The main headline stories over the past month have been the sudden crash of the Chinese stock market bubble, the devaluation of the Chinese currency, and how they sparked a sell-off in global shares.

The bursting of the Chinese stock market bubble should not have been a surprise, as we wrote about it in May. The market is little more than a casino driven mainly by first time gamblers using borrowed money, and share prices have little to do with company fundamentals or the underlying economy.

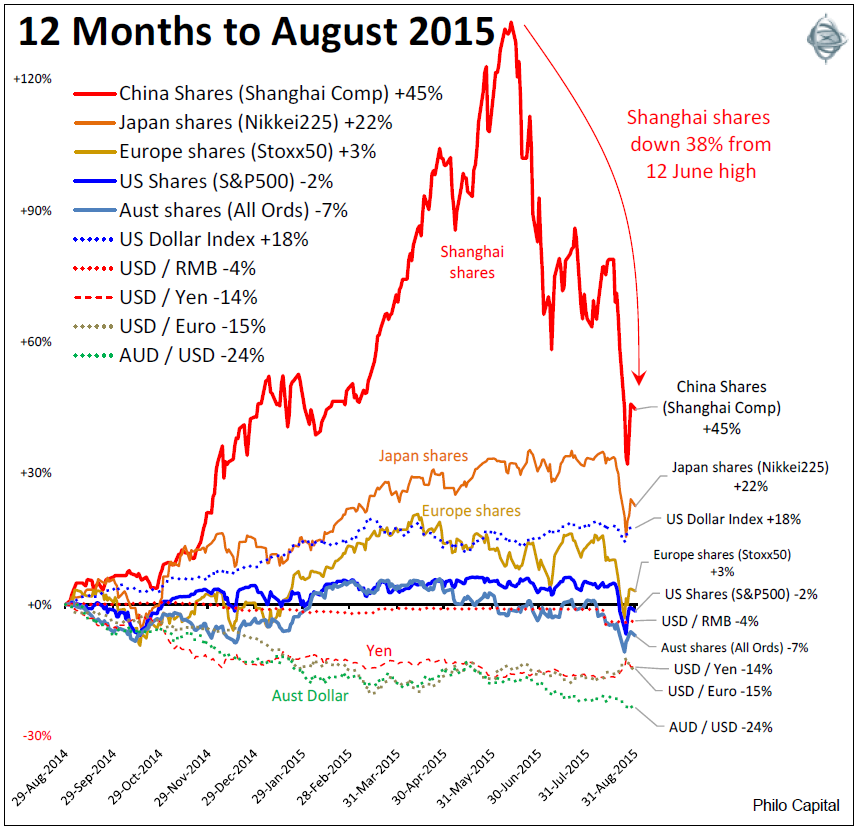

The Chinese market fell by 26% midmonth but recovered partially to end down 12% for the month. To date the Chinese crash has wiped out just six months of gains, so the only people who lost money were those who panic bought in the frenzy earlier this year (many first-timers and many using borrowed money), and then panic sold in the crash.

Investors who had bought shares prior to March this year are still ahead. At the end of August the Shanghai Composite closed down 38% from its 12th June high. Fearing the crash would have wider implications for the Chinese economy the central bank cut interest rates and reduced bank reserve ratio requirements, increasing the amount banks can lend. It also suspended most listed shares from trading so shareholders were unable to sell shares. The main risk in emerging markets is the likely impact of a rising US dollar and US interest rates on US dollar borrowers.

Turning to recent currency moves, the real story of the past year has been the rise of the US dollar as the Fed prepares to raise interest rates with the improving US economy while other major markets are slowing, cutting rates and printing money. The Chinese have been remarkably patient watching the RMB being dragged upward by the US dollar peg. Over the past 12 months the RMB has fallen a tiny 4% against the US dollar, including the 3% “shock” devaluation on 11-12 August 2015. In contrast the Euro has fallen by 15% and the Yen has fallen by 14% over the same period.

Japanese and European company earnings and share prices have benefited from the falling Yen and Euro but US shares have struggled against the rising dollar and fears of higher US interest rates. Australian shares have also been flat, held back by the collapses in commodities prices and also by the big banks’ scramble to raise capital to reduce their leverage.

What else is happening in China?

The Chinese economy is probably growing at a rate much lower than the official 7%. Growth has been propped up since 2009 by debt-funded state-directed infrastructure spending. As the economy is slowing even further this year, the latest plan is to grow Beijing into a mega city of 300 million people that spills over into neighbouring Tianjin, Hebei and Shandong provinces. It has already started relocating government departments. The official unemployment rate is being kept low at around 4% by mega projects like these and also by keeping factories over-producing and then exporting the surpluses to the rest of the world, which has kept global inflation low.

Aside from the stock market fall the main market event in August was the sudden 3% devaluation of the RMB against the US dollar to help exporters. However by month end the central bank was having to intervene to prevent further declines, amid accusations from the US that China was enflaming a currency war.

Military tension also rose between China and Japan in the lead-up to the 70th anniversary of the end of World War 2. Nationalist pride directed against China is Japan PM Shinzo Abe’s ‘fourth arrow’ in his national revival plan. Also North Korea stepped up its war preparations against South Korea after a heated artillery exchange.

Ashley Owen is Joint CEO of Philo Capital Advisers and a director and adviser to the Third Link Growth Fund. This article is for general education only, not personal financial advice.