As we approach the end of 2023, a 'new normal' has emerged for investors in global equities.

Firstly, the era of quantitative easing is firmly behind us and investors need to adjust to a new environment of higher interest rates across developed markets. Further, despite its popularity, history tells us that “T-bill and chill” might not be the best approach to employ when interest rates peak.

And while equity markets have had a strong year driven by the ‘Magnificent Seven’ stocks, the rally might broaden to other sectors in 2024.

Heading into 2024

The key word for me is normalisation. We are entering an investment environment where inflation and interest rates are likely to be more normalised. The era of quantitative easing (QE) is over, and we need to start getting used to seeing real interest rates in developed markets sit between 1% to 2%, higher than levels many have been accustomed to for over a decade.

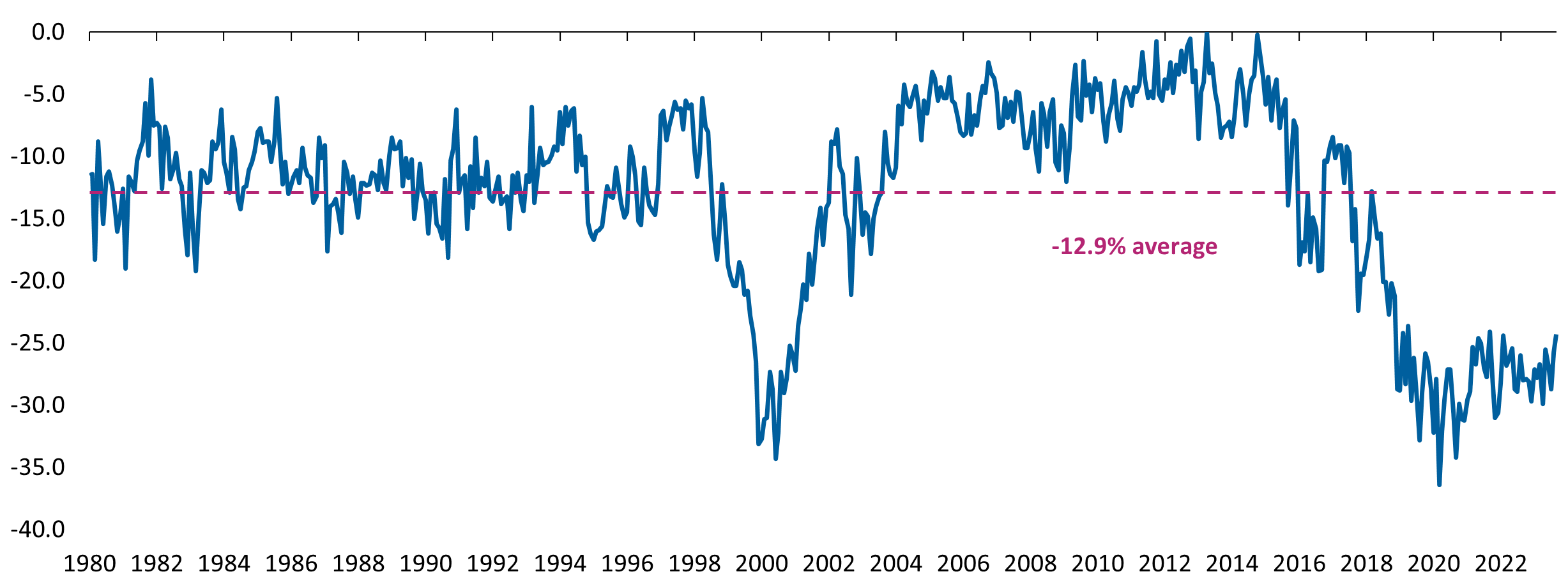

Another aspect that is normalising is the relationship between equities and fixed income. Looking at historical data, the two asset classes generated positive returns alongside one another in 33 of the past 46 years (as the following chart shows). The only year when the exact opposite happened was in 2022. But given how they have been performing in 2023, it seems that we are returning to a more normalised relationship between both asset classes.

US markets are normalising after breaking down in 2022

Distribution of stock and bond returns (%), 1977-2023

Sources: Capital Group, Bloomberg Index Services Ltd., Standard & Poor's. Returns above reflect annual total returns for the S&P 500 ("stock returns", depicted on the x-axis) and the Bloomberg U.S. Aggregate index ("bond returns", depicted on the y-axis) for each year between 1977 - September 2023. As of 30 September 2023.

