy, we currently have the highest exposure to the value factor that we've had for the full history of the fund.

GH: Delving into the portfolio, are you backing any themes or trends which you think the market has underappreciated?

EM: We are overweight what you would think of as the classic value-oriented sectors, including financials, energy, materials and industrials. It’s the other side of being underweight the large technology stocks. Similarly, this puts us underweight the US, with about 40% of the fund in the US versus about 60% for our global benchmark, the MSCI World Index, but that’s due to our valuation focus. If there is a better and cheaper equivalent industrial business in Germany versus the US, we will buy the German. On a bottom-up analysis, we're finding more compelling ideas coming from other parts of the world.

GH: A subject we don’t discuss much is the turnover of stocks in funds, and your fund’s turnover is about 50% per annum. That seems high for a contrarian manager who buys a stock and then waits for the market to catch up.

EM: Yes, the way you describe how we invest is exactly right. I would say it's been a busy year, but it’s more driven by trading around positions due to our valuation sensitivity, rather than major portfolio changes. If we buy a stock that appreciates, we might change the position size actively, and the flip side of that is true as well. Our company name turnover of stocks in and out of the fund completely is lower because we look three to five years ahead.

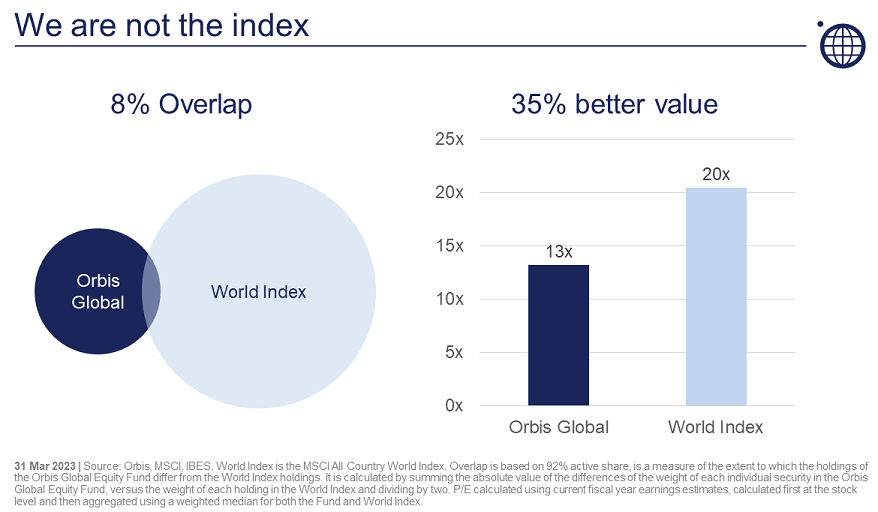

GH: And another metric, can you explain to our readers what ‘active share’ means, where I saw your last number was 92.

EM: ‘Active share’ compares a fund’s composition versus its benchmark, and it looks at the individual weights of the stocks in the fund compared to the benchmark. For example, if a fund owns every share in its benchmark to the same weight, that is a 0% active share. If the fund owns not a single share in its benchmark, that is called 100% active. Anything above 80% or so would typically be considered highly active. And yes, the fund is currently 92% but that's about normal for us. We build the portfolio based on individual stocks, not looking at a benchmark or an index and then making deviations from there.

Another difference relative to the benchmark is the valuation spreads, as we are finding some low P/E multiple stocks quite attractive. The overall P/E of our fund is about 13 times earnings compared to about 20 times for the index. That’s striking, and in my decade at Orbis, I don't remember a bigger difference.

GH: How are you feeling about the outlook for equity markets?

