The debate about the importance of gender diverse leadership has been settled for the most part. Companies, investors and governments have all played a part in boosting the participation of women in the boardroom and on management teams. While progress has been patchy, female representation is higher than ever in companies around the world.

It is now possible to take a detailed look at the impact of this diversity on the way companies operate, and to see if it creates opportunities for investors.

Realindex’s research report, ‘Beyond Lip Service: tracking the impact of the gender diversity gap’, is based on a global data set spanning over 2500 large cap companies, in 30 countries, over more than a decade. It looked beyond easy-to-find board diversity data, to include executive team composition.

The findings of the data are clear: more gender diverse leadership teams deliver better performance outcomes.

Diversity and firm performance

To understand the potential drivers for gender diversity, we looked at firm level attributes of the global large and mid-cap companies using the MSCI ACWI index. The correlation of gender diversity was examined with a variety of firm specific characteristics: the type of indicators that we would look for in our quantitative company analysis process.

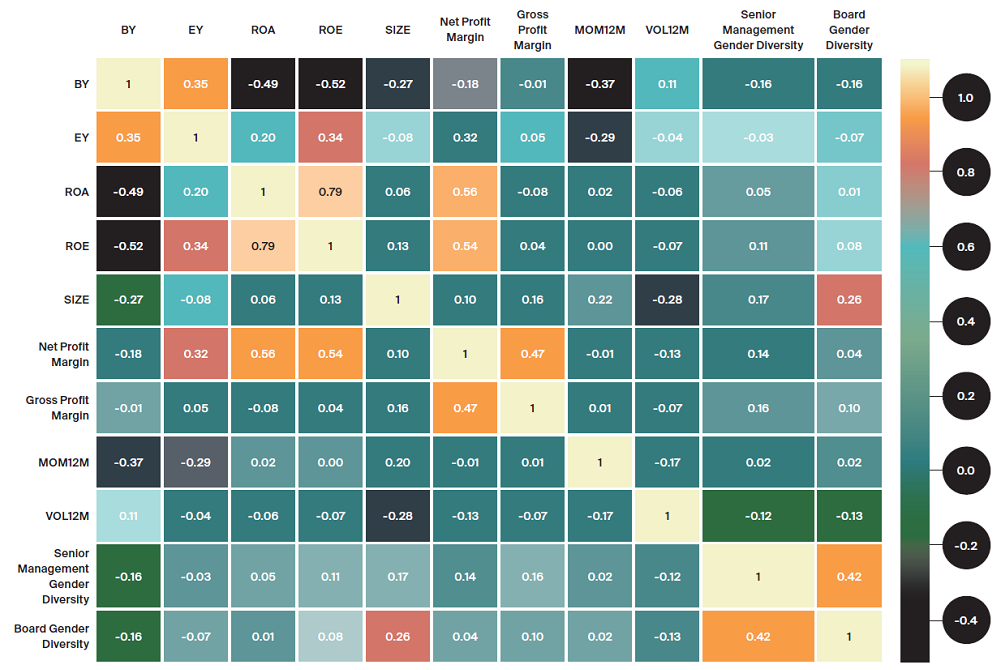

Table 1 reports the average cross-sectional correlations of the firm gender diversity (as captured by the percentage of females in senior management - senior management gender diversity, and the percentage of females on the board – board gender diversity) with a number of firm characteristics. The highest correlation of 1 is represented in the lightest colour, and the lower correlations are shown in the darker colours.

Table 1. Correlation of gender diversity metrics with other firm characteristics MSCI ACWI

Source: FactSet, Realindex, 1 January 2009 – 31 December 2021

Note: For the purposes of this study, we define senior management as the chief executive officer, and their direct reports which would typically include, the chief financial officer, chief operating officer, head of human resources, and chief legal officer.

We found that gender diverse firms (both board and senior management) are typically higher quality firms, where gender diversity has positive correlation with return on assets (ROA), return on equity (ROE), and profit margins (Gross and Net Profit Margins). They also tend to have higher price returns over the previous year (MOM12M) and lower market volatility as evidenced by the negative correlation to 12-month price volatility (VOL12M).

We also found that larger capitalised firms (as captured by Size) tend to have higher diversity, especially in the boardroom, while diverse firms also appear to have high valuation multiples, as seen by the negative correlation between the diversity metrics, and book yield (BY) and earnings yield (EY).

Diversity and future operating performance

The questions that follow are:

- Has increased female representation made a meaningful impact on firms by improving their operating outcomes?

- Does senior management gender diversity have a more material impact than diversity in the boardroom?

The central proposition behind this is that diversity in management, and leadership more generally, would lead to greater innovation and, in turn, better financial or operating performance. To answer these questions, we looked at whether there is a link between diversity and profitability / performance of the firm.

