A prevailing superannuation belief is that benefits of scale are so substantial and longer-term returns from small funds so relatively poor that small funds will surely fade and die. Fortunately we don’t live in such a Darwinian world, and some actually thrive: examples include small family offices and small hedge funds.

Economies and diseconomies of scale

Scale benefits likely do accrue in process-driven areas such as administration and custody, in insurance where risk-pooling reduces premia, and in passive management, an option few funds use effectively. Yet even in administration scale benefits have limits. At some size ($100 billion?) decreasing returns to scale will push net marginal efficiency gains to zero ... and beyond. Potentially more damaging are legacy issues. Mergers leave funds exposed to rival and non-communicating people and software that materially undermine scale benefits.

On the investment side the evidence is mixed. For instance, SuperRatings’ surveys of diversified funds reveals a strong negative correlation between (rankings of) size and performance over five and seven years. Contrariwise, studies of very large US, Canadian and Dutch DB funds (KPA 2006) show that after controlling for risk a ten-fold increase in funds under management (FUM) results in a 20 basis point reduction in unit costs. Based on similar data, Bauer (2011) concludes that “larger funds realise economies of scale only in their relatively minor investments in … private equity and real estate, while thus experiencing liquidity-related diseconomies of scale in equity and fixed income.” This appears to be in conflict with an EDHEC study of 7,500 private investments over 40 years which concludes that small portfolio investments outperform larger ones (EDHEC 2011). However, for the very large funds studied by Bauer most scale benefits in private equity and real estate likely derive from their direct internal management.

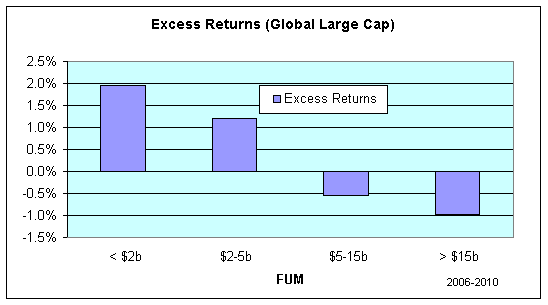

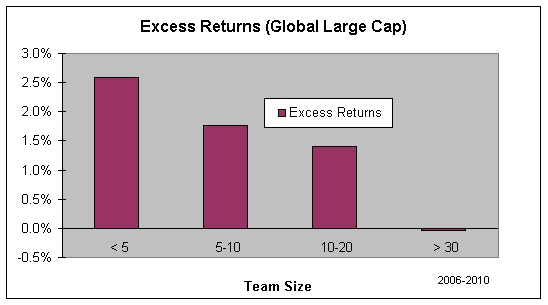

In some areas size has a known negative effect on performance. Depending on the strategy, diseconomies of scale in active listed equities can occur relatively quickly, probably around $6 billion for a ‘standard’ broad-based Australian equities strategy, and perhaps as low as $500 million for some specialised concentrated long-short strategies. As manager’s FUM grow, driven by an all too common identification of size with power and influence and encouraged by asset-based fees, performance tends to fall as a result of greater market impact and of managers protecting their reputation and business by both increasing the number of holdings and decreasing risk. Charts 1 and 2, sourced from Mercer, BARRA and Russell, speak to those effects on global equity manager performance as measured by the two (dependent) variables - FUM and number of investment professionals.

CHART 1

CHART 2

Many hedge funds recognise the damage size can inflict on their strategies and so choose to remain small which allows them to focus on being the best rather than the biggest.

PIMCO and Blackrock’s success hints at fixed income not suffering from diseconomies to the same extent. That perception may be due to the recent 15 year bull run and because global fixed income markets are huge compared to equity markets and most managers use derivatives extensively, instruments that suffer less from diseconomies.

There is evidence that smaller direct property and private equity managers outperform larger ones, which may be a result of access to smaller deals left by larger managers, greater flexibility in deal structures and pricing, and small size being a proxy for youth and vigour.

The mixed evidence suggests a healthy default hypothesis: Actually capturing economies of scale in institutional investing requires substantial organisational, investment and commercial acumen. Mere merging is unlikely to suffice.

Large can innovate and small can thrive by specialising

Prevailing dogma holds that small (and often young) organisations are hungry, flexible and innovative while large (and often old) ones are comfortable, inflexible and sclerotic due to the drag of empires, silos, egos, agents and staff alienation. Yet very large companies can be flexible and nimble (think Apple, Cisco) and even GM and the Soviet bureaucracy had pockets of hunger and innovation (think the Soviet space programme.) Forbes produces an annual survey of the most innovative large companies, an impressive list we hear little about. But even if the dogma is largely valid it’s not clear that hunger, flexibility and innovation are critical for super funds. And even organisations lacking those attributes and lacking scale can survive in our non-Darwinian market. One common source of survival is affinity, leveraging the value we ascribe to the comfort of being with ‘our own’, something CBUS and AvSuper claim to exploit although the power of default award funds likely explains most of the ‘affinity’.

But the dominant way small organisations thrive (think biotech) is through specialisation, often via single product lines, and a consequent sharp focus. Yet aside from the colour of their brochures super funds of all sizes are essentially indistinguishable in their offerings. In that uniform world, a world driven by peer risk and the fear of being different, specialisation is neither evident nor desirable, so focus is lost through a haze of complexity induced by offering everything to everyone.