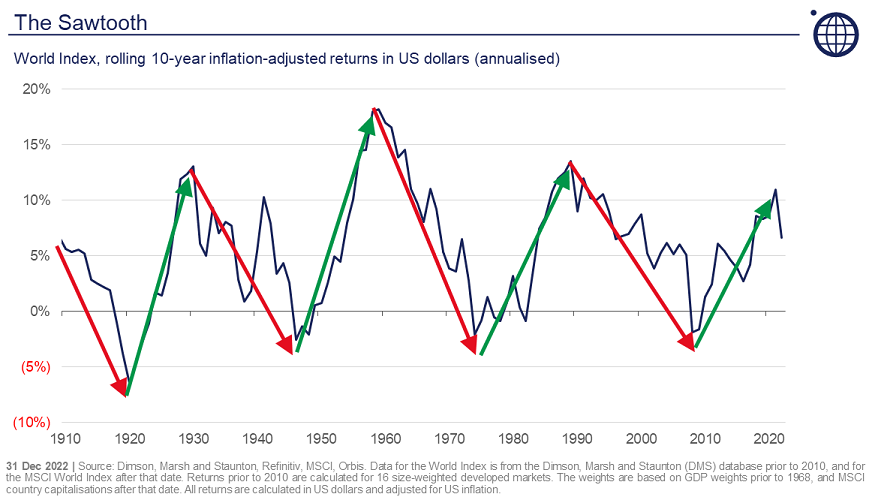

EM: By the end of 2021, we came off a strong decade for world markets, returning about 10% a year in real terms. It was an amazing result after the previous 20 years of decline in real (inflation adjusted) terms. If you look at rolling 10-year real returns from the stock market, there’s a saw tooth pattern over decade-long cycles, and we've just seen one of the peaks. So we think it's a good time to look different from the market. In contrast, when the market is strong, you don't need to be different. You're in the market, and you'll have a smile on your face.

GH: That’s what investors in active funds are paying for, not replicating an index and charging higher fees. But it also delivers different outcomes versus the index which a manager like Orbis must explain to its clients.

EM: Yes, and I’ve personally been a part of many conversations like that over the last three to five years that have been quite difficult. The market for our style looks attractive to us now, but it also did 12 months ago, 24 months ago and 36 months ago. And that's the nature of this approach as sometimes we underperform for an extended period of time. Value versus growth cycles are terrible timing indicators and they don’t help in the short run, but they do inform the quality of the opportunity set looking forward.

GH: I notice Alphabet is in your top 10 holdings. How does that fit with your contrarian approach, and why that one and not the other big tech stocks?

EM: It’s funny, we have owned each of the FANGS, or whatever they are called these days, at some stage but Alphabet has more recently looked a bit more out of favour than the others, and it looks a little bit better value, except maybe for Facebook/Meta. I think investors are more worried about the impact of the economic cycle on Alphabet due to its advertising exposure, but we like its free cash flow yield and its ability to continue growing. One thing that these big tech companies are proving out now is that they have a lot of room to cut costs.

GH: Your biggest holding is a company called FLEETCOR. Can you give a brief summary of the investment case?

EM: Yes. For a start, the stock is down about 25% from its peak and trades at only 11 or 12 times earnings, and pre COVID, it was double that. Briefly, they operate in a niche of two-sided payment networks. One example is Fuelman. Any business with lots of vehicles on the road, such as plumbers, electricians or landscapers, they issue credit cards to every employee to pay for fuel. And then Fuelman manages all the payments and reimbursements and separates out the personal from business costs which can otherwise become complicated. It keeps track of everything, and they offer discounts on fuel by working with the large groups of petrol stations.

The market is worried about the transition to electric vehicles, but what it misunderstands is that FLEETCOR already offers a sophisticated solution for electric vehicles for when employees charge their vehicles at home, which is very common. So the threat of electric vehicles in the fleet is really an opportunity. And the same guy has run the business for 20 years and still owns about 6% of the shares. He has built the company through a series of acquisitions, and they’ve grown earnings at 20% a year since going public in 2010.

GH: A typical Orbis stock where the market turns against it for a reason.

EM: Yes, and we think over time, that bear case will become a bull case for the company. We always look for the reason a stock is cheap and whether those concerns are genuine.

***

Simon Mawhinney is Managing Director and Chief Investment Officer from Allan Gray Australia, a contrarian fund manager with equity, balanced and stable funds. The Allan Gray Australia Equity Fund held $9.5 billion as at 31 March 2023. This is an edited transcript where Simon responded to viewer questions at a webinar on 6 April 2023, hosted by Julian Morrison, Investment Specialist.

JM: Let’s start with a quick market summary. Global equities were up about 4% over the 12 months by end March 2023, but most of that came in Aussie dollar terms from a depreciating Aussie dollar. So overseas shares performed generally worse than most people realise. The Australian share market was down about 0.5% over 12 months. The market remains cautious. There are fears of recession, yet the market is not far from its all-time highs. It’s a contradiction.

Our focus always remains on valuation versus price, and we particularly look for asymmetric payoff profiles. Our contrarian approach seeks to take advantage of overreaction, looking at those types of companies where the upside may not be in the price. The Allan Gray Australia Equity Fund is essentially a diversified portfolio of contrarian ideas with about 40 stocks with high conviction in our preferred positions.

