The return of cash as an income yielding asset has transformed the investment landscape. For so long the ugly duckling, cash now provides serious competition for every other asset. Stocks, bonds, hybrids, and other assets all need to justify why investors should pay a premium for them versus the safety of cash. That’s especially the case for investors searching for steady income.

Let’s look at the pros and cons of different assets for those seeking regular income, from the lowest yielding to those offering better yields.

Bank savings/money market funds

Bank savings accounts don’t yield much, especially at the major banks. Outside of that, it gets better but often with lots of strings attached.

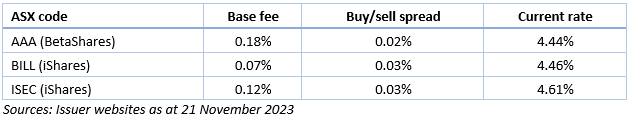

An alternative is ‘cash’ ETFs. These ETFs can get you a higher yield and good liquidity. The main choices are as follows:

AAA is the market leader and offers the best liquidity and tightest spreads. It’s become a popular place to leave cash with better rates than bank saving deposits. However, it’s also the most expensive on fees, making the others more attractive if money can be left in cash for a while. ISEC carries more risk than the others as it can hold up to 20% in floating rate notes.

Term deposits

Investors have been pouring money into term deposits and for good reason. They’re an attractive option for many investors seeking income. The good news is that banks have improved their offers to attract more depositors. Even the major banks have upped their game after badly lagging for the past 18 months:

- Commonwealth Bank has a ‘special offer’ term deposit of 5.05% per annum (p.a.) for personal and SMSF customers for 12-23 months.

- ANZ offers a 5.05% p.a. term deposit for 12-24 months.

- Westpac has done a little better, now offering 5.10% p.a. over 12-23 months.

- NAB is at 5% p.a. for a 12-month term deposit.

As is often the case, there are better deals outside the major banks. Macquarie had been aggressive in attracting term deposits though that seems to have recently changed. It now offers a 5.05% p.a. term deposit, largely in line with the big banks.

ING has one of the highest term deposit rates at 5.3% p.a. for 12 months. Judo Bank isn’t far behind at 5.25% p.a. over the same period.

A curious development is that many of the banks which were the most aggressive with their term deposit rates had previously attached many conditions to their offers. I’m thinking especially of ING and Macquarie. However, most of those conditions now seem to have been dropped.

It pays to know the particulars of the banks’ term deposit offers. Here are a few suggestions:

- There are different rates for term deposits paid at maturity and those paid monthly. Know the difference and what suits your needs best.

- Know the penalties for withdrawing money from a term deposit early - they vary significantly.

- Always read the terms and conditions carefully. There may be other ‘nasties’ in there. I read in ING’s terms that it can change the terms and conditions whenever it likes. That’s not nasty, and it might be standard practice, though it’s good to know who’s holding the whip hand in the relationship from the start!

In my own case, I bank with two of the majors though recently chose to open several Judo Bank term deposits, from 3 to 12 months. I found the process both quick and easy.

The big positive for investing in term deposits is that you lock in an attractive yield. The downside is that every term deposit still trails the current inflation rate of 5.4%. So, you’re losing money in real terms.

That may not remain the case if inflation continues to fall yet it remains a risk. And that’s where potential alternatives for getting better yield come into play.

Bonds

Bonds have had a miserable three years, though don’t let that put you off (it’s probably bullish).

10-year government bonds are regarded as ‘risk-free’ as the government will always pay you back. In Australia, these risk-free bonds are yielding 4.48%. That’s reasonable, though down from the peak of 4.98% at the end of October. Many bond funds with a mix of federal and state government bonds offer yields of more than 5%.

Investment-grade corporate bonds have even more appealing yields, anywhere between 5.75% and 6.5%. Note that corporate bonds are riskier than government bonds given their exposure to corporate balance sheets.

ETFs with high quality government and corporate bonds can be a good option. Two of the most popular are Vanguard’s Australian Fixed Interest Index ETF (ASX:VAF) and iShares Core Composite Bond ETF (ASX:IAF). They’re yielding 4.95% and 5.91% respectively.

There are different types of bonds that offer even better yields. For instance, Australian commercial mortgage and private debt have yields of 10-12%. These are potentially compelling as they offer the prospect for equity-like returns with less risk.

Even further up the risk spectrum, there are insurance-linked bonds with yields of up to 15%. These bonds are based on insurance payouts from weather events, and therefore are highly risky and suit sophisticated investors.

With bonds and all assets, the higher the potential rewards, the greater the risks. And vice versa. The trick as an investor is to find the reward versus risk that meets your return expectations and risk profile.

A key benefit of owning government-related bonds is that if an economic slowdown happens in future, bond yields are likely to fall and prices to rise. That way, an investor can get both income and capital appreciation from owning bonds. That’s something that you can’t get with cash.

The greatest risk from owning bonds is inflation. High inflation means rising rates, and bond prices move inversely to rates. It’s noteworthy that 10-year government bond yields are well below inflation at present, which means these bonds are losing money in real terms.

Stocks

For a pick-up in yield, stocks are an obvious option. The ASX 200 is trading at more than 17x trailing price -to-earnings or an earnings yield of 5.81%. On the face of it, that’s not great value compared to the yields of risk-free bonds or term deposits. You’re not being paid enough to compensate for the risks of holding stocks.

The dividend yield on the ASX 200 is 4.44% or a grossed up 6.34%. That’s reasonable, without being outstanding.

