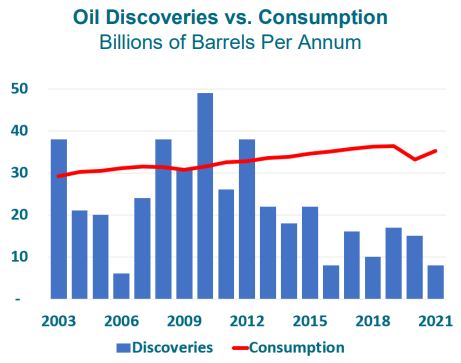

The biggest crisis facing the world economy is a lack of cheap energy to drive economic prosperity and growth. Three quarters of the world’s energy comes from fossil fuels, but underinvestment in exploration over the past decade has resulted in the world consuming three times more oil than was discovered.

The west is now highly dependent on OPEC and Russia for its oil supplies making it exceptionally vulnerable. Spare capacity is minimal, and the US and Europe have drained their emergency reserves to hold oil prices down, lulling people into a false sense of security. China’s lockdowns have tempered oil demand but recent moves to reopen will add further pressure to the global oil market.

The great energy transition to wind and solar power has so far had very little impact on demand for fossil fuels. What is scary is that governments continue to endorse the renewables transition despite having no clear plan as to how their intermittency will be addressed. Enormous batteries are still way too costly, so expensive back-up generation is required, resulting in rising energy costs for consumers.

The CEO of Origin Energy recently called for “honesty” with the Australian public about the increase in electricity bills required to finance the “truly staggering” investment necessary to meet Australia’s 2030 emissions target.

What can be done?

From what we can see, the only realistic way to provide clean, affordable, and reliable energy to the world’s growing population is to go nuclear. Europe is finally waking up to this with the UK, France, Poland, Netherlands, and Belgium restarting their nuclear programs.

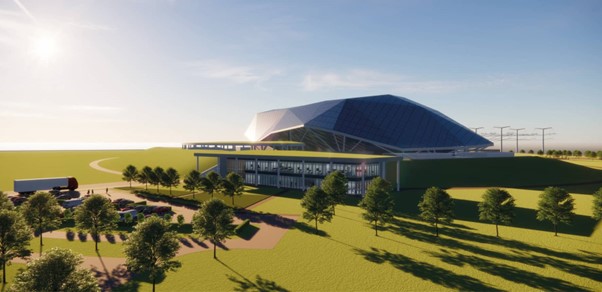

Companies such as Rolls Royce are developing new cost-effective small modular nuclear reactors that can be built in factories and transported on trucks whilst incorporating fourth generation safety features.

Rolls Royce - Modular Reactor Design

However, building nuclear generation will take a long time. In the meantime, we have a growing world population that aspires to improved standards of living. Oil, gas, and coal will therefore be with us for some time to come.

Easy money and inflation

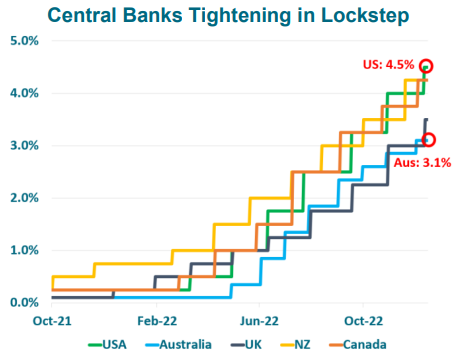

The energy crisis is reinforcing the inflation nightmare the world faces. As we all know the inflation genie is out of the bottle and interest rates are rising faster than at any time in recent history. Central bankers were slow to react in 2021 deeming inflation ‘transitory’ and face an uphill battle to regain credibility. They are now marching in lockstep to rein in the inflationary beast.

In the wake of COVID, the lowest interest rates in history fostered a speculative boom bigger than any other, with people betting on nearly anything that walks or crawls.

The crypto craze was symptomatic of the boom, with investors buying ‘assets’ that pay no interest or dividend, are far from secure, chew up valuable energy and have endless competitors as promoters conjure up new coins and sell them to the unsuspecting public.

Similarly, profitless tech stocks have been punished. The destruction is highlighted by the 80% collapse in the share price of the high-profile ARK Innovation Fund. ARK soared in 2020 and 2021 as risky technology stocks took off, the majority of which have now sunk.

These are the canaries in the coal mine. Throughout history, reckless risk taking has always led to disaster.

Governments seem ill-equipped for challenges

Governments and central banks seem ill equipped to handle the plethora of economic problems the world faces.

Modern monetary theory which professed that printing money, known as quantitative easing, could solve our problems has now been completely discredited. Markets are ultimately bigger than any government, proven by George Soros breaking the British pound. More recently, Liz Truss met her Waterloo when her proposal to cut taxes and run huge deficits led to soaring interest rates and the pound collapsing once again.