Below are some inchoate ideas on how a small ($4-10 billion?) superannuation fund (‘SmallSuper’) might break from that uniform commoditisation and thrive through a degree of specialisation.

A new strategy for SmallSuper

The strategy is to identify and capture investment opportunities left on the table by large funds - a family office or old-style investment banking approach that will require substantial organisational courage, investment talent, commercial acumen, skilful governance and the courage to not do everything.

The most evident sources of opportunities are capacity-constrained strategies, particularly but not exclusively in active listed equities niche strategies. Examples include US microcap, catastrophe bonds , local residential property, South American power generation and other investments deemed too small for consultants’ businesses and that large funds ignore because of the immaterial impact on total returns. For instance, a microcap manager with $400 million capacity represents a 0.5% allocation for AusSuper even if it took all capacity, but approximately 10% for SmallSuper at which size it would have a material impact on return and risk. In the unlikely event that AusSuper or any consulting firm even knows about the strategy or the manager they will likely dismiss it, leaving the opportunity to SmallSuper.

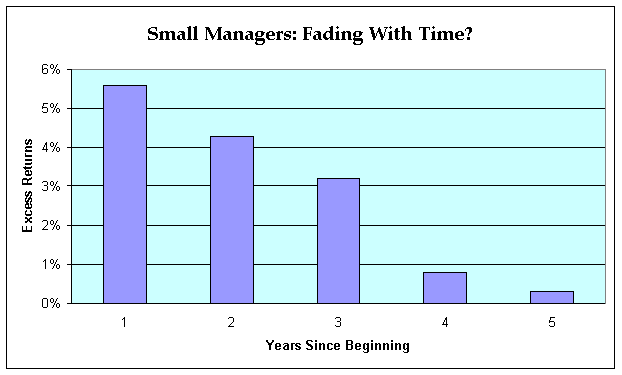

To have a significant impact on performance initially perhaps 30-50% of SmallSuper would be thoughtfully structured around similar opportunities across a variety of asset classes and strategies, allocations that would expand with experience and confidence. A major component of the expected performance boost is likely to come in the managers’ early years, as seen in Chart 3. Charts 3 and 4 are sourced from Russell studies on global equities.

CHART 3

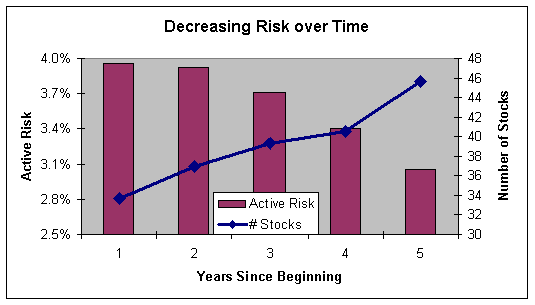

Well-documented evidence shows how in the beginning managers do outperform net of fees, but with growth not only does outperformance decline but the fraction of outperformance clients receive declines even more. With no legacy to lose young funds tend to take more risk and consequently perform better. With age and growth they tend to pull in risk to preserve their business, as seen in Chart 4, an effect likely to hold in all investment areas.

CHART 4

A further opportunity for SmallSuper lies in selective local unlisted investments. A paper by Josh Lerner (2013) shows how funds can generate strong returns by capitalising on local knowledge of local projects. SmallSuper should be able to act more quickly on many smaller or local projects provided it can effectively hedge the dangerous and ubiquitous domestic-bias risk of believing that mere propinquity creates informational and commercial advantage.

Challenges for SmallSuper

Capitalising on this strategy will require the early identification of future winners and a consequent high tolerance for immediacy risk, the risk of entering an untested strategy and manager. It will require the skills, temperament and strength to fire managers before comfort sets in and a consequent low tolerance for the endowment bias. SmallSuper could eventually extend its strategy by selectively incubating, seeding and taking equity stakes in new managers, an approach that contains another set of risks.

Doubtless SmallSuper’s risk profile will change and new levels of skills and understanding will be needed, along with different resources, incentives and a likely increase in costs. Critically it will require a different and more appropriate governance structure along the lines of the early US endowments. Initially those changes and charges can be partly offset by an intelligent structuring of the remaining 50-70% of the fund as a totally passive diversified fund or outsourced to a manager capable of acting as a genuine strategic partner (as compared to a tactical commodity) particularly as a source of new opportunities that provide economies of scope.

SmallSuper’s fund will be exposed to the business risk of being quite different to the mass of look-alike competitors. It can be re-positioned as the innovative higher growth fund exposed to genuinely different risks, a super fund that’s resisting the imperative to become a marketing and distribution machine at the expense of investing.

Conclusion

There are opportunities for smaller superannuation funds to distinguish themselves. To do so will require a creative restructuring of the fund designed to capitalise on being small, and the courage to remain simple, focused and different from the herd.

Dr Jack Gray is a Director of Brookvine, an independent advisor, and at the Paul Woolley Centre for Capital Market Dysfunctionality, University of Technology, Sydney, and was voted one of the Top 10 most influential academics in the world for institutional investing. Jack would like to thank Steve Hall (CEO, Brookvine) and Alison Tarditi (CIO, Commonwealth Superannuation Corporation) for criticisms and improvements. A somewhat expanded version is available at https://www.brookvine.com.au/wp-content/uploads/Can-Small-Be-Beautiful_0115.pdf