As for individual stocks, the banks are a place to start for yield. Yes, they aren’t growing much and may struggle to grow in future. Yet, they are a quasi-oligopoly that should generate adequate returns on capital. Dividend yields on the major banks range from 4.35% at CBA (ASX:CBA) to 6.4% at ANZ (ASX:ANZ) with NAB (ASX:NAB) and Westpac (ASX:WBC) falling in between. These are net yields, and on a gross basis, they look very good.

Outside of the banks among large caps, commodity stocks offer nice dividends though their sustainability and consistency are always the question mark.

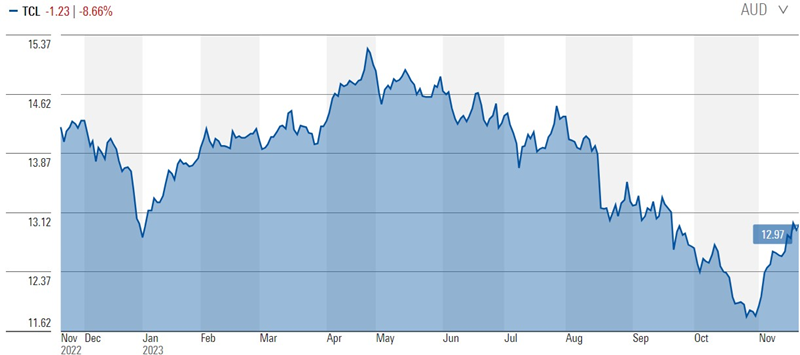

Of the top 25 stocks, Transurban (ASX:TCL) looks interesting, with a dividend yield of 4.47%. The stock is far from cheap, though the yield is attractive.

Source: Morningstar

Coles (ASX: COL) is another one that seems reasonable from an income viewpoint. The stock sports a dividend yield of 4.32%. Coles has some headwinds, especially with its inability to execute as well as Woolworth. Though in my experience, ascendancy among the supermarket duopoly tends to ebb and flow over time. The critical point is that the duopoly needs to stay intact and if that happens, then returns and dividends should be ok.

Source: Morningstar

Dividend ETFs

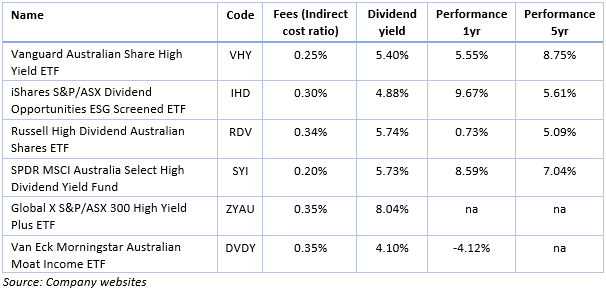

Of course, the other option is to buy a dividend ETF instead of individual stocks. Here are the main dividend ETFs listed on the ASX:

Vanguard’s VHY is by far the most popular dividend ETF, followed by State Street’s SYI.

It’s important to note that each of these ETFs use a different methodology to come up with their underlying holdings.

One potential drawback of these ETFs is that none of them offer fully franked dividends. The level of the franking depends on the franking offered by their underlying portfolio companies.

More broadly, it’s worth mentioning that dividends rely on earnings, and in an ideal world, you want a growing stream of earnings that can pay a growing stream of dividends. It’s not only about the starting dividend yield of an ETF or stock, but what that yield may look like in future.

Also, one potential issue for investors is that stocks and dividend ETFs are unlikely to deliver regular, consistent dividends. The reason is that when there’s a sharp fall in earnings, there’s normally a corresponding fall in dividends.

That said, grossed up yields of 7-9% for solid, growing stocks are worth investigating given their superiority to the yields offered from government bonds and cash.

Listed investment companies

Listed investment companies (LICs) are a popular alternative for ASX dividends. One advantage that LICs can build up cash reserves to pay consistent dividends through an economic cycle. For instance, several of the blue-chip LICs were able to continue to pay steady dividends through the pandemic despite falls to their net asset values (NAVs).

A disadvantage of LICs is that the prices of many seem stuck at perpetual discounts to NAVs. Investors have soured on the structures and fees of LICs, and NAV discounts have proven difficult to remove.

That said, there are a handful of solid, long-lasting LICs that offer the prospect of steady, growing dividends. Australian Foundation Investment Company (ASX:AFI) and Argo Investments (ASX:ARG) are standouts in this regard. Whitefield Investments (ASX: WHF) is smaller yet has a good track record.

Washington H. Soul Pattinson (ASX:SOL) is sometimes referred to as an LIC but it isn’t. It’s a family-run investment company with a long history of outperforming the ASX and delivering strong dividends.

Hybrids

Bank hybrid notes – combining features of both equity and debt - have been hugely popular among investors in recent years. With major banks offering 6-8% yields, and smaller banks more, it’s little wonder they’ve been well received.

I have been, and remain, more cautious on hybrids for a few reasons. The first is the APRA review into hybrids. This might change the ballgame. It’s likely that APRA will change the product terms to make it clear to banks and investors that in times of financial distress, distributions may be missed and AT1 will be converted into equity, or even written off. In other words, APRA will probably want to make it clear that distributions aren’t safe at all costs.

The second reason is that bank hybrids are relatively new products in Australia, and they haven’t been tested across an economic cycle, especially during a serious economic downturn.

Other assets and issues

For the sake of brevity, I’ve only covered the major assets in this article. I also haven’t addressed tax issues with the different assets, or the specific income needs of SMSFs and retirees. That’s for another article.

James Gruber is an assistant editor at Firstlinks and Morningstar.com.au