Philip Lowe, the Governor of the Reserve Bank of Australia, is one of the world’s first central bankers to admit to all the problems. Dr Lowe recently warned that de-globalisation, fewer working-age people, rising barriers to trade and the revival of the trade union movement will affect both living standards and price levels. Additionally, he highlighted that the renewable energy transition was leading to insufficient investment in traditional energy sources, resulting in “higher and more volatile energy prices”.

The boom in asset prices over the past decade will be hard to repeat considering the headwinds economies and markets confront.

Governments will be keen to tax anything that moves. The British and German governments have already started upping taxes on oil, gas and renewable producers and the Australian Federal and Queensland governments are following suit.

With budget deficits worsening, tax departments have their sights set on multinationals, but there will be pressure for taxes to rise across the board. As we commented earlier the outlook is inflationary, however this could swing deflationary at the drop of a hat if further interest rate hikes cause a crash in stocks, bonds, and property, similar to what happened in 1987.

How our fund is positioned

Given the precarious state of the world economy and unstable asset markets, we are maintaining 12% of the Trust in gold and 39% in Treasury Bills that now yield 4.5%.

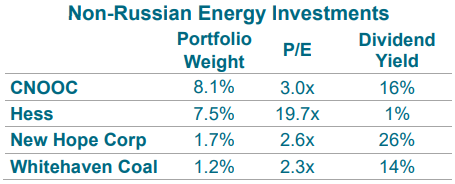

We currently have 19% of the fund in non-Russian energy related stocks that are earning huge profits and paying big dividends. We have another 7% in Russian oil and gas stocks that are also making large profits, but foreigners remain unable to trade and hence they are valued at a 48% discount to Moscow Exchange prices. All our energy companies have huge reserves and bright futures in an energy constrained world.

Our biggest holding is China National Offshore Oil Company (CNOOC), which is one of the world’s preeminent oil producers, and is among industry leaders in production growth, profit margins and returns on capital. CNOOC is also incredibly cheap, capitalised at $60 billion, it will produce 500 million barrels of oil this year, generating a profit of around $20 billion.

Further to this, CNOOC owns 25% of the world class Starbroek block in Guyana, with Exxon and Hess. The Starbroek field has a resource of 12 billion barrels of oil, with analysts predicting it to eventually surpass 20 billion barrels. Production is aggressively ramping up over the coming decade.

Hess also remains excellent value thanks to its 30% interest in Starbroek and its significant US shale oil assets, which generate huge amounts of cash at current oil prices. Hess’s interest in the “discovery of the decade” makes it a prime takeover target.

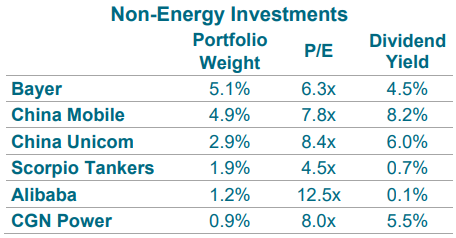

Our non-energy investments are all in resilient industries and have sound balance sheets, so can hold their own when things get tough. Further, they are priced attractively.

We recently acquired shares in Alibaba, China’s leading ecommerce business after its share price fell 70% from its 2020 peak. Revenues and profits are growing soundly, and it trades on a price to earnings multiple of just 12x. Importantly, Alibaba’s core ecommerce business is hugely profitable, in stark contrast to its major competitor Amazon which loses money on ecommerce sales.

The only non-profitable stocks we hold are Energy Resources of Australia (ERA) and Berkeley Energia, which both hold massive undeveloped uranium deposits.

Given the revival of nuclear energy, the outlook for uranium demand is positive. The problem however is that many of the world’s major uranium mines were developed long ago and are now in decline. Moreover, a substantial portion of supply comes from former Soviet states and potentially unstable African countries, making western utilities keen to source supplies from aligned countries.

Globally there are very few high-quality undeveloped uranium deposits. Arguably the best is ERA’s 300-million-pound Jabiluka deposit, discovered in 1971, prior to the formation of the adjacent Kakadu National Park. The Trust has an 8% shareholding in this incredible deposit with Rio Tinto the major shareholder.

Uranium mining has had a contentious history in Australia, and for various reasons the Jabiluka mine has never been developed. A key issue has been opposition from traditional owners; however, opinions can change.

Public perception towards nuclear energy is changing rapidly as the world recognises the need to decarbonise. A deposit of Jabiluka’s size, which can be mined with underground machinery and minimal surface impact, would provide enough clean energy to power Australia for at least 20 years.

At the current uranium price, Jabiluka’s life of mine revenue would be about $25 billion. If developed, the wealth and jobs created by this project would be enormous for both its traditional owners and for Australia. It would play a genuinely important role in the world’s carbon reduction efforts, and it could significantly enhance Australia’s relationships with its key security partners.

Willy Packer is the Founder, Managing Director, and an investment manager at Packer & Co. This article contains general information only and does not consider the circumstances of any investor. Please seek financial advice before acting on any investment as market circumstances can change.

This article has been extracted from Packer & Co's Investigator Trust Report.