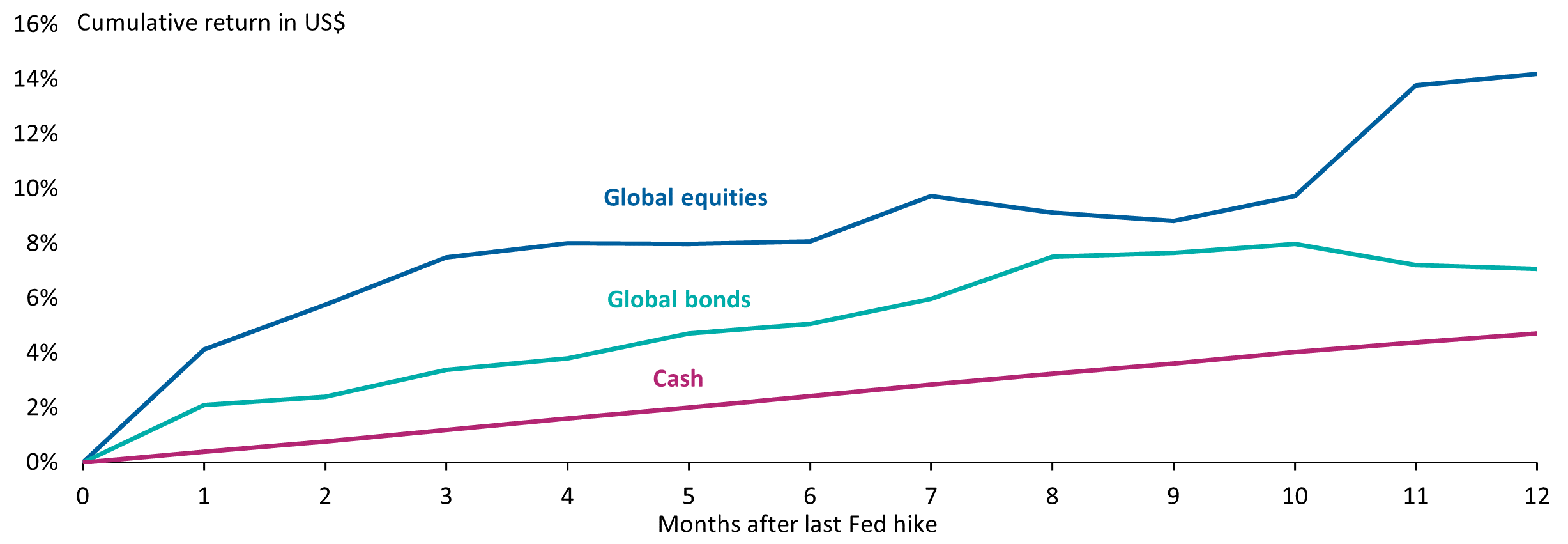

Cash underperforms after rates peak

There is loads of cash on the side lines with around US$5.6 trillion invested in money market assets as at end-September 2023. Cash has been generating nice returns given rising interest rates across developed markets. But when the amount of cash hits such an unprecedented level, it’s often a sign that investors ought to be thinking about diversifying their investments.

Investment professionals at Capital Group like to study history because even though none of us can predict the future, we can learn from past data and obtain clues as to how markets could potentially fare. If we look at the previous four hiking cycles in the US (from 1977 to 2023), global equities generated an average cumulative return of 14% in the 12 months following the last US Federal Reserve (Fed) interest rate hike. Cash only generated a return of 4.5% while fixed income finds itself somewhere in between the two. If history were to repeat itself, money market fund yields would decline once rates peak, and investors would be better served by diversifying into stocks and bonds.

Equities and fixed income have outpaced cash after rate peaks

As at 30 September 2023. Returns reflect the average cumulative return in US$ terms over each of the first 12 months immediately following the last increase in the target US Federal Funds Rate (“last Fed hike”) over the prior four hiking cycles. The specific ending months for the periods included in the average calculations are: February 1995, May 2000, June 2006, and December 2018. Global equities are represented by the MSCI ACWI (with net dividends reinvested). Global Bonds are represented by the Bloomberg Global Aggregate Total Return index. Cash is represented by the Bloomberg US Treasury Bills 1-3 months total return index. Fed: US Federal Reserve. Sources: Capital Group, FactSet

Equities

The S&P 500 has had a strong run in 2023 (year-to-date returns of 14.6%[1]) but a lot of that was driven by the ‘Magnificent Seven’ – Alphabet, Amazon, Apple, Meta Platforms, NVIDIA and Tesla. If we look outside of these seven companies, valuations are considered fairly normal. In fact, some sectors are down for the year because the US economy is in the midst of a rolling recession where different sectors are undergoing downturns at different times.