Let’s start with a question on investing in cyclically-sensitive stocks. If we go into recession, how would you expect these stocks to perform? Is there a margin of safety that you could talk about on those maybe pick one or two? And how do you view Downer in that context?

SM: If we do have a recession, it will be one of the best-telegraphed recessions in history. Everyone is expecting it, so exposure to a cyclical company when stock markets are forward-looking must mean there’s some amount priced in already for recessionary conditions. We feel some prices on offer reflect economic conditions which border on woeful.

And that's where the asymmetric profile comes from. Yes, things can always get worse but many companies are already priced for bad. And so I think there's a reasonable amount of upside despite having cyclically-exposed companies in our portfolio. Downer is an example. It has $12 billion of annual revenue and it could either do a really bad job and generate 2% to 3% margins on that $12 billion of revenue and so its earnings of $240 million to $360 million. And that would be awful. But at the good end of the spectrum, it could perform in line with its peers and earn 5% margins and get $600 million earnings. There have been changes at Downer which I think are very positive. I have oversimplified it but I don't think we will lose our shirt if Downer does a poor job but we stand to benefit greatly for our investors if Downer does a good job.

JM: Why have you reduced energy exposure so much? Is it to take profits and reinvest into other ideas representing value, or is it due to stock valuations?

SM: It's a combination of both of those things. The upside to a company that has risen in price is by definition lower than it was when the share price was much lower, and so the discount to our intrinsic value has narrowed. And if we find opportunities to reallocate capital into other areas with at least as much, or better, upside than energy companies, then we introduce portfolio diversity into returns. And so we now have a portfolio which is more spread across a lot of different thematic, although we are not thematic investors. It isn't as heavily exposed to energy as it was, especially after the strong performance in some of energy companies over the last year.

JM: While Allan Gray does not predict macro events or where interest rates are heading, how do you assess value in Real Estate Investment Trusts (REITs)?

SM: The REIT sector uses independent valuations which can be used as a yardstick for value and discounts to intrinsic value. But those valuations have not changed much as cap rates have not gone up in line with interest rates. Cap rates seem low and so valuations seem overstated. We think about more reasonable long-term risk-free interest rates and premium to those risk-free rates to assess whether or not a REIT is worth investing in.

But we are not property specialists, and if we can find a better yield in another sector, that’s where we will go. We have not seen capital moving towards the REITs and there are better returns elsewhere.

JM: Yes, and there may be specific examples in property such as Lendlease where a negative sentiment may drive the price low enough to make it worth buying.

SM: Yes. Lendlease is a complicated beast that we've tried to demystify. These property companies have a large element of risk and we aim to buy them at a discount. Many of them have a reasonable amount of debt and higher earnings in the past when operating at full occupancy rents. It's unclear what the future looks like.

JM: There is some corporate activity in companies you hold such as Newcrest and Origin. Would you rather continue to own without a takeover or do you think the offers are compelling enough?

SM: I think Origin's offer is compelling although not certain because it's subject to ACCC approval, for example. But we intend to tender our shares in favour of that takeover offer and would happily redeploy the asset elsewhere. And then in Newcrest’s case, there's no firm deal by Newmont and it's a scrip approach. So we wouldn't necessarily need to redeploy the funds. Currently Newcrest is roughly 10% of the portfolio.

JM: Tech and healthcare sectors have moved around a lot over the last year and you haven't owned much of either. Do you find anything interesting in these sectors at the moment? Do you see them as more or less risky than the overall market?

SM: There are some fabulous companies that have done some great things, but the reality is they are just too expensive. We are not about investing in sexy companies that have done good things if they're very expensive, so we still have no money allocated to the tech sector. You know that is probably where most of the entrepreneurial spirit in the world is now, but it’s also where the companies are most richly priced. It won't be forever and it would be good to own some of these great companies at a much lower price.

Allan Gray and Orbis Investments will host their 2023 Investment Forum in person in many parts of Australia over late May and into June. More information about the event can be found here.

Graham Hand is Editor-At-Large for Firstlinks. Eric Marais is an Investment Specialist at Orbis Investments, a sponsor of Firstlinks. This report contains general information only and not personal financial or investment advice. It does not take into account the specific investment objectives, financial situation or individual needs of any particular person.

For more articles and papers from Orbis, please click here.