Working as a stockbroker during the .com boom, I overheard an interesting conversation.

In early 2000, the technology sector was white hot. Hundreds of small mining stocks were ditching their mineral prospects and re-inventing themselves as Silicon Valley look-alikes. The move had been underway in the US for about four years and Australia was late to the party, but CEOs were working hard to make up for lost time.

One of the best examples of how crazy things had become was Davnet (ASX:DVT). In July 1998, Davnet was trading at 1.2 cents per share. Post a tech deal and some ‘enthusiastic’ projections, Davnet reached 28.5 cents by mid-1999, and then an astonishing $2.30 by the end of the calendar year. The price pushed even higher and peaked at $6 on the 28 March 2000, turning over an astonishing $29 million on the day.

What does that have to do with the conversation I overheard? Well, in March 2000, I was sitting on the trading desk when the phone next to me rang. It was a client calling one of the older advisers. The client was doing her weekly ironing while watching a stock report on television. She phoned to demand that the adviser sell her bank and BHP shares and put it all into the latest tech hopeful. There was no discussion to be had, no advice sought. She had watched tech stocks go up for too long, and now she simply had to act.

How to anticipate a bubble burst

When the ‘old hand’ hung up the phone, he stood up, walked across to the office bell, and rang it, declaring the top of the market for tech stocks. His prediction was surprisingly accurate. Within three weeks the market peaked and the stocks turned.

What that seasoned veteran realised — and what I learned from that conversation — was that assets that are clearly overvalued can become even more expensive provided there is someone left to buy them, that is, a marginal buyer. The point at which everyone who is capable of buying has bought means there are no more buyers and the bubble will burst. In the case of the tech boom, stocks had been hugely overvalued since the beginning, but it wasn’t until the buyers were exhausted that we saw the eventual peak.

We can spend an enormous amount of time and energy working out what something is worth to the fourth decimal point and, of course, understanding the fundamental or intrinsic value of an asset is paramount to successful investing. However, fundamental valuations fail to assist in understanding the investor mindset. If something is cheap but there is no marginal buyer, then guess what — it remains cheap. Let me repeat that: if something is cheap but there is no marginal buyer, it remains cheap. Similarly, if something is fully, or overvalued, but a large proportion of the likely demographic has yet to purchase, then the pool of marginal buyers is substantial and the price may well rise considerably further.

Examining the demand profile

Let’s now apply this thinking firstly to Australian listed equities and then secondly to the Sydney property market. For the purposes of this discussion, let’s remain in the helicopter (high level) and put valuations aside, focussing on the demand profile.

In the case of Australian equities, a number of things stand out. Firstly, anecdotally there remains a high level of caution even to the point of scepticism. Cash levels remain elevated. Stock weightings remain below historic norms. In short, the asset class looks to be under-owned.

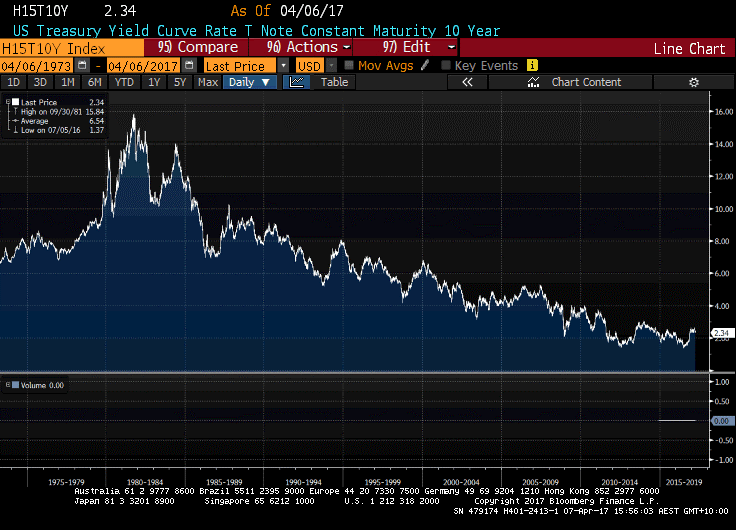

Secondly, and even more importantly from a demand perspective, the 34-year bull market in bonds looks to be over. For 30+ years, bond yields have headed south, driving bond prices higher. This is now reversing. Bond prices are declining as the yield curve grinds higher. As we have seen with renowned bond investor Bill Gross, we have reached the inflection point and the risks are now materially higher.