US residential housing, for instance, contracted sharply in 2022 after the Fed started aggressively raising interest rates. Now it looks like the housing market is starting to recover while other parts of the property market, such as commercial real estate, remains in a downturn.

Likewise, the semiconductor industry was plagued by supply chain concerns and lower demand for chips in 2022. That sent semiconductor stocks plummeting. The environment has stabilised in 2023, with demand returning and semiconductor stocks becoming one of the driving forces in global equity markets.

The chemicals industry is also showing signs of inventory bottoming and a similar situation is playing out in certain segments of the industrials sector. So, the key message is that equities still have a lot to offer and investors who have been on the side lines so far can still benefit from investing in the asset class.

Areas to focus on

One area that I am keen to highlight is dividend stocks. Dividend-paying stocks acted as a cushion to offset some of the downside in 2022 but have lagged the broader market in 2023. Some of the underperformance is justifiable because long-end US Treasuries have been yielding higher, which have hurt the performance of many bond proxy[2] stocks.

But there are certain parts of dividend land that I feel have been unduly punished. This includes dividend growers or stocks that consistently pay and grow the dividends. Capital Group’s analysis shows that dividend growers are typically higher quality companies with better capital allocation. This is because dividend growers typically generate earnings growth and free cash flow that back dividend growth. As a result, these stocks tend to be lower volatility investments that have a higher chance of doing better than the underlying market. Given how many of these companies have been negatively impacted by the wider dividend stocks decline, dividend growers are certainly an interesting area to look for opportunities heading into 2024.

What this also means is the potential broadening of the current equity market rally. History tells us that narrow market rallies coming out a recession have often been followed by steady gains for the broader market, which means opportunities outside of the magnificent seven.

In terms of sectors, I have been doing work with our analysts in the industrials, health care and energy sectors. The combination of low valuations and supply constraints has created several attractive opportunities across US and European energy companies. The US medical technology industry is also interesting because of its derating in 2023 despite continued innovation.

Large opportunity set remains in dividend-paying stocks

P/E ratio of high dividend stocks vs. S&P 500 Index (%)

Data as at 30 September 2023. P/E ratio = price-to-earnings ratio. Source: Goldman Sachs

Data as at 30 September 2023. P/E ratio = price-to-earnings ratio. Source: Goldman Sachs

Innovative new technologies, especially artificial intelligence (AI)

Capital Group is of the view that innovation is critical to successful long-term investments. Innovation drives growth and enhances productivity. And better productivity could help cap inflation. Our investment professionals continue to conduct research around AI and the conclusion, so far, is this is going to be a big deal.

We are starting to see many companies globally adopt generative AI to accelerate their digital transformation (DX) and drive productivity gains by improving on existing work processes.

An example of this is a Europe-based multinational drinks and liquor company. The company spent five years transforming its operational data into a machine-readable, digital format. And through the use of generative AI, it has been able to build on the data by instantly analysing on-premise and off-premise sales data. That, in turn, enables the company to attain real-time feedback on how much inventory is required to go into a particular outlet or restaurant. The end result? With the same budget, it is now able to conduct 15 brand marketing campaigns concurrently as opposed to just five in the past.

Recently, I also met with the Chief Technology Officer (CTO) of an Asia-based insurance company to discuss their DX journey. The insurer has developed a direct-to-consumer app, which is effectively a one-stop portal for the company to engage in customer acquisitions and KYC (know-your-customers) processes as well as for customers to reallocate their portfolios and even submit claims. The central cog to the platform is the incorporation of a Gen AI co-pilot[3] that enables interactive as well as iterative learnings. One important question asked during the meeting was how did the CTO managed to convince stakeholders to invest in these tech initiatives? His answer was: the hurdle rate for their technology investments is 20% and the return is reflected in relatively flat operating costs while insurance premiums are growing at the low double digits. So even though AI is still at an early stage of development, companies are already seeing considerable benefits incorporating the technology into their operations.

- Data as at 8 November 2023. Source: S&P

- Refers to stocks with stable cashflows and therefore dividends. The defensive qualities of these stocks tend to generate safe and predictable returns that are similar to bonds

- Refers to a conversational interface that uses large language models to support users in various tasks. It effectively provides AI assistance in every aspect of an application’s workflow.

Winnie Kwan is an Equity Portfolio Manager at Capital Group Australia, a sponsor of Firstlinks. This article contains general information only and does not consider the circumstances of any investor. Please seek financial advice before acting on any investment as market circumstances can change.

For more articles and papers from Capital Group, click here.