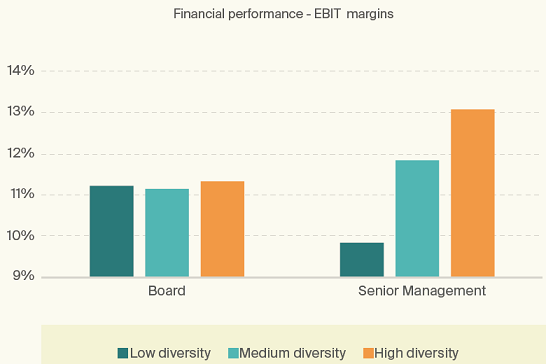

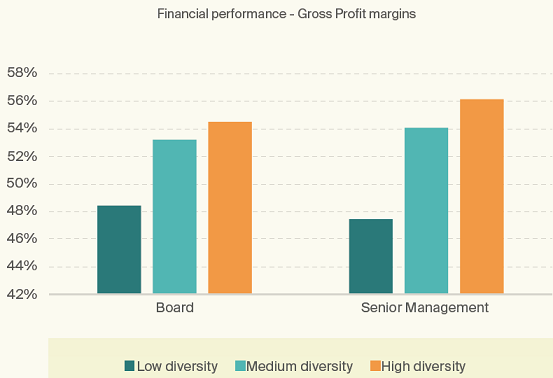

For both board and senior management gender diversity, we analysed profitability metrics commonly investigated in other studies, such as gross and net profit (EBIT) margins. Some interesting results emerge over the sample period, as highlighted in the charts below.

- In any given year, higher-diversity firms (those approximately in the top one-third of all firms) have about 20% higher margins in the following 12 months than lower-diversity firms (those approximately in the bottom one-third of all firms).

- In terms of EBIT margins, diversity in senior management is correlated with approximately 30% higher future profit margins, while the diversity at the board level board has less significant effect.

Figures 1-2. Gender diversity and one-year ahead margins

Source: FactSet, Realindex, 1 January 2009 – 31 December 2021

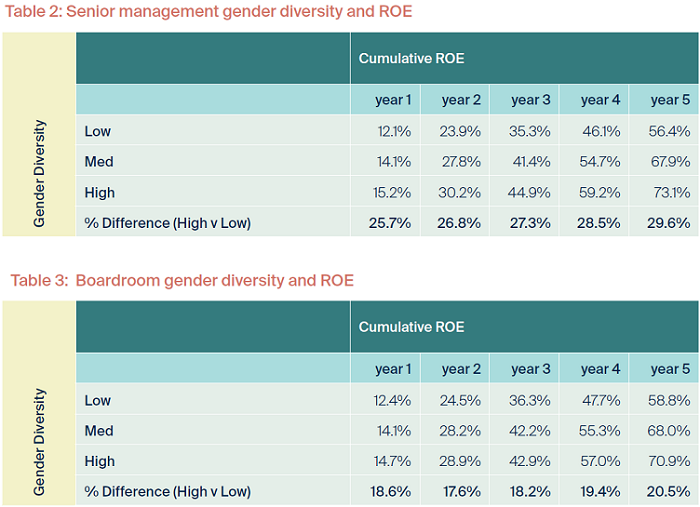

Our analysis then examined future operating performance over multiple years by testing whether the Return on Equity (ROE) of a firm is impacted positively by gender diversity. To do this, we again ranked firms based on their level of senior management or boardroom gender diversity and examined ROE performance over the next 5 years.

The data (in the tables below) shows that for senior management, higher-diversity firms are able to generate cumulative ROEs that are almost 30% higher than lower-diversity firms over a 5-year period. Similarly, for boardroom diversity, cumulative ROE for high boardroom gender diversity firms outstrips firms with low diversity, by 20%.

Source: FactSet, Realindex, 1 January 2009 – 31 December 2021.

Testing the findings

To understand whether these results are robust, we examined whether the relationship remains after controlling for several other common factors, in order to determine if diversity is essentially just picking up other characteristics of the firm that are known to be related to future operating performance.

This analysis confirmed the results shown earlier and revealed several insights:

- Controlling for sector and region effects, as well as other firm level characteristics, both senior management and board gender diversity are strongly statistically significant in predicting future firm level profitability.

- For either metric, we can see that firms in the top decile of gender diversity are able to generate approximately an additional 5% of ROE over the next five years, compared to firms in the bottom decile of either diversity metric, after controlling for other effects that drive firm performance.

- Furthermore, despite their correlation, the presence of both diversity metrics within the same regression does not invalidate the significance of either metric. In fact, we find that firms in both the top decile of senior management and board diversity generate approximately an additional 10% of ROE over the next 5 years compared with firms that have low (bottom decile) diversity in both senior management and the board. This suggests the importance of gender diversity for both boards and senior management teams, as predictors of financial performance.

Overall, the data sends a clear message: companies with a boys’ club approach to leadership are a red flag for investors.

On the other hand, companies that walk the talk on women in leadership roles perform better, potentially making them more attractive investments.

Beyond this, we must not forget that equal representation is the right thing to do. This study has focused on gender diversity in leadership roles, but we acknowledge diversity is multidimensional, such as diversity in skills, experience, and backgrounds. Future work will look to see how we can build a more comprehensive picture in team diversity, thereby gaining greater insights into the management quality or organisational capital of the firm.

Dr Joanna Nash and Dr Ron Guido are Senior Quantitative Portfolio Managers at Realindex Investments, a wholly owned investment management subsidiary of First Sentier Investors, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor.

For a more detailed look at levels of gender diversity in companies by country and sector, read the full report here.

For more articles and papers from First Sentier Investors, please click here.