If you read the typical hedge fund headlines, you’d think institutional investors were abandoning them in droves. Common issues cited include subdued performance and high fees. In this article I discuss hedge fund performance, the role they play in multi-asset portfolios and how we manage hedge fund investments.

It’s intriguing to hear about well-known investors redeeming their hedge fund assets for performance reasons, and I’m curious about their expectations and whether they were reasonable.

Given there is a huge range of hedge funds available, it also makes me wonder if the investor had any constraints (perhaps related to resources, experience, fees or liquidity) and whether these were consistent with their expectations of the hedge fund manager. Perhaps their liquidity or fee constraints prevented them from hiring better hedge fund managers. The fact is that many hedge fund investors are pleased with their chosen hedge funds and that net flows from institutional investors have been positive for many years, with the exception of the last few months. Recent reports from Barclays (Coming to Terms) and JP Morgan (Institutional Investor Survey) confirm that, as a group, institutional investors continue to allocate to hedge funds despite what the headlines would have you believe.

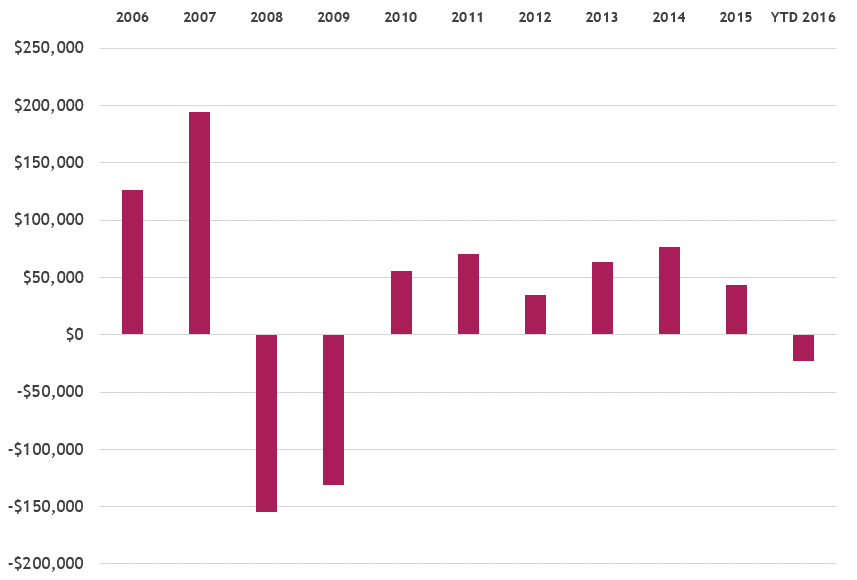

Net asset flows (US$M) to hedge funds, 2006 to 2016

Source: Alternative Investment Management Association (AIMA) and HFR.

The role of hedge funds

So what role were hedge funds expected to play in a portfolio context? Did investors expect them to have a negative correlation to equities all the time (to decrease their equity risk), or did they want a highly concentrated equity manager that increased their exposure to equities? It is important to have this well framed at the outset and to understand the associated costs.

If an investor wants a fund that is guaranteed to produce positive returns during equity down markets, are they willing to sacrifice option premium any time the market advances? The benefits we expect from hedge funds include capital preservation, lack of equity correlation during difficult market events and access to otherwise unavailable return streams.

We often see a direct comparison of returns between hedge funds and equities, normally with a headline along the lines of ‘equities outperform hedge funds’, but never the reverse. This of course could be true at any time, but does it really matter? It is worth bearing in mind that hedge funds invest across many different asset classes and target exposure levels that are quite different to equity indexes, so comparing them to any single asset doesn’t make much sense, even though it does make a good headline.

Direct comparisons also fail to take into account the different types of risks inherent in each investment. You rarely read extended stories about equities outperforming bonds, for instance, because most people understand that the risks involved in each are quite different, so it makes little sense to compare them. To this point, I find it surprising that a large number of investors think that hedge funds in aggregate are riskier than equities even though any research I have seen would point to a well-managed portfolio of hedge funds being substantially less risky than equities (in terms of capital preservation and volatility).

While we think of risk as multi-faceted, highly subjective and impossible to reduce to a single number, for the purposes of this study we’ll use volatility as a risk proxy because it has gained wide support from investors. On this basis, since 2009 we have seen a decrease in the volatility of most hedge fund returns and current levels are 20% below the average of the past 15 years. Equities on the other hand are currently running at volatility levels approximately 20% above the average for the same time period.

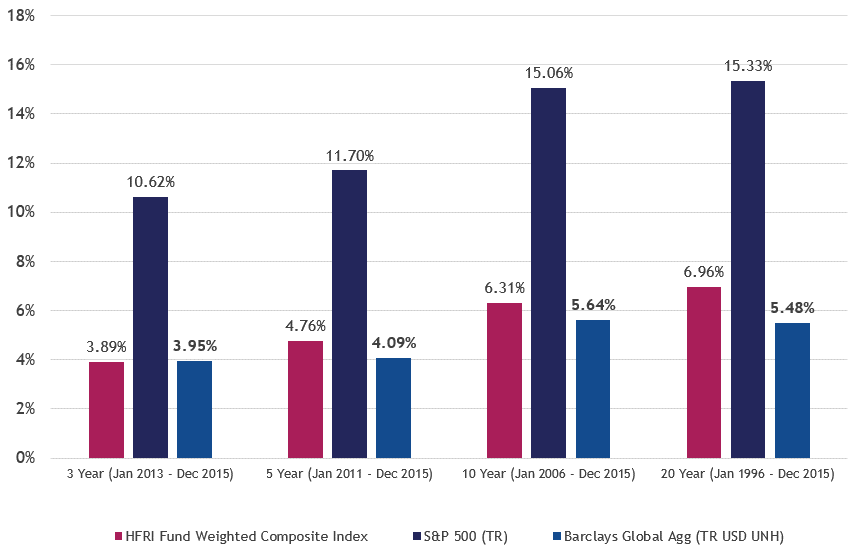

Additionally, hedge funds in aggregate display a far lower level of volatility than equities due to their active risk management. The graph below shows the significantly lower volatility of the hedge fund composite index than the main equity index.

Annualised volatility of hedge funds, S&P500 and global bonds.

Source: AIMA Research

There is a widely held but largely incorrect view that, due to the use of techniques such as shorting and leverage, hedge funds are riskier than traditional long-only equities. These techniques create different risks, but that doesn’t necessarily make hedge funds any riskier. There may be individual funds that are riskier than equities, but the vast majority of hedge funds use these techniques to reduce, not increase their risk. Of course, the results will vary among managers due to their skill in applying the techniques, but in aggregate hedge funds are substantially less risky than equities using almost any commonly accepted measure of risk.

US stocks have outperformed hedge funds in recent years, but longer-term performance going back decades shows hedge funds delivering significant outperformance, especially on a volatility-adjusted basis. At certain times, it is normal for hedge funds to underperform equities, but over time their ability to protect capital during tough times can result in their outperformance. We continue to believe that investors and financial advisers should consider the role and benefits that hedge funds can play in a diversified investment portfolio.

Craig Stanford is Head of Alternative Investments with Morningstar Investment Management Australia Limited and Chairs the Investor Education Committee for AIMA in Australia. This material has been prepared for educational purposes only, without reference to your objectives, financial situation or needs. You should seek your own financial advice.