Why is this significant? Because the bond market is substantially larger than the equity market. Globally the bond market is in the order of US$100 trillion versus all equity markets combined of circa US$64 trillion. If even a small percentage of investors reduce their exposure to bonds and re-allocate to equities, the effect of this ‘marginal buying’ would be pronounced.

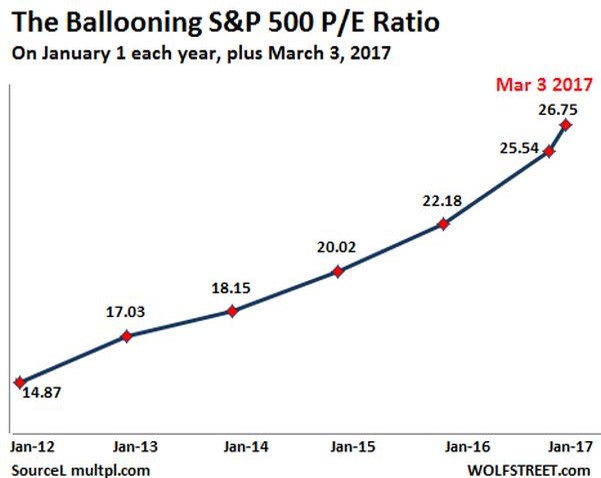

I suspect this is already well underway — certainly in the US at least. Shares, which are fully valued in an historical context, continue to rise because of the ‘weight of money’: the marginal buyer switching from bonds to equities.

If we now turn our attention to Sydney property, there are possibly four main groups that constitute the ‘demand profile’.

The first of these is the home-owner, the spent buyer. Whilst this group may upsize or downsize and may dominate turnover, their net impact on demand is neutral. So, it is really the other three groups that provide the marginal buying.

Second is the investor pool. Traditionally this category has been one of the major drivers, accounting for up to 40% of demand. This group is clearly in the sights of the regulators, with a directive from APRA this month instructing lenders to restrict growth to this segment to a maximum of 10%. With additional pressure being applied through the percentage of interest-only loans, lending value ratios (LVRs) and net interest margin (NIM), this group is post-peak and on the way down.

Third is those non-owners wanting to buy their primary residence. This pool now appears more stretched than ever on two fronts:

a) those who can afford to buy have already capitulated and bought and,

b) the remainder looks less able to buy than ever.

On this second point, Demographia’s 13th Annual International Housing Affordability Survey (2017) is telling, finding that Sydney is now the second most unaffordable major housing market in the wold behind Hong Kong.

Offshore buyers a critical factor

This leaves the heavy lifting — the marginal buying — to the much-maligned offshore purchaser. And this is where some analysis falls down. Whilst the off-shore buyer may only represent in the vicinity of one in ten purchases, a very high percentage of these purchases represents new buying, that is, true marginal buying. So, this category is critical, also because affordability and other metrics have less impact on their buying decisions. But while this category has the most financial capacity to continue to grow, it too appears to be post-peak given the increasing regulatory scrutiny.

It is important to remember that the supply side will be growing, so the market requires steady buying at the very least but preferably increased buying to maintain prices or drive them higher. With the three main categories of marginal buyer under duress, it’s difficult to see how demand can be maintained let alone increase.

In summary, despite both Australian equities and Sydney housing prices appearing fully valued, the outlook for each asset is noticeably different. In the case of Australian equities, there is latent demand in the system. In the case of Sydney property prices, the marginal buyer may have been largely marginalised!

Romano Sala Tenna is Portfolio Manager at Katana Asset Management. This article is general information and does not consider the circumstances of any individual.