In fixed income investing, there are two conventional sources of return that investors are familiar with: collecting interest payments from bonds (i.e. income) and correctly predicting the direction of rates, which delivers capital gains or losses (i.e. duration exposure). The expected returns from both these sources are heavily challenged by the current low levels of interest rates and credit spreads, as well as uncertainty about their future direction.

But what if there was another source of returns that could help restore balance to fixed income portfolios? At Ardea, we believe that source of return is relative value fixed income investing.

Relative value strategies can deliver positive returns from fixed income, irrespective of the current level or future direction of rates and credit spreads. Conventional approaches tend to miss these opportunities. Conventional return sources are challenged at the moment and simply holding government bonds is no longer a reliably defensive strategy.

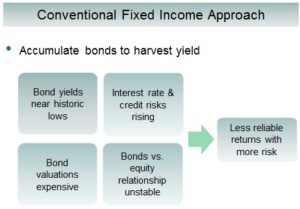

Conventional fixed income return sources are challenged

For investors seeking a defensive investment, fixed income has traditionally been the asset of choice. The debt markets, by offering a senior claim above equities on the assets of a company or government can provide a safer option for investors’ capital. In addition, bonds can provide a stable stream of income as bond issuers are contractually obliged to make regular interest payments, unlike equity dividends, which can be cut at any time.

However, three challenges currently face those reliant on fixed income to provide reliably defensive returns.

The first is that low interest rates have eroded the yield cushion in fixed income. We can think of the income from a bond as a ‘yield cushion’ because that stream of income (or yield) helps cushion investors’ capital against losses if rates rise. When rates are low, the yield cushion is thin, giving little protection against potential capital losses.

For example, as bond yields rose in late 2016 and early 2017, 10-year Australian government bonds incurred a capital loss of around 10% over 6 months, compared to interest income of just 1.13% over the same period.

Hardly what you expect from a ‘defensive’ investment. Add to this, the fact that central banks around the world are signalling a shift away from the extreme stimulus that has kept rates suppressed since the 2008 financial crisis. Investors are now left with less return for more risk.

The second is that bonds are not as reliable a risk diversifier as commonly assumed. An allocation to bonds is supposed to provide a buffer when equity markets fall, as bond yields should decline and thus bond prices rise.

The starting point of bond yields is already close to zero. In addition, while this bond-equity correlation has held in recent history, a longer perspective shows that it’s actually quite unstable. It is sensitive to shifting interest rate and inflation paradigms, just like the one we’re currently seeing in the US.

The third is that ‘credit creep’ in fixed income portfolios has further compromised the defensiveness of fixed income portfolios. The ‘reach for yield’ means larger allocations to higher yielding credit assets, with more risk in the form of defaults, credit spread volatility and illiquidity.

'Credit tourists' accepting these risks

In the desperation for yield, defensive portfolios that wouldn’t normally take these types of credit-related risks have been forced to become ‘credit tourists’.

In benign markets, credit assets tend to perform independently of equities (i.e. they have low correlation to equities). But in times of market stress, say during a recession, they often become highly correlated and incur capital losses as equities fall, just when the defensiveness of fixed income is most needed. This risk has been masked by the current bull market, resulting in a build-up of hidden equity 'beta' in fixed income.

Particularly concerning is the growing evidence of late cycle credit risks. Corporate borrowers are taking advantage of cheap debt and weakening creditor protection in bond and loan terms. The extreme ‘reach for yield’ behaviour includes a BBB-rated European company issuing a bond with a negative yield. That’s right, a company with real default risk being paid to borrow money! This is the kind of behaviour you might see towards the end of a party. Seems like a good idea at the time, but the next morning not so much. This topic is discussed in Ardea’s publication: “Corporate bonds – More Risk for Less Return”, available here.

What’s the alternative and why does it exist?

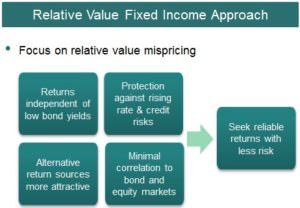

Conventional fixed income approaches focus on how much yield can be earned from buying and holding a bond. In contrast, a relative value approach specifically identifies whether that bond is mispriced relative to other related securities with similar risk characteristics and therefore has potential for its price to rise or fall. A profit can then be monetised when the relative mispricing corrects, and capital can be recycled into the next opportunity.

Fixed income markets have a vast range of liquid bonds and derivatives giving diverse opportunities to exploit. Rotating through many modestly sized and uncorrelated relative value positions can deliver more stable returns with lower risk than portfolios with large concentrated bets on market direction. Positions can be isolated from unwanted market risks by using risk management tools such as derivatives, meaning relative value portfolios can seek returns independent of the current level and future direction of interest rates.

Fixed income markets are inefficient. Underlying structural factors such as regulation, investor mandate restrictions, market segmentation and varying investor objectives have always existed in fixed income. These forces give rise to buying and selling flows that are non-economic in nature (i.e. they’re not focused on maximising profit). Examples include banks managing their balance sheets, insurance companies hedging liabilities, passive investors tracking benchmarks and central banks pursuing policy objectives. These drivers of market inefficiency are structural in nature and persistent through time and across market cycles. The reliable source of returns allows for a repeatable investment process.

What can relative value do for you?

A relative value approach does not rely on accumulating bonds to harvest yield or trying to predict market direction or reaching for yield in credit and is therefore not vulnerable to those challenges. It can include specific strategies to protect against extreme negative scenarios, for example, by using interest rate options that profit from rising volatility. The end result is the potential for stable returns exceeding cash or inflation.

The opportunities provide compelling diversification benefits when used alongside traditional government bond, credit or equity investments, as indicated in the diagram below.

Gopi Karunakaran is a Portfolio Manager at Ardea Investment Management and Sam Morris is an Investment Specialist at Fidante Partners, a sponsor of Cuffelinks. This article is for general information only and does not consider the circumstances of any individual.

For more articles and papers from Fidante, please click here.