The proposed departure of the UK from the European Union could lead to other difficulties and defections, and the US will be more insular under the Trump presidency. These trends point to an even greater need for Australia to consolidate its future in its own region of the Asia Pacific, and indeed in the wider arena of Asia.

In 2017, the shares of world GDP are forecast to be: Asia Pacific (33%), Indian Sub-Continent (9%), North America (19%), Central and South America (6%), Western and Central Europe, mainly the EU (17%), Eastern Europe (4%), Middle East (7%) and Africa (5%). These are higher shares than contemplated for the two Asian regions just 18 months ago.

Asia’s place in the world

Calendar 2016 was a landmark year. It was the first time the GDP of the East surpassed the GDP of the West, at least in purchasing power parity (PPP) terms, which is the most important measure of economic size. And in 2017, Asia, at over 42% of the world’s GDP, will exceed Europe and North America combined.

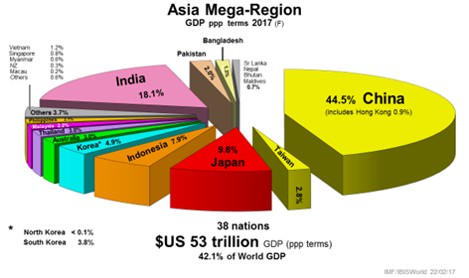

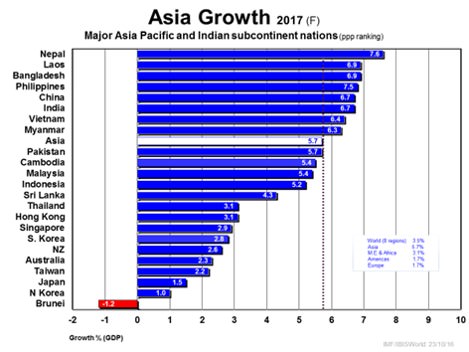

Asia’s economic composition in 2017 and its growth prospects, broken up by nations, are shown in the two following exhibits, the giants being China, India, and Japan.

Australia’s place in the world and region

Australia is tiny, at 3% of the region’s GDP, yet that still puts us as the 19th largest economy in the world of 230 nations and protectorates with 1% of its global GDP (in PPP terms). Tinier still is our population of 24.5 million at 0.33% of the world population of 7.4 billion.

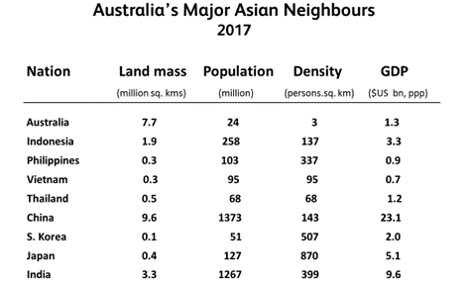

The table below is an added reminder of our smallness among Asia’s economic and populated giants, in everything except land mass.

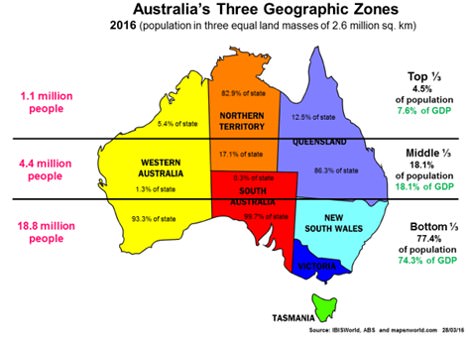

The next exhibit below shows the degree of our scarcity of population. Australia’s top one-third, with a land mass of 2.6 million square kilometres, has a population of just over a million people. Our nearest neighbour, Indonesia, with less than three quarters of that land mass, has a population nearly 250 times greater!

In case we think of the top third of our continent as dry and largely uninhabitable, that part of our land mass has 60% of our annual water supply.

There are now seven Asian cities in the world that are of a similar or greater population size than our entire nation, with its extraordinary land mass. They are: Tokyo (38 million), Shanghai (34 million), Changquin (> 32 million), Jakarta (31 million), Karachi (25 million), Delhi (25 million) and Beijing (25 million). More will follow.

None of this should lead to xenophobia of the sort we have exhibited at various times in our history. We are already on our way to becoming a Eurasian society by the end of this century, having been European in the 20th century and British in the 18th century. We will be on our way to becoming an Asian society in the 22nd Century, albeit a rich and westernised Asian society.

We are expected to have a population of 70 million by the year 2100. Even at that stage, some Asian cities will be more populated than our entire nation. So, re-evaluating our place in Asia and our relevant population – given our land mass and resources – will be an ongoing, neighbourly and moral responsibility for many generations to come. We will need big and enlightened minds in such a significant and powerful part of the world where we live and work.

Phil Ruthven is Founder of IBISWorld and is recognised as one of Australia’s foremost business strategists and futurists.